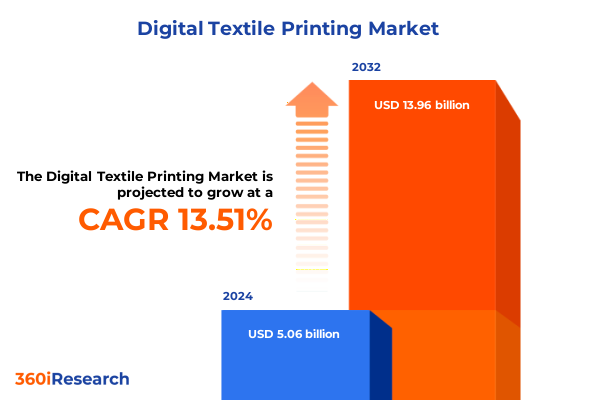

The Digital Textile Printing Market size was estimated at USD 5.71 billion in 2025 and expected to reach USD 6.44 billion in 2026, at a CAGR of 13.62% to reach USD 13.96 billion by 2032.

Exploring the Evolution of Digital Textile Printing: Foundations, Innovations, and Emerging Opportunities Shaping the Industry’s Future

Digital textile printing has emerged from its experimental roots to become a cornerstone of modern fabric production, seamlessly blending artistic expression with advanced manufacturing techniques. This introduction unveils the transformative journey by tracing how early developments in ink formulation and machine design have evolved into today’s sophisticated processes capable of delivering fine detail, vibrant colors, and mass customization. Over the past decade, investments in research and development have accelerated improvements in printhead resolution, ink adhesion, and substrate compatibility, enabling fabrics to meet the stringent demands of fashion, home decor, and industrial applications. Moreover, digital workflows now allow brands to dramatically shorten lead times and reduce waste by printing on demand, thereby supporting more responsive and sustainable supply chains.

As the industry continues to mature, the convergence of digital technology and textile expertise has spawned new creative possibilities. Collaborative endeavors between technology providers, textile mills, and brand designers are fostering a culture of innovation that emphasizes flexibility, personalization, and rapid prototyping. In this context, stakeholders are increasingly adopting data-driven design platforms and integrated software solutions that streamline color management, ensure print consistency, and facilitate seamless production from initial concept to final output. Consequently, businesses of all sizes can leverage digital printing to differentiate their offerings, enter niche markets with bespoke designs, and respond swiftly to shifting consumer preferences.

Looking ahead, ongoing advancements in ink chemistry, machine learning, and automation promise to reshape the landscape further. Next-generation pigments and reactive chemistries tailored for digital deposition are set to expand the palette of printable substrates, while smart manufacturing systems will drive higher throughput and lower unit costs. Against this backdrop, organizations that embrace the transformative potential of digital textile printing will be well positioned to capitalize on emerging trends such as personalized apparel, home textiles with embedded sensors, and sustainable on-demand production models.

Uncovering Pivotal Technological and Market Forces Driving Unprecedented Transformations in the Digital Textile Printing Sphere

The digital textile printing sector is undergoing a period of profound transformation driven by both technological breakthroughs and shifting market expectations. Key advances in printhead design, such as piezoelectric nozzles capable of delivering ultrafine droplets, have elevated image clarity and color vibrancy while reducing ink consumption. Concurrently, the rise of pigment and reactive chemistries engineered specifically for digital deposition has widened the range of printable materials beyond conventional cotton and polyester, encompassing blends, technical textiles, and performance fabrics with specialized functionalities. These innovations are unlocking new applications, from sportswear incorporating moisture-wicking dyes to industrial fabrics requiring high abrasion resistance and UV stability.

Market dynamics are also evolving rapidly, as brands and retailers embrace direct-to-garment and small-batch production to meet consumer demand for personalization and local manufacturing. Digital channels have empowered designers to launch limited-edition collections with intricate graphic patterns, while data analytics platforms enable real-time optimization of production runs to minimize waste and stock obsolescence. At the same time, sustainability considerations are prompting a shift away from water-intensive analogue processes toward waterless or low-water digital methods that align with corporate responsibility goals and regulatory mandates. This shift is further accelerated by growing consumer awareness of environmental impacts, driving adoption of digital techniques that reduce chemical usage, energy consumption, and overall carbon footprint.

Moreover, Industry 4.0 principles-such as IoT integration, predictive maintenance, and automated workflow orchestration-are increasingly prevalent in digital textile printing facilities. By connecting printers, curing units, and finishing equipment through unified software platforms, manufacturers can achieve unprecedented levels of consistency, quality assurance, and throughput. Taken together, these transformative shifts underscore the emergence of a more agile, sustainable, and digitized textile ecosystem that is redefining how fabrics are designed, produced, and distributed.

Assessing the Far-Reaching Consequences of Recent United States Tariff Measures on Global Supply Chains and Cost Structures in Digital Textile Printing

The introduction of new tariff measures by the United States in early 2025 has had a considerable effect on the global dynamics of the digital textile printing industry, prompting stakeholders to reassess supply chains, sourcing strategies, and cost structures. Increased duties on imports of printed fabrics and components from key producing regions have elevated landed costs for raw materials such as specialized inks, printheads, and textile substrates. As a result, many manufacturers have undertaken a reconfiguration of their procurement networks, shifting orders toward domestic suppliers or alternative low-cost countries to mitigate tariff exposure. This reorientation has also spurred nearshoring initiatives, particularly among garment brands seeking greater visibility and control over production and delivery timelines.

Beyond the immediate financial impact, the tariff environment has reinforced the strategic importance of vertical integration and local production capabilities. Printers that have invested in in-house finishing and fabric preparation facilities are now better positioned to absorb cost fluctuations and maintain stable pricing for their customers. Conversely, companies reliant on fully outsourced manufacturing in tariff-affected territories are exploring joint ventures and licensing arrangements with regional partners in the Americas. These collaborations aim to establish tariff-free production corridors while leveraging localized expertise in print technology and textile processing.

In parallel, currency fluctuations and shipping rate volatility have magnified the influence of the new duties on end-to-end expenses. To offset higher input costs, many industry players are optimizing production schedules using advanced planning systems, consolidating shipments, and renegotiating long-term agreements with logistics providers. Ultimately, the cumulative impact of the United States tariffs in 2025 extends far beyond immediate price adjustments, prompting a holistic reevaluation of global operations and driving more resilient, regionally diversified business models.

Illuminating Market Dynamics Through In-Depth Segmentation of Printing Technologies, Materials, Inks, Applications, End Users, and Sales Channels

A granular examination of market segments reveals nuanced opportunities and challenges that stakeholders must navigate to capture full value. When considering printing technology, acid fabric printing remains relevant for specialty applications requiring vibrant color on nylon and silk, but inkjet printing has surged ahead as the dominant method due to its flexibility and scalability. Within inkjet systems, direct-to-fabric printers excel in high-volume textile yardage production, whereas direct-to-garment machines cater to on-demand customization for small batches and personalized apparel. Dye sublimation continues to flourish in the signage and soft signage domains, offering durability and colorfastness for polyester-based materials.

Insights from the analysis of material types further highlight the importance of fiber composition in determining end-use performance and aesthetic appeal. Natural fibers, especially cotton, linen, and silk, command strong interest for premium fashion and home decor applications, while synthetic fibers such as nylon, polyester, and rayon support technical textiles and cost-effective décor solutions. Blended materials that combine natural and synthetic elements are gaining traction for their ability to deliver both comfort and functionality.

Ink chemistries also present distinct value propositions: reactive inks remain the standard for cotton printing, disperse inks for polyester applications, pigment inks for universal compatibility, and sublimation inks for high-definition graphic reproductions. Application-based segmentation underscores the strategic differences between fashion and textiles, home decor, industrial fabrics, and soft signage. In fashion, the ability to produce accessories, apparel, and sportswear with complex prints drives premium margins, while curtains, furnishing fabrics, and wall coverings represent core revenue streams in the home decor space. Printer type segmentation between multi-pass and single-pass technologies further delineates solutions optimized for precision versus throughput, and the choice of direct sales or distributor networks influences customer engagement and service models.

This comprehensive research report categorizes the Digital Textile Printing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Printing Technology

- Printer Type

- Material Type

- Ink Type

- Application

- End-User

- Sales Channel

Revealing Regional Nuances and Opportunities in the Americas, Europe Middle East and Africa, and Asia-Pacific Corridors for Digital Textile Printing Innovation

Regional analysis uncovers distinct patterns of adoption, innovation, and growth potential across the Americas, Europe Middle East and Africa, and Asia-Pacific. In the Americas, mature consumer markets combined with strong fashion and home decor industries have encouraged widespread adoption of digital textile printing, particularly within small and medium enterprises that leverage direct-to-garment capability to serve niche customer segments. Supply chain resilience has also become paramount in North and South America, with investments in local ink production and substrate finishing reducing dependency on cross-border logistics.

Turning to the Europe Middle East and Africa region, stringent environmental regulations and elevated labor costs have driven a rapid shift toward low-input waterless printing methods. Luxury fashion houses in Europe are partnering with technology providers to pilot bio-based inks and recyclable textiles, while soft signage producers in EMEA are adopting single-pass printers to meet the demand for large-format graphics in exhibitions and retail displays. The Middle East has emerged as a strategic hub for sportswear customization, supported by state-sponsored design initiatives ahead of major international events.

Asia-Pacific remains the largest volume market, with China and India at the forefront of production capacity expansion. Manufacturers in this region benefit from an integrated ecosystem of textile mills, chemical producers, and print machine suppliers, enabling rapid scale-up and cost efficiencies. Nevertheless, rising environmental scrutiny and capacity rationalization have prompted leading players to adopt closed-loop water systems and advanced filtration technologies. Southeast Asian markets are also drawing increased investment in single-pass printing lines to serve booming e-commerce demand for affordable, fast-fashion items.

This comprehensive research report examines key regions that drive the evolution of the Digital Textile Printing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovations from Leading Providers Driving Growth and Differentiation in the Digital Textile Printing Market

The competitive landscape of digital textile printing is defined by a mix of long-standing industry incumbents and agile newcomers, each deploying unique strategies to differentiate and capture market share. Traditional printing equipment manufacturers are evolving their product portfolios to include high-resolution inkjet modules that integrate seamlessly with finishing and pre-treatment systems, thus offering turnkey solutions that reduce complexity for end users. Meanwhile, emerging technology companies are focusing on niche segments, developing micro-factory models optimized for ultra-low water usage and minimal footprint, appealing to localized producers and design studios.

Strategic partnerships have become a hallmark of industry growth, with collaborations between print machine providers and ink formulators yielding integrated platforms engineered for peak performance. In parallel, software innovators specializing in color management and workflow automation are expanding their presence by forging alliances with hardware vendors, enabling synchronized updates and continuous improvements in print quality. At the same time, several companies are investing in dedicated research centers to advance pigment dispersion, reactive dye calibration, and novel priming techniques, underscoring a commitment to pushing the boundaries of color gamut and substrate compatibility.

Service differentiation is also increasingly important, as suppliers bolster their offerings with training, on-site support, and digital marketplaces. Cloud-based analytics platforms that deliver real-time insights on machine utilization, maintenance scheduling, and consumption metrics are emerging as critical value-adds. By combining robust hardware, tailored chemical systems, and advanced software, leading organizations are redefining customer expectations and driving accelerated adoption of digital textile printing solutions across diverse end markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Textile Printing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeoon Technologies GmbH

- Agfa-Gevaert N.V.

- AM Printex Solutions

- Atexco Honghua Digital

- ATPColor Srl

- Brother Industries, Ltd.

- Colorjet Group

- Dover Corporation

- Durst Group AG

- Electronics for Imaging, Inc.

- Hollanders Printing Systems B.V.

- JV Digital Printing

- KERAjet S.A.

- Konica Minolta, Inc.

- Kornit Digital Ltd.

- Mimaki Engineering Co., Ltd.

- Mutoh Holdings Co. Ltd.

- Orange O Tec Pvt. Ltd.

- Ricoh Company, Ltd.

- Roland DG Corporation

- Seiko Epson Corporation

- SPGPrints B.V.

- Tex India Enterprises Pvt Ltd.

- The M&R Companies

Strategic Actions and Best Practices That Industry Leaders Can Implement to Capitalize on Emerging Trends in Digital Textile Printing

To thrive in the evolving digital textile printing environment, industry leaders should pursue a multifaceted strategy that balances operational efficiency with innovation. First, advancing sustainability initiatives by adopting waterless printing technologies and recyclable substrate solutions can enhance brand reputation while responding to tightening environmental regulations. Next, deepening partnerships with raw material suppliers and ink formulators will secure preferential access to cutting-edge chemistries, allowing for faster implementation of new color libraries and specialty dyes.

Simultaneously, organizations can expand their reach by optimizing sales channels; combining direct sales to large enterprise clients with distributor networks that serve small and medium enterprises can ensure comprehensive market coverage. Investing in advanced analytics and AI-driven workflow platforms will enable predictive maintenance, reduce downtime, and optimize ink consumption, translating to improved profitability and service levels. Furthermore, cultivating a robust training and certification program for operator competency can accelerate client onboarding and minimize production errors.

Finally, maintaining a proactive stance on regulatory developments and trade policy shifts will safeguard supply chain continuity. By diversifying production footprints and establishing nearshoring partnerships, companies can mitigate the risks associated with tariff fluctuations. Embracing these actionable recommendations will position organizations to capitalize on emerging market niches, drive sustainable growth, and reinforce their competitive advantage in the dynamic digital textile printing landscape.

Outlining Rigorous Qualitative and Quantitative Research Approaches Ensuring Accuracy, Reliability, and Relevance in the Study of Digital Textile Printing Trends

This research leverages a rigorous mixed-methods approach, combining primary interviews with industry executives, technicians, and end-users alongside extensive secondary data collection from trade publications, technical journals, and public filings. Qualitative insights were gathered through one-on-one interviews and focus group discussions, enabling deep exploration of emerging challenges, adoption drivers, and technology preferences. Quantitative data were sourced from proprietary surveys administered across a representative sample of print service providers, textile manufacturers, and brand owners, ensuring statistical validity and coverage across key geographies and application segments.

Data triangulation techniques were employed to validate findings, cross-referencing interview feedback with secondary intelligence and market observations. To ensure objectivity, all inputs were coded and systematically analyzed using software-assisted thematic mapping, while outliers were identified and re-examined through follow-up inquiries. The research team also conducted field visits to printing facilities in the Americas, Europe Middle East and Africa, and Asia-Pacific to observe operational workflows, assess equipment performance firsthand, and record best practices in pre-treatment, printing, and post-processing stages.

Ethical research standards underpinned every phase of the study, with strict confidentiality protocols for proprietary information and compliance with applicable data protection regulations. The resulting methodology offers a transparent and replicable framework, providing stakeholders with high confidence in the accuracy, reliability, and relevance of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Textile Printing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Textile Printing Market, by Printing Technology

- Digital Textile Printing Market, by Printer Type

- Digital Textile Printing Market, by Material Type

- Digital Textile Printing Market, by Ink Type

- Digital Textile Printing Market, by Application

- Digital Textile Printing Market, by End-User

- Digital Textile Printing Market, by Sales Channel

- Digital Textile Printing Market, by Region

- Digital Textile Printing Market, by Group

- Digital Textile Printing Market, by Country

- United States Digital Textile Printing Market

- China Digital Textile Printing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Synthesizing Main Findings and Forward-Looking Perspectives to Cement the Role of Digital Textile Printing in Next-Generation Fabric Innovation

Bringing together the core findings of this executive summary illuminates a digital textile printing sector at the intersection of technological innovation and sustainability imperatives. The market’s trajectory is being shaped by advanced printhead architectures, specialized ink chemistries, and AI-enabled workflows that collectively enable unparalleled customization, efficiency, and environmental stewardship. At the same time, external forces-such as trade policy adjustments and evolving regional regulations-are prompting a strategic recalibration of supply chains and production footprints.

In the realm of segmentation, distinctions across printing technologies, material substrates, ink types, application categories, and sales channels reveal targeted pockets of opportunity where stakeholders can differentiate through specialty offerings and value-added services. Regional nuances in the Americas, Europe Middle East and Africa, and Asia-Pacific underscore the importance of localized strategies that align with regulatory landscapes, consumer preferences, and infrastructure maturity. Meanwhile, the landscape of key providers highlights the critical role of partnerships, integrated solutions, and service excellence in driving adoption and retention.

By synthesizing these insights, decision-makers gain a comprehensive understanding of the forces shaping digital textile printing today, as well as the strategic levers available to navigate change and capture lasting competitive advantage. This analysis lays the groundwork for informed action, guiding organizations toward sustainable growth and innovation in a market defined by rapid technological advancement and dynamic global dynamics.

Connect with Associate Director of Sales and Marketing to Access the Definitive Digital Textile Printing Market Report Immediately

Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive digital textile printing market report and gain the strategic insights needed to evolve your business. Engage with Ketan to discuss how the findings can be tailored to your organization’s objectives and explore customized consultation options that align with your growth initiatives. Don’t miss the opportunity to leverage this in-depth analysis, which brings clarity to emerging trends, competitive strategies, and regional dynamics in the rapidly transforming digital textile printing industry. Harness the expertise compiled in this report to make data-driven decisions, optimize your technology investments, and drive sustainable innovation across your product and service offerings.

Taking action today will position your organization at the forefront of an industry experiencing unprecedented change. Reach out to Ketan Rohom to arrange an executive briefing, access complementary insights, and unlock the full potential of digital textile printing for your business goals.

- How big is the Digital Textile Printing Market?

- What is the Digital Textile Printing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?