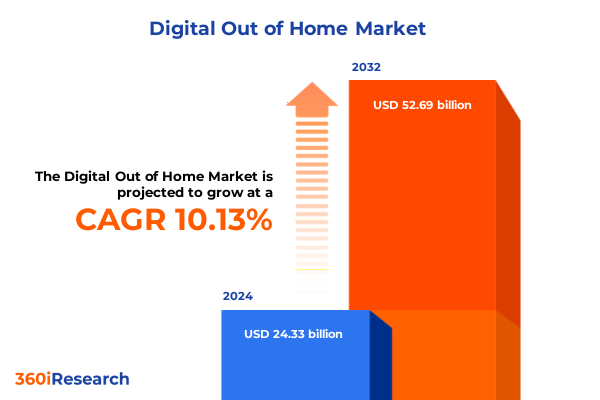

The Digital Out of Home Market size was estimated at USD 26.69 billion in 2025 and expected to reach USD 29.30 billion in 2026, at a CAGR of 10.20% to reach USD 52.69 billion by 2032.

Unveiling the Evolution of Digital Out of Home as a Catalyst for Immersive Consumer Engagement and Strategic Brand Visibility in the Modern Marketplace

Digital out of home has evolved beyond static billboards into a sophisticated, data-driven medium that engages consumers in real time. Advertisers increasingly leverage dynamic content to capture attention in high-traffic urban and suburban environments. By integrating GPS and mobile data signals, screens adjust messaging based on audience demographics, time of day, and local events, delivering highly relevant advertising. This fusion of contextual relevance and visual impact is redefining how brands connect with audiences outside traditional digital channels.

As media consumption habits shift toward on-the-go experiences, digital out of home stands at the intersection of physical presence and digital agility. Its unique capacity to reach audiences who have become resistant to ad blockers and subscription fatigue positions this channel as a vital component of omnichannel strategies. Brands that harness the power of dynamic displays and contextual triggers can foster deeper customer interactions and drive measurable campaign outcomes, elevating the role of outdoor media within the broader advertising ecosystem.

Exploring the Technological and Operational Transformations Reshaping Digital Out of Home from Programmatic Buying to Interactive Augmented Reality Experiences

Technological innovation and shifting consumer behaviors are converging to transform digital out of home into an adaptive and interactive medium. Programmatic buying now automates the planning and purchasing of screen inventory, enabling marketers to optimize spend through real-time bidding. This shift reduces manual workflow inefficiencies and aligns buying decisions with performance metrics, ensuring that ads run where and when they will have maximum impact.

Simultaneously, artificial intelligence and machine learning algorithms are powering predictive content optimization, allowing screens to tailor messaging based on historical engagement data. Augmented reality integration is further enhancing interactivity by inviting passersby to engage with overlays and immersive experiences using their smartphones. These advances, coupled with cloud-based content management platforms, are breaking down operational barriers and opening the door for more agile campaign iterations. As a result, what was once a one-size-fits-all channel now responds instantly to audience cues, fostering a more personalized brand dialogue in the physical world.

Assessing the Far Reaching Effects of United States Tariffs on Display Technology Supply Chains and Operational Costs Across the Digital Out of Home Ecosystem in 2025

The introduction of new United States tariffs in early 2025 has reverberated across the digital out of home sector, influencing procurement strategies and cost structures. Increased duties on display panel imports have prompted hardware providers to reassess global supply chains. Many vendors are accelerating diversification efforts by sourcing components from tariff-exempt regions and forging partnerships with domestic manufacturers to mitigate price volatility.

These adjustments have led to a recalibration of deployment timelines, with network operators prioritizing screen rollouts in markets where favorable trade agreements reduce import burdens. At the same time, service providers are renegotiating long-term maintenance contracts to account for higher hardware replacement costs. Despite these headwinds, operators who have embraced cloud-based network infrastructure have found buffer in operational flexibility, enabling them to shift resources and scale deployments without incurring heavy capital expenditures on new on-premises equipment.

Uncovering Multi Dimensional Segmentation Insights Spanning Platform Types Technology Adoption Media Formats Screen Sizes Network Infrastructure and Industry Verticals

A nuanced understanding of market segmentation reveals how each facets drives opportunities and challenges for digital out of home deployments. Platform type distinctions range from expansive billboard networks anchoring highway corridors to intimate transit displays in subways and buses, each demanding tailored content strategies. Place-based screens within retail environments necessitate different engagement tactics than city-wide networks, reflecting the varied consumer mindsets in each context. Meanwhile, signage formats continue to diversify, morphing from static panels to dynamic, content-rich installations that command attention in high-footfall venues.

Technology adoption further differentiates market needs. Adoption of AI and machine learning solutions enables real-time audience insights and automated content triggers, whereas augmented reality integration fosters immersive experiences that bridge the digital-to-physical gap. Media format choice also plays a crucial role: dynamic displays with live data feeds excel at capturing fleeting attention, while static screens provide brand consistency and minimal maintenance overhead. Screen dimensions influence visibility and use case, with large-format installations dominating outdoor sites, medium displays engaging shoppers within malls, and small screens offering point-of-sale prompts.

Network infrastructure preferences split between cloud-based services that streamline remote management and on-premises systems optimized for secure, localized operations. Display technology itself spans direct-view fine-pixel LED walls supporting large-scale branding, energy-efficient e-paper installations for subtle messaging, traditional LCD screens providing proven reliability, and OLED panels delivering high contrast in premium environments. Finally, industry verticals shape deployment trajectories: automotive showrooms leverage visually striking installations; cinema and live event venues deploy large displays for pre-show promotions; financial institutions prioritize static screens for regulatory messaging; government agencies use secure networks for public information; healthcare facilities adopt discreet signage for patient wayfinding; real estate showcases leverage high-resolution panels to virtualize properties; and retail spaces tailor content across electronics, fashion and apparel, and home goods outlets to drive point-of-purchase decisions.

This comprehensive research report categorizes the Digital Out of Home market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Media Type

- Screen Size

- Network Infrastructure

- Displays Type

- Industry Vertical

Analyzing Regional Dynamics Highlighting Market Nuances in the Americas Europe Middle East Africa and Asia Pacific for Digital Out of Home Deployments

Regional market dynamics illustrate how digital out of home strategies are being tailored across geographies to address unique consumer, regulatory, and infrastructure considerations. In the Americas, urban concentrations in North American metropolises continue to favor high-resolution, large-format installations along transit corridors and shopping districts. Marketing teams in this region are increasingly integrating real-time campaign analytics with mobile geofencing data to measure walk-by conversions and refine targeting. Central and South American markets show growing interest in cloud-based networks that reduce upfront infrastructure commitments while delivering flexibility in emerging urban landscapes.

Across Europe, Middle East and Africa, regulatory frameworks around data privacy and outdoor advertising permissions shape deployment strategies. Many European capitals have implemented strict content approval processes, leading operators to adopt hybrid on-premises systems that ensure compliance. In the Middle East, rapid infrastructure development and investment in smart city initiatives have accelerated large-scale digital signage rollouts in airports and public squares. African markets are witnessing pilot programs that combine solar-powered e-paper displays with satellite connectivity to bridge power and connectivity gaps, demonstrating innovative pathways for incremental expansion.

Asia-Pacific continues to be a hotbed of digital out of home experimentation. High-density urban centers in East Asia leverage AI-driven content networks across shopping malls, districts, and transportation nodes to deliver personalized brand experiences. Southeast Asian markets show rising appetite for interactive and augmented reality activations at live events and cultural festivals. Meanwhile, governments in Australia and New Zealand promote regulated but growth-oriented frameworks that encourage cloud-first deployments, setting the stage for rapid adoption of next-generation display technologies.

This comprehensive research report examines key regions that drive the evolution of the Digital Out of Home market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Emerging Players Driving Innovation Partnerships and Competitive Strategies in the Digital Out of Home Landscape

A handful of global leaders drive innovation and competitive pressure within the digital out of home market. Legacy outdoor media conglomerates have expanded their service offerings through strategic acquisitions of programmatic ad networks and content management technology providers. These incumbents leverage established site portfolios to introduce enhanced data analytics capabilities, forging end-to-end solutions from audience measurement to creative execution. Meanwhile, digital native entrants are disrupting the status quo by offering modular, API-driven platforms that integrate seamlessly with third-party customer data and ad tech stacks.

Partnerships between hardware manufacturers and software developers are becoming more frequent, creating vertically integrated solutions that lower barriers to entry for emerging advertisers. Some players are focusing on proprietary AI engines that optimize content scheduling and creative rotations in real time. Others invest heavily in research and development of new display materials such as transparent OLED and adaptive e-paper. Competitive differentiation often centers on the ability to deliver turnkey services, combining hardware deployment, network maintenance, and campaign analytics under a unified contract model.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Out of Home market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aflak Electronic Industries Co.

- Bell Canada Enterprises Inc.

- Blip by ACME Intergalactic Inc.

- Broadsign International LLC

- Christie Digital Systems USA, Inc. by Ushio, Inc.

- Cisco Systems, Inc.

- Clear Channel Outdoor, LLC

- Daktronics Inc.

- Electro-Matic Corporate

- EMC Outdoor LLC

- Firefly Systems Inc.

- Global Media Group Services Limited

- Google, LLC by Alphabet Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hola Systems

- Intel Corporation

- Intersection Parent, Inc.

- JCDecaux SE

- Lamar Media Corp.

- LG Electronics, Inc.

- oOh!media Limited

- OUTFRONT Media Inc.

- Panasonic Holdings Corporation

- Pattison Outdoor

- QMS Media Limited

- Samsung Electronics Co., Ltd.

- Sharp NEC Display Solutions

- Ströer SE & Co. KGaA

- Talon Outdoor Limited

- The Neuron Holdings, Inc.

- Vistar Media, Inc. by T-Mobile

- Xtreme Media Private Limited

Developing Actionable Strategies for Industry Leaders to Navigate Technological Disruption Regulatory Challenges and Consumer Engagement in Digital Out of Home

Executive decision makers can capitalize on these industry shifts by adopting a multifaceted strategy that balances technological investment with operational agility. Embracing AI driven content management platforms will enable marketers to automate real time optimization and measure incremental lift across out of home channels. Simultaneously, exploring augmented reality activations can drive deeper consumer engagement and extend campaign lifecycles beyond passive viewing.

Supply chain resilience must remain a strategic imperative in light of recent trade policy changes. Diversifying component sourcing and engaging with domestic hardware suppliers can mitigate tariff related cost pressures. At the same time, adopting cloud based network infrastructure will reduce capital expenditures and accelerate deployment timelines. Aligning with regulatory frameworks across regions through hybrid on premises configurations ensures compliance without sacrificing the benefits of centralized remote management.

Collaborative partnerships with data providers and customer experience platforms offer pathways to unify digital out of home within broader omnichannel ecosystems. By integrating location based insights and mobile engagement metrics, brands can attribute offline conversions to outdoor ad spend, creating closed loop measurement that informs budget allocation. Lastly, tailoring content strategies to the distinct demands of industry verticals-from retail point of sale to healthcare wayfinding-will unlock maximum relevance and drive return on investment across campaigns.

Detailing Rigorous Research Methods Including Primary Interviews Secondary Data Triangulation and Case Study Analyses Underpinning the Digital Out of Home Report

This report was developed through a rigorous research process combining extensive secondary research with targeted primary data collection. Industry publications, trade association briefings, and patent filings provided foundational insights into technology trends and regulatory developments. These findings were validated through interviews with executives across digital out of home networks, hardware manufacturers, and technology integrators.

Quantitative data was triangulated using global trade statistics, advertising spend reports, and proprietary databases tracking network growth and audience measurement. Select case studies illustrate successful deployments across major regions, highlighting best practices and lessons learned. Expert panel discussions and peer review sessions ensured that the analysis reflects both current realities and emerging trajectories. The methodology balances depth of coverage with analytical rigor, providing a transparent foundation for the conclusions and recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Out of Home market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Out of Home Market, by Platform Type

- Digital Out of Home Market, by Media Type

- Digital Out of Home Market, by Screen Size

- Digital Out of Home Market, by Network Infrastructure

- Digital Out of Home Market, by Displays Type

- Digital Out of Home Market, by Industry Vertical

- Digital Out of Home Market, by Region

- Digital Out of Home Market, by Group

- Digital Out of Home Market, by Country

- United States Digital Out of Home Market

- China Digital Out of Home Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Core Takeaways Illustrating Market Evolution Strategic Imperatives and Future Outlook for Stakeholders in the Digital Out of Home Sector

The digital out of home landscape stands at an inflection point driven by confluence of technological innovation, shifting consumer behaviors, and evolving regulatory frameworks. Dynamic content capabilities, powered by AI and augmented reality, are redefining how brands capture attention in public spaces. At the same time, tariff impacts and supply chain considerations underscore the importance of operational flexibility and strategic sourcing.

Segmentation insights reveal that platform diversification, network infrastructure choices, and industry vertical requirements will continue to shape deployment priorities. Regional nuances demand tailored strategies, whether that means leveraging cloud first models in developed markets or pioneering off grid display technologies in underserved areas. Competitive dynamics favor those who integrate hardware and software into cohesive, end to end offerings that align with omnichannel marketing goals.

Looking ahead, stakeholders who invest in data driven content optimization, forge resilient supply chains, and embrace emerging display formats will secure a leadership position in this rapidly evolving sector. By synthesizing market intelligence with actionable recommendations, this report equips decision makers to navigate uncertainty and unlock the full potential of digital out of home.

Engage with Associate Director Sales and Marketing to Secure the Comprehensive Digital Out of Home Market Report and Drive Strategic Growth Initiatives

To explore how this comprehensive market research report can empower your strategic planning and growth initiatives, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). He will guide you through the detailed findings, bespoke data breakdowns, and customized support tailored to your organization’s needs. Engaging with Ketan ensures you gain direct access to exclusive insights and receive expert consultation on leveraging digital out of home intelligence to enhance campaign effectiveness and ROI. Secure your copy today to stay ahead of industry shifts and drive sustainable growth through informed decision-making.

- How big is the Digital Out of Home Market?

- What is the Digital Out of Home Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?