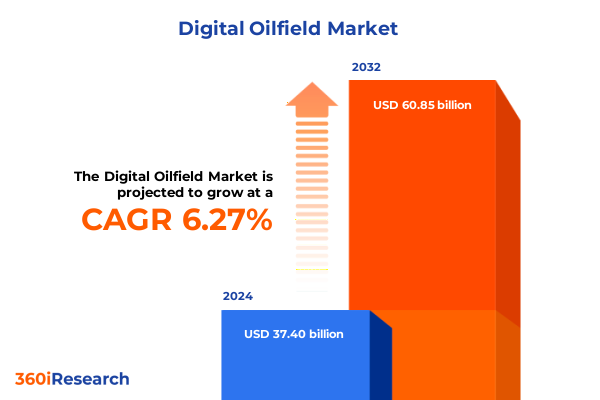

The Digital Oilfield Market size was estimated at USD 39.65 billion in 2025 and expected to reach USD 42.04 billion in 2026, at a CAGR of 6.30% to reach USD 60.85 billion by 2032.

Understanding the transformative convergence of technology and operations that is redefining oilfield performance and decision-making

The energy industry is at a pivotal juncture as operators strive to balance production efficiency, resource sustainability, and cost optimization. In this environment, the integration of digital technologies into traditional oilfield operations has emerged as a critical strategy for maintaining competitiveness and achieving operational excellence. Through intelligent instrumentation, advanced data analytics, and seamless communication platforms, organizations can enhance real-time decision-making and reduce downtime across the entire asset lifecycle. This trend is driven by the convergence of operational and information technologies, unlocking new levels of visibility into reservoir performance, drilling processes, and maintenance scheduling.

As the complexity of hydrocarbon exploration and production continues to increase, so does the demand for interoperability among hardware, software, and service components. Organizations that adopt a holistic digital oilfield framework gain a comprehensive view of operational metrics, enabling them to anticipate equipment failures, optimize drilling parameters, and coordinate supply chain activities with greater precision. Consequently, the industry is witnessing a shift from siloed technologies to integrated platforms that support collaboration across engineering, operations, and executive teams. This introductory overview lays the foundation for understanding how digital oilfield innovations are reshaping every facet of upstream and midstream activities, setting the stage for transformative shifts and strategic recommendations in the sections that follow.

Tracing the evolution from analog oilfield processes to data-driven ecosystems reshaping operational effectiveness

Over the past decade, the oil and gas industry has undergone a series of transformative shifts that have moved the sector from manual, analog processes to dynamic, data-driven ecosystems. The proliferation of Internet of Things devices has equipped field instruments, sensors, and actuators with connectivity, enabling continuous monitoring of pressure, temperature, and flow rates in real time. Parallel advances in industrial computing and edge platforms now bring analytical capabilities closer to operational assets, reducing latency and enhancing the speed of critical interventions. These developments are further amplified by cloud-based collaboration and communication tools, which facilitate remote operations centers capable of overseeing drilling and production activities across multiple geographies.

Moreover, artificial intelligence and machine learning algorithms are being embedded within data management and maintenance management software to predict equipment degradation, optimize reservoir extraction strategies, and identify safety anomalies before they escalate. The digital twin concept has also matured, offering virtual replicas of physical assets that allow engineers to run simulations under varied scenarios without risking field disruptions. Collectively, these shifts are democratizing advanced analytics and empowering interdisciplinary teams to leverage prescriptive insights in real time. As the industry continues to embrace these innovations, early adopters are gaining distinct advantages in operational reliability, environmental performance, and cost control.

Analyzing how 2025 tariff policies have reconfigured procurement strategies and supplier ecosystems in digital oilfield projects

In 2025, a series of tariff measures imposed on imported industrial and technological equipment has placed renewed emphasis on domestic sourcing and localization strategies within the United States. These duties, targeting steel, specialized drilling sensors, and network hardware, have elevated procurement costs and complicated the supply chains that underpin digital oilfield deployments. Operators reliant on foreign-manufactured field instruments and networking components have encountered extended lead times and increased capital expenditures, prompting a reassessment of vendor partnerships and inventory management practices.

In response, many organizations have accelerated collaboration with domestic fabricators and electronics manufacturers to mitigate the financial impact of tariff-induced price escalations. This shift has fostered a resurgence in local engineering expertise and an expansion of regional maintenance and support service networks. At the same time, software providers have updated licensing models to accommodate the evolving economic landscape, offering flexible subscription plans and cloud-based delivery to alleviate upfront hardware investments. Overall, the cumulative effect of tariff policies in 2025 has reshaped procurement strategies and spurred innovation in sourcing and delivery frameworks, reinforcing the importance of agile supply chain planning in digital oilfield rollouts.

Unveiling multidimensional segmentation insights that illuminate how hardware, software, services, and process focus areas unite for tailored digital oilfield solutions

Segmenting the digital oilfield market according to solution category reveals a layered ecosystem where hardware, software, and service offerings converge to drive operational improvements. On the hardware side, field instruments capture critical sensor readings that feed into industrial computers and edge devices, while networking equipment underpins secure data transmission. Additionally, actuators and specialized sensors execute control commands and provide feedback loops that refine drilling and production workflows. Within services, consulting teams bring domain expertise to tailor digital strategies, engineering and installation crews integrate complex systems into existing infrastructure, and maintenance and support units ensure continuous uptime through rapid response and troubleshooting.

The software segment adds further depth, with collaboration and communication platforms enabling virtual coordination among geographically dispersed stakeholders, data management systems structuring and cleaning vast volumes of operational information, and maintenance management suites optimizing repair schedules and asset performance. When examining process-oriented segmentation, areas such as asset management consolidate equipment data for lifecycle planning, drilling optimization leverages real-time inputs to enhance wellbore trajectories, and production optimization balances throughput against reservoir sustainability. Reservoir optimization applies advanced modeling to maximize yield, while safety management systems integrate automated alerts and compliance tracking to uphold regulatory standards.

Considering operational environments, offshore projects in deepwater drilling and subsea wells demand robust, corrosion-resistant instrumentation and specialized remote intervention services. Conversely, onshore activities centered on land-based exploration and shale extraction require scalable sensor networks and flexible software deployments capable of handling rapid shifts in well activity. By weaving these segmentation dimensions into a cohesive narrative, industry stakeholders can identify complementary solution bundles and address unique operational challenges with targeted digital oilfield strategies.

This comprehensive research report categorizes the Digital Oilfield market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution

- Process

- Operation Type

Exploring how regional variations across the Americas, EMEA, and Asia-Pacific shape distinct digital oilfield priorities and innovation pathways

Regional dynamics in the digital oilfield landscape reflect the distinct operational priorities and regulatory environments across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, advanced infrastructure and a strong push for energy independence have catalyzed investments in real-time analytics and edge computing solutions, enabling operators to streamline shale extraction and unconventional reservoir management. The regulatory emphasis on environmental oversight has also accelerated adoption of safety management technologies and emissions monitoring platforms.

Meanwhile, Europe, Middle East & Africa presents a diverse set of challenges and opportunities. Mature offshore basins in the North Sea and the Gulf of Mexico demand digital twins and predictive maintenance systems to optimize asset longevity, while emerging producers in West Africa and the Middle East are leveraging collaboration tools to coordinate multinational field development projects. This region’s regulatory framework and economic diversification agendas have fostered partnerships between national oil companies and technology providers, driving localized innovation in reservoir optimization and sustainability reporting.

In the Asia-Pacific, the rapid expansion of deepwater exploration around Southeast Asia and offshore Australia is accompanied by investments in automated drilling systems and remote monitoring platforms. Energy-hungry markets like China and India are prioritizing production optimization to balance supply security against carbon intensity targets, spurring demand for integrated data management suites and AI-driven analytics. Across these regions, interoperability standards and cybersecurity protocols are becoming critical enablers of cross-border digital oilfield deployments, highlighting the need for harmonized approaches to data governance and system integration.

This comprehensive research report examines key regions that drive the evolution of the Digital Oilfield market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting how innovation-driven providers and strategic partnerships are converging to deliver end-to-end digital oilfield platforms

Leading solution providers in the digital oilfield space are distinguished by their ability to offer end-to-end platforms that integrate instrumentation, analytics, and service delivery. Traditional oilfield service majors have broadened their portfolios by acquiring or partnering with specialized technology firms to embed advanced data management and predictive maintenance capabilities into their core offerings. These alliances have produced holistic packages that combine field-hardened sensors, robust networking architectures, and cloud-enabled software ecosystems designed for scalability.

Meanwhile, industrial automation and control specialists have leveraged their expertise in process instrumentation to expand into drilling optimization and production efficiency services. By integrating machine learning algorithms into maintenance management platforms, these companies have created self-learning systems that continuously refine operational parameters based on historical performance and real-time feedback. A new wave of digital-native entrants, often spun out of research institutions or technology incubators, is also making its mark by focusing on niche applications such as digital twin modeling, cybersecurity frameworks, and remote collaboration interfaces.

Across all categories, successful providers exhibit deep domain knowledge, strong partnerships with original equipment manufacturers, and a track record of delivering measurable improvements in uptime, throughput, and safety. Their ability to navigate complex engineering challenges, adhere to stringent regulatory standards, and customize solutions for diverse asset types underscores the critical role of vendor expertise in digital oilfield transformation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Oilfield market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Baker Hughes Company

- Cisco Systems, Inc.

- Digi International

- Emerson Electric Co.

- ENVERUS, INC.

- Halliburton Company

- Honeywell International Inc.

- HUVRdata

- International Business Machines Corporation

- KONGSBERG Gruppen ASA

- mCloud Technologies Corp

- Nabor Industries

- National Oilwell Varco, Inc.

- Pason Systems Corp.

- RigNet, Inc.

- Rockwell Automation, Inc.

- Schlumberger Limited

- Select Energy Services

- Shell PLC

- Siemens AG

- SparkCognition, Inc.

- VIRIDIEN S.A.

- Weatherford International PLC

Outlining strategic steps for industry executives to pilot, scale, and sustain digital oilfield initiatives with maximum impact

To harness the full potential of digital oilfield technologies, industry leaders should prioritize the development of an integrated technology roadmap that aligns with long-term operational goals. Initiating pilot programs focused on high-impact use cases such as preventive maintenance or reservoir modeling can deliver quick wins, build organizational buy-in, and establish proof points for broader rollouts. Strategic partnerships with vendors that offer open architectures and modular solutions will ensure flexibility and future-proofing as new technologies emerge.

Equally important is the cultivation of a digital-ready workforce through targeted training programs and cross-functional collaboration. Empowering field engineers and data scientists to work in tandem accelerates the translation of insights into actionable interventions. Concurrently, leadership must champion data governance frameworks, cybersecurity standards, and change management practices to address cultural resistance and safeguard critical information assets.

Finally, leaders should adopt an iterative approach to scaling digital oilfield initiatives, leveraging continuous feedback loops and performance metrics to refine strategies over time. By embedding agile methodologies and fostering transparent communication, organizations can navigate the complexities of implementation, mitigate risks, and capitalize on technological advances to drive sustained improvements in efficiency, safety, and environmental stewardship.

Detailing the comprehensive primary and secondary research methods used to derive unbiased operational and technology insights

The research underpinning this executive summary has been conducted through a rigorous blend of primary and secondary investigation methods. Primary insights were gathered via in-depth interviews with senior executives, operations managers, and technology specialists across upstream, midstream, and service organizations. These discussions provided firsthand perspectives on the real-world challenges, adoption barriers, and success factors associated with digital oilfield deployments.

Secondary research involved a comprehensive review of technical publications, industry white papers, regulatory filings, and publicly available company disclosures. Data triangulation techniques were employed to corroborate findings, ensuring consistency across diverse information sources. A panel of subject matter experts reviewed the analysis to validate key themes and contextualize trends within broader market dynamics.

Throughout the process, qualitative assessments were complemented by quantitative evaluations of technology adoption rates, project timelines, and reported performance improvements. The methodology emphasizes transparency, reproducibility, and impartiality, providing stakeholders with a clear understanding of the research scope, data sources, and analytical frameworks used to inform strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Oilfield market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Oilfield Market, by Solution

- Digital Oilfield Market, by Process

- Digital Oilfield Market, by Operation Type

- Digital Oilfield Market, by Region

- Digital Oilfield Market, by Group

- Digital Oilfield Market, by Country

- United States Digital Oilfield Market

- China Digital Oilfield Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Summarizing how integrated technologies and adaptive strategies are poised to redefine upstream performance and competitive standing in energy

Digital oilfield transformation is accelerating a paradigm shift in the energy sector, one characterized by heightened connectivity, predictive intelligence, and collaborative workflows. By integrating advanced instrumentation, data management systems, and AI-driven analytics, organizations can unlock unprecedented operational visibility, drive continuous improvement, and mitigate risk across every phase of the asset lifecycle. The innovations described in this summary illustrate how the convergence of hardware, software, and services is not merely an incremental upgrade but a fundamental reimagining of how oil and gas operations are conceived and executed.

As geopolitical factors and regulatory landscapes continue to evolve, the ability to adapt procurement strategies, localize supply chains, and align with emerging regional priorities will determine who leads in this next era of energy production. Companies that embrace iterative implementation, workforce empowerment, and strategic alliances will be best positioned to transform challenges into opportunities and to deliver superior financial and environmental outcomes. This brief synthesis of key trends, segmentation dynamics, and regional nuances underscores the complexity of digital oilfield initiatives while highlighting the clear pathways to operational excellence.

Unlock bespoke digital oilfield intelligence by securing an exclusive market research report through a direct consultation with an industry expert

Engaging directly with Ketan Rohom will empower your organization to navigate the rapidly evolving digital oilfield environment with confidence and clarity. Reach out for personalized insights tailored to your operational challenges and strategic objectives, and secure access to a comprehensive market intelligence package that distills complex technological trends, geopolitical factors, and segmentation analyses into actionable guidance. Your next step toward informed decision-making and sustained competitive advantage in the energy sector begins with a simple conversation. Elevate your understanding of emerging opportunities and drive transformative outcomes by connecting with Ketan Rohom to obtain the definitive report on digital oilfield innovation.

- How big is the Digital Oilfield Market?

- What is the Digital Oilfield Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?