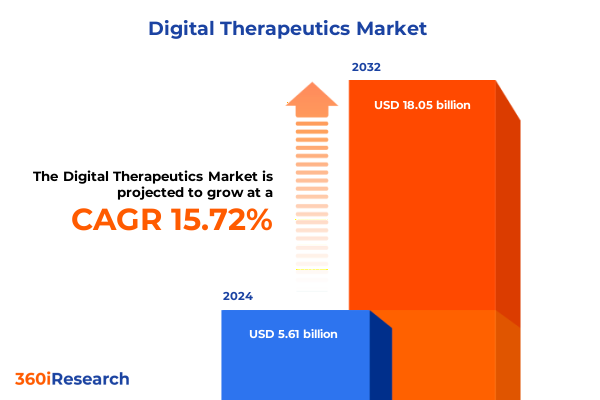

The Digital Therapeutics Market size was estimated at USD 5.61 billion in 2024 and expected to reach USD 6.41 billion in 2025, at a CAGR of 15.72% to reach USD 18.05 billion by 2032.

Exploring the Rise and Promise of Digital Therapeutics as a Catalyst for Accessible, Effective, and Personalized Healthcare Interventions

Digital therapeutics represent a paradigm shift in healthcare delivery, leveraging software-driven interventions to treat, manage, and prevent a wide range of medical conditions. Unlike traditional wellness apps, these clinically validated solutions undergo rigorous testing to demonstrate efficacy. For example, Sleepio, a digital cognitive behavioral therapy platform for insomnia, received endorsement from the UK’s National Institute for Health and Care Excellence (NICE), underscoring the regulatory and clinical confidence in software-based care pathways.

The rapid acceptance of virtual medicine, accelerated by global disruptions such as the Covid-19 pandemic, has paved the way for digital tools to address treatment gaps in mental health, chronic disease management, and beyond. Stakeholders across the ecosystem-including healthcare providers, payers, and patients-are increasingly recognizing the capacity of digital therapeutics to improve outcomes, enhance accessibility, and optimize resource utilization, as highlighted in forward-looking industry analyses on emerging therapeutic areas and technology adoption patterns.

Innovations in AI, Virtual Reality, and Data-Driven Care Models That Are Redefining Treatment Pathways and Patient Engagement

Artificial intelligence and virtual reality are redefining the therapeutic landscape by enabling hyper-personalized interventions and immersive treatment modalities. AI-driven algorithms continuously analyze patient data to adapt treatment plans in real time, improving adherence and efficacy. Concurrently, virtual reality applications are expanding beyond gaming into clinical settings, offering new avenues for exposure therapy in phobia treatment and pain management, indicating a maturing ecosystem of science-backed innovations.

Regulatory frameworks and reimbursement pathways are also evolving to support digital therapeutics. In mid-2024, the U.S. Centers for Medicare & Medicaid Services proposed new billing codes specifically for digital mental health treatments-marking a significant milestone in recognizing software-based therapies as reimbursable medical services. This shift not only validates the clinical value of digital interventions but also incentivizes insurers and providers to integrate these tools into standard care protocols, underscoring a maturing market poised for broader adoption.

Assessing the Wide-Ranging Consequences of Newly Imposed United States Tariffs on Digital Therapeutics Supply Chains and Innovation

In April 2025, the U.S. government implemented a baseline 10% tariff on imported medical devices and electronics, extending steeper duties to key trading partners. These levies have raised the cost of hardware components essential to digital therapeutics, from wearable sensors to diagnostic tools, directly impacting device manufacturers and healthcare providers. Experts anticipate that increased input costs may be passed on to end users, potentially slowing adoption rates for cost-sensitive applications and straining provider budgets.

Moreover, innovation and global collaboration in digital health face new bottlenecks due to tariff-driven cost pressures and geopolitical friction. Startups and scale-ups reliant on cross-border supply chains may defer R&D investments as margins tighten, while delays in hardware delivery and increased production costs could impede product launches. Some organizations are pivoting toward cloud-based solutions, seeking to minimize dependency on tariff-affected physical infrastructure and to maintain continuity of care through digitally delivered services.

Unearthing Critical Segmentation Insights Spanning Therapeutic Areas, Delivery Modes, End Users, Applications, Distribution, Pricing, and Deployment Models

The digital therapeutics market spans multiple therapeutic areas, each with its own clinical nuances and patient needs. Cardiovascular solutions, encompassing arrhythmia management, heart failure support, and hypertension control, coexist alongside diabetes interventions for gestational, Type 1, and Type 2 varieties. Mental health offerings address anxiety disorders, depression, PTSD, and stress management, while neurology solutions focus on epilepsy, multiple sclerosis, and Parkinson’s. Oncology and respiratory care further extend the spectrum, targeting breast and lung cancers as well as asthma and COPD.

Delivery modes range from cloud platforms to desktop applications, mobile interfaces, virtual reality environments, and web-based portals, each tailored to specific patient and provider workflows. Users include employers integrating wellness programs, healthcare professionals such as nurses, physicians, and therapists, patients seeking self-management tools, and payers evaluating value-based care outcomes. Functional applications cover disease management, rehabilitation, remote monitoring with sensor and wearable integration, and overall wellness management. Products are distributed directly through app stores and company websites, hospital channels, or pharmacy networks, and are monetized through licensing, pay-per-use models, or subscription plans-whether monthly or annual. Finally, deployment can be cloud-based or on-premise, depending on organizational requirements and data governance considerations.

This comprehensive research report categorizes the Digital Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Therapy Area

- Platform

- Channel Type

- End User

- Deployment Mode

Examining Regional Dynamics and Growth Drivers Across Americas, Europe Middle East and Africa, and Asia-Pacific Digital Therapeutics Markets

In the Americas, the United States leads the digital therapeutics sector with robust regulatory support, high smartphone and broadband penetration, and growing reimbursement frameworks. Employer-sponsored programs and integrated health system initiatives drive adoption, while strategic partnerships between technology vendors and payers accelerate clinical trial scale-up and market access. Canada’s market, though smaller, shows strong uptake in mental health applications, supported by public healthcare systems seeking cost-effective care alternatives.

Across Europe, Middle East, and Africa, digital health policies and interoperability mandates in countries like Germany, France, and the UK underpin expansive chronic disease management offerings. The European Union’s digital health strategy promotes cross-border data exchange, enhancing the scalability of regionally developed solutions. In the Asia-Pacific region, rapid growth is fueled by rising chronic disease prevalence, burgeoning middle-class healthcare spending, and investments in elderly care solutions. China and India emerge as key growth markets, reflecting both public and private sector initiatives to close care gaps through digital innovation.

This comprehensive research report examines key regions that drive the evolution of the Digital Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Market Players Driving Digital Therapeutics Advancement Through Strategic Partnerships, Innovative Solutions, and Market Entry Strategies

Omada Health’s success in completing a high-profile IPO underscores the market’s renewed investor confidence in digital therapeutics. The company achieved a valuation of $1.28 billion at its Nasdaq debut, raising $150 million for chronic condition management platforms targeting diabetes and hypertension. Its strategic AI-powered nutrition agent and expansion into “food as medicine” illustrate the sector’s drive toward personalized, data-driven care ….

Hinge Health has similarly demonstrated growth and resilience, raising $437 million in its NYSE listing and achieving profitability for the first time. Its comprehensive musculoskeletal care model combines wearable devices with expert-led digital exercise therapy, cementing its position in a competitive field alongside peers such as Sword Health. Strategic alliances with virtual care providers and consumer tech companies further amplify its market reach and clinical impact.

WellDoc’s BlueStar platform stands out for its strong life sciences-based business model, leveraging randomized clinical trials to demonstrate significant A1C reductions in diabetes management. Collaborations with global pharmaceutical partners and integrated AI coaching reinforce its leadership in cardiometabolic and behavioral health interventions. Propeller Health’s AI-enabled smart inhalers exemplify effective sensor integration for respiratory care, delivering real-world patient monitoring and provider insights that enhance adherence and outcomes ….

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 2morrow Inc.

- Abbott Laboratories

- AptarGroup, Inc.

- Big Health, Inc.

- Biofourmis Inc.

- Canary Health Technologies Inc.

- Click Therapeutics, Inc.

- CogniFit Inc.

- Cognoa, Inc.

- CureApp, Inc.

- DarioHealth Corp.

- F. Hoffmann-La Roche Ltd

- Fitterfly Healthtech Private Limited by PB Healthcare Services Pvt. Ltd.

- GAIA AG by Ethypharm SAS

- Glooko, Inc.

- Grünenthal GmbH

- H2O Therapeutics Co.

- Headspace Inc.

- Hinge Health, Inc.

- Hyfe, Inc.

- Kaia Health Software Inc.

- Lark Technologies, Inc.

- LifeScan, Inc.

- Lumanity Inc.

- Lumos Labs

- MedRhythms

- Noom, Inc.

- Novartis AG

- Novo Nordisk A/S

- Omada Health, Inc.

- Otsuka Holdings Co., Ltd.

- ResMed, Inc.

- SilverCloud by American Well Corporation

- Teladoc Health, Inc.

- Teva Pharmaceutical Industries Ltd.

- Vida Health, Inc.

- Virtual Therapeutics Corp.

- Welldoc, Inc.

Implementing Strategic Actions for Industry Leaders to Navigate Regulatory Complexities, Leverage Emerging Technologies, and Maximize Market Potential

Industry leaders must prioritize rigorous evidence generation and regulatory engagement to differentiate their offerings in an increasingly competitive landscape. By collaborating closely with healthcare providers to co-design workflows, organizations can ensure seamless integration into clinical practice and demonstrate tangible outcomes that support reimbursement negotiations. Embracing open standards for data interoperability not only enhances patient care continuity but also facilitates scalable solutions capable of adapting to future regulatory requirements.

To mitigate supply chain risks and cost pressures, companies should diversify component sourcing and explore software-centric deployment models that reduce hardware dependencies. Investment in robust cybersecurity frameworks and transparent data governance will build stakeholder trust and protect patient privacy. Finally, adopting agile development methodologies and leveraging real-world evidence will enable faster iteration, informing product improvements and sustaining long-term commercial viability.

Outlining a Rigorous Research Methodology Incorporating Primary Interviews, Secondary Data Analysis, and Robust Quality Assurance Protocols

This research combines primary interviews with C-suite executives, clinical experts, and payers to capture first-hand insights into adoption drivers and barriers. Secondary data sources, including peer-reviewed journals, regulatory filings, and reputable industry publications, provide a comprehensive view of market dynamics. Each data point undergoes rigorous cross-verification to ensure accuracy and relevance.

Quantitative analyses leverage advanced statistical techniques to identify patterns in adoption rates and technology efficacy, while qualitative thematic analysis distills strategic imperatives from stakeholder perspectives. A structured quality assurance protocol, involving multi-level editorial and subject matter reviews, underpins the report’s integrity, guaranteeing actionable, evidence-based recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Therapeutics Market, by Product Type

- Digital Therapeutics Market, by Therapy Area

- Digital Therapeutics Market, by Platform

- Digital Therapeutics Market, by Channel Type

- Digital Therapeutics Market, by End User

- Digital Therapeutics Market, by Deployment Mode

- Digital Therapeutics Market, by Region

- Digital Therapeutics Market, by Group

- Digital Therapeutics Market, by Country

- United States Digital Therapeutics Market

- China Digital Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Key Takeaways on Market Trends, Strategic Imperatives, and Future Opportunities in the Evolving Digital Therapeutics Landscape

Digital therapeutics are reshaping the future of healthcare by combining clinical science with cutting-edge technology to deliver scalable, patient-centric solutions. The convergence of AI, VR, and real-world data is driving personalized treatments across therapeutic areas, while evolving reimbursement and regulatory pathways are legitimizing software-based care.

As trade dynamics introduce new cost challenges, companies that adopt flexible deployment models and diversify supply chains will maintain resilience. Collaborations between technology developers, healthcare providers, and payers will be critical in driving adoption, improving outcomes, and securing sustainable revenue streams. Collectively, these trends point toward a maturing digital therapeutics ecosystem poised for continued innovation and market expansion.

Engage with Ketan Rohom to Secure Comprehensive Market Intelligence and Empower Data-Driven Decision Making with the Digital Therapeutics Report

As organizations seek to harness the full potential of digital therapeutics, partnering with an expert advisor can transform market insights into decisive strategic actions. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore how tailored intelligence on therapeutic innovations, regulatory developments, and competitive positioning can accelerate growth and reduce time to value. Engage directly to unlock a comprehensive market research report that equips your leadership team with the clarity and confidence to navigate this rapidly evolving sector and achieve sustainable differentiation.

- How big is the Digital Therapeutics Market?

- What is the Digital Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?