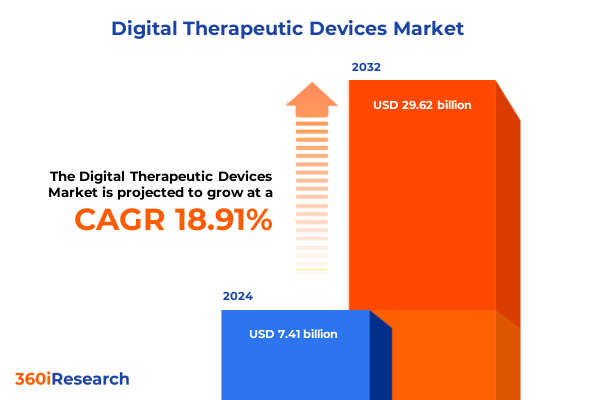

The Digital Therapeutic Devices Market size was estimated at USD 8.71 billion in 2025 and expected to reach USD 10.24 billion in 2026, at a CAGR of 19.10% to reach USD 29.62 billion by 2032.

Unveiling the Foundations of Digital Therapeutic Devices: A Compelling Introduction to the Rapidly Evolving Therapeutic Technology Landscape

The digital therapeutic devices landscape represents a paradigm shift in how healthcare interventions are conceived, delivered, and evaluated. These solutions, which leverage software algorithms to prevent, manage, or treat a range of medical conditions, are rapidly redefining the traditional boundaries between clinical care and patient self-management. As wearables, mobile applications, virtual or augmented reality environments, and web-based interfaces become ubiquitous, they offer unprecedented opportunities to augment evidence-based therapies with personalized, data-driven engagement pathways. Furthermore, the convergence of sensor technologies, real-time monitoring, and seamless connectivity has established a robust foundation for these interventions to integrate directly into routine care.

Against this backdrop, stakeholders across pharmaceutical companies, healthcare providers, technology firms, and payers are recalibrating their portfolios and partnerships to capture long-term value. Innovators are collaborating with patient advocacy groups and regulatory bodies to validate efficacy through rigorous clinical trials and real-world evidence studies. Concurrently, the proliferation of interoperable digital ecosystems is enabling more holistic care journeys, where therapeutic content can adapt dynamically based on patient responses and evolving comorbidities. Such dynamic feedback loops are not only enhancing adherence but also generating the critical data that drives iterative improvements in protocol design.

This executive summary delivers a comprehensive view of the forces propelling digital therapeutic devices forward. It distills the transformative trends reshaping the field, examines the impact of recent policy measures on supply chains, unpacks key segmentation and regional differentiators, and presents tactical guidance for business leaders. Through this structured analysis, you will gain the clarity needed to navigate complex market dynamics and unlock growth avenues in an increasingly competitive environment.

Charting the Convergence of Technology and Healthcare to Reveal Transformative Shifts Driving the Digital Therapeutic Devices Ecosystem Forward

Over the past several years, the digital therapeutic devices sector has experienced a series of transformative shifts, driven by technological maturation, evolving regulatory frameworks, and a growing recognition of patient-centric care models. Notably, the integration of artificial intelligence and machine learning has elevated the precision of behavioral interventions, enabling platforms to tailor content in real time. As predictive analytics become more sophisticated, these systems can anticipate symptom exacerbations and prompt preemptive coaching or clinical escalation, thereby reducing hospital readmissions and enhancing long-term outcomes.

Simultaneously, regulatory pathways have evolved to accommodate software-as-medical-device classifications, granting developers clearer guidance on evidentiary requirements for safety and efficacy. Collaboration between regulatory agencies and industry consortia has streamlined approval processes for certain digital therapeutics, fostering faster time-to-market without compromising rigorous validation standards. Moreover, the emergence of reimbursement codes specific to therapeutic software has begun to bridge the gap between clinical acceptance and commercial viability.

Interoperability initiatives are further catalyzing ecosystem growth, as application programming interfaces and data standards allow digital therapeutic platforms to integrate seamlessly with electronic health records and telehealth solutions. This convergence is fostering deeper engagement across primary care, specialty clinics, and home settings, thereby expanding use cases beyond traditional settings. Partnerships between digital health vendors and biopharmaceutical companies are also gaining traction, with several co-development agreements launched to embed therapeutic algorithms into broader treatment protocols. These strategic alliances underscore the sector’s shift from point solutions to holistic digital care journeys, establishing new benchmarks for patient empowerment and clinical collaboration.

Analyzing the Cumulative Repercussions of 2025 United States Tariff Policies on the Digital Therapeutic Devices Value Chain and Access

In early 2025, the implementation of new United States tariffs on imported electronic components, sensors, and processing units has imposed cumulative cost pressures on digital therapeutic device manufacturers. These levies, affecting both critical hardware modules and specialized subsystems, have compelled developers to reevaluate supply chain strategies. Consequently, production costs for wearable sensors, mobile interfaces, and connectivity modules have increased, prompting some companies to explore regional manufacturing partnerships or component redesigns to mitigate tariff exposures.

Moreover, ancillary impacts have rippled through logistics and distribution channels, as higher import duties have raised freight expenses and extended lead times for key materials. This has strained lean manufacturing models that rely on just-in-time inventory, driving certain vendors to establish buffer inventories or dual-sourcing arrangements. These adjustments, while necessary for continuity, have further elevated working capital requirements and compressed margins during the initial post-tariff quarters.

Despite these headwinds, the broader adoption of digital therapeutics continues, buoyed by patient demand and clinical evidence supporting their efficacy. Industry players are responding by reengineering modular architectures, emphasizing software-centric upgrades over hardware revisions. At the same time, strategic alliances with domestic electronics assemblers are growing more common, reflecting a shift toward localized production that can shield end-product pricing from international trade volatility. Looking ahead, sustained tariff pressures are likely to incentivize additional vertical integration and increased investments in modular hardware platforms, ultimately reshaping competitive dynamics within the digital therapeutic devices landscape.

Illuminating Key Segmentation Dynamics to Uncover Diverse Usage Patterns and Commercial Trajectories Within the Digital Therapeutic Devices Domain

Diving into the core segmentation of digital therapeutic devices reveals nuanced usage patterns and differentiated growth drivers across multiple dimensions. Within therapeutic areas, solutions targeting cardiovascular conditions-specifically heart failure and hypertension-remain at the forefront, driven by large patient populations and well-established clinical endpoints. At the same time, diabetes management platforms, tailored to both type 1 and type 2 profiles, are advancing rapidly through integrations with glucose monitoring systems and personalized coaching modules. Mental health interventions, covering anxiety, depression, and stress management, have surged in parallel, fueled by increased awareness and rising demand for scalable behavioral therapies. Meanwhile, musculoskeletal applications addressing chronic pain and physical rehabilitation are leveraging sensor-based feedback to optimize movement protocols, and respiratory tools for asthma and COPD are refining inhalation tracking and breath-control exercises to support long-term adherence.

Turning to delivery modes, mobile applications dominate early adoption due to their ubiquitous availability on smartphones, while wearable devices offer continuous engagement through haptic feedback and physiological monitoring. Virtual and augmented reality experiences are gaining footholds in cognitive and motor-skill rehabilitation, delivering immersive therapeutic environments that heighten patient motivation. Web-based platforms, often accessed via desktop portals, serve as hubs for clinician dashboards and comprehensive progress reporting.

End-user settings range from patient homes-where remote monitoring and digital coaching foster sustained engagement-to hospitals and clinics integrating these solutions into multidisciplinary care pathways. Research institutes contribute robust clinical validation protocols that underpin regulatory submissions and payer negotiations. Finally, distribution strategies extend across offline channels, including clinical partnerships and device distributors, and online platforms that facilitate direct-to-consumer outreach. These interwoven segment dynamics underscore the importance of tailored approaches for product development, commercialization, and stakeholder alignment within the digital therapeutic devices sphere.

This comprehensive research report categorizes the Digital Therapeutic Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapeutic Area

- Delivery Mode

- Distribution Channel

- End User

Decoding the Regional Nuances That Shape Adoption and Innovation Trends Across the Americas, EMEA, and Asia-Pacific Digital Therapeutic Markets

A regional lens on digital therapeutic devices highlights distinct enablers and obstacles within major geographies. In the Americas, widespread smartphone penetration and established reimbursement frameworks have accelerated adoption, particularly for mobile and wearable solutions. Healthcare providers in the United States are piloting digital therapeutics in value-based care models, generating real-world evidence to support broader payer coverage. Canada is witnessing growing collaborations between provincial health authorities and local developers, focusing on chronic disease management programs that reduce hospital utilization.

Across Europe, Middle East, and Africa, regulatory alignment around software-as-medical-device directives has created more predictable approval pathways, although reimbursement remains fragmented among national health systems. Western European countries are deploying digital therapeutics within mental health and cardiovascular clinics, while the Gulf Cooperation Council region is exploring partnerships to introduce wellness-oriented pilots in employee health programs. In African markets, mobile-first strategies are emerging to address access barriers, leveraging telehealth synergies to reach underserved populations.

In Asia-Pacific markets, high population densities and rapid digital infrastructure expansion have fostered vibrant innovation hubs. Japan and South Korea are piloting augmented reality–based rehabilitation offerings in hospital networks, while Australia is integrating digital therapeutic coverage into national health insurance schemes. China’s vast patient base has attracted significant investment in diabetes management apps, with several local startups forging alliances with international academic centers to validate clinical protocols. These regional distinctions inform tailored market entry strategies and partnerships, underscoring the need for context-sensitive commercialization roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Digital Therapeutic Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Innovations and Competitive Positioning of Leading Players Propelling Growth in the Digital Therapeutic Devices Industry

Leading organizations in the digital therapeutic devices landscape are differentiating through unique value propositions, strategic partnerships, and robust clinical pipelines. One prominent player has distinguished itself by integrating cognitive behavioral therapy modules into a comprehensive mobile platform, securing multiple clearance pathways and forging collaborations with payers to embed access into employee wellness programs. Another innovator has built a cloud-based analytics engine that aggregates multimodal sensor data, enabling wearable-enabled interventions to adapt in real time to patient physiology and adherence patterns.

A third contender has focused on virtual reality paradigms for motor rehabilitation, partnering with academic medical centers to conduct randomized trials demonstrating significant gains in functional outcomes for stroke survivors. Simultaneously, a company specializing in digital diabetes management has leveraged continuous glucose monitor integrations and AI-driven coaching to reduce hypoglycemic events among type 1 populations. These enterprises are also forging alliances with pharmaceutical firms to explore combination approaches, where prescription therapies are paired with digital behavioral support to enhance therapeutic efficacy.

Across the board, successful market entrants harness cross-industry partnerships-encompassing technology vendors, healthcare providers, and specialty distributors-to streamline go-to-market efforts and bolster clinician adoption. Their strategic emphasis on longitudinal evidence generation and payer engagement underscores a shared recognition that sustained growth in this sector depends on measurable clinical impact, regulatory compliance, and clear pathways for reimbursement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Therapeutic Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 2Morrow, Inc.

- Akili Interactive Labs, Inc.

- Big Health Ltd.

- Biofourmis, Inc.

- Canary Health, Inc.

- Click Therapeutics, Inc.

- CureApp, Inc.

- DarioHealth Corp.

- Kaia Health Software GmbH

- MindMaze SA

- Noom, Inc.

- Omada Health, Inc.

- Pear Therapeutics, Inc.

- Propeller Health, Inc.

- Teladoc Health, Inc.

- Vida Health, Inc.

- WellDoc, Inc.

Empowering Industry Leaders with Tactical Strategies to Accelerate Adoption, Enhance Efficacy, and Navigate Regulatory Complexities in Digital Therapeutics

To capitalize on the accelerating momentum of digital therapeutic devices, industry leaders must pursue coordinated strategies that address technology, regulatory, and market adoption imperatives. First, forging proactive engagements with health authorities and standard-setting organizations will facilitate clearer guidance on software validation, safety protocols, and quality management systems, thereby reducing approval timelines. Concurrently, establishing transparent communication channels with payers and provider networks can drive the creation of novel reimbursement models tailored to outcomes-based care, mitigating cost barriers for patients and healthcare systems.

Second, investing in interoperability frameworks-such as open APIs and adherence to emerging data standards-will enable seamless integration of digital therapeutics into electronic health records and telehealth platforms. This technical alignment not only enhances clinician workflows but also lays the groundwork for comprehensive patient journeys spanning acute, post-acute, and chronic care. Third, prioritizing rigorous evidence generation through real-world data studies and randomized controlled trials will substantiate clinical value propositions, fostering trust among prescribers and health economists alike.

Finally, adopting patient-centric design principles and inclusive usability testing ensures that solutions resonate with diverse demographic cohorts, enhancing engagement and retention. Complementing these efforts with strategic alliances-across technology vendors, pharmaceutical firms, and specialty distributors-will accelerate market entry and broaden global reach. By integrating these tactical recommendations, industry leadership can unlock sustainable growth and deliver meaningful health outcomes at scale.

Detailing the Rigorous Research Framework and Analytic Techniques Underpinning Comprehensive Insights Into Digital Therapeutic Devices

This research report is underpinned by a multifaceted methodology designed to ensure depth, accuracy, and actionable insights into the digital therapeutic devices domain. Firstly, extensive secondary research was conducted across peer-reviewed journals, regulatory databases, patent filings, and conference proceedings to map out technological advancements, policy developments, and emerging clinical evidence. This phase included analysis of medical device registries, health technology assessment reports, and interoperability standards to establish a comprehensive contextual framework.

Complementing this desk research, primary qualitative interviews were carried out with a broad spectrum of stakeholders, including medical affairs leaders, regulatory specialists, reimbursement experts, and practicing clinicians across key geographies. These conversations provided firsthand perspectives on adoption barriers, implementation challenges, and evolving stakeholder expectations. Where possible, interviews were supplemented by anonymized case studies that illustrate real-world deployment scenarios in both acute and community care settings.

Quantitative data were sourced from proprietary healthcare databases and public reporting platforms, enabling triangulation of adoption metrics, clinical outcome measures, and investment trends. Statistical validation techniques were applied to ensure data robustness, while thematic analysis of interview transcripts ensured that qualitative insights were systematically captured. All findings underwent peer review by an advisory panel of digital health thought leaders, with iterative refinements made to enhance clarity and relevance. This rigorous approach ensures that the report’s conclusions and recommendations are both empirically grounded and strategically insightful.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Therapeutic Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Therapeutic Devices Market, by Therapeutic Area

- Digital Therapeutic Devices Market, by Delivery Mode

- Digital Therapeutic Devices Market, by Distribution Channel

- Digital Therapeutic Devices Market, by End User

- Digital Therapeutic Devices Market, by Region

- Digital Therapeutic Devices Market, by Group

- Digital Therapeutic Devices Market, by Country

- United States Digital Therapeutic Devices Market

- China Digital Therapeutic Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings to Illuminate Future Pathways for Innovation and Collaboration in the Expanding Digital Therapeutic Devices Sector

The digital therapeutic devices sector stands at a pivotal juncture, where technological innovation, regulatory maturation, and shifting stakeholder dynamics are coalescing to drive the next wave of healthcare transformation. Through this analysis, we have illuminated the foundational role of evidence-based software interventions, the imperative of modular and interoperable architectures, and the influence of evolving tariff policies on supply chain economics. We have also unpacked the heterogeneous demands across therapeutic areas-from cardiovascular and diabetes management to mental health, musculoskeletal rehabilitation, and respiratory care-while mapping how delivery modes and end-user contexts shape adoption pathways.

Regional insights emphasize the criticality of localized strategies, as reimbursement landscapes and regulatory requirements vary markedly across the Americas, EMEA, and Asia-Pacific. Examination of leading companies underscores the value of differentiated clinical evidence, strategic alliances, and patient-centric design. Finally, actionable recommendations guide industry leaders toward proactive regulatory engagement, data interoperability, evidence generation, and inclusive design practices. In synthesizing these elements, it becomes clear that sustained success in digital therapeutics will hinge on collaborative ecosystems where technology vendors, healthcare providers, and payers align around shared outcomes.

Looking forward, the convergence of real-world data analytics, personalized intervention pathways, and scalable distribution models promises to elevate patient care while unlocking new value propositions for stakeholders. This comprehensive overview offers a roadmap for navigating the complexities of the digital therapeutic devices landscape, ensuring that innovators and investors alike are equipped to shape the future of medicine.

Secure Exclusive Access to In-Depth Digital Therapeutic Devices Research and Connect Directly with Associate Director of Sales & Marketing

To gain the most comprehensive and actionable insights into the burgeoning digital therapeutic devices arena, decision-makers are invited to secure this in-depth research report. By partnering directly with Ketan Rohom, Associate Director of Sales & Marketing, you can obtain tailored guidance on integrating these emerging therapeutics into your strategic roadmap. Engage with Ketan to explore exclusive data packages, clarify your specific informational needs, and discuss bespoke consulting services that align with your organizational objectives. This report provides the clarity you need to navigate evolving regulatory frameworks, harness innovative delivery platforms, and optimize patient engagement strategies. Reach out today to unlock a competitive edge and accelerate your journey toward shaping the future of digital health.

- How big is the Digital Therapeutic Devices Market?

- What is the Digital Therapeutic Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?