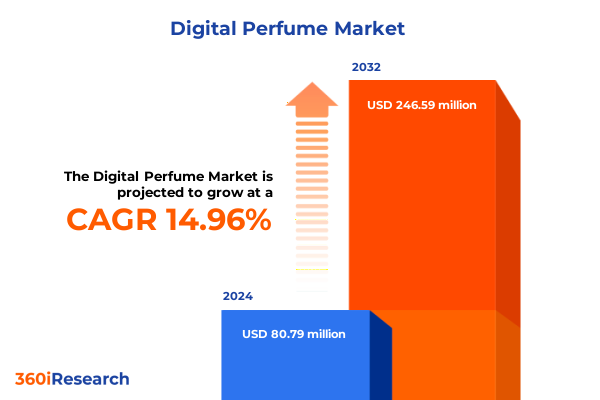

The Digital Perfume Market size was estimated at USD 92.67 million in 2025 and expected to reach USD 109.07 million in 2026, at a CAGR of 15.00% to reach USD 246.58 million by 2032.

Navigating the Fusion of Fragrance and Technology: The Rise of Digital Perfume Shaping Tomorrow’s Consumer Experience

The convergence of fragrance artistry and digital innovation has ushered in an era where scent can be curated, customized, and delivered through virtual channels. As consumers increasingly seek personalized experiences across every dimension of daily life, the concept of digital perfume transcends the traditional boundaries of fragrance creation. This introduction unpacks how sensors, data analytics, and online platforms coalesce to offer immersive olfactory journeys that were once confined to analog bottle experiences.

Within this dynamic landscape, brands deploy innovative technologies such as smart diffusers, app-enabled scent cartridges, and virtual reality scent simulations to engage tech-savvy audiences. These advancements not only enhance the consumer experience but also open new avenues for direct-to-consumer distribution and subscription models. Meanwhile, strategic partnerships between fragrance houses and digital solution providers underscore the sector’s collaborative spirit.

Looking ahead, the digital perfume domain holds promise for further integration with wearable devices, AI-driven scent profiling, and multisensory marketing campaigns. Understanding this fusion of tradition and technology establishes the foundation for exploring core market shifts, external pressures, segmentation intricacies, and regional variations that define the contemporary digital fragrance arena.

How Technological Innovation and Changing Consumer Behaviors Are Reshaping the Digital Perfume Industry with Unprecedented Agility

In recent years, the digital perfume market has undergone transformative shifts propelled by rapid technological progress and evolving consumer expectations. Advanced scent customization platforms now leverage machine learning algorithms to analyze user preferences in real time, enabling brands to formulate tailor-made fragrances that resonate on a personal level. Consequently, companies have moved beyond one-size-fits-all offerings to embrace modular composition techniques that empower consumers to blend notes according to their moods and occasions.

Simultaneously, the proliferation of high-resolution olfactory sensors has revolutionized quality control and consistency in scent production. By capturing precise chemical signatures, these devices ensure that digitized fragrances accurately replicate the intended aromatic profile, fostering greater trust among discerning users. Moreover, the integration of augmented reality in marketing has elevated product discovery, allowing consumers to visualize scent narratives before purchase.

Amid these technological advances, shifting buyer demographics play a pivotal role. Millennials and Generation Z consumers prioritize authenticity, sustainability, and seamless online engagement, prompting brands to adopt transparent ingredient sourcing and carbon-neutral delivery methods. As a result, the landscape continues to evolve with heightened agility, setting new benchmarks for innovation in scent personalization and digital engagement.

Assessing the Ripple Effects of 2025 United States Tariffs on the Digital Perfume Sector Supply Chain and Cost Structures

The introduction of new United States tariff measures in 2025 has generated notable effects throughout the digital perfume supply chain. Increased duties on imported aroma chemicals and high-precision microelectronic components have led manufacturers to reassess sourcing strategies. Consequently, some key fragrance houses have shifted part of their raw material procurement to domestic or tariff-exempt suppliers, while others have accelerated investments in in-house synthesis and localized production facilities.

Cost pressures stemming from tariff impositions have also spurred creative responses. Digital fragrance firms have recalibrated their pricing structures, absorbing portions of the increased input expenses to remain competitive in suburban and urban markets alike. At the same time, many have renegotiated contracts with shipping and logistics partners, optimizing consolidation and route planning to mitigate incremental freight surcharges.

Moreover, the broader impact of these tariffs extends to research and development investments. Companies are prioritizing cost-effective formulation techniques and modular hardware designs that reduce reliance on imported modules. This strategic pivot not only addresses short-term margin impacts but also cultivates a more resilient production network capable of adapting to future trade policy fluctuations.

Unlocking Market Dynamics through Distribution Channels, Product Formats, Price Tiers, Gender, Age Groups, and Scent Families in Digital Fragrance

A comprehensive understanding of digital fragrance consumers emerges only by examining multiple segmentation dimensions. When analyzing distribution channels, the market bifurcates into offline avenues such as department stores, perfumeries, specialty stores and supermarkets & hypermarkets, alongside online pathways including brand websites, e-commerce platforms, marketplaces and social commerce, each offering unique touchpoints for experiential engagement and purchase conversion.

Exploring product formats reveals distinct usage occasions: lighter mists and colognes cater to casual daily wear, while eau de parfum, eau de toilette and perfume extrait de parfum appeal to enthusiasts seeking intensified longevity and concentration. Meanwhile, price tiers span the spectrum from mass market offerings to premium, niche, and luxury segments, reflecting varying degrees of exclusivity and artisanal craftsmanship.

Gender classification continues to influence fragrance narratives, with separate men’s and women’s collections alongside an expanding unisex category that resonates with modern sensibilities. Age group segmentation, comprising Baby Boomers, Generation X, Millennials and Generation Z, highlights generational shifts in scent preferences and purchasing habits, particularly in digital discovery channels. Finally, scent family distinctions such as floral (including floral aldehyde, fruity floral, soft floral), fresh (citrus fresh, green fresh, oceanic fresh), gourmand (chocolate, sweet, vanilla gourmand), oriental (amber and spicy orientation) and woody (aromatic, mossy, oriental woody) offer nuanced paths for tailored aroma experiences.

This comprehensive research report categorizes the Digital Perfume market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Format

- Price Tier

- Gender

- Age Group

- Scent Family

- Distribution Channel

Comparative Analysis of Americas, EMEA, and Asia-Pacific Regions Highlighting Growth Drivers and Consumer Preferences in Digital Fragrance

Geographically, the Americas region continues to lead in digital perfume adoption, driven by strong e-commerce infrastructure, high levels of consumer disposable income and widespread acceptance of subscription-based scent services. Within this territory, urban coastal hubs exhibit the highest concentration of digital fragrance enthusiasts, while secondary markets are gaining traction through targeted localized marketing campaigns and influencer partnerships.

In the Europe, Middle East & Africa landscape, regulatory frameworks around fragrance ingredients and data privacy shape product development strategies. European consumers often favor niche artisanal offerings that emphasize clean ingredients and provenance, whereas Middle Eastern markets display an affinity for rich, opulent scent profiles. African markets, though nascent, show significant growth potential fueled by mobile commerce penetration and aspirational branding.

Asia-Pacific has emerged as a rapidly expanding frontier, with digital fragrance penetration amplified by widespread smartphone usage and integral social commerce ecosystems. In this region, domestic brands leverage culturally rooted aroma traditions while international players introduce hybrid formulations to capture evolving consumer tastes. Southeast Asia and East Asia are particularly dynamic, bolstered by strong influencer culture and integrated digital payment solutions.

This comprehensive research report examines key regions that drive the evolution of the Digital Perfume market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Pioneers and Disruptors: Strategic Moves of Leading Players Shaping Innovation and Competition in the Digital Perfume Market

Leading multinational fragrance houses have responded to digital disruption by forging partnerships with technology startups, licensing proprietary scent delivery mechanisms, and launching dedicated online fragrance platforms. Some conglomerates have acquired niche digital scent firms to bolster their innovation pipelines, while a handful of specialized players build brand equity by focusing exclusively on app-controlled scent experiences.

Disruptive new entrants differentiate through unique value propositions such as AI-enabled scent profiling or biodegradable delivery systems. Their agility and digital-first ethos attract venture capital funding, enabling rapid scaling and high visibility on social media channels. Conversely, legacy brands capitalize on established manufacturing expertise and deep fragrance archives, combining tradition with digital channels to retain their loyal customer bases.

In addition, strategic alliances between digital perfume creators and consumer electronics manufacturers have yielded novel hardware integrations, including smart home scent units and wearable scent diffusers. These collaborations illustrate how cross-sector innovation drives market momentum and sets the stage for future ecosystem growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Perfume market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alnasir Tech Solutions Inc.

- AromaBit Technology Ltd.

- Aryballe Technologies SA

- Feelreal, Inc.

- Givaudan

- OVR Technology Co., Ltd.

- Scent Sational Technologies LLC

- Scentee, Inc.

- Sensorys Technology GmbH

- smellIT AB

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Digital Perfume Trends and Strengthen Market Positioning

Industry leaders should accelerate investments in AI and machine learning frameworks that enhance scent personalization capabilities. By leveraging predictive analytics, brands can anticipate consumer preferences and design dynamic fragrance modules that evolve over time to match individual usage patterns. Embracing open developer ecosystems for scent APIs will cultivate a broader partner network, fostering new applications across wellness, entertainment and virtual reality.

To navigate ongoing tariff uncertainties, companies must diversify supplier portfolios and consider nearshoring critical component production. Strategic collaboration with logistics providers will optimize cross-border shipments and reduce exposure to sudden duty changes. In parallel, establishing transparent cost-pass-through models with retail partners ensures pricing clarity and sustains consumer trust.

Moreover, brands should tailor regional go-to-market strategies to local cultural preferences, leveraging data-driven insights to localize scent stories and digital marketing narratives. Developing modular hardware solutions that adapt to varying regulatory environments and power standards can accelerate international rollout and reduce time-to-market. Finally, cultivating community engagement through digital forums and interactive scent experiences will build brand loyalty and support ongoing innovation.

Comprehensive Research Framework Combining Primary Interviews, Secondary Data Analysis, and Proprietary Digital Scent Testing Protocols

This report’s insights derive from a robust methodology that blends primary and secondary research. Primary data collection included in-depth interviews with executives across fragrance houses, digital scent technology firms, retail distributors and logistics specialists. These qualitative discussions provided granular perspectives on strategic priorities, operational challenges and emerging consumer behaviors.

Secondary research entailed a thorough review of academic publications, industry white papers and patent filings related to digital scent technologies and e-commerce innovations. Market intelligence platforms and regulatory filings informed analysis of tariff developments and supply chain shifts. Proprietary scent testing protocols were conducted in controlled environments to validate hardware accuracy and fragrance stability across digital delivery systems.

Quantitative analyses utilized anonymized transaction data from leading e-commerce retailers and subscription service providers to identify purchase patterns and channel performance metrics. Cross-referencing demographic datasets with digital engagement indicators enabled precise segmentation profiling. Ethical considerations guided data handling practices in accordance with global privacy standards.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Perfume market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Perfume Market, by Product Format

- Digital Perfume Market, by Price Tier

- Digital Perfume Market, by Gender

- Digital Perfume Market, by Age Group

- Digital Perfume Market, by Scent Family

- Digital Perfume Market, by Distribution Channel

- Digital Perfume Market, by Region

- Digital Perfume Market, by Group

- Digital Perfume Market, by Country

- United States Digital Perfume Market

- China Digital Perfume Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings and Future Outlook to Empower Stakeholders in Navigating the Evolving Digital Perfume Landscape

The landscape of digital perfume is characterized by rapid technological innovation, evolving consumer expectations, and geopolitical influences that shape supply chain strategies. From the integration of AI and augmented reality in product development to the adaptive sourcing decisions prompted by tariff changes, market participants must continuously recalibrate their approaches to maintain competitive advantage.

Segmentation analyses reveal that distribution channels, product formats, price tiers, demographic cohorts and scent families each offer distinct doors to consumer engagement. Regional insights emphasize that success depends on tailoring offerings to local regulatory, cultural and digital infrastructure contexts. Meanwhile, the strategic maneuvers of both established conglomerates and agile startups highlight the importance of cross-sector partnerships and innovation agility.

Looking forward, the future of digital fragrance lies in hyper-personalized scent journeys, interoperability between scent devices and broader digital ecosystems, and resilient supply chains that can withstand policy shifts. By synthesizing these findings, stakeholders will be empowered to make informed decisions that harness the full potential of digital perfume.

Secure Your Competitive Edge Today: Connect with Ketan Rohom to Access the Definitive Digital Perfume Market Research Report

Don’t let critical market opportunities pass by while your competitors gain ground. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the definitive Digital Perfume market research report. Armed with thorough insights into technological transformations, tariff implications, segmentation dynamics, regional nuances, and strategic company actions, you’ll be equipped to make data-driven strategic decisions.

Engage directly with Ketan to explore bespoke licensing options, enterprise access solutions, or customized briefings tailored to your organization’s needs. Whether you are looking to refine your product development roadmap, optimize your supply chain strategy, or target high-growth consumer segments, this comprehensive report serves as your essential guide to unlocking value in the digital fragrance market. Contact Ketan today to embark on a more informed path to market leadership.

- How big is the Digital Perfume Market?

- What is the Digital Perfume Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?