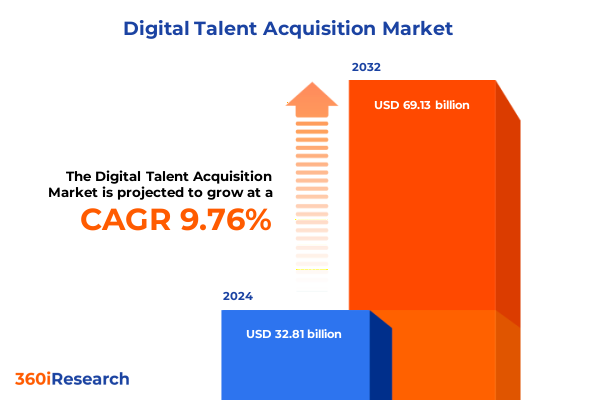

The Digital Talent Acquisition Market size was estimated at USD 36.08 billion in 2025 and expected to reach USD 39.26 billion in 2026, at a CAGR of 9.73% to reach USD 69.13 billion by 2032.

Unveiling the Strategic Imperatives Driving Digital Talent Acquisition in an Era Defined by Innovation and Market Transformation

Digital talent acquisition stands at the intersection of rapid technological advancement and shifting workforce expectations, compelling organizations to reimagine traditional recruitment frameworks. As enterprises navigate an increasingly competitive hiring landscape, the integration of intelligent automation with human-centered processes has emerged as a core strategic imperative. This introduction lays the groundwork by examining how evolving candidate behaviors, fueled by mobile engagement and on-demand interactions, are influencing the design of recruiting solutions and reshaping employer branding strategies.

Building on this foundation, it is essential to recognize the role of data-driven decision making in elevating recruitment practices. Predictive analytics and real-time dashboards are empowering talent acquisition teams to move beyond reactive hiring and towards proactive workforce planning. Through this lens, stakeholders gain greater visibility into talent pipelines, enabling more effective allocation of resources and alignment with organizational goals.

Moreover, the convergence of candidate experience platforms with broader human capital management ecosystems is setting new benchmarks for end-to-end recruitment efficiency. This holistic perspective underscores the importance of seamless integration between applicant tracking systems, candidate relationship management, onboarding solutions and recruitment marketing software, as organizations strive to deliver consistent and engaging experiences. In this context, understanding market segmentation and regional nuances becomes critical for developing scalable and adaptable talent acquisition strategies.

Embracing the Next Generation of Digital Talent Strategies as Artificial Intelligence and Automation Redefine Recruitment Processes Nationwide

Recruitment is undergoing transformative shifts as artificial intelligence and machine learning redefine how talent is identified, engaged and assessed. Automated resume screening and algorithmic matching tools are accelerating time-to-hire while reducing unconscious bias. Furthermore, video interviewing platforms powered by natural language processing are elevating the quality of candidate evaluation, enabling more nuanced insights into competencies and cultural fit than ever before.

Beyond the rise of AI, the adoption of robotic process automation across candidate outreach, scheduling and follow-up workflows is freeing talent teams to focus on strategic engagement rather than transactional tasks. Simultaneously, the expectation for seamless mobile interactions has driven the emergence of recruitment marketing software that personalizes career site experiences and nurtures talent through targeted campaigns. Consequently, organizations are forging closer connections with passive candidates and strengthening employer value propositions in a crowded talent marketplace.

Transitioning from these technological enablers, diversity equity and inclusion have become front-and-center priorities, prompting the integration of unbiased assessment & testing solutions with sophisticated analytics to uncover and mitigate hiring disparities. In parallel, hybrid and remote work models continue to reshape candidate expectations, making it imperative for solutions to support virtual onboarding and digital workplace readiness. Collectively, these dynamics are transforming recruitment from an operational process into a strategic differentiator.

Assessing How Tariff Adjustments on Technology Imports and Equipment in 2025 Are Shaping Costs Talent Management Platforms and Service Delivery Models

Assessing the cumulative impact of recent tariff adjustments requires understanding how increased duties on imported hardware and related equipment affect the digital talent acquisition ecosystem. The imposition of higher tariffs on servers, networking devices and specialized AI processing units has directly influenced the cost structure of on-premise infrastructures used by recruitment software providers. As a result, many vendors have reevaluated pricing models to offset elevated import duties, leading to revised service agreements and support commitments.

Moreover, these tariff changes have accelerated the shift toward cloud-based deployments as organizations seek to mitigate capital expenditure on hardware subject to fluctuating trade policies. By leveraging cloud solutions, enterprises are able to access scalable computational resources for applicant tracking systems, video interviewing tools and assessment engines without the financial burden of tariff-exposed devices. Consequently, this migration is reshaping vendor roadmaps, with an emphasis on delivering end-to-end cloud-native platforms that reduce exposure to global supply chain disruptions.

In response to these cost pressures, recruitment technology providers are exploring strategic partnerships with domestic hardware manufacturers and data center operators. This alignment supports compliance with domestic content requirements and fosters resilient supply chains. Simultaneously, the emergence of virtualization and containerization technologies is enabling more portable solutions that can seamlessly shift between on-premise and cloud environments, ensuring continuity while neutralizing the effects of ongoing tariff volatility.

Illuminating Market Dynamics Through Component Services Solutions Deployment and Industry Vertical Segmentation to Drive Strategic Recruitment Decisions

Insights gleaned from component segmentation reveal that services offerings encompassing consulting, implementation & integration, as well as support & maintenance, play a pivotal role in determining client satisfaction and long-term platform adoption. In parallel, solutions components such as applicant tracking system modules, assessment & testing solutions, candidate relationship management tools, video interviewing software, onboarding solutions and recruitment marketing software form the technological backbone that drives end-to-end talent acquisition experiences.

In addition to dissecting services and solutions, end-user segmentation demonstrates that both large enterprises and small & mid-sized organizations possess distinct requirements. Large enterprises often demand comprehensive, fully integrated systems with enterprise-grade security and compliance capabilities, whereas smaller organizations prioritize ease of use, cost efficiency and rapid deployment. These divergent needs are further influenced by deployment preferences, as deployments on cloud infrastructures emphasize agility and remote accessibility, while on-premise installations cater to clients with stringent data residency or customization demands.

Continuing this granular view, industry vertical segmentation across banking financial services & insurance education energy & utilities government healthcare hospitality information technology & telecom manufacturing and retail & e-commerce highlights how regulatory environments, candidate volumes and talent skillsets vary dramatically. Finally, application-oriented segmentation underscores that foundational modules such as applicant tracking systems, candidate assessment tools, onboarding solutions and sourcing tools each address critical phases of recruitment, necessitating tailored feature sets and integration strategies.

This comprehensive research report categorizes the Digital Talent Acquisition market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- End User

- Deployment

- Industry Vertical

- Application

Uncovering Regional Variations in Adoption and Innovation Across the Americas Europe Middle East Africa and Asia Pacific Recruitment Ecosystems

Regional dynamics in the Americas illustrate a mature market where widespread adoption of cloud-based recruitment platforms has intertwined with advanced analytics to optimize talent pipelines. Organizations across North and South America are prioritizing candidate experience enhancements, leveraging mobile-first career portals and social talent campaigns to engage passive candidates. Furthermore, the Americas region continues to pioneer integration strategies, connecting recruitment suites with broader human capital management systems to deliver unified workforce insights.

Moving to Europe the Middle East & Africa space, regulatory frameworks around data privacy and employment diversity have compelled vendors to embed robust compliance controls and multilingual capabilities into their offerings. In the European Union, adherence to stringent data protection laws has driven the growth of on-premise and hybrid deployments, while emerging markets in the Middle East & Africa are embracing localized recruitment marketing solutions to address language diversity and cultural nuances. This region also exhibits rising interest in AI-driven talent assessment as organizations seek to standardize hiring processes across multiple jurisdictions.

Turning to Asia-Pacific, a dynamic mix of established economies and rapidly developing markets characterizes the recruitment technology landscape. Here, the emphasis on mobile hiring platforms and social media integration remains high, reflecting the region’s tech-savvy workforce and high smartphone penetration. Additionally, Asia-Pacific companies are experimenting with gamified assessment tools and asynchronous video interviewing to streamline remote hiring workflows. The convergence of cost-sensitive sourcing strategies with innovative candidate engagement models is shaping unique adoption patterns distinct from Western counterparts.

This comprehensive research report examines key regions that drive the evolution of the Digital Talent Acquisition market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Leading Innovators and Strategic Partnerships Driving Competitive Advantage in the Talent Acquisition Technology Landscape

The talent acquisition technology landscape is being led by a cohort of established enterprise vendors and disruptive newcomers investing heavily in artificial intelligence and machine learning. Major players have expanded their footprints by integrating conversational AI chatbots, skills taxonomy engines and advanced analytics into core applicant tracking systems. Meanwhile, agile startups are gaining traction by offering niche solutions such as video interviewing platforms, candidate relationship management tools and onboarding suites that emphasize simplicity and rapid time to value.

Strategic partnerships between software providers and global consulting firms are emerging as a key driver of market differentiation. These alliances facilitate end-to-end deployment capabilities that marry technical expertise with deep domain knowledge, enabling clients to implement best practices around recruitment process design and change management. Partnerships with cloud infrastructure providers further enhance system scalability and reliability, ensuring that talent acquisition platforms can adapt to fluctuating hiring volumes without compromising performance.

In addition attracting venture capital funding has underscored the sector’s growth trajectory with increased mergers and acquisitions activity aimed at consolidating complementary capabilities. Established incumbents are acquiring niche innovators to bolster their recruitment marketing and candidate assessment portfolios, while pure-play recruitment technology firms are broadening their service delivery through international expansions and targeted co-development initiatives with ecosystem partners.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Talent Acquisition market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADP, Inc.

- Beamery Inc.

- Ceridian HCM, Inc.

- Cornerstone OnDemand, Inc.

- Eightfold AI Inc.

- Greenhouse Software, Inc.

- HireVue Inc.

- IBM Corporation

- iCIMS, Inc.

- Jobvite, Inc.

- Lever, Inc.

- LinkedIn Corporation

- Modern Hire, Inc.

- Oracle Corporation

- Phenom People Inc.

- SAP SE

- SeekOut Inc.

- SmartRecruiters Inc.

- Symphony Talent LLC

- Workday, Inc.

Empowering Industry Leaders with Tactical Steps to Leverage Advanced Tools Foster Talent Engagement and Navigate Geopolitical Complexities

Industry leaders should prioritize adopting AI-driven candidate engagement tools that combine conversational interfaces with predictive analytics to enhance personalization and streamline communication. By investing in integrated solutions that connect recruiting marketing, assessment platforms and onboarding workflows, organizations can create frictionless experiences for candidates and internal stakeholders alike. This holistic approach not only accelerates time-to-hire but also strengthens employer brand resonance in key talent markets.

Furthermore, it is essential to establish a robust governance framework around data privacy and security to ensure compliance across multiple jurisdictions. Standardizing data models and implementing centralized reporting dashboards will deliver a single source of truth for talent metrics, enabling real-time adjustments to recruitment campaigns based on performance insights. In-depth scenario planning that factors in ongoing geopolitical shifts and tariff fluctuations will help recruitment teams remain agile in the face of supply chain or infrastructure disruptions.

Additionally building strategic partnerships with domestic infrastructure providers and specialized solution consultants can mitigate operational risks linked to hardware cost pressures and implementation complexities. Organizations that invest in continuous upskilling of talent acquisition teams-focusing on digital fluency, change management and analytical acumen-will be best positioned to capitalize on emerging technologies and drive sustained recruitment excellence.

Detailing the Rigorous Research Approach Integrating Quantitative Analysis Qualitative Insights and Triangulated Data Validation Processes

This research employed a rigorous mixed-methods approach to capture the multifaceted nature of the digital talent acquisition market. Primary research included in-depth interviews with senior talent acquisition executives across large enterprises and small & mid-sized firms, enabling firsthand insights into solution adoption drivers, implementation challenges and future priorities. Complementing this qualitative input, a structured online survey gathered quantitative data from a representative sample of HR professionals to validate emerging trends and benchmark service requirements.

Secondary research sources encompassed a comprehensive review of industry whitepapers, regulatory publications and technology provider collateral. This phase also included an analysis of publicly available vendor financial statements and customer success case studies, ensuring a holistic understanding of competitive dynamics and market positioning. Data synthesis was accomplished through triangulation techniques that cross-verified findings from primary and secondary streams, resulting in a robust and reliable dataset.

Quality assurance was maintained through iterative validation workshops with domain experts and ongoing data cleansing protocols to address inconsistencies. Limitations of the study were acknowledged in relation to the rapidly evolving nature of artificial intelligence applications and the potential impact of future trade policy changes. Nonetheless, the methodological rigor underpinning this report provides stakeholders with confidence in the accuracy and relevance of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Talent Acquisition market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Talent Acquisition Market, by Component

- Digital Talent Acquisition Market, by End User

- Digital Talent Acquisition Market, by Deployment

- Digital Talent Acquisition Market, by Industry Vertical

- Digital Talent Acquisition Market, by Application

- Digital Talent Acquisition Market, by Region

- Digital Talent Acquisition Market, by Group

- Digital Talent Acquisition Market, by Country

- United States Digital Talent Acquisition Market

- China Digital Talent Acquisition Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Insights That Synthesize Market Evolution Challenges and Opportunities into a Cohesive Strategic Outlook for Talent Acquisition Stakeholders

Synthesizing the strategic landscape of digital talent acquisition underscores a clear trajectory: organizations that seamlessly blend artificial intelligence, automation and human-centric design achieve superior recruiting performance. The interplay of component services and tailored solutions across deployment models highlights the necessity for flexible, scalable platforms that align with enterprise objectives and sector-specific requirements. Regional variances further illustrate how compliance, cultural factors and technological readiness drive distinct adoption patterns.

Examining the cumulative impact of recent tariff adjustments emphasizes the importance of resilient supply chains and the pivot toward cloud-enabled offerings. This shift not only alleviates cost pressures but also fosters greater accessibility to advanced recruitment tools for organizations of varying sizes. As market consolidation continues and strategic partnerships proliferate, the competitive landscape will favor vendors capable of delivering integrated, future-proof solutions.

In conclusion, stakeholders must adopt a dual focus on innovation and operational discipline to harness the full potential of digital talent acquisition. By leveraging data-driven insights, reinforcing governance mechanisms and fostering collaborative ecosystems, industry leaders can transform recruitment from a transactional necessity into a strategic accelerator for organizational growth.

Engage Directly with Ketan Rohom to Unlock Comprehensive Digital Talent Acquisition Insights and Secure Tomorrow’s Competitive Edge Today

To explore a comprehensive roadmap for elevating your talent acquisition strategy and gain access to in-depth market intelligence, reach out to Ketan Rohom, Associate Director, Sales & Marketing. He will guide you through how the latest insights can be tailored to your organizational priorities and share a detailed demonstration of the full report’s actionable findings.

By engaging directly with Ketan Rohom you will secure a strategic partner committed to empowering your recruitment transformation journey. Connect now to ensure your team leverages cutting-edge analysis and positions your enterprise for competitive advantage in an ever-evolving talent landscape.

- How big is the Digital Talent Acquisition Market?

- What is the Digital Talent Acquisition Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?