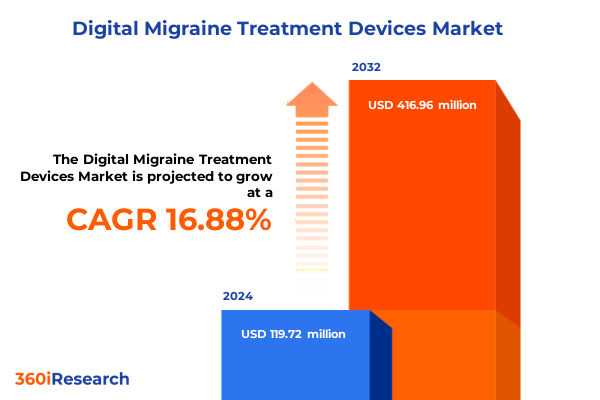

The Digital Migraine Treatment Devices Market size was estimated at USD 137.43 million in 2025 and expected to reach USD 161.27 million in 2026, at a CAGR of 17.18% to reach USD 416.96 million by 2032.

Groundbreaking Overview of the Digital Migraine Treatment Device Market That Sets the Stage for Innovative Therapeutic Strategies

Migraine remains one of the most disabling neurological disorders worldwide, imposing a substantial burden on patients, healthcare systems, and economies. Traditional pharmacological therapies, while effective for many, often bring with them systemic side effects, adherence challenges, and variable clinical responses. Over recent years, the limitations of standard drug regimens have catalyzed the exploration of non-pharmacological approaches, most notably the advent of digital neuromodulation and sensor-driven therapeutic solutions. These next-generation devices leverage electrical, magnetic, and biofeedback modalities to provide targeted intervention, minimizing systemic exposure and offering alternative or adjunctive relief for acute and chronic migraine sufferers.

Against this backdrop, digital migraine treatment devices have progressed from proof-of-concept prototypes to commercially available products backed by rigorous clinical validation. Developers have harnessed advances in miniaturization, wireless connectivity, and user-centric design to create interventions that patients can self-administer in home and clinical settings. Moreover, the integration of companion mobile applications and cloud-based analytics has enabled personalized therapy protocols, real-time treatment monitoring, and data-driven optimization of stimulation parameters. This executive summary delves into the key industry dynamics that are driving innovation, evaluates the transformative forces reshaping the competitive landscape, and outlines actionable insights for stakeholders seeking to navigate the fast-evolving domain of digital migraine therapeutics.

Key Paradigm Shifts Redefining the Digital Migraine Treatment Landscape Fueled by Technological Advancements and Patient-Centric Innovations

The landscape of migraine management is undergoing profound transformation driven by breakthroughs in materials science, electronics, and digital connectivity. Where pharmacotherapy once held a monopoly on acute and prophylactic migraine relief, neuromodulation technologies such as remote electrical stimulation and transcranial magnetic applications have now demonstrated efficacy in reducing attack frequency and intensity without systemic drug exposure. Concurrently, the proliferation of low-power wireless components and advanced battery technologies has enabled the development of truly portable and wearable devices that seamlessly integrate into patients’ daily routines. As a result, treatment paradigms are shifting towards decentralized care models where individuals can manage migraine events in real time via compact, user-friendly platforms.

In parallel, the emergence of artificial intelligence and predictive analytics is elevating the personalization of neurostimulation therapies. By analyzing patient-generated data from sensors and mobile applications, algorithms can adapt stimulation parameters to match individual response profiles and evolving symptom patterns. Moreover, the expansion of telehealth infrastructure has facilitated remote device programming and monitoring, fostering closer patient-clinician collaboration while reducing barriers to specialist access. These combined forces are not only enhancing therapeutic outcomes but are also setting new standards for patient engagement, adherence, and long-term disease management. As healthcare stakeholders converge on value-based care frameworks, digital migraine treatment devices are poised to deliver measurable improvements in quality of life while optimizing resource utilization across care settings.

Comprehensive Review of the 2025 United States Tariff Measures and Their Cumulative Impact on Digital Migraine Treatment Device Supply Chains

The enactment of cumulative tariff measures in 2025 has introduced a layer of complexity that manufacturers and suppliers of digital migraine treatment devices must navigate carefully. As part of broader trade policy adjustments, the United States government expanded Section 301 duties and imposed additional levies on specific categories of medical and electronic components commonly sourced from international suppliers. These components include specialized semiconductor chips, high-precision sensors, and magnetic materials integral to remote electrical and transcranial stimulation devices. With tariff rates elevated across multiple supply chain tiers, device producers are experiencing incremental increases in landed costs that can erode profit margins or necessitate price adjustments in final product offerings.

Over time, the compounded effect of these tariffs has manifested in extended lead times and inventory bottlenecks as firms reassess sourcing strategies. Some manufacturers have been compelled to re-engineer device architectures to incorporate domestically produced components, while others have intensified efforts to establish dual-country supply lines to mitigate exposure. Although these actions enhance resilience against trade fluctuations, they come at the expense of increased development overhead and potential delays in time-to-market. Simultaneously, elevated input costs may create friction with payers and healthcare providers who are increasingly focused on cost containment and value-based procurement, thereby influencing negotiation dynamics and reimbursement discussions.

In response, industry participants are exploring a range of mitigation approaches, such as localized manufacturing partnerships, strategic inventory positioning, and collaborative frameworks with custom duty consultants to optimize tariff classification. These initiatives aim to balance cost pressures with the imperative to maintain uninterrupted supply for patients reliant on digital migraine therapies. As the trade landscape continues to evolve, stakeholders must remain agile, employing data-driven scenario planning and proactive policy engagement to safeguard operational continuity and sustain innovation momentum in this critical segment of neurological care.

In-Depth Insight into Key Market Segmentation Dimensions Driving Diverse Opportunities in the Digital Migraine Treatment Device Ecosystem

When segmented by device type, handheld devices designed for user-initiated application in acute migraine episodes contrast with implantable devices that deliver continuous neuromodulation under specialist oversight, as well as wearable devices engineered to integrate unobtrusively into daily routines. Handheld solutions often benefit from streamlined approval pathways and minimal training requirements, while implantable systems demand surgical expertise, rigorous long-term safety data, and specialized clinical support. Wearables, on the other hand, occupy a middle ground, combining ease of use with the capacity for automated or scheduled therapy delivery and real-time adherence monitoring.

Grouping devices based on underlying technology further refines market dynamics. Remote electrical neuromodulation has gained traction for its noninvasive, patient-controlled acute relief, whereas transcranial magnetic stimulation platforms require higher upfront investment but can address chronic and refractory presentations. Transcutaneous electrical nerve stimulation stands out for its established use case and lower price point, attracting budget-sensitive buyers, while vagus nerve stimulation, leveraging bioelectronic pathways, is positioned for addressing severe migraine subtypes that do not respond adequately to other modalities. Each technology is subject to distinct clinical trial demands, reimbursement pathways, and competitive pressures.

Considering the end-user perspective reveals divergent adoption patterns across homecare settings, hospitals & clinics, and specialty centers. Homecare environments prioritize devices that enable self-management with minimal clinician intervention, supported by digital guidance and remote monitoring. Hospitals & clinics offer a controlled setting for supervised administration and integration with broader neurology services, while specialty centers that focus on advanced migraine care typically demand high-precision, customizable platforms accompanied by robust support and training programs.

Finally, distribution channel segmentation underscores the balance between traditional and emerging pathways. Offline channels, encompassing direct sales to healthcare institutions and distribution through medical device wholesalers, remain the backbone of device dissemination, ensuring compliance with regulatory and storage requirements. Conversely, online channels are gaining traction, propelled by direct-to-consumer models and telehealth-driven sales, which facilitate personalized device selection, subscription-based service models, and streamlined reordering processes, thereby complementing the established offline infrastructure.

This comprehensive research report categorizes the Digital Migraine Treatment Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Technology

- End-User

- Distribution Channel

Strategic Regional Perspectives Highlighting Growth Dynamics and Adoption Patterns Across Major Global Markets for Digital Migraine Devices

In the Americas, the United States stands at the forefront of digital migraine device adoption, driven by robust reimbursement pathways, well-established neurology clinical networks, and high patient engagement with digital health solutions. Clinical trial activity remains concentrated in leading academic centers, fueling innovation and generating real-world evidence that underpins payer negotiations. While Canada follows a similar trajectory, its single-payer systems introduce different evaluation criteria and budgetary constraints that impact device rollout timelines. Elsewhere in Latin America, adoption is nascent, hindered by limited specialist infrastructure and cost sensitivity, although select private hospital groups are piloting digital neuromodulation offerings as part of differentiated care strategies.

Across Europe, the Middle East, and Africa, regulatory convergence under the updated European Medical Device Regulation has streamlined market entry for CE-marked devices, yet significant heterogeneity persists at the national reimbursement level. Countries with centralized health technology assessment frameworks, such as Germany and France, have shown a willingness to cover innovative digital therapeutics under conditional reimbursement, contingent on post-market data collection. In contrast, certain Middle East jurisdictions are prioritizing digital health initiatives through public-private partnerships, creating pilot programs in urban specialist centers that may serve as springboards for wider adoption across the region.

In Asia-Pacific, national policy directives aimed at modernizing healthcare delivery have catalyzed interest in digital migraine treatments, particularly in Japan, Australia, and China. Investments in advanced neurology infrastructure and high smartphone penetration rates facilitate the integration of sensor-based monitoring and remote therapy management. Nonetheless, fragmented reimbursement environments and varying levels of clinician familiarity pose challenges to scaling adoption uniformly. Emerging markets such as India and Southeast Asian nations are still defining regulatory pathways for digital medical devices, suggesting a phased approach to market development that prioritizes key urban centers before broader expansion.

This comprehensive research report examines key regions that drive the evolution of the Digital Migraine Treatment Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analyzed through Key Company Strategies, Collaborations, and Innovative Developments in Digital Migraine Treatment Devices

Theranica has spearheaded commercial success in the remote electrical neuromodulation segment with its Nerivio platform, which offers patients a discreet, arm-worn stimulator paired with a mobile application that tracks real-time symptom relief and treatment adherence. By securing regulatory clearances across multiple jurisdictions and forging value-based reimbursement agreements, the company has created a scalable blueprint for digital migraine management that leverages patient data insights to refine therapy protocols.

ElectroCore’s gammaCore device, utilizing noninvasive vagus nerve stimulation, exemplifies the convergence of bioelectronic medicine and neurology expertise. The firm has focused on expanding its clinical indications beyond migraine to cluster headaches and other neurovascular disorders, collaborating with leading headache centers and leveraging digital connectivity for remote device titration and compliance monitoring. Strategic partnerships with larger medical device distributors have served to amplify market reach and diversify sales channels.

Eneura’s SpringTMS system represents one of the first consumer-accessible transcranial magnetic stimulation solutions for migraine prevention and acute relief. By establishing a robust post-market surveillance framework and engaging key opinion leaders in neurology, the company has generated real-world evidence to support expanded labeling, while exploring next-generation coil designs that reduce power consumption and enhance treatment precision.

Meanwhile, emerging innovators such as Cala Health, with its digital neuromodulation wristband targeting neuromotor pathways, and NeuroMetrix, whose Quell TENS wearable has shown promise in adjunctive migraine relief, are redefining the competitive landscape through novel form factors and subscription-based service models. Collaborative research agreements with academic institutions and joint ventures with established device manufacturers point to an industry increasingly characterized by strategic alliances that accelerate time-to-market and broaden therapeutic utility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Migraine Treatment Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CEFALY Technology

- Chordate Medical Holding AB

- Cirrus Healthcare Products LLC

- Dr Reddy's Laboratories Ltd.

- electroCore, Inc.

- eNeura Inc.

- Hi-Dow International Inc.

- LivaNova PLC

- Neurolief Ltd.

- Nocira, LLC

- Salvia BioElectronics B.V.

- ShiraTronics, Inc.

- Soterix Medical Inc.

- Theranica Bio-Electronics Ltd.

- Tivic Health Systems, Inc.

- tVNS technologies GmbH

- WELT Corp.

Tactical Recommendations for Industry Leaders to Capitalize on Emerging Trends and Strengthen Market Position in Digital Migraine Therapy Devices

To maintain a competitive advantage, industry leaders should prioritize the initiation of multicenter, real-world clinical studies that encompass diverse patient populations and use cases. By collaborating proactively with payers and healthcare systems to design outcome-based reimbursement models, stakeholders can secure favorable coverage decisions and demonstrate the long-term value proposition of digital neuromodulation therapies in reducing migraine-related disability and healthcare utilization.

Investment in advanced analytics and artificial intelligence capabilities is essential for developing adaptive treatment algorithms that respond dynamically to patient-reported outcomes and biosensor data. Establishing interoperable platforms that integrate with electronic health record systems and remote monitoring tools will facilitate seamless clinician oversight, drive adherence, and enable continuous optimization of device performance based on aggregated evidence.

Given the ongoing impact of trade policy and component scarcity on production costs, device manufacturers must implement a robust supplier diversification strategy. This includes cultivating partnerships with domestic component producers, qualifying secondary international sources, and leveraging flexible manufacturing arrangements that can pivot in response to policy shifts. Such resilience planning will minimize disruption and safeguard margins in the face of regulatory volatility.

Finally, amplifying patient and provider engagement through tailored education initiatives and digital outreach can accelerate acceptance and uptake. Developing modular training programs for neurologists, headache specialists, and allied health professionals will ensure devices are prescribed and utilized according to best practices, while consumer-focused digital campaigns and telehealth collaborations will expand reach. By uniting technological innovation with operational rigor and stakeholder collaboration, industry leaders can solidify their position in this dynamic therapeutic sector.

Rigorous Research Methodology Outlining Qualitative and Quantitative Approaches Ensuring Robust Analysis of Digital Migraine Treatment Devices

This analysis integrates a mixed-methods approach to provide a comprehensive perspective on the digital migraine treatment device sector. Primary research efforts included structured interviews with key opinion leaders in neurology, device development executives, reimbursement specialists, and patient advocacy representatives across North America, Europe, and Asia-Pacific regions. These consultations aimed to capture firsthand insights into clinical adoption barriers, technology preferences, and strategic growth initiatives.

Secondary research comprised an exhaustive review of regulatory filings, clinical trial registries, and peer-reviewed publications to assess the efficacy and safety profiles of leading device modalities. Market activity and innovation trends were further illuminated through patent landscape analysis and scrutiny of company press releases and investor presentations. Additionally, payer policy documents and health technology assessment reports were examined to understand evolving reimbursement frameworks and value-based contracting models.

Data synthesis involved triangulation techniques to reconcile findings across primary and secondary sources, ensuring consistency and depth of understanding. Quantitative data points were validated through cross-referencing with multiple independent sources, while qualitative insights were contextualized within broader industry dynamics. The research team engaged an external advisory panel comprising senior clinicians and former regulatory officials to review preliminary conclusions and provide feedback on methodological rigor and interpretive accuracy.

Collectively, these methodological steps ensured that the analysis reflects a balanced, evidence-based, and forward-looking assessment of the competitive landscape, supply chain considerations, and strategic imperatives shaping the future of digital migraine treatment devices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Migraine Treatment Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Migraine Treatment Devices Market, by Device Type

- Digital Migraine Treatment Devices Market, by Technology

- Digital Migraine Treatment Devices Market, by End-User

- Digital Migraine Treatment Devices Market, by Distribution Channel

- Digital Migraine Treatment Devices Market, by Region

- Digital Migraine Treatment Devices Market, by Group

- Digital Migraine Treatment Devices Market, by Country

- United States Digital Migraine Treatment Devices Market

- China Digital Migraine Treatment Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Perspectives Emphasizing the Strategic Imperatives and Future Outlook in the Rapidly Evolving Digital Migraine Treatment Device Sector

The analysis of digital migraine treatment devices underscores a clear trajectory towards more personalized, minimally invasive, and data-driven therapeutic models. As traditional pharmacological approaches face increasing scrutiny for their systemic limitations and adherence challenges, the industry’s pivot to neuromodulation and sensor-enabled interventions represents a strategic inflection point. Stakeholders must therefore prioritize the development of adaptive algorithms that tailor stimulation to individual patient phenotypes, secure alignment with regulatory and reimbursement authorities through robust evidence generation, and reinforce supply chain resilience to navigate geopolitical and tariff-driven uncertainties.

Looking ahead, the integration of these devices within broader digital health ecosystems promises to unlock new value propositions, not only for migraine management but also for a spectrum of neurological disorders. Partnerships between medical device innovators, technology platforms, and healthcare providers will be critical to establishing interoperable frameworks that facilitate continuous patient monitoring, remote therapy adjustments, and real-world data collection. Moreover, embracing outcome-based contracting and outcome-predictive analytics will enable manufacturers to demonstrate tangible clinical and economic benefits, thereby accelerating market access and adoption.

Ultimately, industry success will hinge on a balanced focus on clinical efficacy, patient experience, and operational excellence. By fostering collaborative networks, leveraging advanced analytics, and aligning with evolving care delivery models, stakeholders can capitalize on the momentum driving digital migraine therapeutics and chart a course toward sustained innovation and patient benefit.

Exclusive Opportunity to Engage with Ketan Rohom Associate Director of Sales & Marketing to Secure the Digital Migraine Treatment Device Market Report

For organizations seeking a deep-dive into the digital migraine treatment device landscape, this report delivers unparalleled insights into technological evolution, regulatory impact, segmentation strategies, and competitive positioning. To explore how these findings can inform your business strategy, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, whose expertise in translating research into actionable market intelligence will guide you through tailored report options and priority access to supplementary briefings.

Engaging with Ketan Rohom ensures that your team receives a personalized consultation to identify the most relevant sections, explore custom add-ons, and establish a timeline for implementation planning. Whether you are refining product roadmaps, optimizing go-to-market strategies, or evaluating partnership opportunities, this collaboration will equip you with the insights necessary to capitalize on emerging trends and strengthen your competitive edge. Contact Ketan today to secure your copy of the comprehensive market research report and embark on a data-driven journey toward leadership in digital migraine therapeutics.

- How big is the Digital Migraine Treatment Devices Market?

- What is the Digital Migraine Treatment Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?