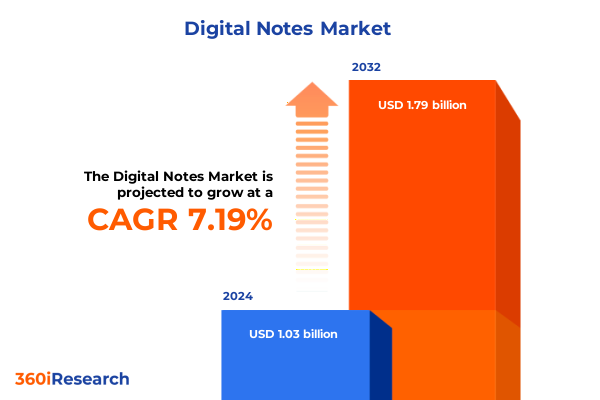

The Digital Notes Market size was estimated at USD 1.09 billion in 2025 and expected to reach USD 1.15 billion in 2026, at a CAGR of 7.38% to reach USD 1.79 billion by 2032.

Unveiling the Evolution of Digital Note Solutions Reshaping Traditional Writing into Dynamic Collaborative and Interactive Professional Experiences

The digital notes market has emerged as a pivotal segment bridging analog writing traditions and contemporary digital workflows. As organizations pursue digital transformation initiatives, professionals across sectors are redefining how they capture, organize, and share ideas in real time. Digital note solutions have evolved beyond simple digitization of pen-and-paper inputs into sophisticated ecosystems that integrate cloud connectivity, collaborative platforms, and advanced stylus technologies. Consequently, users no longer face the friction of manual transcription or siloed information, unlocking productivity gains across distributed teams.

Driven by rapid advances in hardware miniaturization and battery life optimization, the current generation of digital notepads, E-ink tablets, and smart notebooks offer feature sets that cater to diverse work and learning environments. These devices now support seamless synchronization with enterprise productivity suites, enhanced handwriting recognition, and version control capabilities that preserve the integrity of meeting notes, sketches, and annotations. Meanwhile, software innovations, including AI-driven summarization and automatic tagging, have transformed static notes into living knowledge repositories. As a result, organizations can harness captured insights to derive strategic intelligence, making digital note solutions a mission-critical component of modern knowledge management practices.

This introduction outlines the core themes addressed in this executive summary, framing the critical drivers, challenges, and opportunities that define the digital notes landscape. From examining technology adoption patterns to assessing regulatory impacts, the subsequent sections delve into the multifaceted dynamics that will shape the future of digital note technologies.

Charting the Surge of Hybrid Work Adoption and AI Integration Propelling Digital Note Ecosystems into a New Era of Seamless Creativity and Productivity

The digital notes landscape is undergoing a profound transformation as hybrid work models and AI-infused workflows converge to redefine information capture. Remote and in-office teams now expect frictionless collaboration across multiple devices, prompting digital note providers to integrate real-time syncing, shared whiteboarding, and asynchronous review tools. These capabilities not only streamline cross-functional project coordination but also foster innovation by enabling parallel ideation sessions without geographic constraints.

Simultaneously, artificial intelligence and machine learning are elevating the value of captured content by automatically categorizing handwritten inputs, extracting key action items, and generating context-aware summaries. This shift from passive digital archives to intelligent knowledge assistants equips users with deeper insights and reduces manual labor. Moreover, the maturation of cloud infrastructures ensures that notes remain secure, accessible, and version-controlled across global operations, addressing both compliance demands and the need for uninterrupted collaboration.

Looking ahead, the convergence of enhanced stylus technologies, multi-modal input support, and immersive digital canvases promises to unlock new creative horizons. As device form factors continue to diversify and software ecosystems expand through open APIs, the digital note market is poised to deliver increasingly seamless experiences. This section highlights the transformative shifts driving the sector forward and underscores the importance of agility in a rapidly evolving technological environment.

Evaluating the United States Tariffs of 2025 and Their Cumulative Impact on the Accessibility and Innovation of Digital Note Devices

In 2025, targeted tariffs imposed by the United States on select electronic components and display technologies have exerted a cumulative influence on the digital note device landscape. By increasing import duties on key manufacturing inputs, these measures have reverberated throughout global supply chains, compelling vendors to reassess sourcing strategies and cost structures. Device makers have responded by diversifying assembly locations and forging new partnerships with component suppliers to mitigate price pressures and maintain competitive end-user pricing.

These tariff-driven dynamics have also accelerated innovation in local manufacturing capacities. Companies have invested in regional production hubs that offer lower logistical overhead and reduced exposure to import levies. Such initiatives not only address short-term cost challenges but also foster longer-term resilience by building deeper local expertise in E-ink panel fabrication and precision stylus engineering. Consequently, end users are witnessing enhancements in device responsiveness and durability, as well as shorter lead times for custom orders.

Despite the near-term disruptions induced by elevated duties, the long-term outlook suggests that the reconfigured supply chain environment will promote a more balanced global ecosystem. By encouraging strategic on-shoring and collaborative R&D, the 2025 tariff framework is shaping a landscape where manufacturers can deliver high-quality digital note solutions with greater agility. This analysis of cumulative tariff impacts provides critical context for understanding cost dynamics and innovation trajectories across the digital notes market.

Illuminating Core Market Segments by Product, Application Nuances, End User Requirements, and Deployment Models Shaping Digital Note Adoption Strategies

A nuanced examination of market segments reveals how product type, application, end user profile, and deployment preferences converge to drive digital note adoption. Device offerings span from streamlined digital notepads optimized for rapid note capture to versatile E-ink tablets that balance extended battery life with crisp display clarity. Complementing these hardware options are smart notebooks that merge physical writing experiences with digital synchronization, catering to users who value tactile feedback alongside cloud-based accessibility.

Application areas further refine use cases, encompassing collaborative work scenarios where asynchronous ideation and real-time co-authoring tools enhance team productivity. Creative professionals leverage dedicated drawing modes for both artistic sketches and technical diagrams, while leveraging precision stylus support to maintain fine-tuned control. Academic and business note-taking environments benefit from intelligent organization and search capabilities, enabling swift retrieval of lecture highlights or meeting summaries. Meanwhile, project management workflows incorporate resource allocation and task management integrations to align captured insights with broader operational planning.

End users range from educational institutions harnessing digital note platforms to enrich teaching methodologies, to large enterprises deploying solutions across global offices and small and medium businesses seeking scalable collaboration tools. Healthcare providers, including clinics and hospitals, adopt digital handwriting inputs for seamless patient documentation, while individual professionals turn to personal digital notes to streamline daily workflows. Finally, deployment models span cloud-native architectures that facilitate cross-device synchronization and on-premise installations for organizations with strict data governance requirements. Understanding these segment interdependencies is essential for designing targeted product roadmaps and unlocking new growth opportunities.

This comprehensive research report categorizes the Digital Notes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Deployment

- Application

- End User

Exploring Critical Regional Dynamics from Americas to Europe Middle East Africa and Asia Pacific That Influence Digital Note Technology Adoption Trends

Regional dynamics play a defining role in digital note market trajectories, with distinct drivers emerging across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, a strong emphasis on corporate digital transformation has fueled enterprise investments in connected notepads and integrated collaboration suites. Early adopters appreciate seamless compatibility with leading productivity platforms and proactive local support networks that ensure high adoption rates.

Across Europe Middle East & Africa, regulatory frameworks surrounding data privacy and cross-border information flows have shaped deployment preferences. Organizations in these regions often favor on-premise solutions to maintain full control over sensitive content, while demand for E-ink devices is amplified by energy-efficiency goals and sustainability mandates. Strategic partnerships between local distributors and global manufacturers have emerged to address these unique compliance requirements and optimize after-sales service.

In the Asia-Pacific region, rapid digital literacy growth and favorable government initiatives promoting smart classrooms and digital healthcare applications have catalyzed widespread uptake. Educational institutions lead adoption in urban centers, deploying smart notebooks and cloud-enabled stylus devices to foster interactive learning. Simultaneously, manufacturing hubs have attracted increased R&D investment, driving advancements in display technology and stylus responsiveness. Examining these regional nuances is critical for stakeholders seeking to align product portfolios and go-to-market strategies with local market conditions.

This comprehensive research report examines key regions that drive the evolution of the Digital Notes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Strategic Advancements and Competitive Positions of Leading Innovators Driving Breakthroughs in Digital Note Hardware Software and Service Offerings

Leading innovators across hardware and software domains are shaping the competitive landscape through differentiated product architectures and strategic alliances. Companies specializing in E-ink displays have introduced next-generation panels with faster refresh rates and enhanced contrast ratios, enabling digital note devices to closely mimic the feel of pen on paper. Meanwhile, stylus technology providers are embedding pressure-sensitive sensors and programmable shortcut controls to cater to both creative and corporate workflows.

On the software front, platform vendors have expanded integration libraries to encompass popular project management, learning management, and enterprise content management systems. These integrations facilitate seamless transitions between note capture and broader operational processes, positioning digital notes as a central collaboration hub. Several ecosystem players have also launched developer SDKs and API sandboxes, encouraging third-party applications to leverage handwriting recognition and annotation metadata for customized solutions.

Partnerships between device manufacturers and enterprise software leaders have yielded bundled offerings that accelerate deployment timelines and reduce integration complexity. Additionally, service-oriented companies are providing managed device fleets and end-user training programs to help organizations maximize ROI. By continually balancing hardware innovation with software extensibility and support services, these key players are reinforcing their market positions and driving the evolution of holistic digital note solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Notes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ACECAD Digital Corp

- Anoto Group AB

- Apple Inc.

- Bending Spoons S.p.A.

- Google LLC by Alphabet Inc.

- HP Inc.

- Huawei Technologies Co., Ltd.

- IRIS S.A.

- Kent Displays Inc.

- Lenovo Group Limited

- Livescribe Inc.

- Luidia, Inc.

- Microsoft Corporation

- Moleskine S.r.l.

- NeoLAB Convergence Inc.

- NoteSlate

- Notion

- Portronics Digital Private Limited

- Ratta US Inc.

- reMarkable AS

- Rocketbook

- Samsung Electronics Co. Ltd.

- Sony Corporation

- Wacom Co., Ltd.

- Xencelabs Technologies Ltd.

Empowering Industry Leaders with Targeted Strategic Recommendations to Capitalize on Digital Note Innovations and Sustain a Competitive Edge in Evolving Markets

To capitalize on emerging opportunities, industry leaders should prioritize targeted investments in R&D that enhance cross-device interoperability and AI-driven content intelligence. Emphasizing open interoperability standards will facilitate seamless integrations with prevailing productivity ecosystems, ensuring that digital note outputs become pivotal inputs for broader enterprise workflows. In parallel, allocating resources to develop advanced handwriting and sketch recognition algorithms will create differentiated experiences that elevate user engagement.

Strategic supply chain diversification is equally critical. Firms must explore partnerships with regional manufacturers and assembly facilities to reduce exposure to tariff fluctuations and logistical delays. By building adaptable sourcing models, organizations can sustain competitive pricing while accelerating time to market for new feature sets. Furthermore, establishing local service hubs will enhance customer satisfaction and drive higher adoption rates through responsive maintenance and training programs.

From a go-to-market perspective, crafting compelling value propositions that align with specific vertical use cases-such as academic settings, healthcare documentation, and enterprise collaboration-will resonate more deeply with decision makers. Adopting outcome-based pricing models and offering tiered subscription services can also unlock new revenue streams while lowering entry barriers for smaller customers. Finally, ongoing monitoring of regulatory landscapes and proactive engagement with standards bodies will help firms anticipate compliance shifts and position themselves as trusted partners.

Outlining a Rigorous Research Approach Utilizing Expert Interviews Quantitative Surveys and Secondary Analysis to Uncover In-Depth Digital Note Market Trends

This research synthesizes primary and secondary data through a rigorous multimethod framework. Initially, expert interviews with device engineers, software architects, and enterprise technology leaders provided insider perspectives on innovation roadmaps and adoption challenges. These qualitative insights were complemented by quantitative online surveys conducted across representative samples of end users in education, enterprise, healthcare, and professional segments, ensuring balanced coverage of diverse use cases.

In parallel, extensive secondary analysis was performed on industry publications, regulatory records, and technology roadmaps to validate emerging trends and contextualize market shifts. Data points related to tariff implementations and supply chain structures were corroborated through customs databases and manufacturer disclosures. Findings were triangulated via cross-referencing internal financial reports and third-party white papers, enabling a holistic view of cost dynamics and competitive positioning.

To ensure methodological rigor, data collection protocols adhered to standardized frameworks for survey design and interview moderation. Special attention was given to sample stratification by region and end-user category to capture localized nuances. The resulting insights have been synthesized into actionable narratives, highlighting both macro-level drivers and micro-level user experiences that collectively inform strategic decision making in the digital note domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Notes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Notes Market, by Product Type

- Digital Notes Market, by Deployment

- Digital Notes Market, by Application

- Digital Notes Market, by End User

- Digital Notes Market, by Region

- Digital Notes Market, by Group

- Digital Notes Market, by Country

- United States Digital Notes Market

- China Digital Notes Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Major Insights into Technology Advances Regulatory Factors and User Experience Trends That Will Define the Next Frontier of Digital Note Solutions

The convergence of technological innovation, shifting work paradigms, and evolving regulatory environments is redefining the digital notes market. Rapid advancements in display and stylus technologies are ensuring that digital note devices deliver near-analog writing experiences, while AI-powered content intelligence transforms captured notes into strategic assets. At the same time, hybrid work and distance learning models continue to fuel demand for seamless collaboration and real-time synchronization across distributed teams and classrooms.

Regulatory influences, including data privacy mandates and import duty frameworks, have prompted device manufacturers and enterprise adopters to refine their deployment strategies. The cumulative impact of the 2025 tariff structure has underscored the importance of supply chain resilience and regional manufacturing capabilities. Meanwhile, end-user expectations for customizable note-taking experiences and tight integration with productivity platforms have driven a shift toward software-centric value propositions.

Looking forward, the digital note sector is poised for further transformation as immersive technologies, such as augmented reality and haptic feedback, gradually enter the mainstream. Organizations that navigate these trends-by balancing hardware excellence, software extensibility, and regulatory compliance-will unlock new efficiency gains and competitive advantages. This synthesis of core findings offers a strategic lens through which stakeholders can anticipate the contours of next-generation digital note solutions.

Connect with Ketan Rohom for Exclusive Access to Detailed Digital Note Market Research That Drives Strategic Decisions and Fosters Competitive Growth

For industry professionals eager to deepen their understanding of digital note market dynamics and gain an actionable edge, this comprehensive report offers unparalleled depth and clarity. By connecting with Ketan Rohom, Associate Director of Sales & Marketing, stakeholders will secure privileged insights into breakthrough trends, strategic imperatives, and competitor benchmarks that are not available through public channels. Engaging with this report paves the way for more informed investment decisions, targeted product development roadmaps, and strengthened go-to-market strategies. Reach out to Ketan Rohom to transform these insights into tangible business outcomes and accelerate growth in a rapidly evolving digital note ecosystem

- How big is the Digital Notes Market?

- What is the Digital Notes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?