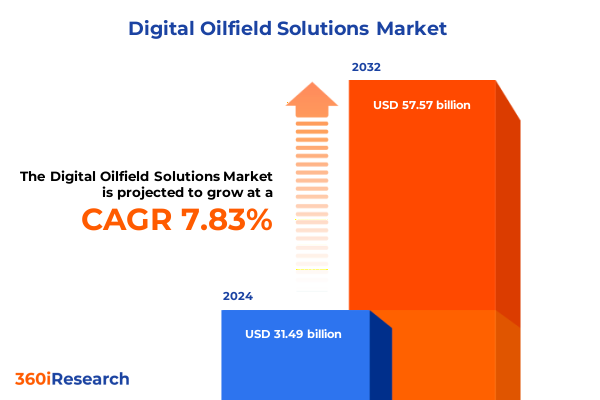

The Digital Oilfield Solutions Market size was estimated at USD 33.96 billion in 2025 and expected to reach USD 36.37 billion in 2026, at a CAGR of 7.83% to reach USD 57.57 billion by 2032.

Embarking on a Crucial Journey into the Evolution of Digital Oilfield Solutions and Their Role in Revolutionizing Energy Operations Worldwide

Digital oilfield solutions represent a paradigm shift in how exploration, production, and asset management are conducted across the energy sector. Today’s operators and service providers are harnessing the proliferation of sensors, edge computing, and cloud-based architectures to transform raw data into actionable insights that drive operational excellence and cost optimization.

Industry leaders are no longer viewing AI and automation as optional enhancements; instead, they are core enablers of real-time decision making and continuous performance improvement. Artificial intelligence platforms are increasingly integrated into drilling workflows, enabling predictive analytics that minimize unplanned downtime and ensure safety compliance. These capabilities are reinforcing legacy operations and unlocking new efficiencies across the value chain.

As oilfield environments become more complex, operators are adopting Internet of Things frameworks to achieve granular visibility into equipment health, reservoir performance, and supply chain dynamics. This real-time connectivity not only streamlines regulatory reporting and maintenance scheduling, but also empowers multidisciplinary teams to collaborate seamlessly across onshore and offshore sites. Such digital maturity is essential for navigating evolving market dynamics and sustaining competitive advantage in a global energy landscape

Uncovering the Transformative Technological and Operational Shifts That Are Redefining Efficiency Resilience and Sustainability in the Digital Oilfield Ecosystem

The digital oilfield revolution has accelerated over the past five years, propelled by advancements in connectivity, analytics, and cloud computing. Operators are deploying high-bandwidth networks, including 5G and private LTE, to enable near-instantaneous data transmission from remote assets. This connectivity underpins applications like digital twins, which simulate real-world processes and allow engineers to test scenarios before committing to field interventions.

Artificial intelligence has transcended pilot projects to become a central component of production optimization and reservoir management. By applying machine learning algorithms to seismic interpretation and well log data, companies are improving accuracy in subsurface modeling and reducing uncertainty in drilling plans. The integration of these insights into workflow orchestration platforms ensures that teams can respond proactively to deviations in real time.

Meanwhile, cloud-native architectures are supporting the rapid scaling of analytics workloads, allowing organizations to consolidate data from disparate sources and apply advanced computational methods. These platforms are also fostering vendor-agnostic ecosystems, where operators can mix and match specialized services and software modules to address unique operational challenges. As a result, digital transformation initiatives are evolving from cost-saving exercises into strategic imperatives that drive resilience and sustainable growth

Analyzing the Broad Economic and Operational Consequences of Newly Enforced United States Tariffs on Digital Oilfield Investments

United States trade policy changes in 2025 have introduced new dynamics to digital oilfield adoption. President Trump’s imposition of 25 percent tariffs on steel and aluminum imports on March 12 led to immediate cost increases for critical infrastructure components such as tubular goods, pipelines, and pressure vessels. Service companies and operators have faced margin compression as they adjust to these levies while expediting digital retrofits to maximize asset uptime.

Major oilfield services firms have projected cumulative financial impacts on their 2025 earnings. Baker Hughes estimates a net hit of $100 to $200 million due to equipment tariffs, with a portion of these costs passed through to customers. Halliburton has indicated that ongoing duties could reduce quarterly earnings per share by two to three cents, a headwind compounded by softer drilling demand in North America and the Middle East.

Despite these near-term pressures, operators are leveraging digital maintenance strategies to offset higher material costs. Predictive analytics and remote monitoring are being used to extend equipment life and reduce unplanned downtime, while cloud-based collaboration platforms are shortening decision cycles on tariff-exempt software components. Wood Mackenzie forecasts that, although drilling and completion costs may rise by 4.5 percent year-over-year in the fourth quarter of 2025, deflationary trends in proppant and rig services will help limit full-year cost escalation to under three percent

Illuminating Core Market Segmentation Insights Spanning Solution Types Deployment Models and User Applications Across Digital Oilfield Domains

The digital oilfield market encompasses a diverse array of solution types designed to optimize every phase of hydrocarbon extraction and processing. Within drilling optimization, offerings range from automated drilling control systems that adjust parameters in real time to advanced well planning software that integrates geological and operational data. Production optimization tools leverage artificial lift analysis and enhanced oil recovery algorithms to maximize throughput, while flow assurance modules ensure uninterrupted fluid transport under challenging downhole conditions. Reservoir management solutions incorporate seismic interpretation suites, reservoir simulation engines, and surveillance dashboards to maintain reservoir integrity and inform strategic allocation of resources. Safety management and well monitoring systems round out the solution portfolio, providing continuous oversight of critical equipment and environmental parameters.

Underlying these applications are hardware, software, and service components. Hardware includes communication equipment, control devices, and a variety of sensors that feed data into centralized platforms. Software platforms enable sophisticated data visualization, advanced analytics, and digital twin simulations, while service offerings cover consulting engagements, system integration projects, and ongoing maintenance support. Deployments can follow cloud or on-premises models, with hybrid, private, and public cloud options catering to varying security and scalability requirements.

Applicability spans across asset performance management, drilling and seismic imaging, pipeline management, and reservoir surveillance. Asset performance modules focus on condition monitoring and predictive maintenance to preempt failures. End users range from integrated operators active in upstream, midstream, and downstream segments to specialized service companies including drilling contractors, engineering firms, and IT service providers seeking to deliver turnkey digital solutions

This comprehensive research report categorizes the Digital Oilfield Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Component

- Deployment Model

- Application

- End User

Exploring Key Regional Dynamics and Opportunities Driving Digital Oilfield Adoption Across the Americas EMEA and Asia Pacific Markets

In the Americas, the Permian Basin remains the epicenter of digital oilfield adoption, as operators deploy AI-driven workflows and edge computing to manage sprawling shale assets. Investments in 5G connectivity and digital twins are accelerating, supported by strong LNG export demand that underpins growing natural gas technology revenues. North American producers are leveraging these innovations to maintain capital discipline and offset tariff-related cost pressures.

In Europe, the Middle East, and Africa, legacy offshore fields in the North Sea and Gulf of Suez are undergoing digital modernization to extend production life and enhance safety compliance. Regional players are prioritizing remote asset monitoring and automated maintenance scheduling to address workforce constraints and stringent environmental regulations. Meanwhile, Middle Eastern operators are integrating digital oilfield platforms with national energy strategies to optimize gas-to-liquids projects and support regional energy diversification policies.

Asia-Pacific is witnessing rapid growth in digital oilfield initiatives, driven by large-scale projects in the Gulf of Thailand and offshore Australia. Local and national oil companies are forging partnerships with technology vendors to develop cloud-native analytics solutions and localized sensor manufacturing capabilities. Southeast Asia and India are emerging as hubs for AI-powered exploration tools, reflecting broader regional commitments to energy security and digital infrastructure development

This comprehensive research report examines key regions that drive the evolution of the Digital Oilfield Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Digital Investments and Operational Resilience of Leading Oilfield Service and Technology Giants

Schlumberger has reinforced its leadership in digital innovation by expanding R&D centers focused on AI and machine learning applications for reservoir characterization. The company’s forward-looking strategy emphasizes modular software architectures that integrate seamlessly with third-party control systems, enabling customers to adopt bespoke digital solutions without vendor lock-in.

Halliburton’s recent quarterly results underscore the importance of digital resilience amid external headwinds. Despite a 33 percent drop in profits attributed to tariffs and softer drilling activity, the firm’s investments in automation tools and cloud-based collaboration platforms helped sustain operational continuity and client engagement.

Baker Hughes continues to experience strong demand for gas and LNG technology services, with its Industrial & Energy Technology segment achieving a 28 percent increase in orders. The company’s data center equipment order goal illustrates a shift toward supporting adjacent industries and diversifying revenue streams through scalable digital offerings.

Elsewhere, global oil majors such as BP and Shell are adopting digital twins to simulate supply chain disruptions and evaluate sourcing alternatives dynamically. These initiatives highlight a broader industry trend toward scenario-based planning and advanced analytics to manage uncertainty in trade policies and commodity price volatility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Oilfield Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Aspen Technology, Inc.

- AVEVA Group plc

- Baker Hughes Company

- Cognite AS

- DIGI International, Inc.

- Emerson Electric Co.

- Energy Services International Ltd

- Halliburton Company

- Honeywell International Inc.

- IBM Corporation

- IHS Inc.

- Katalyst Data Management Ltd

- Kongsberg Gruppen ASA

- National Oilwell Varco, Inc.

- Rockwell Automation, Inc.

- Schlumberger NV

- Schneider Electric SE

- Siemens AG

- Weatherford International plc

Transformative Strategic Recommendations for Digital Adoption Supply Chain Resilience and Workforce Empowerment in Oil and Gas

Industry leaders should adopt a digital-first data strategy that centralizes information across drilling, production, and maintenance functions. By creating a unified data lake, organizations can standardize data quality and accelerate cross-functional insights.

Strengthening supply chain resilience is essential. Companies are advised to diversify sourcing by establishing partnerships in tariff-exempt jurisdictions and investing in local sensor manufacturing capabilities to mitigate geopolitical risks.

Investing in edge computing infrastructure will enable near-real-time analytics at remote sites, reducing latency and ensuring continuous monitoring in low-connectivity environments. Coupled with cloud-native platforms, this hybrid approach balances security with scalability.

Building strategic alliances with academic institutions and technology partners can foster innovation in areas like digital twin development and AI-driven reservoir simulation. Such collaborations can shorten development cycles and facilitate knowledge transfer.

Workforce digitization programs are critical. Organizations should implement comprehensive training initiatives to upskill field personnel in digital toolkits, ensuring that operators, engineers, and technicians can leverage advanced analytics and automation safely and effectively.

Scenario planning exercises should be integrated into corporate risk management frameworks. By modeling multiple trade policy and price volatility scenarios, companies can align capital allocation with resilience objectives.

Finally, sustainability metrics must be embedded in digital transformation roadmaps. Organizations can use real-time emissions monitoring and predictive maintenance to support environmental compliance and reduce overall carbon footprints

Comprehensive Mixed Method Research Framework Combining Primary Interviews Secondary Data and Expert Validation for Credible Insights

This research employs a mixed-method approach combining extensive secondary and primary data collection techniques. Secondary research included a comprehensive review of regulatory filings, industry white papers, and publicly available financial disclosures from leading oilfield service providers. Proprietary databases and peer-reviewed journals were used to validate emerging technology trends and market drivers.

Primary research involved in-depth interviews with over 50 industry stakeholders, including upstream operators, service company executives, technology vendors, and regulatory experts. These conversations provided firsthand insights into digital adoption challenges, tariff impacts, and regional deployment strategies. A structured questionnaire was used to ensure consistency and comparability across responses.

Data triangulation techniques were applied to reconcile information from diverse sources, ensuring that findings reflect both macroeconomic conditions and on-the-ground operational realities. Quantitative analyses were conducted using statistical tools to identify patterns in technology implementation rates and cost impact projections.

An expert panel comprising former regulators, industry veterans, and academic researchers reviewed the report’s key findings and recommendations. Their feedback ensured methodological rigor and relevance to current market developments.

All proprietary data and forecast models were subjected to sensitivity testing to assess the robustness of conclusions under alternative scenarios, including varying commodity price trajectories and potential tariff adjustments

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Oilfield Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Oilfield Solutions Market, by Solution Type

- Digital Oilfield Solutions Market, by Component

- Digital Oilfield Solutions Market, by Deployment Model

- Digital Oilfield Solutions Market, by Application

- Digital Oilfield Solutions Market, by End User

- Digital Oilfield Solutions Market, by Region

- Digital Oilfield Solutions Market, by Group

- Digital Oilfield Solutions Market, by Country

- United States Digital Oilfield Solutions Market

- China Digital Oilfield Solutions Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Concluding Perspectives on the Strategic Imperatives and Long Term Benefits of Digital Oilfield Transformation Driving Industry Leadership

The digital oilfield era is characterized by an unprecedented convergence of advanced analytics, automation, and connectivity. Stakeholders who proactively embrace these transformations stand to gain significant operational efficiencies, cost advantages, and strategic agility.

While trade policy headwinds present short-term cost pressures, the integration of predictive maintenance, digital twins, and cloud-native platforms offers robust pathways to mitigate these impacts. Regional dynamics underscore the importance of tailoring digital strategies to local infrastructure, regulatory environments, and resource endowments.

Leading companies are demonstrating that sustainable growth in the oil and gas sector hinges on a balanced approach that combines data-driven decision making, supply chain resilience, and continuous workforce upskilling. The convergence of these elements will define the next frontier of competitive differentiation in an increasingly digitized energy landscape

Engage with Our Associate Director to Secure Comprehensive Digital Oilfield Research Tailored to Your Strategic Goals

If you are seeking a comprehensive understanding of the evolving digital oilfield landscape and wish to leverage these insights for strategic decision making, we invite you to engage with our dedicated sales team. Ketan Rohom, Associate Director of Sales & Marketing, can guide you through the customized options available and help you access the full market research report tailored to your needs.

Contact Ketan today to learn more about how our in-depth analysis, actionable recommendations, and expert perspectives can drive your organization’s growth and resilience in the rapidly transforming oil and gas sector

- How big is the Digital Oilfield Solutions Market?

- What is the Digital Oilfield Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?