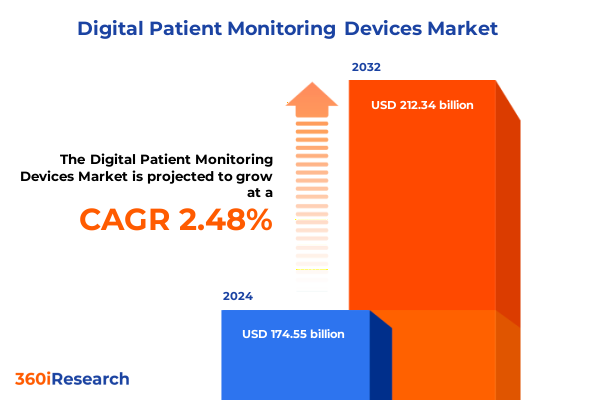

The Digital Patient Monitoring Devices Market size was estimated at USD 177.21 billion in 2025 and expected to reach USD 179.90 billion in 2026, at a CAGR of 2.61% to reach USD 212.34 billion by 2032.

Digital patient monitoring devices at the forefront of connected care, reshaping how clinicians, payers, and patients engage across the continuum

Digital patient monitoring devices have moved from the periphery of healthcare to its core infrastructure, enabling clinicians to observe patients continuously across settings rather than relying solely on episodic visits. These devices encompass implantable systems, portable monitors, and consumer-grade wearables, combined with secure connectivity and analytics that transform raw signals into clinically meaningful insight. As populations age, chronic conditions proliferate, and health systems face persistent workforce constraints, the ability to monitor patients remotely and intervene earlier has become indispensable rather than optional.

The acceleration of virtual care models during and after the COVID-19 pandemic demonstrated that digital monitoring can sustain continuity of care even in the face of severe disruption. At the same time, consumer familiarity with smartwatches and wristbands has lowered adoption barriers and created new data streams that can complement traditional medical-grade devices. Payers and policymakers have increasingly recognized the value of early detection and proactive management of conditions such as heart failure, diabetes, and respiratory disease, opening the door to reimbursement pathways that support scaling of remote monitoring services.

Against this backdrop, the executive summary frames digital patient monitoring devices as a strategic enabler of data-driven, patient-centered care. The focus extends beyond hardware to encompass software, connectivity, workflow integration, and clinical governance. Rather than treating monitoring as a standalone technology, leading organizations are embedding these capabilities across the care continuum, from high-acuity hospital units to home-based care. This shift is redefining therapeutic pathways, altering resource allocation, and reshaping expectations for what safe, effective, and efficient care looks like in a digitally connected era.

As the market continues to evolve, stakeholders must navigate a complex intersection of technology innovation, regulatory oversight, reimbursement models, and global trade dynamics. Subsequent sections explore how transformative shifts in the ecosystem, emerging tariff regimes, segmentation insights, regional differences, and competitive strategies converge to shape the trajectory of digital patient monitoring over the coming years.

From episodic encounters to continuous insight, how digital patient monitoring is transforming clinical pathways, workflows, and expectations globally

The landscape for digital patient monitoring is undergoing a fundamental redesign, shifting from reactive, encounter-based care toward continuous, insight-driven management. Historically, clinicians relied on intermittent measurements taken in clinical environments, with limited visibility into patients’ daily lives. Today, implantable monitors, portable diagnostic devices, and wearables equipped with advanced sensors and connectivity are providing a near-continuous stream of physiological data. This transition enables earlier detection of deterioration, finer titration of therapies, and more personalized care plans that respond dynamically to a patient’s condition.

Another critical transformation is the convergence of medical-grade devices with consumer technologies. Smartwatches and wristbands now incorporate capabilities such as single-lead electrocardiography, oxygen saturation measurement, and irregular rhythm detection, often linked to smartphone applications. When integrated into clinical workflows, these devices can extend monitoring to broader populations, including individuals who might not otherwise engage with the healthcare system. However, they also introduce challenges around data validation, clinical thresholds, and responsibility for follow-up, prompting closer collaboration between device manufacturers, healthcare providers, and regulators.

At the same time, software and analytics are now as important as hardware in defining competitive differentiation. Cloud-based platforms apply advanced algorithms, including machine learning models, to filter signals, identify relevant trends, and generate actionable alerts for clinicians. Integration with electronic health records and care management systems is becoming a baseline expectation, with interoperability standards increasingly used to avoid fragmented data silos. This software-centric evolution is encouraging new partnership models between device companies, health IT vendors, and telecommunications providers.

Reimbursement and policy developments further amplify these shifts. Expanded coverage for remote patient monitoring and chronic care management in markets such as the United States has legitimized digital monitoring as a reimbursable service rather than a cost center. In parallel, regulatory agencies are refining frameworks for software as a medical device and for cybersecurity, ensuring that connected monitoring solutions meet rigorous standards for safety, privacy, and reliability. Collectively, these changes signal that digital patient monitoring is entering a more mature, integrated phase, where success depends on aligning technological capability with clinical evidence, workflow usability, and sustainable economic models.

Evolving United States tariff policies through 2025 redefine supply chains, pricing strategies, and sourcing decisions for digital patient monitoring devices

By 2025, the cumulative impact of United States tariff policy has become a structural factor in the economics and design of digital patient monitoring devices. Successive rounds of Section 301 tariffs on imports from China, including medical products and critical electronic components, have altered sourcing decisions for manufacturers whose devices depend heavily on sensors, semiconductors, batteries, and specialized plastics. Recent reviews of these tariffs have confirmed that they remain in force and, in some cases, have been expanded or retimed, particularly for certain medical supplies and strategic industrial inputs.

While many digital patient monitoring devices are not always singled out by name in tariff schedules, they rely on categories that have seen substantial rate increases, such as specific semiconductors and associated electronics, which are slated to face higher duties in the mid-2020s. In parallel, tariffs on selected medical products, including face masks, gloves, syringes, and needles, have created a broader backdrop of rising costs for medical consumables, indirectly influencing procurement strategies and hospital negotiation dynamics. This environment encourages health systems and group purchasing organizations to scrutinize the total cost of ownership of monitoring solutions, including hardware, accessories, and service contracts.

For hospitals and health systems already contending with inflationary pressures and workforce shortages, higher input costs associated with tariffs can translate into tighter capital budgets and more stringent value assessments for new technologies. Analyses of prior tariff waves have highlighted that increased duties on medical imports and components often flow through the supply chain, raising costs that ultimately reach providers and payers. In response, purchasing decisions for implantable monitors, portable diagnostic equipment, and wearable platforms are increasingly tied to demonstrable reductions in readmissions, length of stay, or emergency visits.

Manufacturers of digital patient monitoring devices are adapting through a combination of supply chain diversification and design optimization. Many are exploring alternative contract manufacturers and component suppliers outside of heavily tariffed jurisdictions, including greater reliance on facilities in the Americas, Europe, and parts of Asia-Pacific. The United States Trade Representative has explicitly noted that earlier tariffs contributed to reduced import dependence on China and increased sourcing from allied markets, a trend that is now accelerating as companies seek resilience as well as cost competitiveness. This reconfiguration can mitigate tariff exposure but may introduce short-term complexity in quality management and regulatory compliance.

The policy environment remains fluid. New national security investigations into imports of medical equipment and related technologies under Section 232 raise the possibility of additional tariffs on a wide range of devices and components if authorities conclude that import reliance threatens critical infrastructure. For executives overseeing digital monitoring portfolios, this evolving landscape underscores the importance of embedding trade and industrial policy considerations into long-range planning. Tariff risk is no longer a peripheral procurement issue; it is a strategic design, manufacturing, and pricing variable that can influence competitiveness in both domestic and global markets.

Granular segmentation across products, technologies, connectivity, channels, applications, end users, and deployment reveals actionable monitoring device priorities

The structure of the digital patient monitoring landscape becomes clearer when examined through its major segments, beginning with product type. Implantable devices such as cardiac implantable monitors and neurostimulators serve high-risk patients who require continuous, unobtrusive surveillance and precise therapeutic modulation, often in cardiology and neurology programs. Portable devices, including glucometers and Holter monitors, provide flexible, short-to-medium-term observation for patients in transitional phases of care, such as post-discharge or diagnostic workups. Wearable devices in the form of skin patches, smartwatches, and wristbands extend monitoring to large populations in everyday settings, supporting wellness, chronic disease management, and early detection strategies without disrupting routines.

Technology choices strongly influence how these products perform in real-world environments. Bluetooth connectivity is widely used for personal area networks that link devices to smartphones or tablets, enabling patient-friendly experiences in the home. Wi-Fi allows high-throughput data transfer within hospitals and residences equipped with broadband, facilitating seamless integration with electronic systems. Cellular technologies remain critical when continuous connectivity is needed across geographies, for example in ambulatory cardiac telemetry or emergency monitoring, while radio-frequency identification supports tracking of devices, patients, and consumables in complex clinical workflows.

Connectivity type resonates with clinical use cases and risk profiles. Real-time monitoring is increasingly favored for patients at higher risk of rapid deterioration, leveraging either continuous data streams or intermittent yet frequent measurements to support early warning systems and immediate clinician alerts. Store-and-forward models, by contrast, prioritize efficient batching of data for periodic review, which can be adequate for stable patients or low-acuity parameters. Within real-time approaches, continuous monitoring offers the most granular trend insight but requires robust infrastructure and alert management, whereas intermittent monitoring balances data richness with operational practicality.

Distribution channels create another layer of differentiation. Direct sales remain central for large hospitals and clinics that negotiate enterprise agreements, demand tailored integration, and require clinical education support. Distributors are important in regions or segments where fragmented provider footprints make direct coverage challenging. Online sales have become a powerful route for both professionals and consumers to access portable and wearable devices, particularly for wellness-oriented or self-management offerings. Retail pharmacies, meanwhile, serve as a convenient access point for over-the-counter glucometers, wearables, and related accessories, and are increasingly integrating digital programs that link devices to pharmacist-led coaching and telehealth.

From an application perspective, digital monitoring is firmly embedded in several core domains. Cardiac monitoring spans ambulatory ECG devices, Holter monitoring systems, and telemetry platforms designed to detect arrhythmias, ischemia, and heart failure decompensation in inpatient and ambulatory settings. Diabetes monitoring encompasses continuous glucose monitoring systems and self-monitoring of blood glucose, enabling patients and clinicians to adjust therapy in near real time. Fall detection solutions combine motion sensors and algorithms to protect frail or elderly patients, often integrated into wearables or home hubs. Neurological monitoring supports management of epilepsy, movement disorders, and neurodegenerative conditions, while respiratory monitoring covers parameters such as respiratory rate, oxygen saturation, and airflow. Vital sign monitoring extends across heart rate, blood pressure, temperature, and other baseline indicators, forming the backbone of remote ward or home surveillance.

End-user segments shape buying criteria and adoption pathways. Hospitals and clinics, including specialized cardiac units and diabetes clinics, typically prioritize integration with existing IT systems, support for complex patient cohorts, and compliance with stringent governance policies. Ambulatory surgical centers look for monitoring solutions that can manage perioperative risk efficiently and support rapid discharge protocols. Home healthcare providers, by contrast, seek devices that are easy to deploy, reliable in non-clinical environments, and intuitive for patients and caregivers, often supported by centralized monitoring teams.

Finally, deployment mode influences data strategy and long-term scalability. Cloud-based solutions, implemented through private or public cloud architectures, offer elastic compute and storage resources for high-volume data processing, enabling advanced analytics and multi-site deployments. Private cloud configurations appeal to institutions with strict data residency or security requirements, while public cloud platforms provide rapid innovation cycles and access to ecosystem tools. On-premise deployments remain relevant for organizations with legacy investments, limited external connectivity, or heightened concerns about external hosting, though many are now implementing hybrid models that bridge on-premise systems with cloud-based analytics and visualization layers.

This comprehensive research report categorizes the Digital Patient Monitoring Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Connectivity Type

- Distribution Channel

- Application

- End User

- Deployment Mode

Regional dynamics across the Americas, Europe, Middle East & Africa, and Asia-Pacific create distinct pathways for digital patient monitoring adoption

Regional dynamics introduce important nuances into the adoption and evolution of digital patient monitoring devices. In the Americas, particularly in the United States and Canada, advanced health IT infrastructure, relatively high digital literacy, and established reimbursement frameworks for remote monitoring create fertile conditions for scaling both implantable and non-invasive solutions. Integrated delivery networks and large academic centers often serve as early adopters, piloting complex platforms that combine continuous telemetry, predictive analytics, and home-based monitoring programs. At the same time, disparities in broadband access and resource availability between urban and rural areas continue to shape deployment models, prompting innovative hybrid approaches that blend cellular connectivity, community-based services, and simplified device workflows.

Latin American markets within the broader Americas region are progressively incorporating digital monitoring into public and private health systems, often focusing first on portable devices and wearables that address chronic disease burdens in diabetes, cardiovascular disease, and respiratory conditions. Economic constraints and heterogeneous regulatory environments can slow large-scale rollouts, yet they also encourage creative partnerships between governments, insurers, and technology providers to extend monitoring into underserved populations. In these contexts, proven affordability, durability, and multilingual support are as critical as cutting-edge technical features.

Across Europe, Middle East, and Africa, adoption patterns reflect wide diversity in healthcare funding models and regulatory sophistication. Many European countries are at the forefront of integrating digital monitoring into coordinated care pathways, supported by strong data protection regulations and national e-health strategies. Here, emphasis is often placed on interoperability, security, and standardized clinical protocols, with particular interest in managing aging populations and multimorbidity. In parts of the Middle East, substantial investment in smart hospital infrastructure and national digital health programs is driving demand for advanced monitoring across intensive care, step-down units, and home-based services. Several countries in Africa, meanwhile, are leveraging mobile connectivity and telemedicine platforms to leapfrog traditional infrastructure constraints, utilizing cost-effective portable and wearable devices to extend monitoring into remote communities.

Asia-Pacific presents another distinct profile, combining high patient volumes, a strong manufacturing base for electronics and medical devices, and rapidly growing middle classes. Markets such as Japan, South Korea, Australia, and Singapore are advancing sophisticated monitoring programs that integrate implantable devices, home hubs, and cloud-based analytics within mature health systems. In parallel, economies including China, India, and various Southeast Asian nations are witnessing rapid growth in both consumer wearables and medically supervised remote monitoring, driven by urbanization, chronic disease prevalence, and digital-first health initiatives. The region’s role as a production hub for sensors, semiconductors, and finished monitoring devices interacts closely with global trade measures, creating both opportunities and vulnerabilities for local and international suppliers.

These regional contrasts underscore that there is no single template for deploying digital patient monitoring. Executives must calibrate product portfolios, pricing strategies, regulatory engagement, and partnership models to the realities of each geography. Understanding the interplay between health system structure, digital infrastructure, regulatory readiness, and local disease patterns is essential to prioritizing investments and achieving sustainable impact across the Americas, Europe, Middle East and Africa, and Asia-Pacific.

This comprehensive research report examines key regions that drive the evolution of the Digital Patient Monitoring Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Established medtech leaders, consumer technology giants, and digital natives are intensifying competition across the digital patient monitoring ecosystem

The competitive environment for digital patient monitoring devices now spans traditional medical device companies, diversified health technology providers, and consumer electronics and software firms. Established medtech manufacturers bring deep expertise in regulatory compliance, clinical validation, and high-reliability manufacturing, positioning them strongly in implantable monitors, hospital-grade telemetry, and specialized neurological and cardiac systems. These companies increasingly view digital monitoring as central to their broader therapeutic strategies, embedding connectivity and data services into cardiac rhythm management, metabolic disease, respiratory support, and neuromodulation portfolios.

At the same time, technology and consumer electronics companies have redefined expectations for user experience, form factor, and ecosystem integration. Smartwatches, wristbands, and connected patches developed by these players have become everyday health companions for millions of users, generating continuous streams of activity, sleep, heart rate, and rhythm data. Partnerships between such firms and healthcare providers are deepening, moving beyond simple data sharing toward co-developed programs for chronic disease management, clinical research, and early detection of high-risk conditions. These collaborations are beginning to blur the boundaries between regulated medical devices and wellness technologies, requiring careful alignment of regulatory classification, data governance, and liability.

A third layer of competition comes from digital health startups and platform companies that specialize in software, analytics, and care coordination. Many of these firms do not manufacture devices themselves but instead aggregate data from multiple device types, apply machine learning to stratify risk, and provide dashboards and workflows for clinicians and care teams. Their agility enables rapid iteration on user interfaces, alert logic, and integration pathways with electronic health records or telehealth platforms. To scale, however, they depend on reliable partnerships with device vendors and payers, as well as clear evidence that their platforms improve outcomes and operational efficiency.

Across all these groups, strategic themes are converging. Security-by-design has become a prerequisite as connected devices and cloud platforms face rising cybersecurity scrutiny. Interoperability is increasingly treated as a competitive advantage rather than a regulatory burden, with companies adopting standard data models and open application programming interfaces to ease integration into complex hospital and payer environments. Many leading organizations are also investing in AI-enabled decision support that reduces clinician alert fatigue, flags subtle deterioration, and personalizes care pathways.

In parallel, mergers, acquisitions, and strategic alliances are reshaping the competitive map. Device manufacturers are acquiring or partnering with software and analytics firms to accelerate digital capabilities, while technology companies are seeking regulatory and clinical expertise through collaborations with medtech incumbents. The net effect is a shift from isolated product competition toward ecosystem competition, where success depends on the breadth and depth of integrated offerings spanning devices, data, services, and support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Patient Monitoring Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Apple Inc.

- AT&T Intellectual Property

- athenahealth, Inc.

- Drägerwerk AG & Co. KGaA

- Fitbit LLC

- Garmin Ltd.

- GE Healthcare Technologies, Inc.

- Koninklijke Philips N.V.

- Masimo Corporation

- Medtronic plc

- Nihon Kohden Corporation

- Omron Corporation

- ResMed Inc.

- Samsung Electronics Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Siemens Healthineers AG

- Spacelabs Healthcare, Inc.

Strategic imperatives for industry leaders to navigate regulation, tariffs, interoperability, and patient-centered design in digital patient monitoring

For industry leaders, converting the potential of digital patient monitoring into sustainable value requires a deliberate set of strategic actions. A first priority is to anchor product development and portfolio management in clinically meaningful use cases rather than in technology features alone. This means designing implantable monitors, portable diagnostics, and wearables around clearly defined pathways in cardiac, diabetes, neurological, respiratory, fall risk, and vital sign monitoring, with measurable objectives such as reducing readmissions, avoiding emergency visits, or enabling earlier intervention in high-risk cohorts.

Supply chain strategy deserves equal attention in light of evolving tariff regimes and geopolitical uncertainty. Executives should map the origin of critical components, including semiconductors, sensors, communications modules, and plastics, and model the financial impact of different tariff scenarios. Diversifying manufacturing footprints and supplier bases across multiple geographies can help mitigate concentration risk, while closer collaboration with contract manufacturers and logistics partners can shorten lead times and enhance resilience. Integrating these considerations early in product design can prevent later compromises on cost, quality, or availability.

On the demand side, leaders should work closely with healthcare providers, payers, and regulators to ensure that monitoring solutions align with reimbursement frameworks and policy priorities. Demonstrating value through robust clinical and economic evidence is essential for winning formulary placements, securing long-term contracts, and gaining inclusion in care pathways. Investing in real-world evidence programs, registries, and post-market studies helps build confidence that digital monitoring improves outcomes and is safe across diverse patient populations.

Operationally, successful deployment depends on embedding monitoring into clinical workflows in ways that support, rather than burden, clinicians and staff. This includes user-centered interface design, intuitive alert configuration, and clear escalation protocols. Education and change management programs for physicians, nurses, pharmacists, and allied health professionals are critical to achieving adoption and sustained use. Leaders should also consider how to empower patients and caregivers with simple instructions, feedback mechanisms, and access to data that reinforces engagement.

Finally, data governance and cybersecurity must be treated as foundational. Organizations should implement robust frameworks for consent management, data minimization, encryption, and continuous monitoring for cyber threats. Transparent communication with patients and partners about how data are used and protected can strengthen trust and differentiate companies in a competitive marketplace. By executing on these strategic imperatives, industry leaders can position themselves not only to navigate current complexities but also to shape the future standards and expectations of digital patient monitoring.

Robust research methodology integrating multidisciplinary expertise to deliver decision-grade insights on digital patient monitoring device strategies

The insights presented in this executive summary are grounded in a research methodology designed to support high-stakes decision-making in complex healthcare and technology markets. The analytical framework begins with a clear definition of digital patient monitoring devices, encompassing implantable monitors, portable diagnostic equipment, and wearable systems, along with their associated connectivity, software, and service layers. This definitional clarity ensures consistent treatment of the product, technology, connectivity, channel, application, end-user, and deployment segments across the study.

Primary research plays a central role, incorporating structured and semi-structured interviews with a diverse range of stakeholders, including clinicians from cardiology, endocrinology, neurology, pulmonology, and geriatrics, as well as health system executives, biomedical engineers, home healthcare operators, payers, and technology providers. These discussions illuminate real-world priorities, adoption barriers, and workflow considerations that may not be apparent in public documentation. They also help validate or challenge assumptions about how monitoring devices are used across hospital, ambulatory, and home settings.

Complementing this, secondary research draws on regulatory filings, government policy documents, clinical guidelines, peer-reviewed journals, company reports, and reputable industry and technology publications. Special attention is given to regulatory developments related to software as a medical device, cybersecurity requirements, data protection, and reimbursement policies for remote monitoring. Trade and tariff policies are examined through official government communications and legal analyses to understand their implications for device design, sourcing, and pricing.

Data from primary and secondary sources are integrated through triangulation, ensuring that conclusions are supported by multiple lines of evidence wherever possible. Segmentation analysis examines how product categories such as implantable, portable, and wearable devices intersect with technologies like Bluetooth, Wi-Fi, cellular, and RFID, as well as with connectivity modes, distribution channels, clinical applications, end users, and deployment models. Cross-segmentation highlights where unmet needs and innovation hotspots are most pronounced.

Scenario analysis is applied to explore how changes in regulation, tariffs, technology, and care delivery models could alter the trajectory of digital patient monitoring adoption. Rather than attempting to predict precise numerical outcomes, the methodology emphasizes directional insights and decision-relevant narratives. Throughout, the focus remains on translating complex evidence into clear implications for strategy, investment, product development, and partnerships.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Patient Monitoring Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Patient Monitoring Devices Market, by Product Type

- Digital Patient Monitoring Devices Market, by Technology

- Digital Patient Monitoring Devices Market, by Connectivity Type

- Digital Patient Monitoring Devices Market, by Distribution Channel

- Digital Patient Monitoring Devices Market, by Application

- Digital Patient Monitoring Devices Market, by End User

- Digital Patient Monitoring Devices Market, by Deployment Mode

- Digital Patient Monitoring Devices Market, by Region

- Digital Patient Monitoring Devices Market, by Group

- Digital Patient Monitoring Devices Market, by Country

- United States Digital Patient Monitoring Devices Market

- China Digital Patient Monitoring Devices Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Synthesizing technology, policy, and clinical forces to clarify the strategic trajectory of digital patient monitoring devices toward 2030 and beyond

Digital patient monitoring devices sit at the intersection of clinical need, technological capability, and shifting policy and economic conditions. As health systems worldwide grapple with aging populations, chronic disease burdens, and workforce constraints, continuous and remote monitoring offers a way to extend clinical reach, personalize interventions, and make more efficient use of limited resources. Implantable monitors, portable diagnostic tools, and wearables each contribute distinct strengths, and their integration into cohesive care pathways is gradually transforming the patient experience from episodic encounters to ongoing, connected support.

The trajectory of this field is shaped not only by innovation but also by regulatory, reimbursement, and trade frameworks. Evolving tariff regimes in the United States and elsewhere are compelling manufacturers and providers to rethink supply chains, cost structures, and sourcing strategies. Regulatory authorities are refining requirements for software, cybersecurity, and data use, raising the bar for safety and trust. Payers and policymakers are increasingly focused on value, expecting digital monitoring to demonstrate tangible improvements in outcomes and efficiency.

Against this backdrop, competitive dynamics are intensifying as established medtech companies, technology giants, and digital health specialists all vie to define standards and capture mindshare. Success will hinge on aligning device capabilities with real-world workflows, proving clinical and economic value, and building ecosystems that are interoperable, secure, and patient-centered. Those who can navigate these complexities thoughtfully will help define a more proactive, data-driven, and equitable model of care.

Ultimately, digital patient monitoring should not be viewed as an isolated product category but as a foundational layer of modern healthcare infrastructure. The decisions that executives make today about product design, partnerships, regional strategies, and risk management will influence how quickly and effectively this paradigm is realized. By leveraging rigorous research and maintaining a clear line of sight to patient and provider needs, organizations can play a leading role in shaping the next era of connected care.

Act now with tailored insight and guidance from Ketan Rohom to unlock the full strategic value of the digital patient monitoring devices report

Organizations that recognize the strategic importance of digital patient monitoring now have a narrow window to convert insight into competitive advantage. The full market research report offers a level of depth that goes far beyond a high-level executive summary, combining detailed segment breakdowns, regional nuances, competitive benchmarks, and technology roadmaps into a cohesive decision-making toolkit.

By engaging directly with Ketan Rohom, Associate Director, Sales & Marketing, you can align the report’s findings with your specific strategic priorities. Whether you are evaluating investments in new implantable platforms, planning an expansion into home-based monitoring services, or reassessing your sourcing strategy in light of evolving tariff regimes, a guided walkthrough of the research will help focus attention on what truly matters for your organization.

Rather than relying on fragmented internal analyses or general-purpose industry commentary, the report provides a structured view of product, technology, connectivity, channel, application, end-user, and deployment dynamics. This enables leadership teams to test assumptions, validate the robustness of current plans, and uncover opportunities that may be underappreciated in fast-moving markets.

Now is an opportune moment to move from exploration to execution. Connect with Ketan Rohom to discuss how the full report can support your near-term planning cycle, inform board-level discussions, and strengthen long-range strategic planning. Securing access today ensures that your organization is positioned with the intelligence and context needed to lead in the next phase of digital patient monitoring.

- How big is the Digital Patient Monitoring Devices Market?

- What is the Digital Patient Monitoring Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?