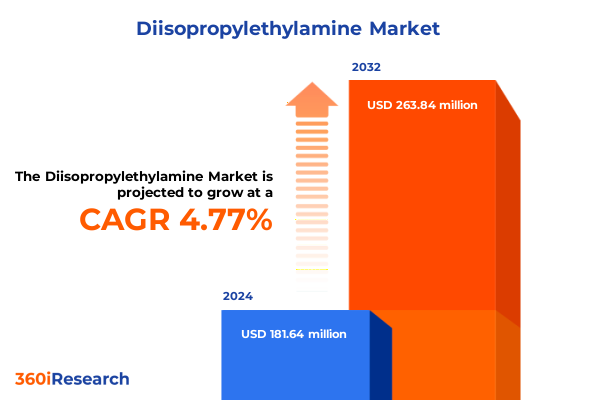

The Diisopropylethylamine Market size was estimated at USD 189.90 million in 2025 and expected to reach USD 203.60 million in 2026, at a CAGR of 4.80% to reach USD 263.84 million by 2032.

Uncovering the Strategic Importance and Industrial Versatility of Diisopropylethylamine in Modern Organic Synthesis and Beyond

Diisopropylethylamine, commonly known as Hünig’s base or DIPEA, is a sterically hindered tertiary amine that plays a pivotal role across organic synthesis platforms. Its non-nucleophilic character and moderate basicity make it the reagent of choice in sensitive coupling reactions where competing side reactions must be minimized. With a molecular formula of C8H19N and a boiling point near 399.7 K, DIPEA maintains a liquid state under ambient conditions, facilitating its use in continuous flow reactors and automated synthesis systems where precise, reproducible dosing is critical.

Exploring How Sustainability Imperatives, Digital Innovations, and Process Intensification Are Redefining Diisopropylethylamine Production and Utilization

The landscape for specialty amine production is undergoing a profound transformation driven by sustainability imperatives, digital innovation, and process intensification. Circular economy principles are reshaping how manufacturers approach raw material sourcing and waste management, fostering closed-loop systems that reclaim and repurpose byproducts. At the same time, digital twins, AI-driven analytics, and blockchain-enabled traceability are being deployed to optimize plant operations, reduce energy consumption, and ensure compliance with increasingly stringent environmental regulations. Process intensification efforts, including microreactor and continuous flow technologies, are streamlining DIPEA synthesis, enabling safer scale-up, reducing thermal hotspots, and delivering tighter control over reaction kinetics. Together, these shifts are converging to redefine competitive advantage in the DIPEA sector, rewarding agile players who can integrate green chemistry frameworks with advanced digital process control.

Assessing the Cumulative Responsibilities of New Ad Valorem Tariffs and Appellate Rulings on Specialty Amines Including Diisopropylethylamine Imports in 2025

In March 2025, the United States adjusted chemical import duties under Proclamation 9704 and Proclamation 9980, increasing additional ad valorem rates from 10% to 25% on a broad range of derivative chemical products processed within subchapter III of chapter 99 of the HTSUS, with an exclusion for Russian origin materials. While many high-volume commodity chemicals such as polyethylene, phenols, and key petrochemicals received exemptions, specialty amines like DIPEA remain vulnerable to these elevated duties. Concurrently, a U.S. federal appeals court has upheld the administration’s IEEPA-based chemical and plastics tariffs, maintaining legal authority for these measures through the appellate review period and reinforcing the must-comply status of the 2025 tariff framework. As a result, domestic users of DIPEA face potential cost pressures, prompting increased interest in localized production, strategic stockpiling, and tariff mitigation strategies such as Section 301 exclusion requests.

Delving into the Nuances of Formulations, Purity Levels, Application Verticals, and Distribution Strategies That Shape the Diisopropylethylamine Market

Form-based differentiation between liquid and solid grades of DIPEA influences handling protocols, storage design, and downstream processing strategies. When examining industrial, laboratory/reagent, and pharmaceutical grade offerings, subtle purification methodologies emerge, reflecting the purity thresholds required for catalytic performance, analytical reproducibility, or human-use safety. Application-focused development reveals DIPEA’s utility across agrochemical intermediates, ligand assemblies for catalysis, complex pharmaceutical synthesis sequences, and as a modifier in surfactant formulations, each use case demanding tailored performance metrics. Distribution strategies hinge on the interplay between established brick-and-mortar chemical distributors and e-commerce platforms offering just-in-time deliveries, underscoring the importance of flexible logistics networks and digital order-management systems.

This comprehensive research report categorizes the Diisopropylethylamine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Grade

- Application

- Distribution Channel

Unveiling Regional Dynamics: Supply Chain Resilience, Regulatory Drivers, and Innovation Hotbeds in the Americas, EMEA, and Asia-Pacific for Diisopropylethylamine

Across the Americas, the DIPEA value chain thrives on robust agrochemical and pharmaceutical manufacturing hubs, supported by integrated petrochemical feedstock corridors that ensure reliable supply. In Europe, Middle East & Africa, stringent regulatory environments such as REACH and evolving ESG mandates are accelerating the adoption of recycled amines and closed-loop manufacturing practices, while localized specialty-chemical clusters in Western Europe drive innovation in high-purity reagent grades. The Asia-Pacific region has emerged as a low-cost production powerhouse, with leading chemical producers in Japan and China investing in advanced reactor technologies and environmental control systems to meet both domestic demand and export standards, though recent reciprocal tariff adjustments have prompted strategic rerouting of trade flows.

This comprehensive research report examines key regions that drive the evolution of the Diisopropylethylamine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Global Leadership, Regional Specialists, and Niche Innovators Driving Diisopropylethylamine Supply Chains

Key players in the DIPEA market encompass a mixture of global conglomerates and specialized amine producers. BASF and Arkema leverage extensive technical service networks and global logistics platforms to support large-scale industrial customers, while Alkyl Amines Chemicals, an integrated Asian producer, emphasizes cost leadership in commodity and specialty grades. Merck KGaA and Tokyo Chemical Industry cater to high-purity and pharmaceutical applications through rigorous quality systems and regulatory support. Dow Chemical and DuPont de Nemours harness process optimization expertise to offer customized reagent solutions, whereas niche organizations such as Koei Chemical and Loba Chemie focus on agile, small-volume supply for research and development markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diisopropylethylamine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel NV

- Albemarle Corporation

- Alkyl Amines Chemicals Limited

- Arkema Group

- BASF SE

- Dow Chemical Company

- Dupont de Nemours Inc

- Eastman Chemical Company

- HiMedia Laboratories Pvt. Ltd

- Honeywell International Inc.

- Johnson Matthey PLC

- Koei Chemical Co, Ltd

- Lanxess AG

- Loba Chemie Pvt. Ltd

- Merck KGaA

- Mitsubishi Gas Chemical Company Inc

- Royal Society of Chemistry

- Sisco Research Laboratories Pvt. Ltd.

- Thermo Fisher Scientific

- Tokyo Chemical Industry

- Tosoh Corporation

- UPL Limited

- VWR International

Implementing Advanced Process Technologies, Digital Supply Chain Controls, and Strategic Partnerships to Navigate Market and Regulatory Complexities in Diisopropylethylamine

Industry leaders should prioritize investment in modular continuous flow systems to minimize batch variation and enhance operational safety, particularly given DIPEA’s low flash point. Strengthening digital supply chain visibility through AI-driven forecasting and blockchain-based traceability will mitigate tariff-related disruptions and support exclusion-filing processes. Collaborations with waste-capture technology providers can close material loops, reducing environmental liabilities and compliance risks. Manufacturers and end-users alike must engage with regulatory stakeholders to secure tariff exclusions and ensure alignment with upcoming chemical policy revisions. Lastly, fostering strategic partnerships between production hubs and localized distribution networks will optimize lead times and cost structures in light of evolving trade dynamics.

Outlining a Multi-Method Research Framework Combining Trade Data Analysis, Expert Interviews, and Data Triangulation for Robust Diisopropylethylamine Insights

The research foundation integrates secondary data from proprietary customs and trade databases, peer-reviewed journals, regulatory filings, and government proclamations to ensure comprehensive coverage of tariff measures and sustainability trends. Primary insights were obtained through in-depth interviews with process engineers, supply chain executives, and R&D leaders across leading specialty-chemical firms. Data triangulation involved cross-verification of customs duty schedules with logistics partner records and acid-base reagent shipment data to establish tariff impact models. Quality assurance practices included validation against industry association reports and auditing of expert feedback, ensuring the conclusions reflect both quantitative rigor and qualitative expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diisopropylethylamine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diisopropylethylamine Market, by Form

- Diisopropylethylamine Market, by Grade

- Diisopropylethylamine Market, by Application

- Diisopropylethylamine Market, by Distribution Channel

- Diisopropylethylamine Market, by Region

- Diisopropylethylamine Market, by Group

- Diisopropylethylamine Market, by Country

- United States Diisopropylethylamine Market

- China Diisopropylethylamine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing the Strategic Imperatives of Tariff Resilience, Sustainable Manufacturing, and Digital Transformation in the Future of Diisopropylethylamine

Diisopropylethylamine remains at the intersection of high-value organic synthesis and strategic supply chain management. The convergence of elevated tariff regimes, sustainability mandates, and digital process breakthroughs is reshaping how stakeholders source, produce, and apply this critical reagent. As the market evolves, organizations that embrace lean, intensified manufacturing, leverage advanced analytics, and proactively engage in policy shaping will secure competitive advantage. The collective insights underscore the imperative to balance cost, compliance, and innovation in navigating the dynamic DIPEA landscape.

Empower Your Strategic Decisions with Direct Access to the Exclusive Diisopropylethylamine Market Research Report via 360iResearch Leadership

For a comprehensive, in-depth exploration of these insights, tailored data, and strategic guidance, engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He will provide personalized support, answer your queries, and facilitate your purchase of the full market research report on Diisopropylethylamine, enabling your organization to leverage timely analysis and actionable intelligence.

- How big is the Diisopropylethylamine Market?

- What is the Diisopropylethylamine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?