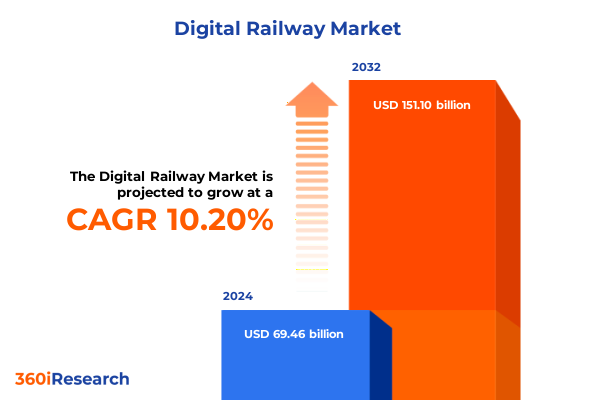

The Digital Railway Market size was estimated at USD 76.18 billion in 2025 and expected to reach USD 83.66 billion in 2026, at a CAGR of 10.27% to reach USD 151.10 billion by 2032.

Introduction to a New Era in Railway Operations Where Connectivity Intelligence and Automation Drive Growth and Efficiency

The railway industry is undergoing a fundamental transformation as it embraces digital technologies at an unprecedented pace. Connectivity solutions, advanced automation, and data analytics are converging to create a new operational paradigm in which efficiency, safety, and passenger satisfaction are elevated to unprecedented levels. As global rail networks expand and passenger volumes increase, stakeholders are seeking integrated systems capable of delivering real-time insights and predictive capabilities. With these shifts, infrastructure owners, operators, and technology providers are collaborating more closely to align digital strategies with broader sustainable mobility goals.

Amid this evolution, digital railway solutions are redefining the way assets are monitored, managed, and maintained. Traditional signaling and control systems are being complemented by Internet of Things sensors and cloud platforms that enable granular visibility into rail operations. Consequently, operators are enhancing reliability and responsiveness while reducing lifecycle costs. Simultaneously, passengers benefit from seamless communication of journey updates and personalized travel services. This introduction sets the stage for a comprehensive examination of the transformative trends, regulatory influences, segmentation insights, regional developments, key industry players, and strategic guidance that define the contemporary digital railway landscape.

Exploring the Pivotal Technological Advancements Reshaping Railway Infrastructure and Passenger Experience with Smart Solutions

The digital railway landscape is being reshaped by a series of interconnected technological advancements that are redefining both infrastructure management and the end-user experience. Foremost among these shifts is the proliferation of Internet of Things devices, which enable continuous monitoring of track conditions, rolling stock performance, and environmental variables. By integrating sensor-derived data with advanced analytics, operators can proactively identify maintenance needs and prevent service disruptions, thereby maximizing system availability.

Furthermore, the adoption of digital twins has emerged as a transformative trend, providing virtual replicas of physical assets to simulate operational scenarios and plan upgrades with precision. This capability not only accelerates decision making but also supports risk mitigation by testing interventions in a controlled environment. Complementing this is the rise of artificial intelligence and machine learning algorithms, which enhance predictive maintenance, optimize energy consumption, and streamline scheduling processes. As these tools mature, they offer the potential to reshape fleet management and capacity planning with unprecedented accuracy.

In addition, the rollout of 5G connectivity and private LTE networks is paving the way for high-speed, low-latency communication across rail corridors. This infrastructure supports real-time video surveillance, automated train control, and passenger Wi-Fi services without compromising safety or reliability. Meanwhile, cloud computing platforms are enabling scalable data storage and collaborative applications that can be accessed securely from control centers to mobile devices. Collectively, these innovations are converging to create a more resilient, adaptive, and passenger-centric railway ecosystem.

Analyzing the Far Reaching Consequences of Recent United States Tariffs on Supply Chains and Digital Railway Investments in 2025

In 2025, the imposition of tariffs by the United States has had a pronounced effect on the sourcing and cost structure of digital railway components and subsystems. Tariffs levied on electronic modules, communication equipment, and specialized trackside hardware have compelled suppliers to reevaluate their manufacturing footprints. As a result, many international providers are diversifying their supply chains by relocating production to tariff-free regions or negotiating tariff exemptions through collaborative agreements.

Moreover, the cost pressures induced by these duties have influenced procurement strategies across rail operators and infrastructure developers. Project budgets have been rebalanced to accommodate higher import expenses, leading to an increased focus on modular system architectures that allow for phased deployments and selective technology upgrades. Consequently, decision makers are prioritizing components that deliver the highest operational return on investment, thereby ensuring that critical digital enhancements remain on schedule.

In parallel, tariff-driven supply chain adjustments have accelerated the trend toward localized manufacturing partnerships. Regional assembly facilities and joint ventures are being established to mitigate the risks associated with cross-border duties, reduce lead times, and improve responsiveness to service demands. While these adaptations introduce upfront capital requirements, they ultimately foster a more resilient and geographically diversified production network. Accordingly, stakeholders are engaging in scenario planning to anticipate future tariff changes and align long-term digital railway initiatives with a volatile trade environment.

Unveiling Critical Insights from Technology Functional Areas Application and End User Segmentation Shaping Future Digital Railway Strategies

A nuanced understanding of technology, functional, application, and end user segments unlocks strategic clarity for digital railway investments. Based on technology type, the landscape encompasses hardware, services, and software. Hardware includes an array of communication devices, railway control systems comprising automatic train protection, signaling systems and train control, as well as sensors and trackside equipment. Service offerings extend from consulting services to integration and implementation engagements, followed by support and maintenance contracts. Software solutions cover passenger information systems, remote monitoring platforms, and train management systems that provide operational visibility and decision support.

Functional area analysis further refines this view by dissecting asset management, operations management, and traffic management domains. Asset management solutions focus on asset tracking and predictive maintenance techniques to prolong equipment lifecycles. Operations management spans fleet management tools designed to optimize rolling stock utilization and infrastructure scheduling modules that enhance network throughput. Traffic management incorporates capacity planning and timetabling solutions to balance demand, minimize delays, and maximize track efficiency.

Exploring application segmentation reveals key use cases in freight transportation, infrastructure management, operational management, and passenger transportation. Within the freight domain, specialized systems support automotive cargo, bulk commodity shipments, and intermodal transfers. Infrastructure management applications concentrate on predictive maintenance of track assets and comprehensive track monitoring installations. Operational management functions emphasize scheduling and planning engines alongside train performance monitoring dashboards. Passenger transportation solutions cater to commuter rail, high-speed rail and intercity connections, delivering real-time traveler information and operational insights.

Finally, end user segmentation clarifies demand patterns across freight and logistics companies, government transportation agencies, rail infrastructure developers, railway operators and urban transit authorities. Each stakeholder group exerts distinct requirements and procurement cycles, guiding vendors to tailor solutions that address specific operational challenges and regulatory frameworks.

This comprehensive research report categorizes the Digital Railway market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Functional Area

- Application

- End User

Examining Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific Influencing Digital Railway Adoption and Innovation

Regional dynamics play an instrumental role in shaping digital railway trajectories. In the Americas, investment in advanced signaling and passenger information systems has accelerated modernization efforts. North American networks are integrating Positive Train Control enhancements alongside cloud-based collaboration platforms, while Latin American operators are exploring turnkey digital gateways to support fleet expansions and new corridor developments.

Meanwhile, Europe, the Middle East and Africa exhibit varied but complementary adoption patterns. European Union members continue to expand the European Rail Traffic Management System across national networks, prioritizing interoperability and cross-border consistency. Gulf states are channeling infrastructure funding into state-of-the-art control centers and smart station initiatives, leveraging digital solutions to underpin expanding urban transit systems. In Africa, pilot projects emphasize low-cost, scalable sensor implementations to improve safety and track integrity in resource-constrained environments.

Asia-Pacific markets demonstrate robust digital railway growth driven by large-scale high-speed networks and urban mass transit programs. China has deployed extensive IoT frameworks for fleet health monitoring and energy management, while India’s rail modernization plans include private-public partnerships focused on predictive maintenance and signaling upgrades. Southeast Asian countries are evaluating turnkey solutions that incorporate AI-driven analytics and mobile-first passenger interfaces, positioning the region as a hotbed for innovation and market entry opportunities.

This comprehensive research report examines key regions that drive the evolution of the Digital Railway market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Industry Leading Players Driving Digital Railway Evolution through Strategic Partnerships Investments and Innovative Solutions

A diverse ecosystem of established and emerging technology providers is propelling the digital railway market forward through targeted investments and strategic alliances. One notable player has broadened its digital portfolio by integrating its cloud-native analytics suite with advanced signaling offerings, enabling operators to harness end-to-end data orchestration across both on-board and trackside systems. Another leading manufacturer has merged its train control expertise with an AI-enabled predictive maintenance platform, delivering automated fault detection and optimizing service schedules for maximum asset uptime.

Meanwhile, a prominent rail automation specialist has forged partnerships with telecommunications providers to deploy private LTE networks that guarantee high-availability connectivity for mission-critical applications. This collaboration underscores the importance of cross-industry integration in meeting stringent safety and performance requirements. Similarly, a global software innovator has introduced modular platforms that unify passenger information, crew management and operational dashboards into a single interface, enhancing user experience and operational transparency.

Additionally, regional equipment suppliers in Asia are capitalizing on domestic demand by developing cost-effective track monitoring sensors that can be retrofitted to legacy infrastructure. In parallel, a major North American conglomerate is investing in robotics and autonomous inspection vehicles to reduce manual intervention during maintenance cycles. Further highlighting the dynamic competitive landscape, specialized consultancies are expanding their advisory services to guide digital transformation roadmaps, focusing on cybersecurity frameworks and interoperability standards to mitigate risks and ensure seamless integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Railway market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Group

- Alstom Holdings SA

- AtkinsRéalis

- CAF, Construcciones y Auxiliar de Ferrocarriles, S.A

- Cisco Systems, Inc.

- CRRC Corporation Limited

- Fujitsu Limited

- Harsco Corporation

- HIMA Group

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Indra Sistemas, S.A.

- Knorr-Bremse AG

- Microsoft Corporation

- Mitsubishi Electric Corporation

- Nippon Signal Co., Ltd.

- Rhomberg Sersa Rail Holding GmbHLogo

- Siemens AG

- Stadler Rail AG

- Toshiba Corporation

- Trimble Inc.

- Wabtec Corporation

- ZEDAS GmbH

Formulating Strategic Recommendations for Stakeholders to Leverage Digital Railway Trends Enhance Competitive Edge and Drive Sustainable Growth

Industry leaders must adopt a proactive approach to capitalize on digital railway opportunities and mitigate emerging risks. First, organizations should prioritize end-to-end connectivity by investing in robust IoT sensor networks and redundant communication channels. This foundational infrastructure will enable deeper analytics and real-time decision making, unlocking operational efficiencies from maintenance to traffic management. Next, firms are advised to embrace modular, cloud-native platforms that support incremental feature rollouts, facilitating agile responses to changing regulatory or environmental conditions.

Moreover, stakeholders should cultivate strategic partnerships across technology and service provider ecosystems. Collaborative alliances with telecommunications carriers, system integrators, and cybersecurity specialists will strengthen solution portfolios and accelerate time to market. Simultaneously, companies must invest in workforce training programs to develop digital competencies, ensuring that operational teams can leverage new tools effectively and foster a culture of continuous improvement.

Furthermore, industry participants are encouraged to harmonize interoperability standards and promote open architectures. This approach reduces vendor lock-in, simplifies integration of best-of-breed solutions, and enhances system resilience. Lastly, decision makers should integrate scenario planning for potential tariff adjustments and geopolitical shifts, maintaining supply chain flexibility through dual sourcing strategies and localized manufacturing agreements. By following these recommendations, organizations will be well positioned to lead in the evolving digital railway landscape.

Detailing a Robust Multistage Research Methodology Integrating Primary Secondary and Expert Validation for Comprehensive Railway Insights

The research underpinning these insights relied on a rigorous, multistage methodology designed to ensure both depth and reliability. Primary data were collected through structured interviews with key executives at rail operators, infrastructure developers, and technology vendors, providing firsthand perspectives on strategic priorities and operational challenges. Interviews were supplemented by surveys targeting project managers and field engineers to capture granular details on deployment experiences, system performance and maintenance practices.

Secondary research involved systematic analysis of industry white papers, regulatory filings, technical journals and public press releases. This phase enabled cross-verification of primary findings and the identification of emerging technology benchmarks. To further validate conclusions, an expert panel composed of academic researchers, standards body representatives, and digital transformation consultants conducted iterative reviews, challenging assumptions and refining key themes.

Finally, quantitative and qualitative findings were triangulated to ensure consistency and to develop a cohesive narrative around market dynamics. Data accuracy was maintained through continuous cross-referencing, while thematic clustering techniques helped distill complex information into actionable insights. This comprehensive approach guarantees that the resultant strategic guidance reflects the current state of digital railway advancement and anticipates future developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Railway market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Railway Market, by Technology Type

- Digital Railway Market, by Functional Area

- Digital Railway Market, by Application

- Digital Railway Market, by End User

- Digital Railway Market, by Region

- Digital Railway Market, by Group

- Digital Railway Market, by Country

- United States Digital Railway Market

- China Digital Railway Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings and Forward Looking Perspectives to Inform Decision Making in the Rapidly Evolving Digital Railway Ecosystem

Throughout this analysis, the convergence of connectivity, automation and advanced analytics emerges as the driving force behind modern railway transformation. By examining key technological shifts, regulatory impacts and segmentation dimensions, a clear picture has formed of how digital solutions deliver operational resilience, safety enhancements and enriched passenger services. Regional variations in adoption highlight both the universal appeal of these innovations and the necessity of context-specific strategies.

Leading companies are responding with purpose-built offerings that blend hardware, software and services into integrated packages, while tariff dynamics underscore the importance of supply chain agility. Actionable recommendations emphasize the need for scalable infrastructure, collaborative ecosystems and forward-looking scenario planning. Together, these elements create a roadmap for stakeholders seeking to navigate the complexities of digital railway implementation and to harness the full potential of technological advancements.

As the industry continues to evolve, maintaining a balance between standardization and flexibility will be essential. By applying the strategic insights presented here, decision makers can drive sustainable growth, reinforce system reliability and deliver superior experiences for both freight operators and passengers alike.

Drive Insights Into Digital Railway Advancements by Engaging with Ketan Rohom to Secure the Complete Market Research Report Today

I encourage you to deepen your understanding of the dynamic digital railway sector by securing the full market research report through direct engagement with Ketan Rohom, Associate Director, Sales & Marketing. He will guide you through the comprehensive insights, enabling your organization to harness technological breakthroughs and strategic trends to drive operational excellence, cost efficiency, and enhanced passenger experiences. Reach out today to customize the report for your specific needs and capitalize on the actionable intelligence that will position you ahead of the competition.

- How big is the Digital Railway Market?

- What is the Digital Railway Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?