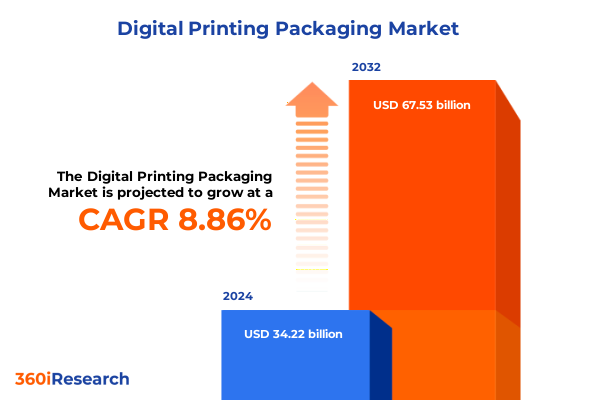

The Digital Printing Packaging Market size was estimated at USD 37.09 billion in 2025 and expected to reach USD 40.20 billion in 2026, at a CAGR of 8.93% to reach USD 67.53 billion by 2032.

Exploring the Dynamic Digital Printing Packaging Industry Fueled by Customization Sustainability and Cutting Edge Technological Innovations

The digital printing packaging industry has emerged as a transformative force, seamlessly blending cutting-edge print technologies with evolving consumer expectations for personalization and sustainability. By integrating digital workflows into packaging design and production, brands are able to deliver highly customized solutions in shorter timeframes while minimizing waste and inventory risk. This paradigmatic shift has accelerated innovation across the value chain, compelling converters, brand owners, and equipment manufacturers to rethink traditional approaches and embrace agile, end-to-end processes.

As pressure mounts to reduce environmental impact and accommodate rapid product cycles, the role of digital printing in packaging has become increasingly pivotal. From flexible pouches to rigid boxes, manufacturers are leveraging digital presses to optimize small volume runs, introduce variable data printing, and test new designs without committing to large minimum orders. This flexibility empowers marketers to engage consumers through targeted packaging campaigns and limited-edition releases, fostering deeper brand loyalty and driving differentiation in crowded markets. Consequently, the fusion of digital printing capabilities with packaging applications is redefining production paradigms and heralding a new era of efficiency and creativity in the packaging ecosystem.

Uncovering the Revolutionary Forces Reshaping Digital Printing Packaging From E Commerce Surge to Hyper Personalization and Sustainable Practice Adoption

Several converging trends are catalyzing a profound transformation in the digital printing packaging landscape. E-commerce expansion continues to fuel demand for streamlined fulfillment, prompting brand owners to adopt on-demand packaging solutions that can be rapidly produced and directly shipped to consumers. In parallel, environmental mandates and consumer advocacy have elevated sustainability to a strategic imperative, driving investment in eco-friendly inks, recyclable substrates, and digital processes that reduce material waste.

Moreover, the integration of advanced automation and artificial intelligence is optimizing every stage of production. Real-time monitoring, predictive maintenance, and smart color management systems are enhancing operational uptime and ensuring consistent print quality. As a result, digital printing equipment is no longer confined to proofing or niche applications but is increasingly embraced as a primary production platform. Together, these forces are redefining value propositions, compelling stakeholders to align technological innovation with market demands and sustainability goals to maintain competitive advantage.

Assessing the Comprehensive Effects of 2025 United States Tariffs on Digital Printing Packaging Costs Supply Chains and Industry Competitiveness

The tariff landscape affecting digital printing packaging has evolved significantly in 2025, shaping cost structures and supply chain strategies across the industry. Early in the year, new measures introduced under the International Emergency Economic Powers Act imposed a 30 percent tariff on Chinese imports in addition to existing Section 301 duties, resulting in a cumulative rate of 55 percent on packaging materials sourced from China. Concurrently, a 25 percent tariff on goods from Mexico and Canada was enacted, although a temporary pause granted brief relief for North American-origin packaging components. These policy adjustments, announced following high-level discussions and interim agreements, aimed to recalibrate trade imbalances but introduced heightened complexity for stakeholders navigating cross-border procurement.

The tangible impacts of these tariffs have reverberated along the end-to-end packaging supply chain. Elevated import costs have compelled brand owners to reassess their sourcing mix, often shifting volumes to domestic converters or alternative international suppliers to mitigate exposure. However, domestic capacity constraints and extended lead times have introduced new operational risks, particularly for small and medium-sized businesses less able to absorb cost inflation. Moreover, sustainability initiatives have faced renewed strain as higher material costs have deferred planned investments in next-generation recyclable substrates and closed-loop recycling programs. This complex dynamic underscores the urgent need for flexible procurement strategies, transparent supplier relationships, and advanced analytics to anticipate tariff fluctuations and preserve margins in a volatile trade environment.

Deciphering Critical Segmentation Patterns Across Technology Packaging Inks Materials and End Use Sectors for Digital Printing Packaging Market

A nuanced understanding of market segmentation reveals critical differentiators influencing adoption and investment decisions in digital printing packaging. Technological segmentation highlights electrophotography and laser printing as established workhorses, while inkjet printing is increasingly favored for its superior versatility and substrate compatibility. Within inkjet, electrostatic, piezoelectric, and thermal variants each address specific application requirements, from high-resolution graphics to variable data and specialty inks.

Packaging format segmentation spans flexible, rigid, and semi-rigid formats, with flexible solutions such as bags, films, pouches, and wraps gaining traction for their lightweight, space-efficient attributes. Simultaneously, rigid options encompassing boxes, cans, containers, and trays serve premium and protective packaging needs, and semi-rigid blister and skin packs offer visibility and product security. Ink formulations further refine capabilities, with solvent-based, UV-curable, and water-based inks each balancing performance metrics such as adhesion, cure speed, and environmental footprint. Material type segmentation includes film and foils, paper substrates-both coated and uncoated-and plastic alternatives, enabling converters to align material selection with brand positioning and regulatory compliance. Finally, end-use segmentation captures the diverse requirements of sectors from food and beverages to cosmetics, electronics, healthcare, household goods, and retail, underscoring the need for tailored digital printing packaging solutions that meet unique functional and aesthetic criteria.

This comprehensive research report categorizes the Digital Printing Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Packaging Type

- Printing Inks

- Material Type

- End-use

Comparative Regional Dynamics and Growth Drivers in Americas Europe Middle East Africa and Asia Pacific Digital Printing Packaging Environments

Regional dynamics in the digital printing packaging market reflect divergent priorities and growth trajectories. In the Americas, the maturation of e-commerce and the need for direct-to-consumer packaging solutions have accelerated digital printing deployment, with brand owners prioritizing short-run personalization and rapid time to market. North American converters are enhancing digital press installations to cater to an expanding portfolio of SKUs and private-label initiatives, while Latin American markets exhibit rising interest in low-investment entry points and turnkey digital printing services.

Across Europe, the Middle East, and Africa, stringent environmental regulations and rising consumer demands for sustainable packaging are shaping market development. European Union directives on single-use plastics and recycling targets have incentivized investment in digital printing technologies that reduce waste and support fiber-based solutions. In the Middle East, infrastructure modernization and diversified economies are driving adoption, whereas African markets remain focused on overcoming logistical challenges and establishing proof-of-concept installations. Meanwhile, Asia-Pacific stands out as a volume-driven powerhouse, where cost competitiveness and industrial scale have fueled widespread integration of digital printing in packaging. Regional hubs such as Japan, China, and Australia are at the forefront of innovation, fostering ecosystem partnerships that advance digital substrate development, ink formulation, and supply chain digitization.

This comprehensive research report examines key regions that drive the evolution of the Digital Printing Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Innovators Driving Technological Advancements and Strategic Collaborations in the Digital Printing Packaging Landscape

Leading companies within the digital printing packaging arena are distinguished by their relentless pursuit of innovation and strategic partnerships. Key equipment suppliers have expanded their portfolios with modular, scalable press architectures that support hybrid workflows combining digital and conventional printing. Ink and substrate manufacturers have responded by co-developing specialized digital inks and recyclable materials to meet performance and sustainability targets. Collaborative ventures between technology providers and brand owners have created pilot programs for targeted personalization campaigns, enabling real-time adaptations based on consumer behavior and seasonal trends.

Furthermore, industry leaders are investing heavily in after-sales service ecosystems, offering remote diagnostics, predictive maintenance, and training programs to optimize press uptime and print quality. Strategic mergers and acquisitions have consolidated capabilities across printing, finishing, and software platforms, fostering integrated solutions that streamline workflows from design to fulfillment. As a result, the competitive landscape is characterized by a blend of established multinational corporations and agile niche specialists, each vying to deliver differentiated value through technological excellence, service quality, and sustainability leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Printing Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Ball Corporation

- Canon Inc.

- CCL Industries Inc.

- Constantia Flexibles Holding GmbH

- Creative Labels Inc.

- Dai Nippon Printing Co., Ltd.

- DuPont de Nemours, Inc.

- Eastman Kodak Company

- Elanders Sverige AB

- HP Inc.

- International Paper Company

- Krones AG

- Landa Corporation Ltd

- Multi-Color Corporation

- Nosco, Inc.

- Packman Packaging Private Limited

- Printpack Holdings, Inc.

- Quad/Graphics Inc

- Smurfit Westrock plc

- Sonoco Products Company

- Stora Enso Oyj

- Sttark Group, Inc

- Sun Litho Company

- THIMM Group GmbH + Co. KG

- Traco Manufacturing, LLC

- Weber Packaging Solutions Inc.

- Xerox Corporation

Implementing Actionable Strategic Recommendations to Enhance Competitiveness Efficiency and Sustainability in the Digital Printing Packaging Sector

Industry leaders must adopt a multifaceted approach to enhance competitiveness and resilience in the evolving digital printing packaging domain. First, integrating hybrid production models that blend digital and conventional printing allows migration of short to medium runs to digital platforms, optimizing cost structures and reducing time-to-market. Secondly, deepening collaboration with upstream suppliers and logistics partners enables more agile material sourcing, dynamic inventory management, and rapid response to tariff-driven fluctuations.

Simultaneously, prioritizing investments in sustainable substrates and digital inks with reduced environmental impact not only aligns with regulatory imperatives but also resonates with increasingly eco-conscious consumers. Embracing advanced analytics and artificial intelligence can further unlock productivity gains, enabling real-time process optimization, predictive maintenance, and quality assurance. Finally, fostering a culture of continuous innovation and workforce upskilling will ensure that organizations can leverage emerging technologies, such as digital embellishments and smart packaging integrations, to differentiate their offerings and capture new growth opportunities.

Outlining Rigorous Research Methodology Integrating Primary Engagement Secondary Data Analysis and Triangulation Techniques for Market Intelligence

This research employed a robust methodology to deliver accurate and actionable insights into the digital printing packaging market. Initially, primary data collection involved in-depth consultations with industry stakeholders, including packaging converters, brand marketers, technology vendors, and regulatory experts. These interviews provided firsthand perspectives on adoption drivers, operational challenges, and strategic priorities. Complementing these insights, secondary research encompassed a comprehensive review of trade publications, technical white papers, and regulatory filings to validate trends and contextualize technological advancements.

Data triangulation was conducted by cross-referencing proprietary databases, tariff schedules, and company disclosures, ensuring consistency and reliability throughout the analysis. Segment mapping was structured around technology type, packaging format, ink chemistry, material substrate, and end-use verticals, enabling a granular examination of growth patterns and competitive positioning. Finally, all findings underwent rigorous quality assurance checks and peer reviews by subject matter experts to confirm the integrity of conclusions and recommendations. This systematic approach guarantees that the resulting intelligence is both credible and highly relevant for stakeholders navigating the digital printing packaging landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Printing Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Printing Packaging Market, by Technology Type

- Digital Printing Packaging Market, by Packaging Type

- Digital Printing Packaging Market, by Printing Inks

- Digital Printing Packaging Market, by Material Type

- Digital Printing Packaging Market, by End-use

- Digital Printing Packaging Market, by Region

- Digital Printing Packaging Market, by Group

- Digital Printing Packaging Market, by Country

- United States Digital Printing Packaging Market

- China Digital Printing Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing Pivotal Insights and Future Outlook for Strategic Growth in the Rapidly Evolving Digital Printing Packaging Industry Landscape

In summary, digital printing packaging is at an inflection point, driven by transformative shifts in consumer behavior, regulatory mandates, and technological innovation. The strategic adoption of digital workflows, coupled with a deep understanding of nuanced segmentation and regional dynamics, will be imperative for stakeholders seeking to maintain an edge. Furthermore, the evolving tariff landscape underscores the importance of agile sourcing and cost management strategies. As industry leaders navigate these complex forces, embracing sustainability, collaborative innovation, and data-driven decision making will define the benchmarks for success and shape the future trajectory of the market.

Connect with Associate Director of Sales Marketing to Secure Your Comprehensive Digital Printing Packaging Market Research Report Today

Engaging with Ketan Rohom, Associate Director of Sales & Marketing, is the essential next step to secure in-depth insights and strategic guidance that will empower your organization to navigate the complexities of the digital printing packaging sector. By acquiring this market research report, you gain exclusive access to comprehensive analyses of market dynamics, segmentation nuances, regional landscapes, and competitive benchmarks that are critical for informed decision making. Our collaborative approach ensures that your unique business needs are addressed, enabling tailored strategies that drive growth and resilience. Reach out to coordinate a personalized briefing, explore customizable research add-ons, and obtain the detailed intelligence necessary to stay ahead in a rapidly evolving industry. Unlock the full potential of digital printing packaging innovations and establish a competitive edge by partnering with Ketan Rohom today

- How big is the Digital Printing Packaging Market?

- What is the Digital Printing Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?