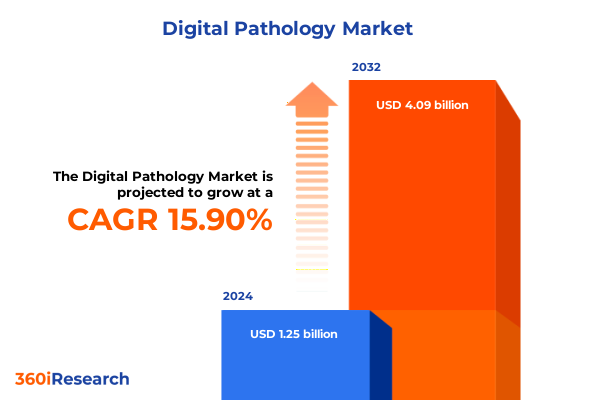

The Digital Pathology Market size was estimated at USD 1.44 billion in 2025 and expected to reach USD 1.66 billion in 2026, at a CAGR of 16.05% to reach USD 4.09 billion by 2032.

Framing the strategic imperative for digital pathology as an integrated, platform-driven capability that transforms diagnosis, research, and clinical decision pathways

Digital pathology has moved from niche innovation to a strategic imperative for clinical laboratories, academic centers, and life sciences organizations seeking more reproducible, scalable, and data-rich approaches to tissue-based diagnosis and discovery. Rather than viewing digitization as a point-solution, leading institutions are treating it as an interoperable platform that spans sample imaging, image management, algorithmic analysis, and long-term data stewardship. This platform view reframes conventional laboratory workflows and creates new intersections with molecular diagnostics, clinical trial operations, and precision oncology programs.

Adoption decisions today are driven by the desire to solve three persistent operational problems: variability in manual interpretation, limited access to subspecialty expertise, and the mounting pressure on laboratories caused by workforce shortages. As a result, vendor roadmaps increasingly prioritize cloud-enabled image management, multi-vendor scanner interoperability, and regulatory-grade AI components that can be integrated into diagnostic practice. These technology priorities are accompanied by organizational shifts-centralized imaging hubs, federated data governance, and cross-disciplinary teams that blend pathology, data science, and regulatory expertise-because converting images into actionable clinical or R&D value requires changes to people, process, and platform in parallel.

Transitioning to digital pathology is therefore as much about change management as it is about hardware and software selection. Institutions that succeed invest early in governance frameworks, validation protocols, and clinician-facing usability, while also mapping how image-derived biomarkers will interface with existing laboratory information systems and clinical decision processes. When these elements are orchestrated together, digital pathology delivers faster case turnaround, improved consultation reach, and a foundation for AI-driven biomarker discovery that can accelerate translational research and clinical trial enrollment.

How regulatory momentum, platform-first AI strategies, and acute workforce pressures are converging to redefine digital pathology adoption and vendor collaboration

The digital pathology landscape is being reshaped by a trio of interdependent shifts that are altering technology roadmaps, procurement priorities, and clinical practice. First, regulatory clarity and major vendor clearances have legitimized primary-diagnostic use of whole-slide imaging and computational tools, making digital-first workflows an achievable objective rather than an experimental pilot. Regulatory momentum has lowered a key barrier to clinical adoption and has encouraged health systems and diagnostic labs to plan enterprise deployments that include high-throughput slide scanners and validated image viewers. This regulatory progress is anchored by multiple recent clearances and designations that signal a mainstreaming of computational pathology into diagnostic care.

Second, the rapid maturation of AI and cloud technologies has shifted value from single-use algorithms to platforms that enable model development, validation, and real-world evidence generation. Companies that combine extensive image repositories with tools for federated or cloud-based model training are shaping how pathologists and translational teams collaborate on biomarker discovery and clinical decision support. These platform-centric approaches also reduce friction for laboratories seeking multi-vendor compatibility across scanners, viewers, and analytics, while improving the speed at which new algorithms can be evaluated and deployed. The industry’s emphasis on platform interoperability is reflected in several high-profile partnerships and funding rounds that accelerate product roadmaps and enterprise adoption.

Third, workforce constraints and operational strain within pathology labs are creating an imperative to deploy tools that increase throughput and reduce cognitive burden. Shortages of trained pathologists, rising case complexity, and burnout have together prompted health systems to prioritize computational triage, remote review, and consultation networks that extend scarce subspecialty expertise. In this context, AI is being positioned not as a substitute but as an amplifier of human capability, enabling pathologists to focus on higher-value interpretation while routine tasks are triaged or pre-annotated. These combined shifts-regulatory acceptance, platform-first AI strategies, and acute workforce pressures-are coalescing to make the next three-year period decisive for labs that move early versus those that defer investment.

Evaluating the cumulative operational and procurement consequences of 2025 U.S. tariff policies on imported scanners, electronics, and medtech components

The tariff environment in 2025 has introduced an elevated layer of commercial and operational risk for laboratories, manufacturers, and channel partners that rely on globally sourced scanners, sensor components, and data-center hardware. New and expanded U.S. tariffs on certain medical devices, electronics, semiconductors, and high-volume consumables have increased direct landed costs for a subset of imported pathology hardware and peripheral equipment, while also creating uncertainty around future supplier commitments and geographic sourcing. The policy changes have not been uniform: tariff rates and effective dates vary by product classification and trading partner, which complicates procurement planning for laboratory managers who purchase multi-component systems from international vendors. Evidence published by hospital associations and governmental notices shows targeted tariff increases on medical supplies and electronics that are material to laboratory operations.

Beyond the direct cost impact on capital equipment and consumables, tariffs have accelerated strategic responses across three dimensions. First, vendors and buyers are re-evaluating supply chains-some are accelerating reshoring or near-shoring of critical subsystems, while others are renegotiating commercial terms to mitigate short-term cost shocks. Second, procurement teams are increasingly factoring duty exposure into total cost of ownership analyses and into the timing of refresh cycles for scanner fleets and storage infrastructure. Third, health systems and vendors are prioritizing contractual flexibility, including clauses for tariff pass-through, extended warranty alignment, and phased hardware delivery to smooth budgetary pressure.

The net effect is a more cautious capital deployment profile among some buyers and a faster pivot by others toward software-led services that reduce exposure to imported hardware. For organizations that plan proactively-by diversifying supplier networks, locking favorable contract terms, and validating remote or cloud-delivered imaging pathways-the tariff environment can be managed without derailing digitization goals. However, smaller laboratories with limited procurement leverage and those dependent on a narrow set of international OEM components face more acute near-term risk, underscoring the need for scenario planning and cross-functional coordination between procurement, laboratory leadership, and clinical teams.

Actionable segmentation insights linking product choices, workflow priorities, application-specific requirements, and end-user decision criteria to deployment strategies

Segment-level dynamics reveal where near-term adoption is strongest and where technical complexity requires deliberate validation. Across product categories, slide scanners, image management systems, and storage architectures remain foundational; however, diagnostic labs and translational research groups increasingly allocate programmatic priority to software capabilities, particularly solutions that support cloud-based image repositories and validated AI workflows. The differentiation between cloud-based and on-premise software is now a commercial and clinical decision: cloud deployments enable scalable compute for complex AI training and real-world evidence aggregation, while on-premise configurations remain attractive where data residency, latency, or integration with local pathology information systems are decisive. The product-level choices therefore reflect a laboratory’s tolerance for cloud transformation, governance maturity, and scaling intent.

When considering workflow segmentation, high-impact investment continues to concentrate on image acquisition and acquisition throughput because scanner performance and digitization quality strongly influence downstream analytic validity. At the same time, image analysis capabilities have migrated from single-algorithm utilities to composite application suites that support biomarker extraction, cell segmentation, and quantitative scoring-capabilities that are increasingly used for biomarker discovery and companion diagnostic development. Image management remains the connective tissue that ensures images are findable, auditable, and accessible for both clinical sign-out and research reuse; effective image management strategies reduce duplication, enable federated review, and unlock secondary uses of tissue images for drug development and training.

Application-level demand shows nuanced differences: biomarker discovery and drug development programs prioritize reproducible, annotated image sets and advanced analytic toolkits, while disease diagnosis workflows emphasize validated algorithms, interoperability with laboratory information systems, and pathologist-centric viewers that support primary diagnostic sign-out. Telepathology and training applications are rising in importance as they leverage digital distribution to expand access and reduce turnaround times, yet these use cases place different emphasis on viewer ergonomics and low-latency networks. End-user segmentation is likewise instructive: academic and research institutes often prioritize flexible, open platforms that support experimentation and algorithm development, contract research and pharmaceutical organizations require tightly governed repositories and audit trails for regulatory submissions, government and regulatory bodies focus on standardization and reproducibility, and hospitals and diagnostic labs weigh clinical validation, integration, and vendor support as decisive factors. Pharmaceutical and biotechnology companies, meanwhile, are driving demand for integrated digital pathology in clinical trials and companion diagnostic development, aligning their procurement choices to regulatory expectations and sponsor-specific assay requirements.

This comprehensive research report categorizes the Digital Pathology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product

- Application

- End User

Regional deployment patterns and procurement drivers across the Americas, EMEA, and Asia-Pacific that determine where and how digital pathology scales commercially and clinically

Regional dynamics are shaping how organizations prioritize investments and where vendors concentrate commercial effort. In the Americas, the combination of regulatory clarity for diagnostic use, strong clinical trial activity, and concentrated health system spending creates a fertile environment for enterprise digital pathology programs that couple high-throughput scanners with validated software and clinical AI. North American health systems emphasize interoperability with laboratory information systems, payer engagement for advanced diagnostics, and operational outcomes such as reduced case turnaround and diagnostic concordance; as such, vendors frequently pilot end-to-end solutions in large academic centers before scaling to community hospital networks. This regional focus also means that tariff-driven supply disruptions and increased duties on imported components are felt early by buyers who depend on international OEM hardware, prompting a mix of local sourcing and contractual hedging.

Europe, the Middle East, and Africa exhibit a heterogeneous landscape where regulatory harmonization, reimbursement pathways, and digital infrastructure maturity vary widely. Large academic centres and centralized pathology networks in Western Europe tend to move faster on primary-diagnostic deployments and are active participants in pan-European research consortia that use digital slides for biomarker discovery. Reimbursement and procurement models in several EMEA countries favor consortium buying and shared infrastructure, which can accelerate adoption for multi-hospital networks but also demands greater attention to standardization and cross-border governance.

Asia-Pacific shows rapid technology uptake driven by high-volume laboratories, government modernization programs, and investments in precision medicine initiatives. Several countries in the region prioritize scaling diagnostics to meet demographic demand and are receptive to cloud-enabled models that reduce on-premise capital requirements. However, Asia-Pacific also presents complex vendor entry dynamics and local regulatory considerations, meaning successful market approaches combine strong local partnerships with demonstrable clinical validation and local-language support.

This comprehensive research report examines key regions that drive the evolution of the Digital Pathology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How platform scale, regulatory readiness, and strategic interoperability determine competitive advantage among scanner manufacturers, software platforms, and specialist AI vendors

Competitive dynamics are now shaped less by single-product advantages and more by the ability to deliver validated, interoperable, and supportable solutions across the full pathology lifecycle. Platform-oriented software companies that maintain large, curated image repositories and invest in regulatory pathways are capturing a disproportionate share of strategic partnerships with pharmaceutical developers and large laboratories. At the same time, legacy medical device manufacturers that pair scanners with validated viewers and end-to-end workflow suites continue to win enterprise deals where clinical-risk management and service reliability are prioritized.

Strategic partnerships and capital inflows are accelerating capability convergence: software firms are forming OEM and integration agreements with scanner manufacturers and contract lab partners to provide an end-to-end proposition, while hardware vendors are expanding their software and cloud offerings to protect after-market revenue. Companies that combine regulatory experience-cleared or breakthrough-designated clinical applications-with broad integrability and a robust commercial support model are best positioned to capture hospital and diagnostic-lab customers. Smaller specialist firms that excel at niche analytics or academic collaborations remain vital to the ecosystem as sources of innovation, but their commercial trajectories hinge on integration with platform partners or sustained grant and consortium funding.

Buyers evaluating vendors should therefore prioritize demonstrable clinical validations, openness to third-party integrations, evidence of enterprise-scale support, and a clear path for AI model governance. Vendors that can articulate how their technology reduces time-to-diagnosis, supports regulatory submissions, and integrates with laboratory workflows without creating additional operational overhead will hold a competitive advantage in procurement conversations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Pathology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3DHISTECH Ltd.

- Aiforia Technologies PLC

- Akoya Biosciences

- Charles River Laboratories

- Corista LLC

- Danaher Corporation

- Deep Bio Inc.

- Epredia

- F. Hoffmann-La Roche Ltd.

- FUJIFILM Holdings Corporation

- General Electric Company

- Hamamatsu Photonics K.K.

- Huron Digital Pathology

- Indica Labs

- Koninklijke Philips N.V.

- Laboratory Corporation of America Holdings

- Mikroscan Technologies, Inc.

- Motic

- Nikon Corporation

- Olympus Corporation

- OptraSCAN Inc.

- Pathcore Inc.

- PathPresenter Corporation

- PerkinElmer, Inc.

- Proscia, Inc.

- Quest Diagnostics Incorporated

- Sectra AB

- Visiopharm A/S

- Xybion Digital Inc.

Practical, cross-functional recommendations for procurement, validation, workforce enablement, and tariff-aware sourcing to accelerate dependable clinical deployments

To navigate the current landscape and convert strategic intent into measurable outcomes, industry leaders should adopt a coordinated approach that aligns procurement, clinical validation, and technical operations. First, establish governance structures that define validation requirements, data governance rules, and deployment milestones; use these frameworks to standardize acceptance testing for scanners, viewers, and analytics so that clinical teams can trust results and accelerate adoption internally. Second, prioritize vendor agreements that offer deployment flexibility-hybrid cloud options, modular licensing, and service-level commitments-to reduce tariff exposure and lock-step capital demands while preserving scalability.

Third, invest in workforce enablement by pairing digital tools with targeted education and change-management programs; equip pathologists, laboratory staff, and IT teams with validation protocols, AI interpretation guides, and escalation pathways so that technology augments rather than disrupts clinical workflows. Fourth, create a phased data strategy that begins with short-term wins-such as digital consultation networks and AI triage for high-volume tasks-while concurrently building longer-term repositories for biomarker discovery and real-world evidence initiatives. Finally, incorporate tariff and supply-chain scenario planning into capital procurement cycles: assess alternative suppliers, negotiate tariff pass-through clauses where appropriate, and prioritize modular purchases that allow deferred hardware scaling in favor of software-driven capability expansion.

Research methodology combining primary stakeholder interviews, vendor briefings, and systematic review of regulatory and policy sources to validate practical insights

The research underpinning this executive summary combined primary and secondary methods to ensure conclusions reflect practitioner realities and public policy developments. Primary research included structured interviews with pathologists, laboratory directors, clinical trial leads, and procurement officers across academic medical centers, hospital networks, and pharmaceutical companies, supplemented by vendor briefings and technical demonstrations to validate product capabilities and integration pathways. Secondary research included a systematic review of regulatory announcements, vendor press releases, trade association guidance, and policy analyses to capture recent FDA clearances, breakthrough designations, and tariff developments.

Data synthesis applied cross-validation between primary qualitative insights and public sources to triangulate claims about adoption barriers, technical readiness, and procurement behavior. Where policy or regulatory statements have immediate operational impact-such as tariff schedules and FDA clearances-these items were independently verified against primary source materials and vendor confirmations. The methodology balances practitioner experience with documentary evidence so that recommendations are both practicable and responsive to the evolving regulatory and commercial context.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Pathology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Pathology Market, by Type

- Digital Pathology Market, by Product

- Digital Pathology Market, by Application

- Digital Pathology Market, by End User

- Digital Pathology Market, by Region

- Digital Pathology Market, by Group

- Digital Pathology Market, by Country

- United States Digital Pathology Market

- China Digital Pathology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding perspective on why deliberate governance, platform selection, and phased deployment are essential to realize clinical and translational value from digital pathology

Digital pathology sits at a rare inflection point: clinical-grade imaging, validated AI, and cloud-enabled management are simultaneously maturing while workforce pressures and trade policy shifts are forcing organizations to be more strategic about procurement and deployment timing. The institutions that convert digitization from pilot projects into repeatable, governed programs will unlock faster diagnostics, improved access to subspecialty expertise, and the potential to accelerate biomarker-driven drug development. Conversely, organizations that delay governance, ignore supply-chain risk, or adopt one-off point solutions risk higher integration costs and slower realization of clinical benefits.

In short, the imperative is to act with deliberate sequencing: establish governance and validation first, engage with platform-capable vendors that demonstrate regulatory and integration strengths, and use phased implementations to deliver near-term clinical value while building capacity for research reuse. When these elements are combined, digital pathology becomes not only a clinical modernization program but also a strategic asset that supports translational research, payer engagement, and sustained improvements in diagnostic quality.

Make an informed purchase decision for the market research report and arrange a tailored briefing with Ketan Rohom to accelerate deployment and commercial adoption

For executives ready to translate insight into impact, purchasing the full market research report will provide the operational intelligence necessary to accelerate digital pathology initiatives, de-risk investment decisions, and prioritize strategic partnerships. The full report delivers validated vendor profiles, regulatory milestone timelines, granular workflow adoption analysis, and region-specific deployment case studies that teams can operationalize immediately to reduce integration friction and shorten time-to-value.

To acquire the report and discuss how the findings apply to your organization’s priorities, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan can guide you to the edition and supplemental modules that best match your technical, commercial, and clinical decision-making needs, and arrange a tailored briefing or data extract so your leadership can act with confidence and speed.

Investing in the full dataset and advisory briefing will equip your organization with the evidence and playbooks needed to manage tariff-driven supply risk, structure AI validation programs, select interoperable vendor stacks across image acquisition and analysis, and align contracting strategies to protect margin while expanding clinical services. A short conversation with Ketan will clarify licensing, custom research add-ons, and executive briefing options so your team can begin implementing the report’s recommendations within weeks.

- How big is the Digital Pathology Market?

- What is the Digital Pathology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?