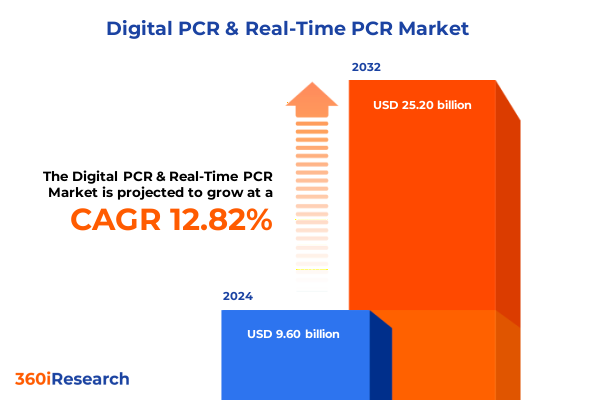

The Digital PCR & Real-Time PCR Market size was estimated at USD 10.78 billion in 2025 and expected to reach USD 12.12 billion in 2026, at a CAGR of 12.88% to reach USD 25.20 billion by 2032.

Unveiling the Evolving Landscape of Digital Polymerase Chain Reaction and Real-Time PCR Platforms Shaping the Future of Molecular Diagnostics

In recent years, molecular diagnostics has undergone a paradigm shift as polymerase chain reaction methodologies have evolved from conventional end-point techniques to sophisticated digital partitioning and real-time quantification platforms. Real-Time PCR offers dynamic monitoring of nucleic acid amplification through fluorescent signal detection, enabling both qualitative and quantitative analyses during each thermal cycle. Conversely, Digital PCR achieves absolute quantification by subdividing samples into thousands or millions of partitions, each serving as an individual reaction chamber. This approach enhances sensitivity and precision, allowing for the detection of rare mutations, low-abundance pathogens, and minimal residual disease with unprecedented accuracy. These complementary technologies are now indispensable across diverse applications, including infectious disease surveillance, oncology biomarker discovery, environmental monitoring, and food safety testing, where they provide the granularity needed for robust decision-making in both clinical and research settings (based on applications data).

How Integration of Artificial Intelligence Automation and Enhanced Multiplexing Is Revolutionizing PCR Workflows to Meet Next-Generation Diagnostic Needs

The PCR landscape is being reshaped by the integration of advanced automation, miniaturization, and artificial intelligence (AI), setting the stage for faster, more reliable, and more cost-effective workflows. Emerging AI-driven algorithms analyze amplification curves in real time, identifying patterns and anomalies that could elude traditional interpretation methods. This enhancement reduces human error and accelerates turnaround times, particularly in high-throughput clinical laboratories where speed and accuracy are paramount. At the same time, the trend toward smaller, portable systems is expanding the reach of PCR technologies beyond centralized labs to decentralized and point-of-care environments. These miniaturized platforms, enabled by robotics and microfluidics, allow for near-patient testing without sacrificing analytical performance.

Multiplexing capabilities have also advanced significantly, with new assays capable of simultaneously detecting multiple genetic targets within a single reaction vessel. This development streamlines sample processing, conserves precious reagents, and reduces overall operational costs while providing comprehensive data in one run. The synergy of automation, data analytics, and assay refinement is fostering a new era of molecular diagnostics-one where rapid, on-demand testing can be performed with high precision and minimal manual intervention.

Assessing the Cumulative Impact of 2025 U.S. Tariff Policies on PCR Instruments Reagents and Consumables Across Global Life Science Supply Chains

In 2025, U.S. tariff policies introduced sweeping changes that have profoundly affected the procurement and distribution of PCR instruments, reagents, and consumables. A universal 10% tariff on most imported goods took effect on April 5, 2025, encompassing critical laboratory equipment and materials, while subsequent country-specific increases have created a patchwork of duties across global suppliers. China-based manufacturers of lab essentials now face cumulative tariffs as high as 145%, significantly increasing costs for products such as pipettes, thermal cyclers, and precision optics. Moreover, a 20–25% duty on active pharmaceutical ingredients and key drug intermediates has escalated prices for enzymes, master mixes, and other high-purity reagents, leading many U.S. laboratories to reevaluate sourcing strategies.

These tariff-driven cost pressures are prompting industry participants to explore alternative supply chains, with an emphasis on reshoring and building partnerships with domestic distributors to mitigate both financial and logistical disruptions. The high cost of tariffs has driven a surge in demand for U.S.-manufactured consumables and services, altering long-established procurement patterns. As laboratories and manufacturers adapt, the PCR market is likely to see a permanent shift toward more localized manufacturing and diversified sourcing frameworks, reinforcing the resilience of critical diagnostic infrastructures.

Key Segmentation Insights Revealing How Product Types Technologies Sample Types Applications and End Users Shape the PCR Market Landscape

The market’s segmentation by product type underscores the critical balance between hardware, consumables, and support services that sustains PCR workflows. Instruments serve as the foundational platforms, while reagents and consumables-including the core enzymes that catalyze amplification, master mixes optimized for efficiency, and bespoke probes and primers-constitute the biochemical engine that drives assay performance. Complementary services and software layers enhance user experience, from instrument calibration to data management analytics.

From a technology perspective, traditional real-time PCR systems continue to anchor many diagnostic laboratories due to their proven reliability and established protocols, while digital PCR’s partition-based approach is carving out a specialized niche for applications demanding maximum sensitivity and absolute quantification. The ability to choose between chip-based or droplet digital PCR formats provides further granularity, even as advances in quantitative real-time PCR and reverse transcription PCR extend applications into RNA quantification and viral load monitoring.

Sample type segmentation reflects the PCR market’s adaptability across diverse matrices. Clinical laboratories processing blood specimens-whether plasma or serum-rely on PCR for precision diagnostics, while environmental testing of soil and water samples demands robust methods to overcome inhibitors. Food safety applications leverage PCR to detect allergens and pathogens, and tissue-based assays contribute to cancer diagnostics and transplant monitoring.

Application-driven segmentation reveals how clinical infectious disease testing, oncology profiling, and transplant diagnostics anchor the market’s core, while environmental surveillance, forensic analyses, and multifaceted research applications such as single-cell and gene expression studies continue to drive innovation. Finally, end users ranging from academic research institutions to clinical diagnostic laboratories, forensic labs, and pharmaceutical and biotechnology companies each demand tailored solutions that align with their specific throughput, sensitivity, and regulatory compliance requirements.

This comprehensive research report categorizes the Digital PCR & Real-Time PCR market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End-User

Key Regional Insights Highlighting Growth Drivers Adoption Trends and Strategic Opportunities Across the Americas Europe Middle East Africa and Asia-Pacific

In the Americas, technological leadership and high healthcare expenditure have cemented the region’s dominance in PCR adoption. North America accounts for the largest share of PCR technology deployment globally, driven by a robust R&D ecosystem, early regulatory approvals of innovative assays, and strong public and private investments in genomic medicine. Contract research organizations and academic consortia frequently collaborate with equipment manufacturers to pioneer new workflows, while a dense network of clinical laboratories ensures rapid uptake of next-generation platforms.

Europe, the Middle East, and Africa represent a mosaic of markets where regulatory harmonization and precision medicine initiatives vary widely. In Western Europe, stringent IVD regulations under IVDR have elevated quality standards and driven demand for validated PCR assays, particularly in cancer genomics and infectious disease diagnostics. Strategic collaborations between research institutions and diagnostic firms in the UK, Germany, and France foster an environment ripe for innovation, even as emerging markets in Eastern Europe and the Middle East seek to expand molecular testing infrastructure.

The Asia-Pacific region is the fastest-growing market segment, propelled by expanding healthcare infrastructure, rising public health testing programs, and a burgeoning biotechnology industry. Countries such as China and Japan are investing heavily in point-of-care and decentralized testing solutions to address large-scale screening needs. Regional governments are incentivizing local manufacturing and streamlined regulatory pathways for molecular diagnostics, reinforcing a dynamic environment where both domestic and international companies can scale PCR technologies rapidly.

This comprehensive research report examines key regions that drive the evolution of the Digital PCR & Real-Time PCR market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Competitive Landscape Insights into Leading PCR Technology Providers and Their Strategic Initiatives in a Dynamic Molecular Diagnostics Market

Leading providers of PCR instrumentation and reagents continue to invest heavily in platform enhancements, assay development, and strategic partnerships to maintain market leadership. Thermo Fisher Scientific has focused on expanding its reagent portfolio with value-added master mixes and one-step RT-PCR kits, while simultaneously advancing automation and data connectivity features across its real-time and digital PCR systems. Bio-Rad Laboratories has leveraged its expertise in droplet digital PCR to introduce high-throughput formats tailored for liquid biopsy and oncology applications, further supported by AI-driven analysis software that simplifies data interpretation and reporting.

Roche, QIAGEN, and Agilent Technologies are also strengthening their competitive positions through acquisitions and co-development agreements aimed at bolstering genomic workflow integration. Roche’s recent partnerships to develop multiplexed assays for infectious disease panels underscore the growing demand for consolidated testing solutions. QIAGEN’s platform is distinguished by its broad assay menu and focus on personalized medicine, and Agilent’s entry into the digital PCR space complements its existing molecular analysis portfolio.

Meanwhile, smaller innovators like Fluidigm and Stilla Technologies are pushing the boundaries of microfluidic partitioning and assay miniaturization, forging niche capabilities in single-cell analysis and high-multiplex pathogen detection. These efforts are complemented by an increased emphasis on U.S.-based manufacturing to mitigate tariff exposure and ensure reliable supply chains, a strategy underscored by recent executive commentary on reshoring initiatives in the life science tools sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital PCR & Real-Time PCR market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories, Inc.

- Agilent Technologies, Inc.

- Analytik Jena GmbH+Co. KG

- Azure Biosystems Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Biocompare

- BIOMÉRIEUX S.A.

- Bioneer Corporation

- Danaher Corporation

- ELITech Group by Bruker Corp

- Enzo Life Sciences, Inc.

- Eppendorf SE

- Etcon Analytical and Environmental Systems & Services Ltd.

- Explorea s.r.o

- F. Hoffmann-La Roche Ltd.

- Hangzhou Longgene Scientific Instruments Co., Ltd.

- Heal Force Bio-Meditech Holdings Limited

- LABGENE Scientific SA

- Merck KGaA

- Promega Corporation

- QIAGEN N.V.

- Quidel Corporation

- R-Biopharm AG

- RainSure Scientific

- SD Biosensor, Inc.

- Solis BioDyne OÜ

- STANDARD BIOTOOLS INC.

- Takara Bio USA, Inc.

- Thermo Fisher Scientific Inc.

- Zymo Research Corp.

Actionable Recommendations for Industry Leaders to Drive Innovation Streamline Supply Chains and Capitalize on Emerging PCR Opportunities in 2025 and Beyond

To thrive in this rapidly evolving environment, industry leaders should prioritize the integration of AI-driven data analytics into PCR workflows to enhance assay reliability and reduce manual interpretation bottlenecks. Investing in multiplex assay development will enable laboratories to consolidate testing volumes and improve cost efficiency, particularly in high-throughput settings. At the same time, organizations must diversify their supply chains by identifying U.S.-based manufacturers and certified local distributors to secure critical reagents and instrumentation, mitigating exposure to volatile tariff regimes and global shipping disruptions.

Embracing agile regulatory strategies will be essential for accelerating assay approvals across multiple geographies. Forming strategic alliances with regional diagnostic firms can facilitate localized development and market entry, while proactive engagement with regulatory bodies ensures alignment with evolving IVD requirements. Additionally, expanding training programs and virtual support capabilities can optimize instrument uptime and boost user proficiency, enabling end users to fully leverage advanced features such as digital partitioning and real-time connectivity.

Finally, fostering collaboration with key academic and clinical research centers will drive co-innovation, enabling the rapid validation of new assay applications and ensuring that product roadmaps remain closely aligned with emerging market needs. This multi-pronged approach will position companies to capitalize on the transformative shifts reshaping molecular diagnostics.

Comprehensive Research Methodology Outlining Data Collection Analysis Validation and Reporting Approaches Underpinning This PCR Market Study

This research study was conducted using a combination of secondary and primary research methodologies to ensure a comprehensive and reliable analysis of the PCR market. Secondary research involved an extensive review of peer-reviewed journals, industry white papers, regulatory publications, patent filings, and publicly available company disclosures to establish a foundational understanding of technology trends, competitive landscapes, and regulatory frameworks.

Primary research included structured interviews with senior executives, product managers, and end users from diagnostic laboratories, pharmaceutical companies, and academic institutions. These discussions provided qualitative insights into purchasing behaviors, product performance expectations, and unmet needs within diverse application areas. Data triangulation techniques were employed to reconcile information across multiple sources, enhancing accuracy and reducing bias.

Quantitative validation was achieved through the analysis of shipment volumes, installed base statistics, and sales data obtained from industry databases and proprietary vendor reports. Rigorous data cleansing and consistency checks were performed, followed by expert review to refine assumptions and ensure methodological robustness. The resulting report offers a high-confidence perspective on technological adoption, market segmentation, and regional dynamics guiding PCR strategies today.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital PCR & Real-Time PCR market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital PCR & Real-Time PCR Market, by Product Type

- Digital PCR & Real-Time PCR Market, by Technology

- Digital PCR & Real-Time PCR Market, by Application

- Digital PCR & Real-Time PCR Market, by End-User

- Digital PCR & Real-Time PCR Market, by Region

- Digital PCR & Real-Time PCR Market, by Group

- Digital PCR & Real-Time PCR Market, by Country

- United States Digital PCR & Real-Time PCR Market

- China Digital PCR & Real-Time PCR Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Conclusion Emphasizing the Strategic Imperatives and Future Directions for PCR Technologies in Precision Diagnostics and Life Science Applications

Digital PCR and Real-Time PCR technologies are now firmly established as cornerstones of modern molecular diagnostics, offering unparalleled sensitivity, precision, and flexibility across clinical, environmental, food safety, and forensic applications. The convergence of AI-enhanced analytics, advanced reagent chemistries, and automated, miniaturized platforms is transforming traditional workflows, enabling on-demand, high-throughput testing with minimal user intervention. Meanwhile, 2025 tariff policies have highlighted the importance of resilient, diversified supply chains and localized manufacturing models that prioritize both cost-effectiveness and operational continuity.

Looking ahead, the rapid evolution of multiplexing and point-of-care capabilities, combined with ongoing regulatory harmonization across key regions, will drive broader adoption of PCR-based assays. Industry leaders that embrace collaborative innovation, agile sourcing strategies, and data-driven decision-making will be best positioned to capitalize on emerging opportunities and deliver solutions that meet the exacting demands of personalized medicine and large-scale public health initiatives. Ultimately, sustained investment in R&D, strategic partnerships, and workforce enablement will underpin the next wave of growth in the molecular diagnostics sector, reinforcing PCR’s role as an essential tool in the life sciences arsenal.

Call to Action Engage with Our Associate Director Ketan Rohom to Access the Complete Market Research Report and Empower Your PCR Strategy Journey Today

To unlock the full insights and strategic recommendations contained in this comprehensive analysis of the Digital PCR and Real-Time PCR landscape, you are invited to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the report’s extensive findings, including the detailed segmentation analyses, regional perspectives, and competitive intelligence that will empower your organization to make data-driven decisions and maintain a competitive edge. Engage with Ketan to explore customized consulting opportunities, secure access to the complete dataset, and discuss how these insights can be tailored to your unique objectives. Take the next step toward driving innovation, optimizing your PCR strategies, and accelerating your path to market leadership by reaching out to Ketan Rohom today to purchase and implement this vital market research report.

- How big is the Digital PCR & Real-Time PCR Market?

- What is the Digital PCR & Real-Time PCR Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?