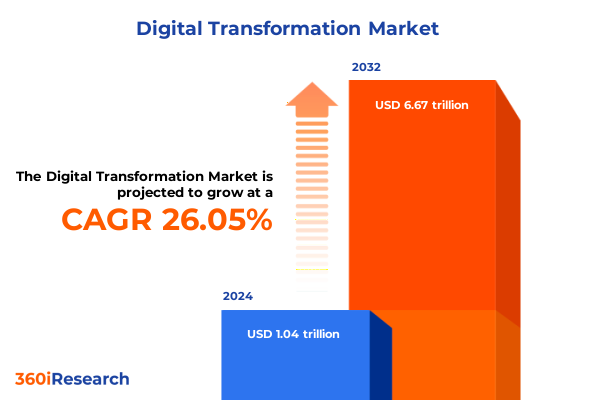

The Digital Transformation Market size was estimated at USD 1.30 trillion in 2025 and expected to reach USD 1.62 trillion in 2026, at a CAGR of 26.23% to reach USD 6.67 trillion by 2032.

Empowering organizations with strategic insights to embark on digital transformation journeys amid rapid technological advancement and market disruption

In today’s rapidly evolving technological environment, organizations recognize digital transformation as a strategic imperative to drive operational efficiency, customer engagement, and competitive advantage. According to Deloitte’s Technology Vision 2025, AI is becoming foundational to enterprise IT, demanding that firms align strategy, talent, architecture, and data to capture its full potential. McKinsey’s 2025 technology trends report highlights the emergence of agentic AI and application-specific semiconductors as catalysts for innovation across industries.

Players across sectors are embedding cloud technologies, advanced analytics, and edge computing to optimize workflows and enhance decision-making. Deloitte’s Chief Transformation Officer study finds that companies are appointing full-time transformation leaders and increasing funding for tech modernization to maintain execution momentum and refine performance metrics. These shifts underscore the need for a holistic approach that integrates change management, talent development, and robust performance measurement to sustain digital initiatives.

Moreover, digital transformation efforts now intersect with regulatory, sustainability, and geopolitical factors, requiring adaptable frameworks that can navigate data privacy mandates and supply chain complexities. Deloitte’s 2025 technology outlook anticipates that businesses will seek a hybrid blend of public and private cloud infrastructures to balance flexibility, security, and cost predictability amid evolving global dynamics.

Unveiling the pivotal shifts in cloud and AI adoption, edge computing growth, and cybersecurity emphasis that are reshaping enterprise transformation pathways

One of the most profound transformations in recent years has been the rapid proliferation of artificial intelligence across enterprise functions. Organizations are leveraging AI not only to automate routine tasks but also to drive strategic decision making and create new revenue streams. Deloitte’s annual Tech Trends report emphasizes that AI is now an essential ingredient across the technology stack, from the server room to the board room, mandating greater alignment between data, talent, architecture, and governance frameworks. Business Insider reports that leading consulting firms have integrated proprietary AI chatbots and agentic AI tools into both internal processes and client engagements, signaling a shift toward continuous, data-driven transformation.

Cloud computing continues to redefine how organizations deliver and consume IT services, prompting a reevaluation of hybrid and multi-cloud strategies. After years of public cloud dominance, many enterprises are rediscovering private and sovereign cloud options to enhance security and compliance. Deloitte’s insights reveal that unanticipated public cloud costs are driving renewed interest in private cloud models that offer better cost predictability and data sovereignty, particularly for GenAI and real-time analytics workloads.

Edge computing is gaining momentum as businesses seek to process data closer to where it is generated, reducing latency and unlocking new capabilities for automation and real-time insights. IDC predicts that by 2027, more than half of Asia-Pacific organizations will modernize their cloud architectures to include edge and AIOps capabilities, enabling accelerated innovation and operational efficiency.

Cybersecurity has emerged as a top priority, driven by the expanding attack surface of IoT, generative AI, and cloud environments. According to an IDC report, U.S. tariffs and supply chain disruptions are exacerbating hardware inflation, which in turn increases the cost of securing critical infrastructure. This dynamic is prompting organizations to integrate security at every layer, from Zero Trust architectures to AI-powered threat detection solutions.

Assessing the overall effects of 2025 U.S. tariff measures on technology supply chains, digital infrastructure costs, and enterprise transformation strategies

The imposition of 25% tariffs on semiconductors, servers, networking equipment, and other critical hardware components has created significant headwinds for digital transformation initiatives. Enterprises sourcing data center infrastructure and IoT devices are now facing higher capital costs and extended lead times, leading to project delays and budget reallocations. GlobalData analysts note that while discretionary IT spending has tightened, companies investing in cloud and AI solutions are better positioned to absorb these shocks by transitioning to software-defined architectures that mitigate hardware dependence.

Tariff measures have driven price increases of 12–20% on essential IT hardware, including servers and edge devices, compelling many organizations to extend equipment lifecycles and accelerate cloud migrations to avoid upfront procurement costs. Reports from Matrix Integration highlight that these inflationary pressures have prompted a shift toward vendor diversification and preventive maintenance strategies that can defer expensive refresh cycles without compromising operational performance.

Beyond immediate cost pressures, executives across manufacturing and technology sectors report a diversion of digital transformation budgets toward tariff mitigation, slowing the rollout of innovation programs at a critical juncture. An AMT survey of manufacturing technology leaders found that 86% of respondents reported increased landed costs due to tariffs, while 83% experienced margin erosion, forcing trade-offs between essential modernization projects and cost containment measures.

Revealing segmentation frameworks that categorize digital transformation markets by product, deployment, organization size, function, and industry verticals

The market segmentation framework provides a comprehensive lens to understand the dynamics of digital transformation across multiple dimensions. Based on product type, offerings are categorized into services and solutions, with services divided into managed and professional services, while solutions encompass business domain transformation, business model transformation, business process transformation, and cloud transformation.

Deployment preferences differentiate between on-cloud and on-premises implementations, reflecting varied organizational priorities around scalability, cost structures, and regulatory compliance. Organizational size segmentation highlights the contrasting strategic objectives of large enterprises, which often emphasize scale and global integration, and small to medium-sized enterprises, which prioritize agility, cost efficiency, and rapid time to value.

Functional segmentation underscores unique requirements across accounting & finance, human resources, IT & operations, marketing & sales, and research & development, illuminating how digital tools must be tailored to support distinct processes and performance metrics. Industry vertical segmentation offers further granularity, tracking adoption trends across automotive; education, with a focus on e-learning solutions and learning analytics; energy & utilities; finance, emphasizing fraud detection and mobile banking; government & defense, spanning border security & surveillance, command & control systems, e-governance, and tax & revenue management; healthcare, through health analytics and remote patient monitoring; manufacturing; media & entertainment, covering audience engagement & personalization and content creation & generation; retail, including eCommerce platforms, inventory management software, and point of sale systems; telecommunications; and transportation & logistics, deploying fleet management, intelligent parking systems, and traffic management.

This comprehensive research report categorizes the Digital Transformation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Deployment

- Organization Size

- Business Function

- Industry Verticals

Highlighting key regional dynamics driving digital transformation adoption in the Americas, EMEA, and Asia-Pacific with distinctive opportunities and obstacles

North America continues to lead global digital transformation efforts, with enterprise technology spending growing at 6.1%, driven by cloud migration, AI integration in financial services, retail, and media, and a deepening focus on cybersecurity resilience. Businesses in the United States and Canada are leveraging hybrid architectures to optimize costs and maintain operational agility, positioning the region at the forefront of enterprise IT innovation.

Across Europe, Middle East & Africa, digital transformation adoption faces headwinds from fragmented regulations, stringent data privacy requirements, and varied levels of digital maturity. European enterprises contribute roughly 28% to the public cloud market, driven by data localization policies and GDPR compliance, while organizations in the Middle East and Africa are increasingly embracing hybrid cloud strategies to modernize government services and energy sector operations.

Asia-Pacific exhibits robust expansion, with cloud spending projected to reach $250 billion in 2025, underpinned by major investments from leading providers and substantial government support for AI and infrastructure modernization. IDC predicts that by 2027, more than half of APAC businesses will modernize their cloud architectures to boost efficiency, highlighting the region’s rapid progression toward multi-cloud and edge-enabled environments.

This comprehensive research report examines key regions that drive the evolution of the Digital Transformation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering how leading global technology and consulting firms leverage AI, cloud, and digital services to accelerate enterprise transformation initiatives

Leading consulting and technology firms are redefining their service portfolios to capitalize on digital transformation demand. Accenture has consolidated its offerings into a unified “Reinvention Services” business unit, emphasizing AI-enabled platforms and strategic consulting to deliver end-to-end transformation solutions. In Q3 2025, Accenture reported significant growth in AI-related revenues and announced new client engagements demonstrating automated supply chain optimization and intelligent business process redesign.

Amazon Web Services continues to expand its global infrastructure footprint, investing billions in Asia-Pacific and Latin America to support surging demand for cloud and AI services. AWS’s long-term investments in new data centers and region expansions underscore its commitment to meeting enterprise requirements for scalability, resilience, and low-latency performance. Collaborative ventures with local partners further reinforce AWS’s strategy to deliver culturally attuned AI capabilities and industry-specific solutions.

Strategic partnerships are also shaping the competitive landscape. Accenture and Microsoft recently announced an expanded collaboration to co-develop generative AI-powered cyber solutions, combining Accenture’s cybersecurity expertise with Microsoft’s security technologies to fortify security operation centers, automate threat detection, and enhance identity management for global clients.

This comprehensive research report delivers an in-depth overview of the principal market players in the Digital Transformation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- AVEVA Group PLC

- Baidu, Inc.

- Cisco System Inc.

- Cognex Corporation

- Emerson Electric Co.

- Ericsson AB

- Google LLC by Alphabet, Inc.

- Hewlett Packard Enterprise Company

- Innominds Software India Private Limited

- Intel Corporation

- International Business Machines Corporation

- Kellton Tech Solutions Ltd.

- Microsoft Corporation

- NVIDIA Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- Siemens AG

- THALES group

- TIBCO Software, Inc

- Wipro Limited

- Yokogawa Electric Corporation

Delivering practical strategies that empower leaders to optimize transformation roadmaps, mitigate risks, and capitalize on emerging digital opportunities

Organizations must prioritize the integration of AI and advanced analytics into core business processes to unlock new value streams and enhance decision making. Establishing cross-functional centers of excellence can accelerate AI adoption by pooling expertise in data science, engineering, and change management. Furthermore, adopting modular, API-driven architectures will reduce dependency on specific vendors and enable seamless integration of emerging technologies into existing landscapes.

To mitigate risks associated with hardware inflation and supply chain disruptions, industry leaders should diversify supplier networks and explore alternative sourcing strategies, including domestic manufacturing and strategic partnerships with trusted vendors. Accelerating the shift toward software-defined infrastructures and cloud-native services will help organizations decouple transformation roadmaps from tariff-exposed hardware components, preserving momentum in digital initiatives.

Detailing the rigorous research approach combining primary interviews, surveys, and comprehensive secondary analysis to underpin market insights accurately

This research combines primary and secondary methodologies to ensure a rigorous and comprehensive analysis. Primary research included in-depth interviews with C-level executives and technology directors across key industries, as well as an online survey capturing the perspectives of over 150 digital transformation leaders worldwide.

Secondary analysis drew on authoritative sources, including industry reports, corporate disclosures, regulatory filings, and reputable news outlets. Data triangulation methods were applied to validate insights, while qualitative synthesis techniques ensured that nuanced viewpoints and emerging trends were accurately represented.

The integration of quantitative and qualitative findings underpins the actionable insights and strategic recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Digital Transformation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Digital Transformation Market, by Product Type

- Digital Transformation Market, by Deployment

- Digital Transformation Market, by Organization Size

- Digital Transformation Market, by Business Function

- Digital Transformation Market, by Industry Verticals

- Digital Transformation Market, by Region

- Digital Transformation Market, by Group

- Digital Transformation Market, by Country

- United States Digital Transformation Market

- China Digital Transformation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Summarizing key takeaways and reinforcing the imperative for organizations to drive digital transformation with agility, innovation, and strategic foresight

Digital transformation remains a pivotal enabler of organizational resilience, innovation, and competitive differentiation in an increasingly complex global landscape. As technological advancements continue to accelerate, businesses must adopt agile approaches, invest strategically in AI and cloud capabilities, and cultivate talent with digital fluency.

The convergence of evolving regulatory frameworks, supply chain volatility, and shifting workforce dynamics underscores the importance of adaptable transformation strategies. By aligning technology investments with clear performance metrics and robust change management practices, organizations can sustain momentum and realize lasting value from their digital initiatives.

Ultimately, success in digital transformation demands a holistic vision that integrates technology, processes, and people. Leaders who embrace continuous learning, foster cross-functional collaboration, and proactively mitigate risks will be best positioned to navigate uncertainty and drive sustainable growth.

Contact Ketan Rohom to purchase the full market research report and gain exclusive insights to drive your digital transformation strategy

Contact Ketan Rohom to purchase the full market research report and gain exclusive insights to drive your digital transformation strategy

- How big is the Digital Transformation Market?

- What is the Digital Transformation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?