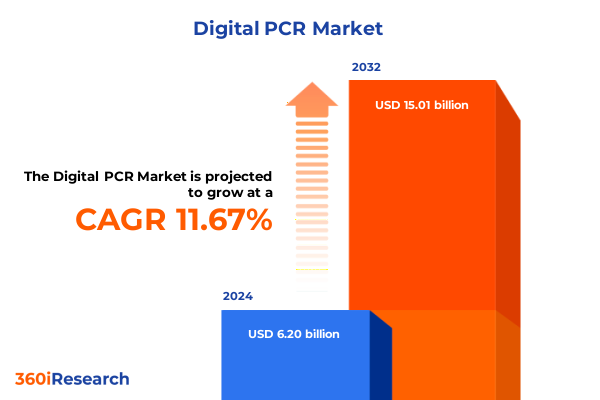

The Digital PCR Market size was estimated at USD 6.85 billion in 2025 and expected to reach USD 7.58 billion in 2026, at a CAGR of 11.84% to reach USD 15.01 billion by 2032.

Unraveling the Precision Revolution: How Digital PCR Rewrites the Rules of Absolute Quantification and Elevates Molecular Diagnostics

Digital PCR has ushered in a new era of absolute nucleic acid quantification, fundamentally reshaping molecular diagnostics and research workflows. By partitioning samples into thousands of discrete reactions, this technology transcends the limitations of traditional quantitative PCR, offering precise, digital readouts that eliminate the need for calibration curves and deliver unparalleled sensitivity for low-abundance targets. Its robustness against inhibitors and ability to detect rare mutations have cemented its role as an indispensable tool in applications ranging from oncology monitoring to infectious disease surveillance.

Since its inception, digital PCR has evolved through innovations in droplet generation, microfluidic channel design, and integrated thermal cycling, resulting in platforms capable of high-throughput analysis and streamlined workflows. As laboratories worldwide embrace digital PCR for its analytical rigor, the technology continues to expand its footprint in clinical research, environmental monitoring, and agricultural biotechnology. The advent of artificial intelligence–powered data analysis further enhances the precision and throughput of digital PCR, automating thresholding and droplet classification to accelerate time to result while maintaining rigorous quality control

Navigating the Next Frontier Through Integration of AI, Microfluidic Platforms and Next-Gen Technologies Driving Transformation in Digital PCR Applications

The landscape of digital PCR is experiencing transformative shifts driven by integration with advanced technologies and automation. Microfluidic innovations now enable precise droplet manipulation on chip, facilitating seamless sample partitioning at picoliter scales and reducing reagent consumption. Concurrently, machine learning algorithms are embedded within data analysis pipelines to perform real-time droplet classification and fluorescence curve interpretation, minimizing manual intervention and enhancing both sensitivity and specificity of quantification.

Beyond computational integration, point-of-care implementations are emerging as platforms become more compact and portable. Digital PCR instruments now incorporate on-board sample preparation modules, merging magnetic bead–based nucleic acid extraction with droplet generation and thermal cycling. These all-in-one systems are tailored for rapid pathogen detection in resource-limited settings, offering sample-to-answer times under 90 minutes and maintaining analytical performance comparable to centralized lab instruments. This convergence of microfluidics, automation, and AI-driven analytics marks a decisive evolution, expanding the utility of digital PCR beyond research labs to bedside and field applications.

Assessing the Far-Reaching Effects of 2025 United States Trade Policies Reshaping Supply Chains for Digital PCR Reagents and Instruments

In April 2025, the United States implemented a universal 10% tariff on nearly all imported goods, encompassing critical laboratory equipment and consumables used in molecular diagnostics. This sweeping measure under Section 301 has escalated operational costs for laboratories relying on overseas suppliers, compelling many to revisit procurement strategies and local sourcing alternatives to manage budget constraints and maintain uninterrupted workflows.

Further compounding these challenges, the U.S. has imposed tariffs of up to 25% on active pharmaceutical ingredients and key intermediates sourced from China, as well as a 15% duty on medical packaging and laboratory instrumentation imports from major manufacturing hubs including Germany, China, and Japan. These higher tariffs have disrupted established supply chains for digital PCR reagents and instruments, prompting end users to stockpile critical materials or pivot to domestic or allied-country vendors to avoid cost spikes and potential delays in experimental timelines.

Looking ahead, U.S. trade policy signals further escalation; the administration has threatened to raise tariffs on pharmaceutical and biotech imports by August 2026, with proposed duties reaching as high as 200% in a phased approach. While these measures aim to incentivize onshoring of manufacturing, they carry significant risk of supply chain bottlenecks and price inflation for specialized digital PCR cartridges, microfluidic chips, and fluorescence detection modules. Laboratories and reagent manufacturers are bracing for extended lead times and higher input costs, making strategic planning and diversification of supply networks imperative for resilience in the evolving tariff environment.

Illuminating Core Drivers Behind Segmentation in Digital PCR Landscape Uncovering Critical Trends Shaping Reagent Technology and User Dynamics

The digital PCR market’s architecture is defined by its product offerings, technologies, applications, end users, and sample types, each dimension unveiling distinct growth dynamics and user requirements. Consumable reagents remain the lifeblood of the sector, driving recurring revenue and innovation in assay chemistries, while high-performance instruments demand capital investment and continuous software updates for optimal performance. Software platforms, increasingly sophisticated with integrated AI modules, unlock deeper data insights and support regulatory compliance across varied workflows.

Within the technological spectrum, array-based digital PCR systems retain a strong foothold for multiplexed assays, even as droplet digital PCR leads adoption for its scalability and sensitivity. Microfluidic digital PCR is gaining momentum, particularly for point-of-care and portable applications where minimal footprint and rapid turnaround are paramount. This technological interplay expands the reach of digital PCR across a mosaic of applications spanning environmental testing for waterborne pathogens, food safety screening, genetic screening programs, infectious disease diagnostics, oncology biomarker quantification, and plant and animal genetics research.

Diverse end users-from academic and research institutes pioneering novel assay development to contract research organizations outsourced for specialized testing-drive market demand. Hospitals and diagnostic laboratories leverage digital PCR for clinical assays requiring absolute quantification, while pharmaceutical and biotech companies integrate digital platforms into drug development pipelines and bioprocess monitoring. The flexibility of sample handling, encompassing blood samples, cell culture extracts, environmental matrices, food products, and solid tissue samples, ensures digital PCR’s broad applicability across sectors.

This comprehensive research report categorizes the Digital PCR market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Sample Type

- Application

- End User

Examining Regional Forces Steering Adoption of Digital PCR Solutions Across Americas Europe Middle East Africa and Asia-Pacific Markets

Regional market dynamics reveal distinct adoption drivers and challenges across the Americas, Europe Middle East and Africa region, and Asia-Pacific. In the Americas, robust funding for precision medicine initiatives and a mature diagnostics infrastructure underpin strong uptake of digital PCR instruments and consumables. End users benefit from established reimbursement frameworks and supportive regulatory pathways, accelerating incorporation of digital quantification in clinical and research settings.

In Europe, the Middle East and Africa, diverse healthcare systems and regulatory landscapes create both opportunity and complexity. European laboratories focus on innovation in oncology and infectious disease applications, while Middle Eastern markets are investing heavily in building local biotech manufacturing capabilities to mitigate import dependencies. African adoption, though nascent, is driven by urgent public health needs in pathogen surveillance, where portable digital PCR platforms offer critical advantages in field diagnostics.

The Asia-Pacific region exhibits the fastest growth trajectory, fueled by expanding biotechnology hubs in China, India, Japan, and South Korea. Significant public and private investment in genomics research and agricultural biotechnology has spurred demand for digital PCR solutions. However, local manufacturing ecosystems and evolving trade agreements are influencing pricing and supply chain strategies, making regional partnership and localization essential strategies for global vendors.

This comprehensive research report examines key regions that drive the evolution of the Digital PCR market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Emerging Innovators Championing Breakthroughs in Digital PCR Instrumentation Software and Consumables

Leading companies are driving continuous innovation in digital PCR through strategic partnerships, advanced product portfolios, and targeted service offerings. Thermo Fisher Scientific leverages its broad consumables portfolio and integrated instrument platforms to deliver end-to-end solutions, combining proprietary reagents with high-throughput droplet digital PCR systems. Bio-Rad Laboratories differentiates with specialized assay kits and robust support programs for clinical research and diagnostic labs, reinforcing its presence in oncology and infectious disease markets.

Innovators such as QIAGEN and Stilla Technologies focus on microfluidic digital PCR and high-precision assays, pushing the boundaries of multiplex detection and assay miniaturization. Fluidigm’s advancements in microfluidic chip design enable automated sample partitioning at scale, while RainDance Technologies continues to refine instrument sensitivity and throughput for rare mutation analysis. These companies, alongside emerging start-ups, are fostering an ecosystem where instrument manufacturers, reagent specialists, and software developers collaborate to enhance user experience and drive next-generation applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital PCR market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Accumax

- Agilent Technologies, Inc.

- Analytik Jena GmbH by Endress+Hauser

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- ELITechGroup by Bruker Corp.

- Eppendorf AG

- F. Hoffmann-La Roche Ltd.

- Fluidigm Corporation

- JN MedSys

- Merck Sharp & Dohme Corp.

- PerkinElmer, Inc.

- Precigenome LLC

- Promega Corporation

- Qiagen N.V.

- RainSure Scientific

- Roche Holding AG

- Stem Genomics

- Stilla Technologies

- Takara Bio, Inc.

- Thermo Fisher Scientific Inc.

- Zymo Research Corp

Strategic Imperatives for Industry Stakeholders to Maximize Value Minimize Disruption and Accelerate Growth in the Dynamic Digital PCR Ecosystem

To navigate the evolving digital PCR ecosystem, stakeholders must adopt a multifaceted strategy. First, diversifying supply chains by qualifying multiple vendors for critical reagents and microfluidic components will mitigate risks associated with tariff fluctuations and regional disruptions. Establishing strategic alliances with local manufacturers or distributors in key markets can further stabilize procurement and reduce lead times.

Second, embracing digital transformation by investing in AI-driven data analysis and cloud-based workflow management will streamline operations and unlock actionable insights. Integrating automated sample preparation modules with digital PCR platforms can accelerate adoption in point-of-care contexts and reduce manual handling errors. In parallel, developing robust training programs for laboratory personnel ensures proficiency with advanced workflows and maintains quality standards.

Finally, engaging proactively with regulatory authorities and participating in industry consortia will shape favorable policy frameworks for digital PCR applications. By contributing to standards development and demonstrating real-world performance, stakeholders can foster trust, expedite approvals, and create an environment where innovation thrives alongside patient safety and data integrity.

Implementing Rigorous Research Methodologies Fusing Quantitative and Qualitative Approaches to Deliver Robust Insights into the Digital PCR Sector

This research harnesses a blend of quantitative and qualitative methodologies to deliver comprehensive insights into the digital PCR landscape. Secondary research involved a systematic review of peer-reviewed literature, industry reports, and regulatory guidelines to map technological advancements, market participants, and evolving supply chain factors. Proprietary databases supplemented this review with company announcements, patent filings, and trade policy updates.

Primary research encompassed in-depth interviews with domain experts, including R&D scientists, laboratory directors, and procurement managers across academic, clinical, and industrial settings. These discussions provided firsthand perspectives on technology adoption challenges, procurement strategies, and unmet user needs. A structured survey of end users further quantified preferences for reagent formats, instrument features, and software capabilities.

Data triangulation through cross-validation of secondary sources and primary inputs ensured the robustness of findings. The combination of bottom-up analysis of company activities and top-down evaluation of regulatory and macroeconomic drivers yields a nuanced understanding of the forces shaping digital PCR’s trajectory, guiding stakeholders toward informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital PCR market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital PCR Market, by Product

- Digital PCR Market, by Technology

- Digital PCR Market, by Sample Type

- Digital PCR Market, by Application

- Digital PCR Market, by End User

- Digital PCR Market, by Region

- Digital PCR Market, by Group

- Digital PCR Market, by Country

- United States Digital PCR Market

- China Digital PCR Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Emerging Considerations That Will Shape the Future Trajectory of Digital PCR Innovation and Adoption Worldwide

The convergence of technological innovation, shifting trade policies, and diverse user requirements underscores the complexity of the digital PCR ecosystem. Advances in microfluidics, AI integration, and portable point-of-care systems are broadening the scope of digital PCR applications, while emerging tariff structures and supply chain realignments are redefining procurement strategies. Segmentation insights highlight the interplay between consumable reagents, instrument platforms, software tools, and specialized end users, each contributing unique dynamics to market development.

Regional analysis reveals a mosaic of adoption drivers, from mature diagnostics infrastructure in the Americas to rapid growth in Asia-Pacific and targeted demand in Europe, the Middle East, and Africa. Industry leaders and emerging innovators are collaborating across the value chain to deliver integrated solutions that balance performance, cost, and regulatory compliance. Strategic recommendations emphasize supply chain resilience, digital workflow transformation, and proactive regulatory engagement as critical imperatives.

Looking ahead, stakeholders must remain agile, anticipating policy shifts and leveraging cross-sector partnerships to capitalize on emerging applications in personalized medicine, environmental monitoring, and agricultural biotechnology. By adhering to rigorous research methodologies and fostering an environment of continuous innovation, the digital PCR community is well-positioned to navigate challenges and drive the next wave of molecular diagnostics breakthroughs.

Engage with Ketan Rohom Associate Director Sales Marketing to Secure Comprehensive Insights and Empower Decisions with the Full Market Research Report

We invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive report can inform your strategies and drive impact. Engaging with our seasoned expert will provide bespoke guidance on leveraging these insights to overcome market challenges, refine your competitive positioning, and capitalize on emerging opportunities.

Secure your access today to gain unparalleled visibility into the evolving digital PCR ecosystem, stay ahead of regulatory and supply chain dynamics, and harness actionable intelligence that will fuel your next phase of growth.

- How big is the Digital PCR Market?

- What is the Digital PCR Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?