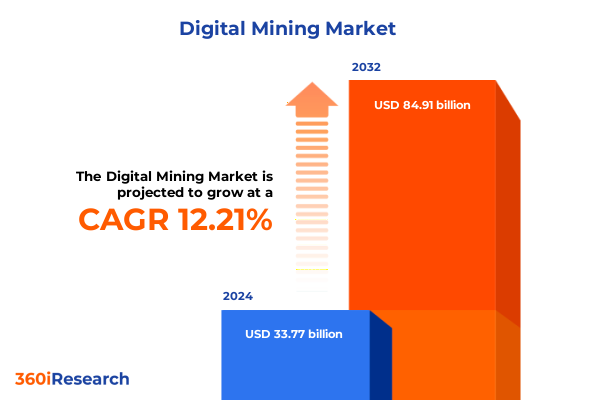

The Digital Mining Market size was estimated at USD 37.53 billion in 2025 and expected to reach USD 41.72 billion in 2026, at a CAGR of 12.36% to reach USD 84.91 billion by 2032.

Positioning Mining Operations for the Digital Era through Advanced Automation, Artificial Intelligence, and Connected Analytics to Drive Efficiency and Safety

The rapid integration of digital technologies in mining operations has fundamentally reshaped how resources are extracted, processed, and managed. By 2023, 70% of mining companies worldwide had adopted comprehensive digital transformation strategies, signaling a decisive shift towards data-driven decision-making and operational efficiency. This widespread uptake reflects a recognition that legacy methods can no longer keep pace with the demands of safety, sustainability, and profitability in a highly competitive market. Mining firms that embrace digital innovation are witnessing measurable improvements in uptime, cost control, and environmental compliance, positioning themselves to meet evolving stakeholder expectations and regulatory requirements

At the heart of this transformation lies the convergence of connected sensor networks, advanced analytics, and autonomous systems. Internet of Things devices embedded in equipment capture real-time data on machine health, energy consumption, and ore quality, feeding predictive maintenance algorithms that reduce unplanned downtime by up to 25%. Concurrently, AI-driven analytics platforms sift through terabytes of geological and operational data to optimize mine planning and resource allocation. Furthermore, digital twin models are now implemented in approximately 45% of mining operations, enabling virtual simulations of processes to forecast performance, test scenarios, and improve safety protocols without halting production

Exploring Disruptive Technologies and Sustainability Innovations Transforming Mining Operations with Enhanced Safety, Productivity and Environmental Performance

Mining operations are increasingly leveraging advanced sensor networks and Internet of Things platforms to gain unprecedented visibility into every facet of production. Embedded sensors monitor machine vibration, temperature, and fuel usage in real time, enabling operators to detect anomalies before they escalate into costly failures. Environmental sensors, meanwhile, track air quality and water management metrics, helping companies comply with stringent regulations and mitigate ecological risks

Artificial intelligence and machine learning have become indispensable for turning raw data into actionable insights. By analyzing historical performance logs alongside live sensor feeds, AI-driven models can forecast equipment failures and schedule maintenance activities well before breakdowns occur, reducing unplanned downtime by up to 20%. Resource and grade optimization algorithms also parse geological data to pinpoint high-yield mineral zones, optimizing drilling strategies and lowering operational costs

Automation and robotics are transforming the physical landscape of mines, with autonomous haul trucks and drilling rigs operating around the clock and dramatically reducing safety incidents. Drones equipped with high-resolution imaging survey expansive sites in a fraction of the time required for manual inspections, while robotic process control systems continually adjust mill and flotation parameters to maximize throughput. This wave of automation is projected to boost overall operational efficiency by as much as 35% in early adopters

Sustainability initiatives are now a core strategic priority, with mining companies integrating renewable energy sources, electrified equipment, and circular economy principles into their operations. Electrification of haul fleets and on-site power generation from solar and wind reduce carbon footprints, while water recycling and dry-stack tailings management address longstanding environmental challenges. As a result, ESG metrics are climbing, with many firms reporting a 40% increase in socially responsible practices over the past two years

Assessing the Comprehensive Consequences of 2025 United States Tariff Policies on Mining Equipment, Supply Chains, and Industry Competitiveness

In early 2025, sweeping U.S. tariffs on imported machinery and components have driven up operational expenses across the mining sector. Tariffs of 25% on equipment sourced from Canada and Mexico and 10% on most European imports have translated into cost increases of up to 5% for key spares and advanced sensors. Companies like Caterpillar have forecast tariff-related costs of $250–350 million in a single quarter, prompting a reassessment of procurement strategies and raw material sourcing

The ripple effects extend into commodity markets, where uncertainty over trade policy has amplified price volatility. Base metals such as copper and iron ore have experienced erratic trading patterns as buyers and sellers grapple with shifting supply expectations. In contrast, critical minerals tied to national security, including lithium and rare earths, have seen price premiums due to fears of supply disruptions-a dynamic that underscores the interdependence between trade policy and extraction economics

To mitigate the risk of supply interruptions, the U.S. administration has introduced selective exemptions for certain critical minerals vital to energy transition technologies, exempting raw lithium, graphite, and rare earth ores from baseline tariffs. However, the protective measures often exclude the specialized equipment and processing chemicals needed for extraction and refining, creating a policy gap that leaves mineral producers exposed to higher operational outlays and logistical complexities

In response, mining companies are reconfiguring their procurement models and exploring alternative supply chains. Key strategies include sourcing equipment from non-tariffed jurisdictions such as Australia and Brazil, investing in local manufacturing of parts, and pursuing vertical integration to gain greater control over input costs. Simultaneously, renewed emphasis on domestic exploration has accelerated permitting for U.S.-based lithium and copper projects, reflecting a broader shift toward regional resilience in mineral supply networks

Unveiling Critical Market Segmentation Insights by Component, Technology, Application, and End User to Illuminate Opportunities and Drive Strategic Focus

In terms of hardware, the digital mining landscape encompasses critical infrastructure such as data acquisition systems, networking equipment, and advanced sensors that feed operational intelligence platforms. These physical components form the backbone for end-to-end monitoring, enabling real-time visibility into machinery performance and environmental conditions. Complementing hardware, specialized services in consulting, support and maintenance, and system integration-both on-site and remote-ensure that deployments operate optimally and evolve in step with emerging operational needs.

Software solutions drive the analytical capability vital to modern mines, spanning control software, visualization tools, and powerful analytics platforms. Within these digital environments, predictive and real-time analytics engines sift through massive datasets to forecast equipment health and optimize process workflows. By integrating these software layers with hardware assets, mining operations can seamlessly transition from reactive to proactive decision-making, unlocking new levels of throughput and safety across increasingly complex production environments.

The technology axis extends beyond on-premises deployments, with cloud-based architectures-hybrid, private, and public-offering scale and flexibility for data storage and computation. Hybrid cloud models enable sensitive mining data to reside locally while leveraging cloud elasticity for heavy analytics workloads. Private cloud configurations provide secure, dedicated environments for proprietary operational algorithms, whereas public clouds empower remote teams with accessible dashboards and collaboration tools. Local infrastructure remains essential for sites with limited connectivity, ensuring uninterrupted operations even in the most remote locations.

Applications span the full spectrum of mining operations, from equipment monitoring and inventory management within asset management to process control systems and autonomous robotics under automation and control. Data analytics applications-descriptive, predictive, and prescriptive-drive continuous improvement, while environmental monitoring and worker safety systems constitute the core of safety solutions. Across these use cases, coal and metals and minerals producers apply tailored digital toolsets that address their specific extraction challenges, resource characteristics, and regulatory landscapes.

This comprehensive research report categorizes the Digital Mining market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End User

Analyzing the Regional Dynamics of Digital Mining Adoption and Innovation across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

Across the Americas, the United States and Canada continue to lead digital mining adoption, fueled by robust R&D ecosystems and pro-innovation regulatory frameworks. Major mining operators in this region have embedded predictive analytics and automation at scale, while energy companies leverage IoT platforms to monitor critical infrastructure. Collaborative initiatives between industry consortia and government agencies accelerate the integration of cloud-based solutions, positioning North American mines at the forefront of operational efficiency and technology-driven sustainability

In Europe, the Middle East and Africa, sustainability requirements and stringent environmental regulations drive digital transformation priorities. Nordic countries like Sweden and Finland pioneer energy-efficient digital ecosystems, integrating low-carbon electrification and digital twins to minimize ecological footprints. Meanwhile, South Africa and select Gulf states are mobilizing investments to digitize exploration and resource management, addressing unique challenges of remote operations and infrastructure gaps through partnerships with technology providers

The Asia-Pacific region exhibits some of the fastest acceleration in digital mining initiatives, with Australia, China, and India at the helm. Australian operators are deploying autonomous haul fleets and real-time analytics platforms to optimize production in the Pilbara, while Chinese mining groups are integrating AI for advanced resource planning. In India, emerging projects are leveraging remote monitoring and cloud architectures to overcome connectivity constraints. Across the region, governments support digital innovation through incentives and smart mining corridors, cementing Asia-Pacific’s role as a critical growth engine for digital mining technologies

This comprehensive research report examines key regions that drive the evolution of the Digital Mining market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Approaches and Technology Investments of Leading Companies Advancing Digital Mining Transformation Globally

Rio Tinto has pioneered the deployment of digital twins and remote operational centers to transform its Pilbara iron ore complex into a fully connected ecosystem. By implementing a detailed virtual replica of its processing plants, the company can conduct real-time simulations and predictive maintenance, reducing unplanned downtime and enhancing safety. These initiatives are further supported by investments in solar energy to power operations, demonstrating an integrated approach to technology and sustainability

ABB continues to advance digital mining efficiency through AI-driven platforms and automation hardware. Its GMD Copilot-a conversational AI assistant integrated with cloud-based monitoring-has improved troubleshooting times by up to 30% and enabled predictive maintenance recommendations. Additionally, ABB’s eMine FastCharge system and Robot Automated Connection Device are setting new standards in mine electrification by autonomously handling high-power charging for haul trucks, significantly reducing manual interventions and CO₂ emissions

Caterpillar is expanding its autonomous capabilities with the Cat Automated Energy Transfer System, which fully automates the connection between battery-electric trucks and high-capacity chargers, enhancing safety and reducing downtime. The company has also partnered with lidar specialist Luminar to integrate advanced sensing technology into its autonomy platform, reflecting a broader commitment to electrification and machine intelligence across quarry and mining operations

Komatsu has responded to tariff-driven cost pressures by diversifying its supply chain and exploring alternative manufacturing locations outside of traditionally tariffed regions. The company estimates a mitigation of $140 million in financial impacts following a U.S.–China trade truce and is actively repositioning production to Thailand and other low-tariff jurisdictions. These strategic adjustments are coupled with continued investment in autonomous machinery and digital services to maintain competitiveness in a challenging trade environment

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Mining market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BHP Group Plc

- Bitfury Group Ltd.

- Bitmain Technologies Ltd.

- Canaan Inc.

- Ebang International Holdings Inc.

- GMO Internet, Inc.

- Goldshell Technology Co., Ltd.

- Halong Mining Ltd.

- Innosilicon Technology Co., Ltd.

- Shenzhen MicroBT Mining Technology Co., Ltd.

- Shenzhen StrongU Technology Co., Ltd.

- Zijin Mining Group Co., Ltd.

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Digital Mining Innovations, Optimize Operations, and Safeguard Competitive Advantage

Industry leaders should prioritize the deployment of predictive maintenance and digital twin frameworks to transition from reactive to proactive operations. By embedding IoT sensors across critical assets and integrating AI-driven analytics, companies can reduce unplanned downtime and extend equipment lifespan, translating into immediate operational savings. Establishing cross-functional teams to oversee these programs will ensure alignment with strategic objectives and facilitate continuous performance improvement

Expanding automation and machine intelligence across the value chain is essential for scaling operational excellence. Autonomous haulage, robotic drilling, and drone-based site inspections deliver consistent performance while minimizing human exposure to high-risk environments. Organizations should develop phased roadmaps that balance pilot initiatives with full-scale rollouts, leveraging proven technology partnerships to mitigate implementation risks and accelerate time to value

To fortify supply chain resilience, companies must diversify sourcing across multiple regions and evaluate vertical integration opportunities for critical components. Strategies include engaging suppliers from non-tariffed jurisdictions, investing in local manufacturing capacity, and establishing strategic stockpiles of essential parts. Such measures will minimize exposure to future trade disruptions and stabilize input costs against volatile policy shifts

Finally, cultivating strategic alliances with technology providers and upskilling the workforce are vital to sustaining digital momentum. Joint innovation programs, co-development partnerships, and targeted training initiatives will embed digital competencies and foster a culture of continuous improvement. By aligning talent development with emerging technological trends, organizations can ensure they are equipped to navigate the evolving digital mining landscape

Detailing the Robust Research Methodology and Data Collection Practices Underpinning Comprehensive Digital Mining Market Analysis

This analysis synthesizes insights from both primary and secondary research, guided by international standards for market research. Secondary data collection involved a comprehensive review of reputable industry publications, technical white papers, government trade reports, and expert commentaries to capture evolving digital mining trends. All external sources were evaluated for relevance, currency, and methodological rigor in accordance with established guidelines for processing secondary data

Primary research encompassed structured interviews with senior executives, technology leaders, and operations managers across major mining organizations. These conversations provided qualitative depth on technology adoption challenges, tariff response strategies, and emerging best practices. Interview participants were selected to represent diverse regions, company sizes, and end-user segments, ensuring balanced perspectives and contextual validity

Data triangulation was applied to validate findings by cross-referencing quantitative indicators-such as deployment rates, efficiency metrics, and investment trends-with qualitative insights from expert interviews. This layered approach enhanced the reliability of key observations and facilitated identification of convergent themes across multiple data streams. All analytical methods adhered to a rigorous framework of transparency and reproducibility

Quality assurance protocols included peer review, consistency checks, and an ethics oversight process to ensure objectivity and integrity. Statistical and thematic analysis tools were employed to codify data and derive actionable insights, while ongoing stakeholder feedback loops refined the interpretive lens. The result is a robust foundation for strategic decision-making in digital mining market analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Mining market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Mining Market, by Component

- Digital Mining Market, by Technology

- Digital Mining Market, by Application

- Digital Mining Market, by End User

- Digital Mining Market, by Region

- Digital Mining Market, by Group

- Digital Mining Market, by Country

- United States Digital Mining Market

- China Digital Mining Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Concluding Reflections on Transformative Digital Mining Dynamics and the Strategic Imperatives Shaping the Future of Mining Operations

The convergence of digital technologies has ushered in a new era for the mining industry, where data-driven processes and automation coexist with traditional extraction practices. As operations become more interconnected, strategic imperatives such as operational resilience, environmental stewardship, and competitive differentiation come sharply into focus. Organizations that integrate predictive maintenance, autonomous systems, and advanced analytics will lead the transformation, unlocking value across safety, productivity, and sustainability dimensions.

The impact of trade policy and regional dynamics underscores the need for agile supply chains and diversified sourcing strategies, while technology partnerships and workforce upskilling remain pivotal to sustaining momentum. In this evolving landscape, opportunities abound for companies to harness emerging innovations-from digital twins to AI-powered monitoring platforms-to refine processes and capture incremental benefits. By taking coordinated, forward-looking actions, industry leaders can secure long-term advantages and position themselves for success in the increasingly digital future of mining operations.

Driving Informed Purchasing Decisions through a Personalized Call to Action with Associate Director Ketan Rohom for Exclusive Digital Mining Market Insights

Are you ready to translate these insights into strategic action and secure a competitive edge in the digital mining landscape? Ketan Rohom, Associate Director of Sales & Marketing, is available to guide you through the detailed findings of our comprehensive market analysis and demonstrate how to tailor these insights to your organization’s priorities.

Reach out to arrange a personalized consultation and unlock access to in-depth data on emerging technologies, regional dynamics, tariff implications, and actionable growth strategies. Harness the power of this report to make informed purchasing decisions that will position your business at the forefront of digital mining innovation.

- How big is the Digital Mining Market?

- What is the Digital Mining Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?