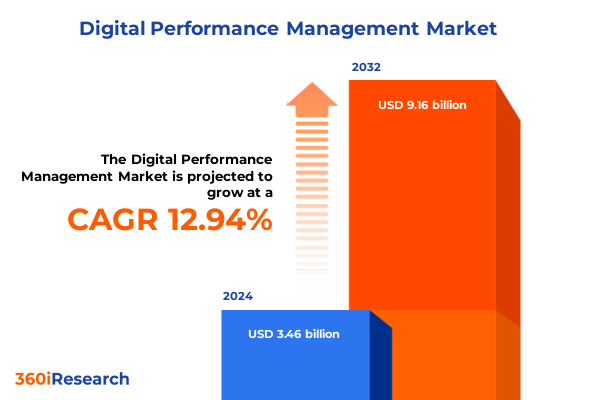

The Digital Performance Management Market size was estimated at USD 3.88 billion in 2025 and expected to reach USD 4.35 billion in 2026, at a CAGR of 13.06% to reach USD 9.16 billion by 2032.

Understanding the Strategic Imperatives and Core Drivers Shaping Digital Performance Management for Modern Enterprise Success

Enterprises across all industries are navigating an era where the performance of digital assets directly influences customer satisfaction, operational efficiency, and long-term profitability. As applications become increasingly complex and distributed, ensuring consistent responsiveness and reliability has never been more critical. Digital performance management emerges as the strategic discipline that bridges the gap between development, operations, and business stakeholders, providing holistic visibility into end-user experiences, infrastructure health, and the interdependencies that define modern digital ecosystems.

In this context, digital performance management serves as both a defensive and offensive tool. Defensively, it safeguards service levels, minimizes downtime, and preserves brand reputation. Offensively, it drives revenue by enabling faster time to resolution, proactive problem detection, and data-driven optimization of customer-facing applications. The importance of real-time analytics and intelligent alerting cannot be overstated, as they empower technical and executive teams to make evidence-based decisions under pressure. In turn, organizations can embrace strategic innovations without sacrificing the reliability that users and regulators demand.

Understanding the strategic imperatives that underpin digital performance management is the first step toward gaining a competitive edge. As we outline in this report, mapping performance metrics to business outcomes and embedding monitoring into every stage of the application lifecycle is foundational. By integrating performance data with broader IT service management workflows, enterprises unlock a continuous feedback loop that fuels ongoing improvement and aligns IT objectives with corporate goals.

Navigating the Evolutionary Shifts and Technological Disruptions Reshaping the Digital Performance Management Landscape Today

The digital performance management landscape has undergone seismic shifts catalyzed by changes in application architectures, infrastructure models, and user expectations. Historically rooted in on-premises, monolithic environments, performance monitoring has evolved to encompass cloud-native paradigms, container orchestration, and distributed microservices. Such disruptions demand a reimagining of traditional approaches, as legacy monitoring tools often lack the scalability and flexibility required to maintain visibility across dynamic, ephemeral environments.

Simultaneously, the rise of observability frameworks and open telemetry standards signifies a move from reactive incident management toward proactive system intelligence. Organizations are increasingly turning to synthetic monitoring to simulate user journeys and collect performance benchmarks before issues manifest in production. Real user monitoring complements this by capturing live traffic patterns and identifying bottlenecks in complex multi-tier architectures. The convergence of these modalities, powered by machine learning and anomaly detection, empowers teams to reduce mean time to detection and resolution in unprecedented ways.

Moreover, edge computing and 5G adoption have further amplified the complexity of digital ecosystems, redistributing compute and introducing new latency vectors. As a result, performance management platforms must adapt to decentralized infrastructures and prioritize real-time analysis at the network edge. In response, leading vendors have introduced AI-driven root cause analysis and self-healing capabilities that minimize human intervention, reduce operational overhead, and elevate service reliability to match evolving digital demands.

Assessing the Far Reaching Consequences of the 2025 United States Tariff Regime on Digital Performance Management Infrastructure and Services

The implementation of the 2025 United States tariff regime has had profound implications for organizations reliant on hardware-intensive digital performance management solutions. By imposing higher duties on semiconductor components, networking equipment, and storage arrays, procurement costs for on-premises infrastructure spiked significantly. These elevated expenditures have prompted many enterprises to reconsider capital-intensive deployments in favor of cloud-centric and hybrid approaches, where hardware responsibilities migrate to service providers and tariff exposure is minimized.

Despite the clear incentive to pivot toward cloud environments, the tariff-induced price adjustments are not limited to hardware alone. Software vendors with on-premises licensing models have adjusted their on-boarding fees to reflect increased support and supply chain management expenses. Consequently, total cost of ownership calculations have shifted, reinforcing the need for holistic assessments that factor in tariff volatility, currency fluctuations, and logistical complexities. In many cases, the upfront savings associated with cloud subscriptions outweigh the long-term tariff risk, accelerating the industry-wide move to consumption-based pricing structures.

However, supply chain bottlenecks resulting from elevated import duties have extended hardware lead times, disrupting upgrade cycles and impeding capacity planning. Organizations that delayed cloud migrations in an attempt to weather the tariff storm found themselves grappling with performance degradation and scaling challenges. Moving forward, enterprises must adopt flexible sourcing strategies and engage with vendors offering tariff-hedged procurement models to safeguard digital performance initiatives against geopolitical upheaval and fiscal uncertainty.

Unlocking Strategic Advantages Through In Depth Analysis of Deployment Models Organizational Sizes Application Types Solution Offerings and Industries

Examining deployments across cloud, hybrid, and on-premises reveals that public cloud environments continue to dominate innovation use cases, leveraging elasticity and global reach to accommodate unpredictable traffic surges. Private cloud configurations, by contrast, are preferred where regulatory compliance, data sovereignty, and customized performance tuning are paramount. Hybrid topologies bridge these extremes, enabling organizations to partition workloads based on latency sensitivity and criticality, while preserving centralized governance and unified monitoring.

When considering organizational size, large enterprises exhibit a propensity to deploy multi-layered performance management suites that integrate APM, synthetic, and network monitoring under a single pane of glass. Medium and small enterprises often adopt modular or cloud-delivered solutions, balancing feature sets with budget constraints. Micro enterprises, with limited IT staff, gravitate toward SaaS offerings that offer preconfigured dashboards and automated health checks, reducing administrative overhead and accelerating time to value.

In terms of application type, API services demand ultra-low latency monitoring at the transaction level, particularly in digital ecosystems where partner integrations and microservices interfaces multiply exponentially. Mobile applications require real-time end-user experience insights to optimize session performance across diverse networks and devices. Web applications, while benefiting from established RUM and synthetic frameworks, are increasingly expected to support single page architectures and compute-intensive frameworks without compromising page load times.

Solution type segmentation underscores the centrality of application performance monitoring for correlating code-level traces with user journeys, whereas cloud infrastructure monitoring provides holistic telemetry on compute, storage, and container orchestration. Database performance monitoring remains indispensable for query optimization and workload balancing, while network performance monitoring, encompassing both flow-based and packet-based techniques, ensures visibility across virtualized and physical network fabrics. Synthetic monitoring simulates complex scenarios to benchmark service levels and validate SLAs before customer impact occurs.

Industry vertical requirements further nuance solution adoption, with BFSI institutions demanding granular encryption-aware monitoring, governments and defense agencies prioritizing classified data handling and resilience, and healthcare providers focusing on patient safety and compliance. IT and telecom operators emphasize high-volume throughput analytics, whereas retail and ecommerce businesses leverage performance insights to bolster digital storefront conversions and minimize cart abandonment.

This comprehensive research report categorizes the Digital Performance Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment

- Organization Size

- Application Type

- Solution Type

- Industry Vertical

Examining Regional Variations and Strategic Emerging Opportunities Across the Americas Europe Middle East Africa and Asia Pacific in Digital Performance Management

In the Americas, digital performance management initiatives are driven by large scale enterprises headquartered in the United States and Canada that prioritize agility, scalability, and user experience optimization. Latin American markets are likewise embracing cloud migration to overcome infrastructure limitations and capitalize on mobile-first consumer behaviors. The maturity of service provider ecosystems in North America accelerates adoption of advanced observability platforms, while regional data privacy regulations in South America shape preferences toward hybrid and private deployments.

Europe, Middle East & Africa presents a mosaic of regulatory regimes, technological maturity, and market demands. Western European countries benefit from robust digital infrastructures and supportive policy frameworks, propelling investments in AI-driven monitoring and cross-border data flows. Central and Eastern European organizations are increasingly modernizing legacy estates, shifting to managed services that reduce capital outlays. In the Middle East and Africa, strategic digital transformation initiatives in government and telecom sectors fuel demand for integrated performance management solutions that can operate reliably in constrained network environments and diverse climatic conditions.

Asia-Pacific remains a hotbed for digital innovation, with powerhouse economies such as China, India, and Australia advancing cloud-first strategies. Rapid urbanization and heightened smartphone penetration in Southeast Asia drive mobile performance monitoring adoption. Meanwhile, stringent cybersecurity mandates in Japan and South Korea compel enterprises to implement real-time anomaly detection and encrypted telemetry. Across the region, regional service providers are forming partnerships with global vendors to deliver localized performance management capabilities and ensure compliance with evolving legislative requirements.

This comprehensive research report examines key regions that drive the evolution of the Digital Performance Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Competitive Dynamics Among Key Vendors Shaping the Digital Performance Management Ecosystem Globally

The vendor landscape is distinguished by a cadre of established players and emerging challengers that collectively shape the competitive dynamics. Solutions from providers such as Dynatrace deliver deep code-level tracing and AI-powered root cause analysis, while New Relic offers a unified platform emphasizing developer-centric visualizations and open source integrations. Datadog’s cloud-native focus and extensive integration ecosystem make it a favorite among organizations pursuing DevOps maturity and microservices architectures.

Alongside these market leaders, a set of specialized vendors competes on unique value propositions. Companies offering synthetic monitoring excel at simulating complex user workflows across dispersed networks, whereas database performance monitoring specialists target high-transaction environments such as trading systems and e-commerce platforms. Network performance monitoring innovators are differentiating through low-latency, distributed agents capable of deep packet inspection and adaptive telemetry collection in SDN environments.

Strategic partnerships, mergers, and acquisitions continue to redefine the competitive landscape. Global technology integrators are embedding performance management modules into broader IT service management portfolios, while cloud hyperscalers are extending native observability toolsets into managed service offerings. This convergence underscores the critical role of performance management as a foundational pillar for achieving digital resilience and operational scalability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Performance Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Akamai Technologies

- Anaplan

- Atos SE

- BMC Software Inc

- Broadcom Inc

- Cisco Systems Inc

- Conviva

- Cornerstone OnDemand Inc

- Datadog Inc

- Dynatrace Inc

- Elastic N.V.

- IBM Corporation

- Infor

- Lattice

- Microsoft Corporation

- New Relic Inc

- Oracle Corporation

- Planful

- SAP SE

- ServiceNow

- SolarWinds Corporation

- Splunk Inc

- Workday Inc

Strategic Recommendations to Drive Operational Excellence Innovation and Competitive Advantage in Digital Performance Management for Senior Leadership Teams

To drive operational excellence, organizations should establish clear performance objectives that align with business outcomes and ensure that monitoring strategies map directly to revenue-impacting workflows. By embedding observability into the DevOps pipeline, teams can shift left on performance testing and reduce costly post-deployment remediations. This approach fosters a culture of shared responsibility, where development, operations, and business units collaborate on end-to-end performance goals.

Innovation thrives when data insights are democratized across functional teams. Senior leadership should champion investments in AI-enabled capabilities that automate anomaly detection, dynamic alerting, and predictive capacity planning. Automating routine diagnostics frees technical resources to focus on strategic initiatives such as cloud-native optimization or customer experience enhancements. Moreover, integrating performance data with IT service management and incident response workflows accelerates resolution times and improves SLA adherence.

Competitive advantage comes from continuous performance tuning informed by real user feedback. Organizations must prioritize user journey analytics and synthetic scenario benchmarking to identify friction points across devices, geographies, and network conditions. Coupling these insights with security posture assessments ensures that performance improvements do not introduce vulnerabilities. Finally, industry leaders should cultivate strategic alliances with service providers and technology partners to co-innovate on emerging needs such as edge observability, 5G integrations, and resilient multi-cloud architectures.

Detailing Rigorous Research Methodology and Analytical Frameworks Underpinning the Insights and Findings Presented in the Digital Performance Management Study

This study’s insights are underpinned by a robust research methodology combining primary and secondary data sources to ensure comprehensive coverage and analytical rigor. Primary research involved in-depth interviews with C-level executives, IT directors, and performance management specialists across multiple industries, capturing firsthand perspectives on pain points, priorities, and adoption drivers. These qualitative inputs were complemented by structured surveys disseminated to a representative sample of mid-market and enterprise organizations, delivering quantifiable metrics on deployment preferences, budget allocations, and technology roadmaps.

Secondary research encompassed an exhaustive review of public company filings, technology whitepapers, regulatory directives, and industry publications to validate market dynamics and historical trends. Vendor press releases, patent filings, and partnership announcements were scrutinized to map competitive developments and identify emergent capabilities. Synthesizing these diverse inputs through data triangulation techniques ensured that the findings reflect both leading-edge innovations and established best practices.

Analytical frameworks such as SWOT, Porter’s Five Forces, and use case maturity models were employed to decompose complex market interactions and forecast potential disruptors. The integration of advanced statistical tools and scenario analysis enabled a nuanced understanding of risk factors-such as tariff fluctuations and regulatory shifts-and their downstream effects on adoption trajectories. Quality checks and peer reviews were conducted at multiple stages to uphold objectivity and accuracy, resulting in a study that executives and practitioners can confidently leverage for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Performance Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Performance Management Market, by Deployment

- Digital Performance Management Market, by Organization Size

- Digital Performance Management Market, by Application Type

- Digital Performance Management Market, by Solution Type

- Digital Performance Management Market, by Industry Vertical

- Digital Performance Management Market, by Region

- Digital Performance Management Market, by Group

- Digital Performance Management Market, by Country

- United States Digital Performance Management Market

- China Digital Performance Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Critical Takeaways and Forward Looking Perspectives on Navigating Challenges and Capitalizing on Opportunities in Digital Performance Management

Throughout this report, critical takeaways include the imperative of embedding performance management across all digital initiatives to safeguard user experience and operational resilience. The transition to cloud-native and hybrid architectures, accelerated by external factors such as the 2025 tariff regime, underscores the necessity of flexible, consumption-based monitoring strategies. Concurrently, the proliferation of edge computing and microservices demands observability platforms that can scale horizontally and provide real-time diagnostic capabilities.

Looking ahead, the convergence of AI-driven analytics, automated remediation, and cross-domain telemetry will redefine best practices in digital performance management. Organizations that prioritize strategic segmentation-tailoring solutions by deployment model, organizational size, and industry requirements-will gain a distinct advantage in optimizing resource utilization and elevating customer satisfaction. Regional nuances and regulatory landscapes will continue to shape adoption patterns, necessitating agile sourcing and compliance-aware monitoring architectures.

Ultimately, navigating these complexities requires a balanced approach that combines visionary leadership with disciplined execution. By aligning performance objectives with broader business goals and fostering a culture of continuous improvement, enterprises can convert performance data into strategic insight. As you chart your organization’s digital performance roadmap, the insights presented herein will serve as a compass, guiding decisions that enhance reliability, accelerate innovation, and sustain competitive differentiation.

Initiate Your Journey to Enhanced Digital Performance Management Excellence Today by Collaborating with Ketan Rohom to Secure the Market Research Report

If you are ready to elevate your organization’s digital performance initiatives and harness the full potential of our comprehensive insights, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His deep understanding of market dynamics and client needs ensures a seamless advisory experience from initial inquiry to final acquisition. By partnering with Ketan, you gain exclusive access to tailored guidance that aligns the report’s rich findings with your strategic objectives, empowering your teams to make informed decisions that drive growth and resilience.

Securing this market research report unlocks in-depth analysis of deployment strategies, segmentation nuances, competitive landscapes, and regional trends that are critical for maintaining a competitive edge. Ketan’s consultative approach will help you interpret the data in the context of your unique operational environment, providing clarity on priority investments and risk mitigation strategies. Whether your focus is on optimizing cloud performance, enhancing real user monitoring, or streamlining network diagnostics, Ketan is positioned to facilitate a smooth transition from insight to implementation.

Reach out to Ketan Rohom today to explore flexible engagement models, volume licensing options, and extended support packages. Embark on a transformative journey that turns market intelligence into actionable strategy and sustainable advantage.

- How big is the Digital Performance Management Market?

- What is the Digital Performance Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?