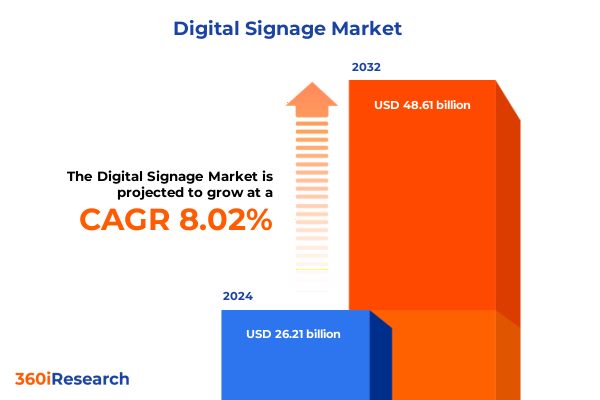

The Digital Signage Market size was estimated at USD 28.27 billion in 2025 and expected to reach USD 30.51 billion in 2026, at a CAGR of 8.04% to reach USD 48.61 billion by 2032.

Digital signage in 2025 emerges as mission-critical infrastructure, blending content, data, and hardware to transform physical spaces into intelligent communication platforms

Digital signage has evolved from a collection of isolated screens into a critical layer of the connected customer and citizen experience. Across retail and hospitality environments, transportation hubs, campuses, financial institutions, healthcare facilities, and stadiums, digital displays now shape how information is discovered, how journeys are navigated, and how brands express themselves in real time. As organizations accelerate their investments in omnichannel engagement, these networks are increasingly viewed as strategic infrastructure rather than discretionary marketing spend.

At the same time, the underlying ecosystem has become more complex and interdependent. Hardware, software, and services intersect in tightly integrated solutions that must be reliable at scale, secure by design, and flexible enough to support rapidly changing content strategies. Displays, media players, projectors, kiosks and terminals are being paired with advanced content management systems, edge server software, and analytics platforms to deliver highly contextual and often interactive experiences across entire estates.

This complexity is expanding against a backdrop of geopolitical and macroeconomic uncertainty. Trade policies, including layered U.S. tariffs on Chinese-origin electronics and materials, are reshaping global supply chains and cost structures, with direct implications for digital signage hardware sourcing and pricing. At the same time, advances in AI, cloud computing, connectivity, and energy-efficient display technologies are enabling new use cases, business models, and performance expectations. The result is a market at an inflection point, where strategic choices made today around technology architecture, partnerships, and geography will define competitive positioning for years to come.

Within this environment, the central question for executives is no longer whether to invest in digital signage, but how to do so in a way that is resilient, data-driven, and closely aligned with organizational outcomes. This executive summary provides a structured view of the key shifts, risks, and opportunities shaping that decision set in 2025.

AI, cloud-native platforms, immersive displays, and programmatic media are reshaping digital signage from static screens into responsive, monetizable experience ecosystems

The most profound transformation in digital signage is the shift from static or pre-programmed messaging to intelligent, data-driven experiences. Artificial intelligence has moved from pilot projects into everyday practice, powering content that automatically adapts to time-of-day patterns, inventory levels, weather conditions, and audience characteristics while remaining compliant with privacy requirements. In mature markets, AI-enabled signage is increasingly integrated with broader marketing and retail media platforms, allowing campaigns to be optimized across both online and in-venue touchpoints in near real time.

Alongside AI, cloud-native content management has become the backbone of modern deployments. Organizations are consolidating disparate on-premise tools into centralized cloud platforms that orchestrate displays, media players, and edge server software across multiple regions and formats. These platforms provide unified scheduling, version control, and role-based access, while exposing APIs that connect signage to CRM, point-of-sale, facility management, and ad-tech systems. Remote monitoring and automation reduce operational overhead, and when combined with edge processing, they enable latency-sensitive, bandwidth-efficient experiences even in distributed or bandwidth-constrained environments.

Interactivity is also undergoing a qualitative shift. Touchscreen kiosks and wayfinding directories are giving way to a broader spectrum of engagement modes that include gesture control, voice activation, mobile handoff via QR codes, and sensor-based triggers. These capabilities are especially influential in transportation, healthcare, and public sector settings, where touchless navigation, multilingual support, and accessible interfaces are increasingly expected. In parallel, entertainment and live content, including real-time data visualizations and AR-enhanced storytelling, are raising the bar for experiential environments such as stadiums, flagship retail, and visitor attractions.

Advances in display technology are another source of structural change. While LCD screens remain pervasive, LED and OLED technologies are rapidly expanding their footprint in both indoor and outdoor applications, offering higher brightness, contrast, and form-factor flexibility. Projection technologies, particularly laser-based solutions, are enabling large-format and immersive experiences with lower maintenance requirements than legacy lamp-based projectors. At the same time, energy-efficient options such as color e-paper are emerging for semi-static, daylight-readable applications where power budgets are tight and sustainability targets are strict.

Finally, the business model for networks is evolving. Programmatic digital out-of-home buying is integrating signage into the broader digital advertising ecosystem, allowing inventory owners to monetize screens dynamically based on audience, context, and performance. Retailers, in particular, are building in-store and near-store digital signage into retail media networks, treating physical screens as addressable media assets. This fusion of infrastructure investment and recurring media revenue is reshaping how returns on digital signage are measured and how partnerships between brands, landlords, and technology providers are structured.

Layered United States tariffs through 2025 reshape digital signage hardware economics, forcing supply-chain reconfiguration and more resilient sourcing and pricing strategies

The cumulative impact of United States tariffs through 2025 is fundamentally altering the economics and risk profile of digital signage hardware, especially for solutions that depend heavily on Chinese-origin displays, components, and subassemblies. What began as targeted Section 301 measures has evolved into a multi-layered tariff regime that can include base most-favored-nation duties, additional Section 301 surcharges ranging from 7.5% to 25%, a 20% duty under national security measures tied to fentanyl-related concerns, and a reciprocal duty on Chinese-origin imports that is set at 10% and may rise further depending on ongoing negotiations.

For digital signage manufacturers and integrators importing LCD and LED panels, controller boards, power supplies, and enclosures from China, these layers combine to create significantly elevated landed costs relative to pre-2018 baselines. While certain product categories have benefited from temporary exclusions extended into 2025, these relief measures are time-bound and subject to late-stage renewals, creating planning uncertainty for procurement teams. Recent extensions of product-specific exclusions through mid and late 2025 have prevented abrupt cost spikes but have not removed the underlying exposure, so businesses remain cautious about overreliance on any single tariff classification or origin country.

At the same time, U.S. trade policy has targeted upstream technologies critical to signage infrastructure. Tariffs on semiconductors are scheduled to rise from 25% to 50% by 2025, with additional measures affecting wafers and polysilicon, which are foundational to display manufacturing and many electronics. These actions are explicitly aimed at encouraging domestic and allied production under broader industrial policy initiatives, but they also increase the cost and complexity of sourcing media players, controllers, and embedded computing platforms when supply chains still flow heavily through China and other Asian hubs.

More recently, a 2025 trade arrangement between the United States and China introduced a temporary reduction in the overall tariff burden on many manufactured goods, bringing combined rates for some categories down from extremely elevated levels to more moderate but still historically high bands. However, this relief is time-limited and coexists with the pre-existing Section 301 and national security-related duties, reinforcing a theme of volatility rather than a clear reversion to pre-dispute norms. Electronics-focused trade groups emphasize that, even under this arrangement, manufacturers must treat tariffs as a durable element of their cost structure rather than a transient shock.

For the digital signage sector, the practical implications are multifaceted. First, the bill of materials for hardware-including displays, media players, projectors, and kiosks and terminals-faces persistent upward pressure when Chinese-origin components are involved, encouraging the redesign of products around alternative sources in Mexico, other parts of Asia, or domestic assembly. Second, integrators are placing a premium on flexible architectures that allow substitution of displays, players, or connectivity modules without major re-engineering, ensuring they can respond quickly to classification changes or new duties. Third, buyers are increasingly evaluating total cost of ownership not only in terms of energy use and maintenance, but also tariff exposure and the resilience of supplier networks.

Finally, these trade dynamics are accelerating strategic shifts rather than halting investment. Some manufacturers are localizing final assembly or key subcomponents to qualify for more favorable treatment, while others are deepening relationships with non-Chinese panel and semiconductor suppliers. Organizations that build tariff scenarios into their sourcing, pricing, and contracting decisions are better positioned to maintain competitive offerings and margin stability, even as the policy environment continues to evolve through and beyond 2025.

Granular segmentation across components, technologies, content, and use cases reveals where digital signage value is created and how adoption patterns are diverging

The structure of the digital signage landscape is best understood by examining how demand and innovation distribute across key segments. From a component perspective, investment continues to coalesce around a triad of hardware, software, and services. Hardware remains the most visible anchor, encompassing displays, media players, projectors, and kiosks and terminals that must operate reliably in diverse physical environments. These devices are increasingly designed with integrated processing, advanced thermal management, and serviceability in mind, reflecting the need for long lifecycles and minimal downtime in mission-critical deployments.

Services overlay this foundation and are growing in strategic importance. Consulting capabilities help enterprises define content strategies, customer journeys, and integration roadmaps that align digital signage with broader digital transformation initiatives. Design and deployment services translate those strategies into physical reality, orchestrating site surveys, mounting, power and data integration, and commissioning at scale. Maintenance and support services close the loop by delivering proactive monitoring, field repair, and lifecycle management, often under multi-year managed-service agreements that turn complex estates into predictable operational commitments.

On the software side, the content management system functions as the operational command center, coordinating playlists, access rights, localization, and approval workflows across networks that may span thousands of screens. Edge server software is gaining prominence where low latency, bandwidth optimization, or local resilience are essential, such as in transportation or high-traffic retail. Analytics and reporting software, tightly integrated with the CMS, provides insights into playback, engagement proxies, and network health, enabling data-driven optimization of both content and infrastructure.

Display technology segmentation reveals distinct patterns by use case. LCD technology still underpins many indoor applications, especially where cost efficiency and standardized form factors are priorities. LED technology is increasingly selected for large-format indoor walls, high-brightness outdoor billboards, and fine-pitch corporate and control-room environments. OLED technology appeals to premium retail and corporate settings that value deep contrast and unconventional shapes. Projection technology, particularly laser projection, serves immersive environments, auditoria, and large venues where flexible canvases or curved surfaces are desired, while lamp-based projection persists in budget-sensitive or legacy refresh scenarios. E-paper technology is emerging as a compelling option for low-power informational and wayfinding signage, especially where content updates are infrequent and ambient light is strong.

Content type segmentation underscores the expanding role of signage beyond traditional advertising content. Informational content remains vital for transportation, healthcare, education, and banking environments, where clarity and real-time updates are crucial. Wayfinding and directory content has become more interactive and context-aware, guiding users through complex campuses and facilities. Interactive and transactional content, including self-service ordering, ticketing, check-in, and feedback, has become central to customer experience strategies in retail and hospitality. Entertainment and live content, such as event feeds, social media visualizations, and live data dashboards, increasingly differentiates premium venues and hospitality environments.

Resolution and screen size choices are closely intertwined. Full HD remains widely deployed, but 4K is rapidly becoming the default for new mid- to large-format installations where visual fidelity and future-proofing matter. 8K is gradually appearing in flagship and specialty applications, particularly in large LED walls and experiential environments. Standard resolutions continue to be relevant for small-format displays and legacy refreshes. Screen sizes below 32 inches are common in shelf-edge, point-of-sale, and room-sign applications, while the 32 to 52 inches range dominates menu boards, indoor posters, and typical information screens. Screens larger than 52 inches, including tiled video walls, are favored for impactful storytelling, command-and-control, and large public spaces.

Connectivity segmentation illustrates how operational models are changing. Wired connectivity, typically via Ethernet and sometimes supplemented by serial control, remains the backbone for installations where reliability and security are paramount, such as banking, healthcare, and critical infrastructure. Wireless connectivity is expanding rapidly, with Wi-Fi supporting flexible placements and retrofits, cellular links enabling remote or outdoor locations without fixed lines, and Bluetooth providing short-range interactions with personal devices. As content grows more dynamic, robust connectivity becomes central not only to content delivery but also to telemetry and remote management.

Applications are diversifying as well. Banking, financial services and insurance organizations use signage for queue management, product education, and brand reinforcement in branches and ATM vestibules. Education deployments span campus-wide messaging, lecture capture support, and wayfinding. Healthcare systems rely on signage for patient flow, clinical communication, and wellbeing content. Retail and hospitality remain among the most visible adopters, using networks for promotions, menu boards, digital merchandising, and ambience. Stadiums and playgrounds deploy large-format and experiential systems to drive fan engagement and sponsorship value, while transportation authorities use digital signage for real-time service information, safety messaging, and advertising.

Finally, installation location and deployment model choices complete the segmentation picture. Indoor installations dominate numerically, but outdoor deployments are growing in strategic importance, requiring high-brightness, weatherproofed hardware and robust remote management. On-premise deployment models remain relevant where data sovereignty, bespoke integrations, or highly controlled environments are required. However, cloud deployment is gaining ground across all regions and verticals, reflecting the need for centralized control, rapid scaling, and integration with broader digital platforms. Organizations that understand and actively manage these segmentation dynamics are better positioned to tailor solutions, pricing, and go-to-market strategies to the specific needs of each customer profile.

This comprehensive research report categorizes the Digital Signage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Display Technology

- Content Type

- Resolution

- Screen Size

- Connectivity

- Application

- Installation Location

- Deployment Model

Regional dynamics across the Americas, EMEA, and Asia-Pacific shape digital signage adoption, technology choices, and go-to-market strategies in distinct yet converging ways

Regional context plays a decisive role in how digital signage strategies take shape, beginning with the Americas. In North America, particularly the United States and Canada, digital signage is tightly integrated into mature retail, quick-service restaurant, and transportation ecosystems, with a strong emphasis on data-driven and AI-enabled experiences. Retail media networks are expanding rapidly, turning in-store displays into monetizable advertising inventory, while cloud-based content management and advanced media players enable centralized control across large, geographically dispersed estates. At the same time, U.S. trade policy and tariffs influence hardware sourcing decisions, nudging many organizations toward diversified supply bases and, in some cases, nearshoring of assembly. In Latin American markets, demand is growing in shopping centers, public transportation, and banking, but deployments tend to be more price-sensitive and often roll out in phased programs as connectivity and infrastructure improve.

Across Europe, the Middle East, and Africa, regulatory, climatic, and cultural differences create a varied but increasingly sophisticated landscape. In Western and Northern Europe, strong data protection regulations and energy-efficiency standards shape both software architectures and display choices, favoring solutions that incorporate robust access controls, privacy-by-design analytics, and low-power hardware options. The integration of digital signage into multimodal transportation systems, smart city initiatives, and corporate campuses is particularly advanced, and large industry events in the region help catalyze innovation, especially around AI-assisted content creation and premium LED installations. In the Middle East, high-visibility flagship projects in retail, hospitality, and entertainment are driving demand for large-format LED, projection mapping, and immersive experiences that operate in harsh outdoor conditions. African markets, while more fragmented, are seeing targeted deployments in transportation, telecom-branded retail, and education, often led by multinational operators and local systems integrators that prioritize reliability and serviceability.

In Asia-Pacific, digital signage growth is intertwined with the region’s role as a manufacturing hub and its rapid urbanization. Countries such as China, South Korea, Japan, and Taiwan are important sources of displays, components, and finished systems, and they also host some of the most advanced deployments in transportation, retail, and corporate environments. In these markets, fine-pitch LED, 8K-ready infrastructure, and sophisticated control-room solutions are becoming more common, reflecting high expectations for visual quality and system performance. Southeast Asian economies and India, meanwhile, are expanding their use of digital signage in airports, metro systems, malls, and smart city corridors, often leapfrogging legacy static formats in favor of cloud-managed, mobile-integrated experiences. The region’s diversity of regulatory regimes, connectivity infrastructure, and price points requires vendors to adopt highly localized go-to-market approaches, with tailored hardware configurations, language support, and service models.

Across all three regional groupings, a few common threads are evident. Cloud-based deployment models are gaining ground, even where on-premise solutions historically dominated, because they enable cross-border governance and rapid rollout of new locations. Sustainability considerations are growing in importance, particularly in regions with high energy costs or aggressive climate goals, driving interest in efficient LED, laser projection, and e-paper solutions. Finally, the interplay between local regulations, trade policy, and domestic industrial strategies is influencing where components are sourced, where assembly takes place, and which vendors are best positioned to support long-term regional roadmaps. Organizations that recognize these regional nuances and align their offerings accordingly will be better placed to capture emerging opportunities while managing risk.

This comprehensive research report examines key regions that drive the evolution of the Digital Signage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Ecosystem players from display OEMs to AI-driven CMS providers compete and collaborate as the digital signage value chain shifts toward platform-centric ecosystems

The competitive environment for digital signage is characterized by a diverse set of participants spanning global display manufacturers, specialized media player vendors, software-centric platform providers, and systems integrators that assemble end-to-end solutions. Large display and electronics companies continue to invest in dedicated professional signage portfolios, emphasizing high-brightness LCD and LED products, system-on-chip architectures, and tight integration with partner content management platforms. Their scale and manufacturing capabilities enable rapid innovation in areas such as narrow-bezel video walls, outdoor-ready high-nit displays, and fine-pitch LED modules engineered for close-viewing environments.

On the media player front, both established and emerging vendors are introducing devices tailored to contemporary deployment needs, including fanless designs for quiet, dust-prone environments, multi-zone playback for complex layouts, and robust remote management capabilities for large fleets. Recent introductions of new player families emphasize out-of-the-box integration with enterprise-grade CMS platforms, 4K and beyond support, and features such as out-of-band management for recovery and diagnostics, reflecting the need to maintain uptime across widely distributed networks and to prepare for upcoming operating system transitions.

Software providers increasingly differentiate themselves through scalability, openness, and analytics rather than basic scheduling features. The market has seen notable consolidation, as illustrated by acquisitions that bring together complementary CMS platforms into larger, channel-focused organizations with global reach. These combined entities are investing heavily in API-first, headless architectures, AI-assisted content analytics, and tools that support monetization, including programmatic advertising integrations and share-of-voice reporting for media buyers. Such moves aim to provide a unified platform for corporate communication, retail media, and digital out-of-home operators, making it easier for partners to standardize on a single software stack.

At the application edge, innovative companies are embedding digital signage into new form factors and business models. For example, AI-powered recycling kiosks that combine reverse vending functions with large-format advertising screens demonstrate how signage can anchor entirely new revenue-sharing arrangements between brands, retailers, and technology providers, while advancing sustainability objectives. Similarly, specialized e-paper-based displays show how ultra-low-power, network-connected signage can extend digital communication into locations where traditional backlit displays would be impractical or cost-prohibitive, such as battery-powered posters or low-maintenance public notices.

Systems integrators and managed service providers tie these elements together, providing design, deployment, and lifecycle support that spans hardware, software, and connectivity. Many are building repeatable solution frameworks for key verticals such as retail and hospitality, transportation, healthcare, and corporate communication, often incorporating templates, data connectors, and pre-validated hardware bundles. At the same time, competitive pressure is driving all players to invest in security, remote diagnostics, and analytics, as customers expect networks to be both highly observable and aligned with broader IT and cybersecurity standards. Vendors that can demonstrate openness, interoperability, and a clear roadmap for AI and automation are increasingly favored in enterprise procurements.

Overall, the company landscape is moving toward platform-centric ecosystems in which hardware, software, and services are tightly coupled yet modular enough to accommodate regional preferences and evolving standards. Strategic partnerships, co-innovation programs with key customers, and selective mergers and acquisitions are likely to continue reshaping the field, particularly in the software and services layers where differentiation is increasingly based on data and workflow sophistication rather than core playback capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Signage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American LED Wall Company

- AUO Corporation

- Barco NV

- BrightSign LLC

- Cisco Systems Inc.

- Daktronics, Inc.

- Electronic Displays Inc.

- First Impression Audiovisual B.V.

- GALAXY SIGNAGE

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hitachi Ltd.

- İnnova Bilişim Çözümleri Anonim Şirketi

- Leyard Optoelectronic Co. Ltd.

- LG Electronics Inc.

- LianTronics Co., Ltd.

- Microsoft Corporation

- Navori SA

- NEC Corporation

- Neoti LLC

- NoviSign Ltd.

- Panasonic Corporation

- ProDVX

- Samsung Electronics Co. Ltd.

- Shanghai Xianshi Electronic Technology Co., Ltd

- Sharp Corporation

- Sony Corporation

- STRATACACHE

- Toshiba Corporation

- Visix, Inc.

- Winmate Inc.

- Ynvisible Interactive Inc.

Strategic leaders must link tariff-aware sourcing, AI-enabled content, and segment-specific solutions to unlock durable value from digital signage investments

To capitalize on the structural changes reshaping digital signage, industry leaders should first embed geopolitical and trade considerations directly into technology and sourcing strategies. Rather than treating tariffs and related duties as external shocks, organizations can model multiple scenarios for duty levels, origin rules, and exclusion timelines, and then design hardware portfolios that can pivot between suppliers and manufacturing locations without disrupting certifications or customer commitments. This includes specifying displays, media players, and enclosures with interchangeable components, negotiating flexible terms with contract manufacturers across regions, and aligning product refresh cycles with expected policy milestones.

At the same time, leadership teams should elevate AI, analytics, and automation from experimental projects to core capabilities. This means investing in content management systems and analytics platforms that support machine learning-driven scheduling, context-aware content selection, and closed-loop measurement of engagement and operational performance. Organizations that pair these tools with robust governance-covering data privacy, algorithmic transparency, and content standards-can create differentiated experiences while maintaining compliance and trust.

Segment-aware solution design is another high-leverage area. By aligning offerings with the distinct needs embedded in component, technology, content, resolution, screen size, connectivity, application, installation location, and deployment model segments, vendors and operators can avoid generic proposals and instead deliver configurations optimized for specific environments. For example, healthcare and banking environments may prioritize wired connectivity, high-availability media players, and on-premise or hybrid deployment, while outdoor transportation or stadium applications may require high-brightness LED or projection, resilient enclosures, and cellular backup links. Recognizing such nuances enables more precise value propositions and pricing structures.

A deliberate shift toward cloud-native architectures, complemented by secure edge processing where necessary, should also be a priority. Centralized control, standardized APIs, and automated provisioning reduce operational complexity and support rapid scaling across geographies. Integrating digital signage platforms with adjacent systems-such as point-of-sale, building management, marketing automation, and security information and event management-can unlock additional value by allowing content and behavior to respond in real time to business and environmental signals.

Sustainability presents both a responsibility and a competitive differentiator. Leaders can set clear energy and materials targets for their fleets, favoring LED, laser projection, and e-paper solutions where appropriate, and designing content strategies that minimize unnecessary brightness and motion. They can also incorporate lifecycle thinking into procurement and service models, extending the usable life of displays through modular upgrades, repairable designs, and responsible end-of-life programs.

Finally, companies should treat content strategy and organizational capability building as integral to success. Even the most advanced hardware and software will underperform if the organization lacks the skills, processes, and cross-functional coordination required to generate, localize, and optimize content. Investing in training, establishing clear roles between marketing, IT, facilities, and external partners, and creating feedback loops based on analytics and field observations will ensure that digital signage deployments remain aligned with evolving customer behavior and strategic objectives. Executives who approach digital signage as a long-term, cross-functional program rather than a sequence of disconnected projects will be best positioned to capture its full strategic value.

Robust multi-source research, rigorous segmentation, and scenario analysis underpin the strategic insights offered in this digital signage executive overview

The insights summarized in this executive overview are grounded in a structured research methodology designed to capture both the breadth and depth of the digital signage ecosystem. The analysis begins with extensive secondary research, drawing on company filings, product announcements, regulatory and standards documents, government trade and customs data, patent landscapes, industry association publications, and specialized technology and media sources. This foundation provides a comprehensive view of technology roadmaps, deployment patterns, regulatory trends, and the evolving structure of supply chains.

Building on this foundation, primary research captures perspectives from across the value chain. Interviews and consultations with hardware manufacturers, software platform providers, systems integrators, content and creative agencies, network operators, and end users in sectors such as retail and hospitality, transportation, banking and financial services, education, healthcare, and sports and entertainment provide real-world context. These discussions illuminate practical challenges related to deployment, operations, security, and return on objectives, as well as emerging best practices and innovation priorities in different regions.

The segmentation framework used throughout the study-encompassing components, display technologies, content types, resolutions, screen sizes, connectivity models, applications, installation locations, and deployment models-serves as the backbone for organizing both quantitative and qualitative findings. Each segment is analyzed in terms of adoption drivers, technological evolution, regulatory and standards influences, and the competitive landscape. Scenario analysis techniques are then applied to explore how changes in tariffs, component availability, macroeconomic conditions, and technology breakthroughs could alter these dynamics over the medium term.

Quality assurance is embedded at multiple stages. Data from different sources are cross-validated to resolve discrepancies, and key assumptions are tested through expert review and iterative refinement. Particular attention is paid to aligning technology-related insights with verifiable product and deployment evidence, and to ensuring that interpretations of trade policy and regulatory developments reflect official communications and credible commentary. The result is a research foundation designed to support informed strategic decision-making across a wide range of stakeholders in the digital signage ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Signage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Signage Market, by Component

- Digital Signage Market, by Display Technology

- Digital Signage Market, by Content Type

- Digital Signage Market, by Resolution

- Digital Signage Market, by Screen Size

- Digital Signage Market, by Connectivity

- Digital Signage Market, by Application

- Digital Signage Market, by Installation Location

- Digital Signage Market, by Deployment Model

- Digital Signage Market, by Region

- Digital Signage Market, by Group

- Digital Signage Market, by Country

- United States Digital Signage Market

- China Digital Signage Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2385 ]

Digital signage now operates as a strategic nexus of experience, technology, and policy, demanding holistic strategies anchored in segmentation and regional nuance

Digital signage stands at a pivotal moment where technology maturity, shifting trade dynamics, and evolving customer expectations intersect. Intelligent displays, advanced content management, and pervasive connectivity are transforming physical spaces into responsive communication platforms that blend advertising, information, wayfinding, interactivity, and entertainment. At the same time, external forces-from layered United States tariffs on key electronic components to regional regulatory frameworks around privacy and energy use-are reshaping cost structures, supply chains, and deployment models.

Within this environment, the segmentation of the market by components, display technologies, content types, resolutions, screen sizes, connectivity options, applications, installation locations, and deployment models is not merely a taxonomic exercise. It reveals where innovation is occurring fastest, where operational complexity is greatest, and where new forms of value are being created. Hardware advances in LED, OLED, laser projection, and e-paper, software evolution toward AI-enabled, cloud-native platforms, and the rising importance of services all contribute to a richer but more demanding solution landscape.

Regionally, distinct pathways are emerging across the Americas, Europe, the Middle East and Africa, and Asia-Pacific, reflecting differences in infrastructure, regulation, industrial policy, and consumer behavior. Yet common patterns-such as the shift to cloud management, the pursuit of sustainability, and the integration of digital signage into broader omnichannel and retail media strategies-underscore that the fundamental trajectory is convergent.

For executives, the central implication is clear: digital signage is no longer a peripheral or experimental channel. It is a strategic asset that, when approached holistically and with an appreciation for geopolitical, technological, and regional nuances, can enhance customer experience, streamline operations, and open new revenue streams. Organizations that treat it as such, investing in resilient architectures, strong partnerships, and data-driven content strategies, will be well positioned to navigate uncertainty and harness the full potential of this rapidly evolving medium.

Secure decisive advantage in digital signage by engaging directly with Ketan Rohom to align this research with your strategic and investment priorities

In a market defined by rapid technology shifts, evolving trade policy, and intensifying competition, the difference between leading and lagging often comes down to the quality of insight available to decision-makers. This executive summary has highlighted the strategic importance of digital signage across components, technologies, applications, and regions, but it only scratches the surface of the evidence, case studies, and scenario work underpinning the full study.

To translate these insights into concrete competitive advantage, organizations need structured guidance on where to prioritize capital, which segments to target, how to navigate tariffs and regulatory complexity, and which technology and service partners can best support long-term goals. The complete market research report provides that depth, combining detailed segmentation analysis, regional breakouts, vendor assessments, and actionable strategy frameworks tailored to stakeholders across the value chain.

Leaders who are ready to move from awareness to execution are encouraged to connect with Ketan Rohom, Associate Director, Sales & Marketing. He can guide you through the scope of the report, align key deliverables with your organization’s strategic priorities, and support the purchase process in a way that ensures stakeholders across strategy, procurement, and technology teams extract maximum value from the findings.

Engaging directly with Ketan also opens the door to a more consultative conversation about how the research can inform your specific questions, whether they relate to hardware sourcing under the current tariff regime, cloud and software investment roadmaps, or regional go-to-market decisions. Taking this next step will equip your organization with the evidence base needed to act decisively and secure a sustainable competitive position in the evolving digital signage landscape.

- How big is the Digital Signage Market?

- What is the Digital Signage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?