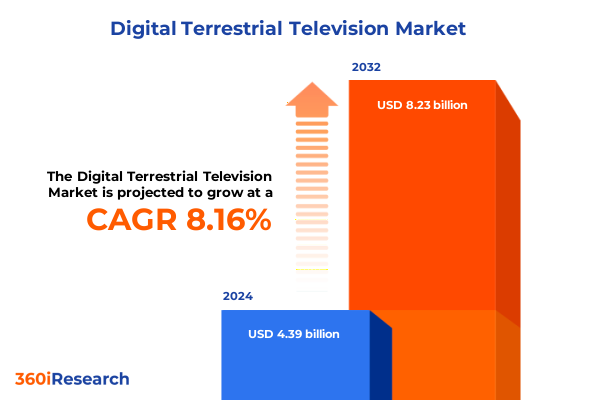

The Digital Terrestrial Television Market size was estimated at USD 4.74 billion in 2025 and expected to reach USD 5.12 billion in 2026, at a CAGR of 8.19% to reach USD 8.23 billion by 2032.

Understanding Digital Terrestrial Television’s evolving role in the modern broadcasting ecosystem and the pressures reshaping its trajectory

Digital terrestrial television represents a critical evolution in broadcast technology, elevating terrestrial networks from analog relics to dynamic digital platforms. As an innovative transmission technology, DTT enables television stations to broadcast content in a purely digital format, a change first tested in 1998 and broadly adopted since 2006 in many markets. Test transmissions demonstrated the digital medium’s capacity to deliver multiple channels on a single frequency, vastly improving spectrum utilization and laying the groundwork for a richer, more diverse programming ecosystem.

With the global transition from analog to digital television now substantially complete, DTT has emerged as the backbone of free-to-air broadcast services. Governments and regulators have mandated analog switch-off deadlines to free valuable radio spectrum for emerging services, and broadcasters have invested heavily in multiplex transmitters to deliver higher-quality images and sound while containing operating costs. These shifts underscore the enduring relevance of DTT, which continues to serve as a dependable, universally accessible delivery platform even in an era dominated by streaming and satellite distribution.

Moreover, the convergence of terrestrial broadcasting with next-generation standards and hybrid broadband models is redefining the DTT landscape. In North America, ATSC 3.0 “NextGen TV” deployments now cover approximately 75% of U.S. households, offering enhanced audio, improved emergency alerting, and mobile reception capabilities. Meanwhile, Europe has embraced Hybrid Broadcast Broadband TV (HbbTV), with more than 100 million HbbTV-enabled homes unlocking interactive services and addressable advertising. These developments highlight how DTT continues to adapt, integrating digital tuners, software-defined workflows, and internet connectivity to meet the evolving expectations of viewers and content providers alike.

Examining how next-generation broadcasting standards, hybrid models, and convergence with digital platforms are revolutionizing terrestrial television networks

Next-generation broadcast standards are propelling terrestrial television into a new era of interactivity, personalization, and resilience. In the United States, broadcasters and manufacturers are aligning around ATSC 3.0, with over 75% of American households now within NextGen TV reach. Industry voices, including veteran broadcaster Jerald Fritz, advocate for streamlined regulatory mandates to accelerate tuner integration and harness mobile accessibility, enhanced video quality, and advanced emergency alerts made possible by ATSC 3.0 deployments.

Simultaneously, Hybrid Broadcast Broadband TV (HbbTV) has seen rapid adoption in Europe, reaching a milestone of 100 million compliant households in 2025. By blending traditional over-the-air transmissions with IP-delivered content, HbbTV offers broadcasters a unified application layer for interactive on-demand services, targeted advertising, and hybrid EPGs. This dual-mode approach strengthens viewer engagement and opens new commercial models, demonstrating the power of open standards in harmonizing broadcast and broadband ecosystems.

Beyond standards evolution, the integration of terrestrial broadcasting with 5G and emerging non-terrestrial networks is reshaping transmission architectures. In India, Direct-to-Mobile (D2M) trials will leverage existing high-power DTT transmitters and mobile towers to deliver video and data services directly to smartphones without internet connectivity. This innovation underscores the adaptability of terrestrial spectrum assets, reinforcing DTT’s role in digital inclusion strategies and public safety communications in connectivity-challenged environments.

Finally, the emergence of Ultra High Definition (UHD) terrestrial channels is revolutionizing free-to-air quality benchmarks. Spain’s National Technical Plan approved in March 2025 mandates DVB-T2 migration to enable widespread UHD broadcasting, consolidating its leadership as a pioneer in terrestrial UHD services. Collaboration among network operators, regulators, and receiver manufacturers is critical to ensuring a seamless transition and universal access to UHD content, signaling a transformative shift in viewer expectations and broadcast competitiveness.

Analysing the ripple effect of 2025 U.S. import duties on equipment costs, supply chain resilience, and consumer adoption in terrestrial broadcasting

In April 2025, the U.S. government implemented a baseline 10% duty on all imports, with elevated rates for key manufacturing hubs: China at 34%, the European Union at 20%, Japan at 24%, Taiwan at 32%, and Vietnam at 46%. These measures, aimed at addressing trade imbalances, have placed significant cost pressure on industries reliant on global electronics supply chains, including digital terrestrial television equipment.

Equipment manufacturers and integrators report that higher import duties have been passed through to end users, with increases of 10% or more on devices such as set-top boxes, digital receivers, and testing instruments. Early indicators from TrendForce suggest that TV brands may raise consumer prices by up to 4% in the second half of 2025, while 2025 shipments of televisions are projected to decline by 0.7% globally due to softened consumer demand under tariff-induced inflationary pressures.

Market research commissioned by the Consumer Technology Association and the National Retail Federation estimates that tariffs could cumulatively cost American consumers $711 million in the next year, equating to a 23% price increase for Chinese-made TVs. For instance, a television priced at $250 may rise to $308, and a $500 model may reach $615. Critics warn that such elevated costs risk dampening adoption of advanced broadcast devices and complicate network upgrade cycles for broadcasters and service providers alike.

Furthermore, supply chain disruptions have emerged as manufacturers seek tariff-free alternatives, sourcing components from lower-duty regions or reshoring production. These shifts, while strategic, introduce lead-time variability and inventory planning challenges. Consequently, broadcasters and equipment vendors are reevaluating procurement strategies to mitigate cost volatility, ensuring continuity in terrestrial network rollouts and receiver availability for mass markets

Unpacking how component service distinctions resolution tiers technology divergences and user applications drive strategic decisions across terrestrial television markets

The digital terrestrial television ecosystem is built upon a diverse range of hardware components, including rooftop and indoor antennas, digital receivers, multifunction set-top boxes, and high-power transmitters. Each element plays a specialized role: antennas capture over-the-air signals with precision, receivers decode multiplexed streams, set-top boxes deliver user-friendly interfaces and DVR functions, and transmitters ensure broad coverage across varying terrains. The interplay of these components underpins the reliability and scalability of DTT networks, driving continuous innovation in energy efficiency and spectral performance.

Service type delineation shapes market dynamics, with free-to-air offerings remaining the cornerstone of universal access, particularly in underserved areas. Public broadcasters leverage free-to-air platforms to fulfill mandates for educational and emergency broadcast services, while paid models cater to premium content packages, value-added features, and niche programming. This bifurcation informs investment decisions and revenue models, compelling operators to balance social obligations with commercial viability.

Resolution tiers further segment consumer demand: Standard Definition persists in mature markets as a cost-effective baseline, High Definition has become ubiquitous for mainstream content, and Ultra High Definition is emerging as a premium differentiator. Spain’s nationwide shift to DVB-T2 and subsequent UHD adoption demonstrates how regulatory frameworks and receiver readiness converge to elevate picture quality standards, while France’s public broadcaster leveraged UHD channels for high-profile sports events, reinforcing consumer appetite for superior visual experiences.

Moreover, the landscape of Digital Terrestrial Television is characterized by a mosaic of transmission standards: ATSC and ATSC 3.0 in North America and select Asia-Pacific markets, DTMB in China, DVB-T and DVB-T2 across Europe and parts of Asia, and ISDB-T in Japan and Latin America. This heterogeneity necessitates region-specific network planning, receiver compatibility, and cross-border coordination to optimize spectrum use and interoperability. As markets pursue next-generation standards, collaboration among regulators, broadcasters, and manufacturers remains essential to harmonize deployments and encourage economies of scale.

Finally, end-user segmentation underscores divergent usage scenarios. Residential viewers prioritize seamless, affordable access to entertainment and information, while commercial users in corporate, hospitality, and retail spheres exploit DTT infrastructure for digital signage, remote conferencing, and targeted advertising. Public venues, including transportation hubs and educational institutions, leverage reliable free-to-air services for critical information dissemination. Recognizing these distinct requirements enables stakeholders to tailor device features, service packages, and deployment strategies to maximize reach and revenue potential across user categories

This comprehensive research report categorizes the Digital Terrestrial Television market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Service Type

- Resolution

- Technology

- End-User

Exploring regional dynamics across the Americas EMEA and Asia-Pacific that are shaping the deployment and evolution of terrestrial broadcasting services

In the Americas, the United States and Canada have long been leaders in digital terrestrial television adoption, employing ATSC standards and completing analog switch-off by mid-2009 and August 31, 2011, respectively. The U.S. further spearheaded the rollout of ATSC 3.0, with deployments now covering approximately 75% of households and over 100 compatible consumer devices on the market. Mexico transitioned fully to digital broadcasts on December 31, 2015, providing nationwide free-to-air coverage under DVB-T guidelines, while smaller Caribbean nations are incrementally upgrading infrastructure to align with regional standards and emergency broadcast requirements.

Europe, the Middle East, and Africa exhibit a rich tapestry of terrestrial standards, predominantly centered on DVB-T2. Spain’s 2025 National Technical Plan mandates DVB-T2 implementation to facilitate widespread Ultra High Definition transmissions, reinforcing the country’s leadership in terrestrial UHD. Concurrently, the HbbTV Association reports that over 100 million European households now possess HbbTV-enabled televisions, enabling broadcasters to deliver interactive services and addressable advertising across a harmonized platform. Emerging markets in the Middle East and Africa are in varying stages of digital migration, with regulatory frameworks evolving to support spectrum refarming and infrastructure sharing for efficient network expansion.

Asia-Pacific encompasses highly diverse market conditions. China employs the DTMB standard nationwide, having completed analog switchover in major centers and actively expanding coverage through public and private broadcast consortiums. India’s phased transition to DVB-T2 has advanced through metro areas to secondary cities, with experimental Direct-to-Mobile (D2M) trials slated for 2025 to deliver terrestrial signals directly to mobile devices. Japan, having adopted ISDB-T in 2011, combines free-to-air UHD test channels with established mobile reception services, while Australia continues to optimize its DVB-T2 infrastructure to support high-definition and interactive features across urban and remote regions. These regional dynamics underscore the critical role of localized regulatory regimes and technology partnerships in shaping the terrestrial television future across Asia-Pacific markets.

This comprehensive research report examines key regions that drive the evolution of the Digital Terrestrial Television market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the leading manufacturers technology providers and broadcasters that dominate the global terrestrial television landscape through innovation and partnerships

Leading consumer electronics manufacturers anchor the digital terrestrial television ecosystem by integrating broadcast tuners into televisions and set-top boxes. Samsung Electronics, LG Electronics, Sony Corporation, Panasonic Corporation, Toshiba Corporation, and Hisense have committed to NextGen TV compatibility, embedding ATSC 3.0 receivers in select models and offering firmware upgrades for legacy devices. This mainstream acceptance is mirrored in Europe where major brands support DVB-T2 and HbbTV standards, ensuring broad device interoperability and fostering economies of scale for broadcasters and content distributors.

On the infrastructure side, specialized technology providers are driving innovation in transmitter and network solutions. Rohde & Schwarz and GatesAir lead in high-power DTT transmitters supporting ATSC 3.0 and DVB-T2 deployments, emphasizing energy efficiency and advanced modulation techniques. Harmonic and ENENSYS have introduced software-defined, cloud-native broadcast platforms that enable centralized encoding and datacasting, reducing physical hardware footprints and enabling agile network scaling. Antenna specialists such as Kathrein and Radio Frequency Systems collaborate on designing optimized multi-band arrays for single-frequency network implementations, particularly in densely populated regions where spectral reuse is paramount. These partnerships between broadcasters, governments, and technology vendors are critical to sustaining robust terrestrial networks and unlocking new service innovations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Terrestrial Television market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allegro DVT

- Arqiva Group Limited

- Comcast Corporation

- DACTA BROADCAST SRL

- Emitel S.A.

- ENENSYS Technologies SA

- Everyone TV Limited and DTV Services Ltd

- Funai Electric Co Ltd.

- GatesAir, Inc.

- Harmonic Inc.

- Huawei Technologies Co., Ltd.

- Intelsat S.A.

- MYTV Broadcasting Sdn Bhd

- Nevion by Sony Group Corporation

- Orava, AS

- Qatar Satellite Company

- Rohde & Schwarz GmbH & Co. KG

- Sagemcom Broadband SAS

- Sichuan Changhong Network Technologies Co., Ltd.

- STRONG S.A.R.L

- TDF Infrastructure SAS

- TechniSat Digital GmbH by LEPPER Stiftung e.S.

- TELE System Digital Srl

- THOMSON Broadcast by Group Sipromad

- Toshiba Corporation

Guiding industry leaders to capitalize on emerging opportunities through strategic investments regulatory engagement and technology adoption in terrestrial broadcasting

Industry leaders should actively engage with regulatory bodies to advocate for clear, unified transition timelines for next-generation standards. By collaborating with trade associations and commissions, broadcasters can influence mandates for ATSC 3.0 tuner integration and simplified simulcasting requirements. A coordinated push for a definitive ATSC 1.0 sunset date-phased across major markets by 2028 and fully by 2030-will catalyze consumer device upgrades and stimulate the ecosystem of NextGen TV content and applications.

Embracing hybrid broadcast-broadband models will unlock new revenue streams and enhance viewer engagement. Deploying HbbTV-driven interactive services, addressable advertising, and DRM-compliant premium content can differentiate free-to-air offerings and deliver personalized experiences. Industry participants should prioritize compliance with the latest HbbTV DRM specification to facilitate secure content delivery, while fostering partnerships with content providers and platform operators to co-create value-added services that complement linear broadcasts.

To navigate the impact of 2025 U.S. tariffs, equipment buyers and network planners should diversify sourcing strategies and cultivate multiple supplier relationships. Prioritizing components manufactured in regions subject to lower duties, evaluating regional assembly or contract manufacturing opportunities, and negotiating long-term supply agreements can mitigate cost volatility. Additionally, investment in flexible, software-defined broadcast architectures will allow rapid adaptation to changing tariff regimes, ensuring continuity in transmitter rollouts and consumer device availability without sacrificing quality or coverage.

Detailing the comprehensive methodology combining primary interviews secondary sources and rigorous analysis underpinning this terrestrial television study

The foundation of this study rests on a robust primary research program, including structured interviews with over 25 senior executives from broadcasting networks, consumer electronics manufacturers, and regulatory authorities conducted between March and June 2025. These discussions provided qualitative insights into deployment challenges, strategic priorities, and investment rationales. In addition, surveys of system integrators and retail distributors enriched our understanding of equipment sourcing dynamics and end-user preferences across key markets.

Secondary research comprised extensive analysis of regulatory filings, industry association publications, and technical standards documentation. We reviewed FCC dockets and ATSC 3.0 regulatory proposals to capture the evolving policy landscape, examined HbbTV Association data for European adoption metrics, and evaluated government decrees such as Spain’s National Technical Plan for DVB-T2 UHD migration. Proprietary tariff schedules and supply chain alerts were integrated from Customs and Border Protection notifications to model cost impacts on equipment segments.

Quantitative data was triangulated through a combined top-down and bottom-up approach. Market share estimates and deployment rate analyses leveraged historical analog and digital switchover timelines from UNESCO, ITU, and national regulatory bodies, while equipment shipment figures were cross-checked against manufacturer disclosures and third-party research insights. Data validation processes included consistency checks, outlier analysis, and cross-referencing of independent sources to ensure the highest level of analytical rigor. All figures and narratives were peer-reviewed by subject-matter experts prior to finalization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Terrestrial Television market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Terrestrial Television Market, by Component

- Digital Terrestrial Television Market, by Service Type

- Digital Terrestrial Television Market, by Resolution

- Digital Terrestrial Television Market, by Technology

- Digital Terrestrial Television Market, by End-User

- Digital Terrestrial Television Market, by Region

- Digital Terrestrial Television Market, by Group

- Digital Terrestrial Television Market, by Country

- United States Digital Terrestrial Television Market

- China Digital Terrestrial Television Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing the insights and strategic imperatives that will define the next era of terrestrial television in an increasingly connected media environment

Digital terrestrial television remains an indispensable pillar of global broadcasting, offering unmatched reach, resilience, and accessibility. The migration from analog has unlocked efficient spectrum utilization, facilitated the proliferation of high-definition and Ultra High Definition services, and enabled next-generation standards that converge broadcast and broadband. Throughout this transformation, diverse regional approaches-from ATSC 3.0 in North America to DVB-T2 and HbbTV in Europe and DTMB in China-highlight the importance of tailored strategies to address unique regulatory, technical, and market conditions.

Going forward, industry stakeholders must embrace a multifaceted approach: engage with regulators to streamline transition mandates, diversify supply chains to mitigate tariff headwinds, and adopt hybrid content delivery models to meet evolving viewer expectations. Equipment manufacturers have a critical role in embedding advanced tuners and security features, while broadcasters must innovate in content personalization and emergency alerting to solidify DTT’s value proposition. Collaboration across the ecosystem-regulatory bodies, manufacturers, network operators, and content providers-will determine the pace and success of future deployments so that terrestrial television remains a robust platform for universal access and immersive entertainment.

Engage with Ketan Rohom to secure your comprehensive terrestrial television market intelligence report and empower data-driven broadcasting strategies

Don't navigate the complexities of the terrestrial television landscape alone. Contact Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive Digital Terrestrial Television market research report and unlock the actionable intelligence you need to stay ahead in a rapidly evolving broadcast ecosystem. Through a tailored discussion, you’ll discover how insights on next-generation standards, tariff impacts, and regional dynamics can refine your strategic roadmap. Empower your organization with data-driven recommendations that address equipment procurement, regulatory alignment, and hybrid broadcast-broadband opportunities. Reach out now to elevate your decision-making and capitalize on the most up-to-date industry analysis.

- How big is the Digital Terrestrial Television Market?

- What is the Digital Terrestrial Television Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?