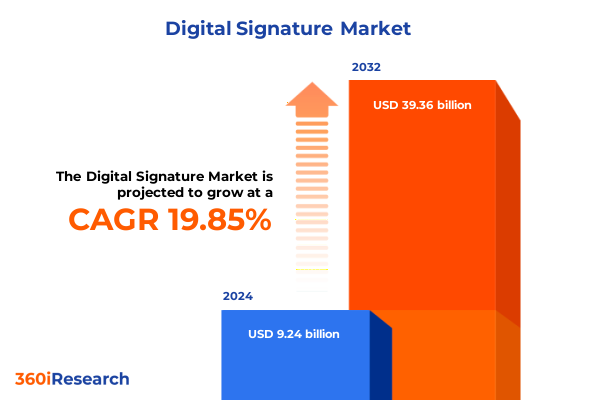

The Digital Signature Market size was estimated at USD 11.00 billion in 2025 and expected to reach USD 13.09 billion in 2026, at a CAGR of 19.97% to reach USD 39.36 billion by 2032.

Illuminating the Strategic Imperatives of Digital Signatures through a Foundational Overview of Adoption Drivers and Regulatory Framework Landscapes

Digital signatures have become integral to the modern enterprise, offering a secure, efficient, and legally enforceable method for validating documents and facilitating transactions. As organizations accelerate their digital transformation journeys, the need for robust signature solutions that comply with evolving regulations and industry standards has skyrocketed. Adoption has been driven by the proliferation of remote work models, the rigorous demands of compliance frameworks such as eIDAS and the ESIGN Act, and the imperative to streamline manual processes that historically slowed down contract execution and record-keeping.

In this context, businesses are increasingly prioritizing solutions that combine cryptographic security, seamless user experiences, and interoperability with existing enterprise ecosystems. Advanced electronic signature platforms are expected to deliver not only strong authentication and tamper-evident auditing but also integration with cloud services, identity management systems, and workflow automation tools. The convergence of these capabilities has birthed a new class of digital trust solutions that underpin mission-critical processes across finance, legal, healthcare, procurement, and more.

This executive summary distills the core findings of our in-depth research, offering a strategic lens on market adoption drivers, regulatory shifts, segmentation breakthroughs, regional dynamics, and competitive landscapes. Through detailed analysis of transformative trends and actionable recommendations, this overview equips decision-makers with the insights required to navigate complexity, capitalize on emerging opportunities, and fortify their digital signature strategies for sustainable growth.

Exploring Catalytic Industry Shifts Fueling the Evolution of Digital Signature Solutions in a Landscape Defined by Security, Cloud, and Collaboration

The digital signature space has experienced profound shifts as enterprises harness the power of cloud-native architectures, zero-trust security paradigms, and intelligent automation. The migration of core infrastructure to cloud platforms has removed traditional on-premise barriers, enabling rapid deployment and seamless scalability. In turn, solution providers have embraced microservices design, containerization, and API-driven frameworks, allowing for deeper integration with identity providers, enterprise content management systems, and blockchain-based ledgers.

Concurrently, heightened cyber threats and stringent privacy regulations have underscored the need for stronger cryptographic methods and multi-factor authentication mechanisms. Organizations are moving beyond basic electronic signatures toward qualified and advanced signature types, embedding hardware-backed key storage and biometric verification to meet compliance mandates and instill stakeholder confidence. The rise of decentralized identity and distributed ledger technologies has further catalyzed innovation, enabling verifiable credentials and trust networks that transcend organizational boundaries.

Finally, evolving collaboration models-fueled by hybrid work and globalized supply chains-have accelerated the demand for intuitive, mobile-first signature experiences. AI-driven document analysis, natural language processing, and automated risk assessments are increasingly woven into platforms to reduce human error and accelerate approval cycles. Together, these industry shifts are redefining customer expectations, enabling enterprises to deploy signature workflows that are not only secure and compliant but also frictionless and context-aware.

Unraveling the Cumulative Consequences of United States Tariff Measures on the Digital Signature Ecosystem throughout 2025 Supply Chains

In 2025, the imposition of additional tariffs by the United States has introduced fresh complexities into the digital signature ecosystem, particularly affecting hardware token manufacturers and the import of secure cryptographic modules. As a result, hardware-based key storage solutions have encountered cost pressures, triggering supply chain realignments and prompting some organizations to rethink their reliance on imported devices for advanced and qualified electronic signature deployments.

These tariff-induced dynamics have also reverberated through regional distribution networks, with import delays and elevated duties driving a pivot toward local suppliers and increased investments in domestic manufacturing capacity. Some enterprises have accelerated plans for cloud-based key management services to mitigate hardware bottlenecks, leaning on software-first approaches that decouple cryptographic key generation from physical devices. While this transition alleviates immediate tariff concerns, it introduces fresh considerations around data sovereignty, compliance with cross-border encryption regulations, and the selection of trusted third-party key custodians.

Amid these shifts, solution providers and end-users alike are prioritizing strategic partnerships to build resilient supply chains and diversify component sourcing. Industry consortia are forming to lobby for tariff exemptions on security-critical hardware, while organizations with global footprints are optimizing their procurement strategies to balance cost efficiencies with compliance imperatives. Ultimately, the cumulative impact of U.S. tariffs in 2025 has underscored the importance of agility and foresight in managing the hardware and service components essential to a robust digital signature infrastructure.

Deciphering Segmentation Insights Revealing Adoption Patterns by Signature Type, Component Tiers, Key Cryptography, Organization Scale, and Industry Verticals

A critical dimension of understanding digital signature adoption lies in dissecting the market through multiple segmentation lenses. First, the solution landscape spans advanced electronic signatures characterized by cryptographically secure, certificate-based signing; qualified electronic signatures with legal equivalence to handwritten signatures under specific regulations; and simple electronic signatures that provide basic validation without advanced proof mechanisms. Each type aligns with distinct risk profiles, regulatory requirements, and user experience considerations, driving varied adoption patterns across industries.

Second, the component framework comprises hardware, services, and software layers. Hardware offerings include secure elements, smart cards, and USB tokens used to store cryptographic keys. On the services front, consulting engagements help define signature policies, integration and deployment services ensure seamless incorporation into enterprise workflows, and support and maintenance offerings guarantee ongoing system reliability. Software itself bifurcates into cloud-based platforms that provide rapid scalability and remote accessibility, and on-premise solutions that deliver tighter control over data residency and infrastructure management.

Third, key cryptography hinges on public and private key pairs that underpin signature authenticity and non-repudiation, with selection influenced by factors such as regulatory mandates, user convenience, and trust model architectures. Fourth, organizational scale delineates large enterprises with global compliance obligations from small and medium enterprises focused on cost optimization and ease of use. Finally, end-user verticals range from highly regulated sectors like aerospace and defense, banking, financial services and insurance, healthcare and life sciences, and government, to technology-driven arenas such as telecommunications and IT, as well as traditional industries like manufacturing, building and construction, and retail and eCommerce. This multidimensional segmentation framework reveals how nuanced requirements drive tailored digital signature deployments across the enterprise spectrum.

This comprehensive research report categorizes the Digital Signature market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Components

- Key Type

- Organization Size

- End-User

Uncovering Regional Dynamics Shaping Digital Signature Adoption across the Americas, Europe, Middle East & Africa and the Asia-Pacific Growth Corridors

Regional dynamics play a pivotal role in shaping how digital signature solutions are designed, adopted, and governed. In the Americas, accelerated cloud adoption and robust investment in compliance frameworks have fueled demand for advanced electronic signatures, particularly among financial services and healthcare organizations seeking to streamline secure document exchange across multiple jurisdictions. Supportive regulatory initiatives at federal and state levels continue to reinforce the legal standing of digital signatures, creating a fertile environment for innovation and partnership.

In Europe, the Middle East, and Africa, stringent regulations such as eIDAS and emerging e-signature laws in non-EU countries have established a harmonized foundation for qualified electronic signatures. Regional integration efforts and cross-border interoperability mandates have prompted solution providers to embed sophisticated trust services, enabling enterprises to navigate complex compliance requirements while maintaining seamless user experiences. The Middle East’s rapid digitization initiatives, coupled with Africa’s growing fintech ecosystem, present expanding opportunities for signature platforms capable of addressing diverse infrastructural contexts.

Across the Asia-Pacific region, digital signature adoption is driven by dynamic economies, government-led digital identity programs, and mobile-first population segments. Countries with mature regulatory environments, such as Australia and Japan, demonstrate high uptake of cloud-based offerings, while emerging markets prioritize cost-effective, on-premise deployments that align with evolving data privacy legislations. Together, these regional corridors underscore the strategic importance of local partnerships, regulatory alignment, and solution adaptability in unlocking the full potential of digital signature technologies.

This comprehensive research report examines key regions that drive the evolution of the Digital Signature market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Market-Leading Providers and Innovative Entrants Driving Competitive Momentum in the Digital Signature Ecosystem

A diverse ecosystem of established vendors, emerging challengers, and specialized providers collectively drives the competitive landscape for digital signature solutions. Longstanding incumbents leverage extensive partner networks, deep regulatory expertise, and scalable cloud platforms to command significant mindshare among global enterprises. These market leaders continually invest in expanding functional capabilities-ranging from advanced cryptographic modules to AI-driven risk scoring-to retain their competitive edge.

At the same time, nimble startups and boutique vendors are gaining traction by focusing on niche use cases such as mobile-centric signing experiences, blockchain-based identity verification, and off-the-grid signing for high-security environments. Their agility allows rapid iteration on user interface design, integration with vertical-specific workflows, and experimentation with emerging technologies like decentralized identity architectures.

In parallel, security-focused hardware providers and key management specialists are forging alliances with both large and small signature platforms, embedding tamper-resistant elements and secure enclaves to satisfy rigorous compliance criteria. The entrance of cloud service giants offering integrated signature services as part of broader productivity suites has further intensified competition, prompting vendors to differentiate through customer-centric support models, regional data residency assurances, and tailored professional services offerings. These competitive dynamics underscore the importance of strategic partnerships and continuous innovation in maintaining leadership within the digital signature arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Signature market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Actalis S.p.A.

- Adobe Systems, Inc.

- airSlate Inc.

- AlphaTrust Corporation by iPipeline, Inc.

- Altron Limited

- Ascertia by InfoCert S.p.A.

- Box, Inc.

- Citrix Systems, Inc. by Cloud Software Group, Inc.

- Conclude (Pty) Ltd.

- DigiCert, Inc.

- Docstribute Limited

- DocuSign, Inc.

- Dropbox, Inc.

- EDICOM Global

- eMudhra Limited

- Entrust Corporation

- GMO Internet Group, Inc.

- Google LLC by Alphabet Inc.

- HID Global Corporation

- Impression Signatures

- International Business Machines Corporation

- Kyocera Corporation

- Microsoft Corporation

- Notarius Inc. by Portage CyberTech Inc.

- OneSpan Inc.

- PandaDoc Inc.

- PaperTrail by Egis Software

- Ricoh Company, Ltd.

- RPost Technologies

- Secured Signing, Inc.

- Signatura

- Signaturit Solutions, S.L.

- SigniFlow

- SIGNiX, Inc.

- Signority Inc.

- Skribble AG

- Symtrax Holdings, Inc.

- Thales Group

- Trust Factory

- Tungsten Automation Corporation

- VÍNTEGRIS, S.L.

- Zoho Corporation Pvt. Ltd.

Formulating Actionable Strategic Recommendations to Accelerate Growth, Ensure Compliance, and Enhance Security in Digital Signature Implementations

Industry leaders should prioritize a holistic approach that aligns technology investments with clear business outcomes, ensuring that digital signature initiatives deliver measurable value. First, organizations must streamline their solution portfolios by selecting platforms that offer both cloud-based agility and on-premise control, enabling them to adapt to evolving security requirements and regulatory expectations without sacrificing user experience.

Next, enterprises are advised to embed advanced authentication mechanisms-such as biometric verification and hardware-backed key storage-into their signature processes to elevate trust and mitigate fraud. This should be complemented by continuous monitoring and AI-driven anomaly detection, which can proactively identify and remediate risks before they escalate into significant incidents. Collaborating with trusted hardware and services partners will further bolster system resilience and compliance.

To maximize adoption, it is critical to integrate digital signatures into broader workflow automation initiatives, linking signing events with enterprise resource planning, customer relationship management, and procurement systems. This orchestration reduces manual handoffs, accelerates approval cycles, and generates comprehensive audit trails that support regulatory audits and internal governance. Leaders should also cultivate internal expertise through targeted training programs and cross-functional governance committees, ensuring that signature policies remain aligned with strategic priorities.

Finally, maintaining supply chain agility in the face of tariff fluctuations requires diversifying component sourcing and exploring service-centric key management models. By establishing contingency plans, monitoring regulatory developments, and participating in industry consortia, leaders can preemptively address potential disruptions and secure uninterrupted access to critical signature infrastructure.

Detailing Comprehensive Research Methodology Incorporating Qualitative Analyses, Stakeholder Interviews, and Rigorous Data Verification Processes

Our research methodology unfolded through a rigorous, multi-phase process that combined extensive secondary research with targeted primary engagements. Initially, we conducted a comprehensive review of publicly available resources, including regulatory guidelines, industry whitepapers, and technology vendor documentation, to map the overarching digital signature landscape and identify prevailing trends.

Subsequently, we undertook in-depth interviews with senior stakeholders from carrier-grade solution providers, enterprise IT organizations, and regulatory bodies to validate and enrich our secondary findings. These conversations uncovered nuanced perspectives on adoption barriers, technology roadmaps, and the interplay between signature frameworks and broader digital transformation agendas. To ensure robustness, we triangulated insights across sources, cross-referencing interview data with publicly disclosed case studies and technical specifications.

To structure our analysis, we developed a granular segmentation framework encompassing signature type, component tier, cryptographic key model, organizational scale, and industry vertical. This segmentation was refined iteratively through quantitative surveys distributed to a representative panel of technology buyers and end-users, enabling us to discern differentiated requirements and supplier landscapes. Finally, all findings underwent critical review by a panel of independent experts in cybersecurity, legal compliance, and digital identity management, ensuring that our conclusions are both actionable and reflective of real-world imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Signature market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Signature Market, by Type

- Digital Signature Market, by Components

- Digital Signature Market, by Key Type

- Digital Signature Market, by Organization Size

- Digital Signature Market, by End-User

- Digital Signature Market, by Region

- Digital Signature Market, by Group

- Digital Signature Market, by Country

- United States Digital Signature Market

- China Digital Signature Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Insights Emphasizing the Strategic Imperatives and Future Trajectories of Digital Signature Adoption and Trust Ecosystems

As digital signatures continue to underpin secure, efficient, and compliant workflows, their strategic importance will only intensify. Organizations that embrace advanced cryptographic methods, cloud-enabled architectures, and AI-driven analytics will be positioned to mitigate risk, accelerate transaction lifecycles, and foster digital trust at scale. Meanwhile, the evolving regulatory landscape and recent tariff developments underscore the necessity of agility in both procurement and deployment strategies.

By leveraging multidimensional segmentation insights and regional dynamics, enterprises can tailor their digital signature initiatives to align with specific compliance requirements, operational contexts, and user expectations. The competitive field will reward those who balance innovation with governance, cultivating partnerships that enhance security while driving feature-rich experiences.

Ultimately, stakeholders who integrate these strategic imperatives into cohesive roadmaps will not only optimize the cost and efficiency of their signature processes but also unlock new avenues for cross-border collaboration, regulatory alignment, and sustainable growth.

Engaging with Ketan Rohom to Secure Comprehensive Digital Signature Market Research Insights and Empower Informed Strategic Decisions

To explore the full breadth of insights into digital signature market dynamics, contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He will guide you through the unique value proposition of our extensive analysis, ensuring you gain a clear understanding of the disruptive trends, key drivers, and competitive landscape shaping this technology. By engaging directly with Ketan Rohom, you will receive tailored advice on how these findings apply to your strategic objectives, whether you are evaluating expansion into new regions, optimizing your technology portfolio, or seeking partnerships with leading solution providers. Reach out today to secure your copy of the comprehensive report and empower your organization with the actionable intelligence necessary to lead in the evolving digital trust ecosystem

- How big is the Digital Signature Market?

- What is the Digital Signature Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?