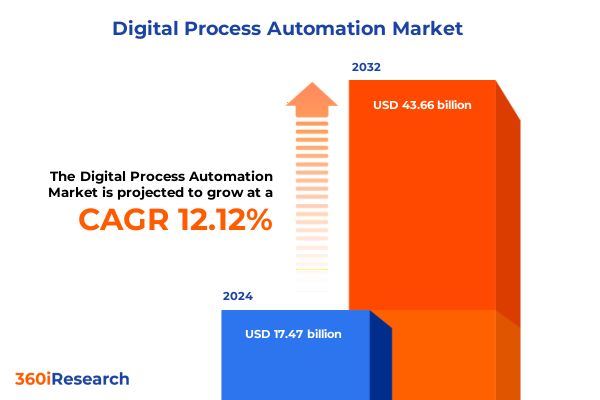

The Digital Process Automation Market size was estimated at USD 19.56 billion in 2025 and expected to reach USD 21.89 billion in 2026, at a CAGR of 12.15% to reach USD 43.66 billion by 2032.

Laying the Groundwork for Digital Process Automation Initiatives by Exploring Core Drivers and Tactical Considerations for Enterprise Leaders

Digital process automation has swiftly emerged as a pivotal enabler for enterprises aiming to transform their operational models and to boost both efficiency and resilience. As organizations confront mounting competitive pressures, the imperative to streamline workflows, reduce manual handoffs, and harness real-time data insights has never been more critical. Within this context, automation technologies are evolving beyond simple task orchestration to embrace intelligent capabilities that incorporate machine learning, natural language processing, and advanced analytics. These breakthroughs are empowering firms to effectively eliminate repetitive tasks, accelerate decision cycles, and elevate customer experiences, thereby fostering a new era of connected business operations.

Amid this dynamic environment, decision-makers are reassessing legacy workflows and exploring end-to-end solutions that seamlessly integrate process automation with enterprise applications, citizen developers, and composable architectures. By adopting a holistic perspective on digital transformation, enterprises can better align automation initiatives with broader strategic goals such as operational excellence, risk mitigation, and data-driven innovation. In turn, this alignment ensures that process automation efforts are not siloed one-off projects but rather foundational elements of an organization’s digital backbone, thus unlocking sustained value and adaptability in an ever-changing market.

Charting the Next Wave of Digital Process Automation Transformations as Artificial Intelligence and Data-Driven Workflows Redefine Operational Efficiency

Enterprises today are navigating a landscape shaped by rapid technological advances and shifting expectations around workforce empowerment and customer centricity. One of the most transformative shifts has been the integration of artificial intelligence and robotic process automation into unified hyperautomation frameworks. These frameworks are enabling digital workers to handle increasingly complex tasks, from intelligent document processing to predictive analytics, thereby extending automation capabilities well beyond rule-based workflows. The convergence of AI and low-code platforms is further democratizing development, allowing citizen developers to construct and deploy automation solutions with minimal reliance on traditional IT resources.

Furthermore, the global transition to remote and hybrid work models has catalyzed a reimagining of process orchestration and collaboration tools. Organizations are investing in cloud-native automation platforms that deliver agility, scalability, and secure access for distributed teams. In parallel, the rise of API-led connectivity and event-driven architectures is facilitating real-time data exchange between disparate systems, thereby breaking down silos and enabling continuous process optimization. These combined forces are redefining operational efficiency and ushering in a new era where agility and resilience are inseparable within enterprise processes.

Evaluating the Cascading Effects of 2025 United States Tariff Policies on Digital Process Automation Ecosystems and Supply Chain Cost Structures

In 2025, the cumulative impact of U.S. tariffs has introduced both challenges and strategic imperatives for organizations pursuing digital process automation. Increased duties on imported hardware components such as specialized servers, networking equipment, and edge devices have raised the overall cost of deploying on-premise solutions. This shift has prompted many enterprises to accelerate their migration toward cloud-based platforms, whose inherent elasticity and subscription-based pricing models can help mitigate upfront capital expenditures and tariff-related cost inflations.

Moreover, tariffs on software licenses tied to cross-border data flows have underscored the importance of selecting vendors with robust domestic presence or local data residency options. As a result, global solution providers are reinforcing their regional data centers and service capabilities to alleviate compliance concerns and to avoid additional cross-border fees. Simultaneously, professional services and managed services engagements have become critical in guiding organizations through tariff-induced complexities. These services ensure that automation roadmaps are resilient to policy fluctuations, that total cost of ownership remains predictable, and that strategic partnerships are optimized to preserve both operational continuity and regulatory alignment.

Unveiling Multi-Dimensional Segmentation Paradigms That Reveal Organizational Size Software Components Deployment Models and Industry Vertical Variations

The digital process automation market is characterized by a spectrum of organizational profiles, each with its distinct priorities and resource allocations. Large enterprises typically pursue platform-wide deployments, leveraging integrated suites that encompass robotic process automation tools, workflow engines, and analytics modules. Their scale and complexity often drive demand for extensive professional services-ranging from strategic consulting and system design to customized integration-and necessitate managed services arrangements to support continuous improvement and governance. In contrast, small and medium enterprises tend to adopt more targeted automation solutions, favoring standalone robotic process automation tools that deliver rapid return on investment and require minimal on-premise infrastructure.

Component-level segmentation further delineates market behavior into services and software. Organizations investing in services lean on managed services to reduce operational overhead and to access specialized expertise, while professional services engagements remain crucial for custom development, change management, and training. On the software side, there is a clear delineation between platform offerings that provide end-to-end automation capabilities and more modular robotic process automation tools that excel at task-level productivity. Additionally, comprehensive suites are gaining traction among firms seeking a one-stop solution for process orchestration, analytics dashboards, and low-code development environments.

Deployment mode continues to influence strategic decision-making, with cloud-based models-whether public, private, or hybrid-outpacing traditional on-premise installations. Public cloud environments enable rapid scalability and seamless upgrades, whereas private cloud options appeal to organizations with stringent data sovereignty requirements. Hybrid cloud architectures are likewise emerging as a preferred compromise, blending on-premise control over critical systems with the flexibility of off-site resources. As enterprises navigate these choices, factors such as latency, security, and integration complexity dictate the balance between centralized and distributed automation workloads.

Process type segmentation reveals differentiated maturity across use cases. Content management tasks, encompassing document classification and intelligent data extraction, are maturing quickly as AI-driven engines become more accurate and adaptable. Workflow automation for structured processes like claims processing and customer onboarding continues to be mainstream, with case management showing particular strength in highly regulated industries. Meanwhile, robotic process automation serves as the bedrock for task automation, handling high-volume, repetitive activities across finance, human resources, and supply chain functions. Together, these process domains underscore the necessity for versatile automation platforms that can address both structured and unstructured workflows.

Industry vertical segmentation underscores the diverse adoption pathways across market sectors. Financial services and insurance organizations are early adopters, driven by the imperative to improve customer experiences while reducing compliance risk. Healthcare and government agencies, grappling with legacy modernization and data privacy mandates, are investing heavily in workflow orchestration and case management solutions. IT and telecom providers are integrating automation to boost network operations and service fulfillment, whereas manufacturing firms focus on supply chain digitization and quality inspection use cases. Retail and consumer goods enterprises, meanwhile, are leveraging automation to optimize order processing and personalized marketing campaigns, highlighting the adaptability of process automation across business contexts.

This comprehensive research report categorizes the Digital Process Automation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Process Type

- Industry Vertical

- Organization Size

- Deployment Mode

Mapping the Regional Pulse in Digital Process Automation With Distinct Trends Shaping the Americas EMEA and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the adoption trajectory of digital process automation solutions. In the Americas, enterprises are leading the charge toward hyperautomation, fueled by significant investment in AI-driven analytics and cloud-native architectures. The United States, in particular, remains a hotbed for innovation, with both established automation providers and emerging startups collaborating on joint ventures and acquisitions to expand their solution portfolios. Canada’s strong emphasis on data governance and privacy is also catalyzing market growth, as organizations deploy sophisticated workflow tools that comply with stringent regulatory standards.

Across Europe, the Middle East, and Africa, regulatory frameworks such as the General Data Protection Regulation and regional cybersecurity directives are influencing deployment strategies and vendor partnerships. Organizations in Western Europe are integrating automation to optimize regulatory reporting and risk management processes, while firms in the Middle East are establishing digital transformation roadmaps that include extensive process orchestration initiatives. Meanwhile, Africa’s markets are demonstrating early signs of automation-driven modernization in sectors such as telecommunications and financial services, leveraging cloud-based delivery to circumvent infrastructure constraints.

In the Asia-Pacific region, government-led digital initiatives and collaborative innovation ecosystems are propelling adoption at a rapid pace. Nations such as China, India, and Australia are prioritizing digital infrastructure investments, enabling domestic enterprises to implement large-scale automation initiatives. Additionally, Asia-Pacific organizations are demonstrating a growing preference for hybrid cloud deployments that combine locally hosted data centers with global platform capabilities. This dual focus on sovereign data control and advanced functionality is positioning the region as a fertile ground for next-generation process automation use cases, including intelligent supply chain orchestration and real-time customer engagement.

This comprehensive research report examines key regions that drive the evolution of the Digital Process Automation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Influential Technology Providers and Emerging Innovators Propelling the Digital Process Automation Market Forward Through Strategic Differentiation

The competitive landscape of the digital process automation sphere is marked by a mix of established technology giants and agile upstarts, each leveraging distinct competitive advantages to capture market mindshare. Leading software providers have doubled down on acquisitions to expand their AI and analytics portfolios, while pure-play robotic process automation vendors continue to enhance their platforms with low-code capabilities and citizen developer tools. Strategic partnerships between IT service firms and automation vendors are also proliferating, enabling end-to-end offerings that span from consulting and implementation to managed operations and continuous improvement.

Key players are differentiating themselves through specialized industry solutions, verticalized accelerators, and prebuilt connectors to leading enterprise applications. Some vendors have introduced embedded AI modules that can automatically recommend process optimizations, while others have focused on enhancing user experience by integrating conversational interfaces and mobile-friendly dashboards. Moreover, the emphasis on open architectures and APIs is driving an ecosystem-centric approach, wherein technology providers collaborate with systems integrators, independent software vendors, and consulting partners to co-create tailored automation roadmaps that align with client-specific objectives.

Emerging innovators are staking a claim by delivering niche capabilities such as intelligent document understanding, real-time business process monitoring, and embedded compliance controls. These niche technologies are rapidly being adopted as bolt-on solutions for larger automation suites, underscoring the importance of interoperability and modularity in vendor evaluations. As the race to establish a leadership position intensifies, the ability to deliver seamless end-to-end automation experiences-from discovery and design to monitoring and optimization-will likely determine which companies emerge as the most trusted advisors and solution providers in the digital process automation market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Process Automation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Appian Corporation

- Automation Anywhere, Inc.

- Bizagi Group Limited

- Blue Prism Limited

- IBM Corporation

- Kofax Inc.

- Microsoft Corporation

- Newgen Software Technologies Limited

- NICE Systems Ltd.

- OpenText Corporation

- Oracle Corporation

- Pegasystems Inc.

- SAP SE

- UiPath Inc.

- WorkFusion, Inc.

Empowering Decision-Makers With Actionable Strategies and Best Practices to Accelerate Digital Process Automation Adoption and Maximize Organizational Value

To fully capitalize on the opportunities presented by digital process automation, industry leaders must adopt a strategic approach that balances visionary aspirations with pragmatic execution. First, establishing a Center of Excellence can serve as a governance hub, ensuring that automation initiatives adhere to best practices, align with enterprise architecture standards, and deliver measurable outcomes. By instituting clear ownership and performance metrics, organizations can foster a culture of accountability and continuous improvement.

Next, prioritizing high-impact use cases with well-defined success criteria is essential. Leaders should focus on automating processes that directly influence customer satisfaction, revenue generation, or regulatory compliance. This targeted approach enables rapid demonstration of value and builds organizational momentum, paving the way for broader, cross-functional automation deployments. Concurrently, maintaining strong executive sponsorship and cross-departmental collaboration will mitigate resistance to change and facilitate seamless integration with existing operational workflows.

Investing in talent and capability-building is equally critical. By upskilling both technical teams and business stakeholders in low-code development, process mining, and analytic storytelling, organizations can unlock the full potential of automation platforms. Complementing in-house expertise with strategic partnerships-whether through managed services providers or technology alliances-can also accelerate time-to-value and mitigate common implementation pitfalls.

Finally, leaders must implement robust frameworks for monitoring, governance, and risk management. Real-time dashboards that track key performance indicators, combined with periodic audit and compliance reviews, will help ensure that automation initiatives remain aligned with strategic objectives and that any deviations are promptly addressed. Through an iterative, data-driven approach to governance, enterprises can sustain momentum and continuously refine their automation roadmaps.

Detailing Rigorous Research Methodology and Analytical Frameworks Employed to Ensure Credibility Reliability and Relevance of Market Insights

The research underpinning this analysis was conducted through a rigorous methodology that combined both primary and secondary approaches. Primary research involved structured interviews with senior executives, process owners, IT leaders, and solution architects, providing deep insights into real-world challenges, deployment strategies, and success metrics. These qualitative insights were supplemented by quantitative surveys administered to a cross-section of organizations, capturing data on technology preferences, adoption barriers, and anticipated investment priorities.

Secondary research entailed a comprehensive review of public filings, industry press releases, white papers, and analyst presentations. This extensive literature analysis ensured that our findings reflect the latest innovations, regulatory changes, and competitive dynamics. Data points were cross-validated against vendor disclosures, third-party case studies, and publicly available benchmarks to ensure consistency and reliability.

To maintain analytical rigor, all data and insights were subjected to a triangulation process, whereby multiple sources and perspectives were compared to identify convergent trends and to mitigate potential biases. Furthermore, an expert advisory panel comprising academic researchers, industry consultants, and technical practitioners reviewed the preliminary findings, providing validation of the research framework and contributing domain-specific expertise. Finally, scenario analysis techniques were employed to stress-test key assumptions and to explore the impact of variables such as tariff fluctuations, emergent regulatory requirements, and technology disruptions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Process Automation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Process Automation Market, by Component

- Digital Process Automation Market, by Process Type

- Digital Process Automation Market, by Industry Vertical

- Digital Process Automation Market, by Organization Size

- Digital Process Automation Market, by Deployment Mode

- Digital Process Automation Market, by Region

- Digital Process Automation Market, by Group

- Digital Process Automation Market, by Country

- United States Digital Process Automation Market

- China Digital Process Automation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Strategic Imperatives to Illuminate the Path Forward for Enterprises Embracing Digital Process Automation

The convergence of advanced automation technologies, shifting regulatory landscapes, and evolving workforce paradigms presents a defining moment for organizations seeking to optimize their business processes. As digital process automation continues to integrate artificial intelligence, low-code development, and cloud-native architectures, enterprises have an unprecedented opportunity to reengineer workflows, enhance decision-making capabilities, and deliver superior customer experiences. However, realizing this potential requires a deliberate strategy, encompassing robust governance structures, targeted use case selection, and a commitment to building internal capabilities.

Looking ahead, organizations that adopt a holistic and adaptive approach-one that combines strategic foresight with operational discipline-will differentiate themselves in terms of agility, resilience, and market responsiveness. By leveraging comprehensive automation suites, aligning stakeholder incentives, and continuously measuring performance against strategic objectives, enterprises can ensure that process automation becomes a catalyst for sustainable growth and innovation. Ultimately, the organizations that succeed in this endeavor will be those that view automation not merely as a cost reduction lever, but as a core competency that drives competitive advantage in an increasingly digital economy.

Unlock Comprehensive Digital Process Automation Insights by Connecting With Ketan Rohom to Secure Customized Market Intelligence Solutions

To explore detailed strategic insights and tailored recommendations that can drive your organization’s digital transformation journey forward, we invite you to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at our firm. Engaging with Ketan will provide you with an opportunity to obtain a fully customized market research report that aligns precisely with your unique business priorities and operational context. This comprehensive report will equip you with the competitive intelligence needed to make confident, data-backed decisions and to accelerate your automation initiatives.

Connect with Ketan today to secure your copy of the full digital process automation market research report, gain access to exclusive supplementary analyses, and arrange a personalized consultation on how these insights can be pragmatically applied within your organization. Taking this next step will ensure that you remain ahead of industry trends and capitalize on the transformative potential of digital process automation.

- How big is the Digital Process Automation Market?

- What is the Digital Process Automation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?