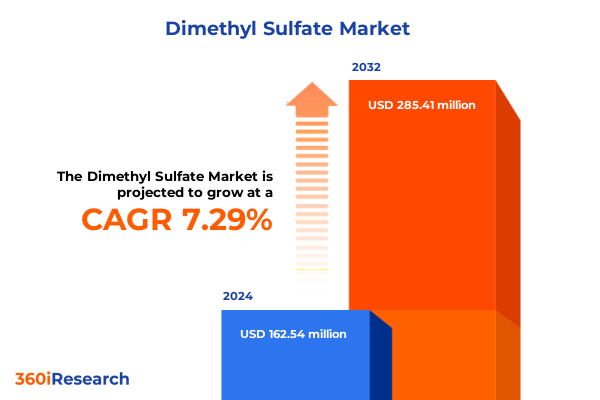

The Dimethyl Sulfate Market size was estimated at USD 174.65 million in 2025 and expected to reach USD 193.90 million in 2026, at a CAGR of 7.26% to reach USD 285.41 million by 2032.

Dimethyl Sulfate Introduction Highlighting Its Role as a Highly Reactive Methylating Agent and Safety Critical Chemical Intermediate

Dimethyl sulfate is recognized as one of the most potent methylating agents in chemical synthesis, prized for its high reactivity and efficiency in transferring methyl groups. Produced commercially through the continuous reaction of dimethyl ether with sulfur trioxide, this compound enables superior reaction rates and yields compared to many alternatives.

Beyond its role in organic chemistry, dimethyl sulfate materials have broad relevance across industrial processes. Its ability to methylate oxygen, nitrogen, carbon, sulfur, phosphorus, and certain metals underpins its widespread utility, rendering it indispensable in advanced manufacturing applications.

Despite its performance advantages, dimethyl sulfate’s acute toxicity and classification as a probable human carcinogen demand stringent safety protocols. Organizations such as the International Agency for Research on Cancer (IARC) list it under Group 2A, reflecting the need for comprehensive hazard controls across production and end-use environments.

Evolving Regulatory Pressures and Sustainability Drivers Accelerating Substitution and Innovative Process Reforms in Dimethyl Sulfate Applications

The landscape of dimethyl sulfate application is undergoing transformative shifts driven by heightened sustainability mandates and rigorous regulatory scrutiny. Notably, the European Chemicals Agency’s 2023 REACH proposal aims to phase out nearly all traditional dimethyl sulfate uses by 2030, with pharmaceutical manufacturers reallocating up to 18% of their development budgets toward alternative methylating agents like dimethyl carbonate to meet compliance deadlines and mitigate substitution risks.

In parallel, process innovations are redefining how dimethyl sulfate is handled and consumed within critical supply chains. State-of-the-art flow chemistry systems now achieve yields exceeding 92% while using 40% less dimethyl sulfate through precise stoichiometric control, a breakthrough showcased in recent API synthesis optimizations for next-generation anticoagulant medications.

Implications of Newly Implemented United States Tariffs in 2025 on Dimethyl Sulfate Supply Chain Costs and Market Accessibility

On January 1, 2025, the Office of the United States Trade Representative (USTR) finalized Section 301 tariff increases that expanded levies on a range of chemical and inorganic imports, including tungsten products, wafers, and polysilicon, raising rates to as much as 50% for certain goods. These actions underscore the USTR’s ongoing strategy to bolster domestic supply chain resilience and support clean energy investments under the Biden-Harris administration.

Meanwhile, President Trump’s Executive Order 14195 issued on February 1, 2025, imposed an additional 10% tariff on precursor chemicals sourced from China-measures that explicitly target substances linked to synthetic opioid production and other strategic supply chains. This levy extends to compounds such as dimethyl sulfate, intensifying cost pressures for U.S. importers and prompting buyers to reconsider sourcing strategies.

Despite these broad tariff measures, certain exclusions under Section 301 have been extended through August 31, 2025. The USTR’s decision to prolong these carve-outs offers temporary relief for select categories; however, dimethyl sulfate did not receive a specific extension, leaving market participants to grapple with increased landed costs, contractual renegotiations, and potential hold-ups in procurement pipelines.

In-Depth Segmentation Analysis Revealing How Application, End Use, Purity, Distribution, and Form Shape Dimethyl Sulfate Market Dynamics

When examining the market through the lens of application, dimethyl sulfate serves as a foundational chemical intermediate, facilitating alkylation and methylation reactions that feed into agrochemical intermediates, pharmaceutical intermediates, dyes, pigment synthesis, film coatings, and pesticide formulations. These diverse end uses underscore the compound’s integral function in complex chemical value chains.

Further segmentation by end use industry illustrates the compound’s critical relevance to adhesives and sealants, polymer manufacturing, agrochemicals, and pharmaceutical production. Purity distinctions separate reagent grade from technical grade offerings, while direct sales and distributor networks define distribution channels. Finally, the market’s focus on liquid formulations simplifies handling protocols and aligns with established downstream processing requirements.

This comprehensive research report categorizes the Dimethyl Sulfate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity

- Distribution Channel

- Form

- Application

- End Use Industry

Nuanced Regional Market Perspectives Demonstrating Contrasting Demand Drivers and Regulatory Environments Across Americas, EMEA, and Asia Pacific

Asia-Pacific stands out as the preeminent region for dimethyl sulfate production and consumption, with China and India driving over 45% of global capacity. Cost-competitive manufacturing ecosystems, coupled with accommodating environmental policies, have fueled extensive agrochemical and pharmaceutical synthesis in these markets. Major chemical parks in Jiangsu, Shandong, and Gujarat leverage integrated feedstock supply chains to support output growth.

Conversely, Europe and North America have scaled back domestic production in response to stringent regulatory frameworks. The EU’s categorization of dimethyl sulfate as a Category 1B carcinogen under REACH prompted a 28% reduction in output from countries like Germany between 2018 and 2023. U.S. producers have confronted tightened OSHA exposure limits, driving many operators to import over 70% of their demand and invest in alternative methylating agents to meet safety standards.

The Americas region reflects a dynamic consumption profile, with the United States and Canada maintaining steady demand through imports that serve robust agrochemical and specialty chemical sectors. Latin America’s growing agricultural footprint has similarly bolstered regional imports, offsetting declines in local production and reinforcing supply chain interdependence with Asia-Pacific hubs.

This comprehensive research report examines key regions that drive the evolution of the Dimethyl Sulfate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Spotlighting Leading Chemical Producers and Specialty Manufacturers Dominating Dimethyl Sulfate Market Innovations

The competitive landscape is anchored by global chemical conglomerates such as BASF SE, Dow Chemical Company, and Arkema Group, each leveraging extensive production capacities, strategic acquisitions, and sustainability initiatives to reinforce their market positions. These organizations continue to invest in process efficiencies and green chemistry programs aimed at enhancing compliance and reducing carbon footprints.

In the specialty segment, firms like Merck KGaA, Haihang Industry Co., Ltd., and Tokyo Chemical Industry Co., Ltd. (TCI) distinguish themselves through proprietary synthesis methods and high-purity grade offerings. Merck’s 2022 expansion of German alkylating agent capacity targeted a double-digit volume increase, while Haihang’s patented catalytic processes reduced energy consumption by 20%. TCI’s ultra-purification techniques, attaining 99.9% dimethyl sulfate purity, cater to electronics and fine chemical applications subject to the most exacting performance and safety requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dimethyl Sulfate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. B. Enterprises

- Aarti Industries Limited

- Angene International Limited

- Anhui Jin'ao Chemical Co., Ltd.

- BASF SE

- CABB Chemicals

- Caledon Laboratories Ltd

- Celanese Corporation

- Chevron Phillips Chemical Company

- DuPont de Nemours, Inc.

- Evonik Industries AG

- FUJIFILM Wako Pure Chemical Corporation

- GRILLO

- Haihang Industry Co., Ltd.

- Honeywell International

- Industrial Solvents & Chemicals Pvt. Ltd.

- IRO Group

- Jiangsu Peiyuan Bioengineering Co., Ltd.

- Kishida Chemical Co., Ltd.

- Labdhi Chemicals

- LANXESS AG

- LobaChemie Pct. Ltd.

- Merck KGaA

- Pallav Chemicals and Solvents

- Sumitomo Chemical

- The Dow Chemical Company

- Thermo Fisher Scientific Inc.

Strategic Actionable Recommendations Guiding Industry Stakeholders to Navigate Regulatory Challenges and Capitalize on Emerging Opportunities

To navigate intensifying regulatory headwinds and substitution risks, industry leaders should prioritize accelerated investment in alternative methylating chemistries and continuous flow processing technologies. Collaborating with academic and industrial research consortia can facilitate shared innovation pathways while dispersing development costs across multiple stakeholders.

Moreover, companies can strengthen supply chain resilience by diversifying raw material sourcing and negotiating strategic partnerships that include tariff exclusion provisions. Developing localized production hubs in regulatory-friendly jurisdictions and pursuing targeted exclusions under Section 301 may mitigate cost volatility and safeguard access to critical intermediates.

Comprehensive Research Methodology Outlining Systematic Data Gathering, Expert Validation, and Analytical Techniques Ensuring Report Credibility

This analysis integrates comprehensive secondary research, including regulatory filings, proprietary industry databases, and peer-reviewed academic studies. Key data points were extracted from authoritative sources such as the U.S. Trade Representative, European Chemicals Agency, and corporate disclosures to construct a robust factual foundation.

Primary validation was achieved through consultations with subject-matter experts in chemical process engineering, supply chain logistics, and regulatory affairs. Triangulation techniques ensured the consistency and reliability of insights, with iterative data verification rounds confirming the accuracy of competitive and regional assessments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dimethyl Sulfate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dimethyl Sulfate Market, by Purity

- Dimethyl Sulfate Market, by Distribution Channel

- Dimethyl Sulfate Market, by Form

- Dimethyl Sulfate Market, by Application

- Dimethyl Sulfate Market, by End Use Industry

- Dimethyl Sulfate Market, by Region

- Dimethyl Sulfate Market, by Group

- Dimethyl Sulfate Market, by Country

- United States Dimethyl Sulfate Market

- China Dimethyl Sulfate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Insights Summarizing Critical Findings and Market Imperatives for Dimethyl Sulfate Amidst Evolving Industrial and Regulatory Trends

In summary, the dimethyl sulfate market remains defined by its indispensable role in methylation and alkylation processes, even as regulatory, sustainability, and tariff pressures reshape the competitive and operational landscape. Stakeholders who adopt forward-looking innovation strategies and proactive compliance measures are best positioned to maintain market leadership amid these shifting dynamics.

Going forward, the interplay between evolving safety regulations, alternative chemical solutions, and geopolitical trade measures will determine the resilience of supply chains and the pace of technological adoption. Continuous monitoring of policy developments and strategic agility will be critical to long-term success in this essential industrial segment.

Connect with Ketan Rohom to Unlock Detailed Dimethyl Sulfate Market Insights and Secure Your Comprehensive Industry Research Report Today

Unlock unparalleled insights into the dimethyl sulfate market by partnering with Ketan Rohom, Associate Director of Sales & Marketing. Gain access to comprehensive data, in-depth analysis, and strategic guidance designed to inform your next critical business decision. Elevate your market intelligence with expert support tailored to address your specific needs and challenges. Connect today to secure your copy of the definitive dimethyl sulfate market research report and stay ahead in this evolving landscape.

- How big is the Dimethyl Sulfate Market?

- What is the Dimethyl Sulfate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?