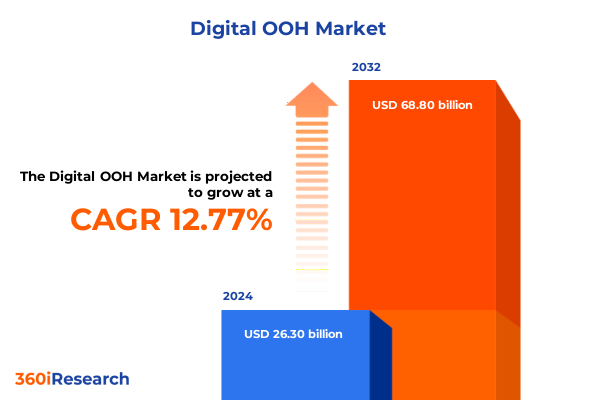

The Digital OOH Market size was estimated at USD 29.17 billion in 2025 and expected to reach USD 32.37 billion in 2026, at a CAGR of 13.03% to reach USD 68.80 billion by 2032.

Unlocking the Strategic Potential of Digital Out-of-Home Advertising Amidst Rapid Technological Advancements and Shifting Consumer Behaviors

Digital Out-of-Home advertising has transcended static billboards and classic transit panels to become a dynamic pillar of the modern media mix. Fueled by innovations in display technology, programmatic capabilities, and real-time data integration, it empowers brands to engage audiences in physical environments with unparalleled precision and creativity. The confluence of high-brightness LED screens in urban hubs, interactive touchpoints in retail and hospitality venues, and connected transit displays has redefined how consumers encounter messaging beyond the confines of personal devices.

Amid evolving consumer expectations for personalized, contextually relevant experiences, media owners and advertisers are compelled to harness advanced analytics, audience measurement, and automated buying systems. This shift underscores a broader trend: the fusion of digital, physical, and data-driven strategies to forge immersive brand encounters. As campaigns become more responsive to environmental and audience signals-ranging from weather-triggered content to proximity-based offers-Digital Out-of-Home is asserting its position as a critical channel for driving awareness, consideration, and foot traffic in an omnichannel ecosystem.

This executive summary distills the most salient developments shaping the DOOH landscape today, from tectonic shifts in technology and regulation to the nuanced behaviors of regional markets. It lays the groundwork for understanding the strategic imperatives that will drive success in a medium characterized by rapid evolution and growing advertiser demand.

How Emerging Technologies, Data-Driven Creativity, and Changing Audience Expectations Are Revolutionizing the Digital Out-of-Home Landscape

Over the past few years, Digital Out-of-Home has undergone transformative shifts driven by advancements in programmatic buying, audience verification, and creative orchestration. Programmatic platforms now enable advertisers to purchase screen time in real time, leveraging third-party data to target based on demographics, footfall patterns, and dayparting strategies. This evolution has democratized access to premium inventory previously siloed within large network operators, empowering brands of all scales to run agile, performance-oriented campaigns.

Simultaneously, the integration of computer vision and mobile location analytics has bolstered measurement accuracy, providing granular insights into campaign effectiveness. Brands can now correlate screen impressions with physical store visits or online engagements, closing the loop on attribution. Augmented reality overlays and dynamic creative optimization further enhance viewer engagement, allowing for contextually triggered content such as live social feeds or interactive wayfinding prompts during high-traffic retail events.

Moreover, sustainability considerations are reshaping hardware design and power management, with new display modules offering lower energy consumption and recyclability credentials. Network operators are adopting green initiatives, optimizing schedules to minimize run-time during off-peak hours and incorporating solar-powered displays in outdoor installations. These combined shifts signal a maturation of the DOOH ecosystem, where technological sophistication, accountability, and environmental stewardship converge to redefine the medium’s value proposition.

Examining the Far-Reaching Consequences of 2025 United States Tariffs on Digital Out-of-Home Production, Distribution, and Operational Expenditure

In 2025, the United States imposed a series of tariffs on imported display components and electronic modules, aiming to protect domestic manufacturing. These measures have rippled across the DOOH supply chain, elevating the cost of display panels, control systems, and media players sourced from key manufacturing hubs in East Asia. Hardware providers have responded by diversifying their procurement strategies, seeking component sourcing from alternative markets or accelerating the development of domestically manufactured alternatives.

These cost pressures have had a cumulative impact on network rollouts and refresh cycles, prompting media owners to extend display lifecycles and renegotiate vendor contracts to manage capital expenditure. Some operators are exploring modular display architectures that enable incremental upgrades without full panel replacements, thereby mitigating tariff-related price hikes. On the software front, investment in platform enhancements and analytics capabilities has been prioritized over hardware expansion, reflecting a shift toward maximizing ROI on existing infrastructure.

End-user industries, notably transportation and retail, are adjusting their deployment strategies in response to higher setup costs and extended lead times. Collaborative models-where venue owners and media networks share revenue or co-invest in installations-are gaining traction as a means to sustain growth trajectories. While these adaptations have introduced operational complexities, they have also accelerated innovation in display modularity and financing structures, laying the groundwork for more resilient upstream and downstream partnerships.

Decoding the Diverse Segmentation Frameworks Revealing Format, Industry, Technological, Application, and Interactivity Dynamics in Digital Out-of-Home

The Digital Out-of-Home market reveals intricate segmentation across multiple dimensions that inform deployment strategies and value creation. Viewed through the lens of format, large-format digital screens dominate urban thoroughfares and highway exteriors, while place-based installations within elevators leverage captive dwell time. Hospitality venues such as hotel lobbies and convention centers utilize tailored content rotations, and retail site-specific displays deliver point-of-sale promotions. Small-format digital posters, integrated into street furniture and transit shelters, serve localized messaging needs, whereas transit digital solutions blend on-board bus panels, inflight entertainment monitors, and rail station displays to target audiences on the move.

End-user industry segmentation underscores distinct content and measurement requirements: the entertainment sector prioritizes high-resolution visuals and dynamic social integrations for event promotions; hospitality venues demand wayfinding overlays and real-time occupancy updates; retail outfits emphasize promotional triggers linked to loyalty programs; while transportation hubs integrate scheduling information and public service announcements into advertising rotations.

Technology choices further differentiate network designs, with DLP solutions prevalent in indoor venues requiring high contrast, LCD panels favored for brightness consistency, LED modules selected for large outdoor canvases, and projection systems employed in immersive experiential zones. Application-driven approaches reveal that advertising dominates screen time, but entertainment loops, informational tickers, and interactive wayfinding stations diversify audience engagement across environments.

Interactivity introduces another layer of complexity: gesture-based installations in mall directories captivate passersby, touch-enabled kiosks enhance self-service ordering in quick-service restaurants, and voice-activated screens facilitate hands-free inquiries in transit stations. Meanwhile, non-interactive displays deliver dynamic content feeds such as live news tickers and weather alerts alongside static brand messages, ensuring a balanced mix of passive and participatory engagements.

This comprehensive research report categorizes the Digital OOH market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Format

- End User Industry

- Technology

- Interactivity

- Application

Unveiling Regional Dynamics Shaping Digital Out-of-Home Adoption and Innovation Across the Americas, Europe’s Markets, the Middle East, Africa, and Asia-Pacific

Regional dynamics exert a profound influence on Digital Out-of-Home adoption and innovation. In the Americas, robust infrastructure investments in major metropolitan areas, combined with strong programmatic demand, have accelerated network expansion. Major transit authorities and retail conglomerates are integrating DOOH into broader smart city initiatives, using unified network APIs to power civic messaging alongside commercial campaigns.

Across Europe, Middle East & Africa, regulatory standards around public space co-regulation and data privacy shape deployment playbooks. Landmark urban centers such as London, Paris, and Dubai showcase high-density LED facades and urban art installations, while emerging markets in Sub-Saharan Africa explore solar-powered outdoor displays to address grid limitations. Advertisers in these regions often negotiate multi-country agreements, balancing localized content strategies with centralized performance tracking.

The Asia-Pacific realm reflects vast heterogeneity: mature markets like Japan and Australia emphasize programmatic-only transactions through established exchanges, whereas Southeast Asian hubs such as Singapore and Malaysia focus on experiential pop-ups and mall-based activations. Rapid urbanization in India and China stimulates demand for roadside digital panels and integrated metro station networks. Operators tailor content toward local languages, cultural nuances, and real-time service announcements, ensuring audience relevance and regulatory compliance.

This comprehensive research report examines key regions that drive the evolution of the Digital OOH market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovators Defining the Competitive Digital Out-of-Home Ecosystem Through Strategic Capabilities and Partnerships

The Digital Out-of-Home ecosystem is characterized by a blend of incumbent media network operators, display technology innovators, and programmatic platform providers. Leading out-of-home network owners have fortified their competitive positions through strategic acquisitions of data analytics firms, enhancing audience verification capabilities and cross-channel attribution offerings. Technology vendors specializing in modular panel architecture and power-efficient designs continuously invest in R&D to address evolving tariff landscapes and sustainability mandates.

Programmatic marketplaces and demand-side platforms have refined their integrations with major ad exchanges, offering unified dashboards for campaign planning, real-time bidding, and performance reporting. These platforms differentiate themselves through advanced targeting engines that combine mobile footprint data, demographic overlays, and contextual triggers such as weather or event schedules. In parallel, creative technology agencies are pushing the envelope with interactive content toolkits, enabling brands to deploy gesture, touch, and voice interfaces without extensive developer support.

Partnerships between venue operators and content agencies are emerging to curate themed experiences in high-footfall environments. These collaborations often feature dynamic wayfinding overlays for hospitality and transportation clients, live social media walls for entertainment venues, and regionally customized promotions for retail chains. Collectively, these strategic alliances underscore an industry increasingly defined by cross-functional synergies rather than isolated hardware or software offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital OOH market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adams Outdoor Advertising

- Blue Line Media LLC

- Broadsign

- Burkhart Marketing Partners, Inc.

- Capitol Outdoor, Inc.

- Clear Channel Outdoor, LLC

- Daktronics, Inc.

- Eye Media, ApS.

- Global Media Group Services Limited

- Intersection Parent, Inc.

- JCDecaux Group

- Lamar Advertising Company

- Lightbox OOH Video Network

- Mvix(USA), Inc.

- Ocean Outdoor UK Limited

- oOh!media Limited

- OUTFRONT Media Inc.

- Primedia Proprietary Limited

- QMS Media Pty Ltd

- Samsung Electronics Co., Ltd.

- Sharp NEC Display Solutions Europe GmbH

- Ströer CORE GmbH & Co. KG

- Talon Outdoor

- The Times Group

Actionable Strategies for Industry Leaders to Harness Programmatic Integration, Creative Innovation, and Operational Excellence in Digital Out-of-Home

To thrive in the evolving Digital Out-of-Home landscape, industry leaders must embrace a multifaceted approach that integrates programmatic agility, creative experimentation, and operational discipline. First, advertisers and network operators should prioritize seamless API connectivity between audience data sources and buying platforms, ensuring campaigns can pivot in real time based on foot traffic, weather shifts, or event triggers. This capability not only optimizes budget allocation but also enhances attribution clarity across channels.

Second, fostering creative partnerships that combine immersive technologies-such as augmented reality overlays and interactive voice assistants-with contextual triggers will drive deeper engagement and longer dwell times. Brands that leverage modular content frameworks can rapidly iterate messaging across formats, industries, and regions while maintaining cohesive brand narratives.

Third, strengthening supply chain resilience through diversified component sourcing and modular hardware architectures will mitigate future tariff shocks. Operators should explore revenue-sharing models with venue partners to distribute upfront investment risks and accelerate network rollouts. Finally, embedding sustainability metrics into performance dashboards-tracking energy consumption per impression or carbon offset programs-will resonate with environmentally conscious stakeholders and comply with emerging ESG requirements.

Comprehensive Mixed-Method Research Approach Integrating Primary Stakeholder Engagement and Secondary Data Analysis to Validate Digital Out-of-Home Insights

The insights presented in this report derive from a rigorous mixed-method research framework. Primary data was gathered through in-depth interviews with senior executives across media network operators, technology providers, brand marketers, and venue owners, ensuring a comprehensive perspective on strategic priorities and operational challenges. These interviews were complemented by site visits to key installation environments, including retail malls, transit hubs, and experiential pop-ups, to observe real-world deployments and gauge audience interactions.

Secondary research involved systematic reviews of industry publications, regulatory filings, and technology whitepapers to contextualize emerging trends in hardware design, software capabilities, and tariff policies. Data triangulation techniques were applied to reconcile divergent estimates and validate qualitative insights against observable market behaviors. Additionally, competitive benchmarking analyses evaluated product roadmaps, partnership announcements, and R&D investments of leading stakeholders to identify differentiating strategies.

All findings underwent a multi-tiered validation process, including expert panel reviews and stakeholder workshops, to ensure both accuracy and relevance. This robust methodology underpins the strategic recommendations and segmentation frameworks presented throughout the executive summary, providing clients with actionable, evidence-based insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital OOH market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital OOH Market, by Format

- Digital OOH Market, by End User Industry

- Digital OOH Market, by Technology

- Digital OOH Market, by Interactivity

- Digital OOH Market, by Application

- Digital OOH Market, by Region

- Digital OOH Market, by Group

- Digital OOH Market, by Country

- United States Digital OOH Market

- China Digital OOH Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Observations to Chart the Future Trajectory of Digital Out-of-Home Advertising Amidst Technological and Market Disruptions

Digital Out-of-Home has reached a pivotal juncture where technological sophistication, regulatory landscapes, and shifting consumer behaviors converge to shape the medium’s future trajectory. Programmatic buying, real-time measurement, and creative interactivity have transitioned from aspirational concepts to baseline requirements for competitive campaigns. At the same time, tariff-induced cost pressures and regional regulatory nuances demand agile procurement practices and localized deployment strategies.

Segmentation insights highlight that diverse format types-from large urban canvases to small transit posters-and varied industry applications each present distinct value propositions and operational considerations. Regional dynamics underscore the importance of tailoring network designs and content strategies to infrastructure maturity levels, regulatory environments, and cultural contexts. Meanwhile, the ecosystem’s collaborative ethos, exemplified by strategic partnerships between network operators, technology innovators, and creative agencies, signals a move away from siloed offerings toward integrated solutions.

Looking ahead, Digital Out-of-Home will increasingly serve as a linchpin in omnichannel media strategies, bridging the digital and physical realms with unparalleled scale and precision. Organizations that embrace data-driven decision-making, invest in modular and sustainable hardware architectures, and cultivate cross-functional alliances will be best positioned to capitalize on emerging growth opportunities and future-proof their DOOH initiatives.

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to Secure Exclusive Digital Out-of-Home Market Research Insights Tailored to Your Strategic Objectives

To access this invaluable resource and gain a competitive edge in Digital Out-of-Home advertising, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in customizing research deliverables to align with specific organizational goals, whether optimizing programmatic integration, enhancing creative executions, or refining deployment strategies across formats and regions.

By engaging with Ketan, you will receive a tailored briefing on how the report’s insights map onto your unique priorities, with flexible options for data deliverables, in-depth presentations, and ongoing advisory support. Secure your copy today to future-proof your strategic planning, deepen client relationships, and unlock new growth avenues in the dynamic DOOH space.

- How big is the Digital OOH Market?

- What is the Digital OOH Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?