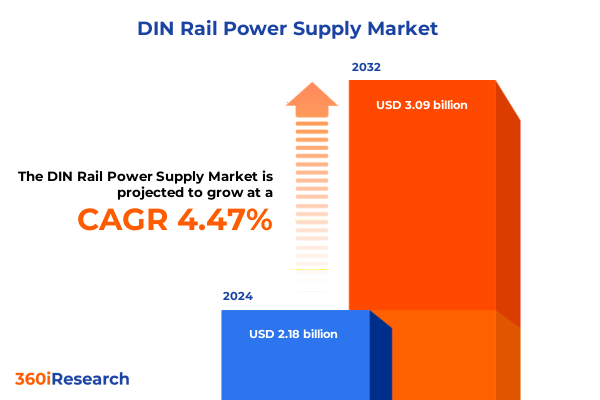

The DIN Rail Power Supply Market size was estimated at USD 2.28 billion in 2025 and expected to reach USD 2.36 billion in 2026, at a CAGR of 4.47% to reach USD 3.09 billion by 2032.

Foundational Overview of DIN Rail Power Supplies Highlighting Historical Evolution Technological Significance and Industry Relevance

The evolution of DIN rail power supplies represents a pivotal chapter in the modernization of industrial power management systems. Originating from the mid-20th century need for standardized mounting solutions in electrical cabinets, the DIN rail format offered an elegant answer to modularity, maintenance efficiency, and space optimization. Over the ensuing decades, manufacturers refined the design to encompass enhanced protection ratings, improved thermal performance, and compatibility with increasingly complex automation architectures.

At the core of this evolution lies the convergence of electrical engineering principles and the rising demands of factory and process automation. As programmable logic controllers, robotics, and instrumentation advanced, the requirement for stable, reliable, and compact power sources intensified. This introduced stringent demands on power conversion efficiency, electromagnetic compatibility, and fail-safe operation, elevating DIN rail modules from simple voltage regulators to critical enablers of digital manufacturing.

Looking ahead, the foundational relevance of DIN rail power supplies extends beyond traditional factory floors. The proliferation of edge computing nodes, remote monitoring devices, and smart sensors in various industrial verticals underscores the necessity for compact, intelligent, and resilient power solutions. Against this backdrop, this report delves into the strategic dynamics shaping the market, equipping stakeholders with a robust comprehension of key trends, forces, and opportunities.

Pivotal Technological and Market Shifts Redefining the DIN Rail Power Supply Landscape Driven by Sustainability Efficiency and Digitalization

The current landscape of DIN rail power supplies is being reshaped by a series of transformative shifts that intersect at the crossroads of sustainability, energy efficiency, and digital integration. The drive toward decarbonization compels manufacturers to achieve ultra-high conversion efficiencies, minimizing energy losses and reducing the carbon footprint of automated systems. Concurrently, regulatory bodies are mandating higher performance thresholds, prompting new device architectures that leverage advanced semiconductor materials and topology innovations.

Digitalization stands as an equally potent catalyst. Modern modules increasingly incorporate embedded microcontrollers, diagnostics algorithms, and communication interfaces that enable real-time monitoring of parameters such as output voltage stability, thermal load, and predictive maintenance indicators. This integration supports IIoT use cases, allowing system integrators to detect anomalies early, schedule maintenance proactively, and optimize overall equipment effectiveness.

Moreover, the emergence of resilient design paradigms underscores the need for power supplies that can withstand harsh industrial environments. Features such as conformal coatings, wide operating temperature ranges, and robust surge protection extend the operational envelope of DIN rail modules. These capabilities align closely with the demands of renewable energy installations, transportation electrification, and remote infrastructure projects, further broadening the addressable market.

Through these converging shifts, the DIN rail power supply segment is transitioning from a commoditized product category into a platform for innovation, where sustainability metrics, digital functionality, and ruggedized designs coalesce to redefine industry benchmarks.

Comprehensive Evaluation of Cumulative Impacts from United States 2025 Tariffs on Import Costs Manufacturing Supply Chains and Market Dynamics

The imposition of new tariff measures by the United States in 2025 has imparted significant cumulative effects on the DIN rail power supply market. In response to broader trade policy realignments, duties on imported power conversion components rose, inflating direct procurement costs for OEMs and system integrators. This shift compelled many suppliers to reevaluate supplier footprints, with some electing to relocate final assembly operations to North America to mitigate duty burdens and shorten lead times.

As tariff pressures escalated, several manufacturers activated alternative sourcing strategies, including increased engagement with regional contract manufacturers and the expansion of domestic component production. While these initiatives have softened the initial cost shock, they have also introduced heightened complexity in supply chain orchestration and risk management. Inventory planning cycles have been compressed, and just-in-time strategies have given way to strategic stockpiling of critical semiconductor and magnetics components to hedge against further duty escalations.

In parallel, end-users have experienced upward pressure on capital expenditures and ongoing service contracts. Pricing adjustments have been absorbed variably across sectors; industrial automation projects often incorporated tariffs into total cost of ownership calculations, whereas price-sensitive segments such as telecommunications infrastructure have explored longer product lifecycles and aftermarket retrofits to contain budget impacts.

Overall, the cumulative effect of the 2025 tariff landscape has been to accelerate operational agility among power supply stakeholders, driving a more distributed manufacturing approach and reinforcing the strategic imperative for localized supply chain resilience.

Deep Dive into Critical Segmentation Insights Revealing How Output Types Applications Efficiency Levels and Certification Criteria Shape Market Opportunities

Segmenting the DIN rail power supply market reveals critical insights into how different product attributes cater to distinct customer requirements and end-use environments. Through the lens of output configuration, multiple output modules serve applications demanding varied voltage rails within a single enclosure, particularly in complex factory automation setups and data center auxiliary systems, whereas single output units prevail where simplicity and cost-efficiency are paramount, such as in basic control panels and light industrial equipment.

When examining application verticals, the requirements diverge significantly. Within industrial automation, the fastest growth is observed in robotics cells and advanced process control, which require power units capable of rapid load transients and minimal ripple. The medical sector, particularly in diagnostic and imaging equipment, demands ultra-stable output and stringent electromagnetic compliance, given the sensitivity of sensors and scanning modules. Renewable energy projects emphasize components that endure wide ambient temperature fluctuations and offer integrated supervisory functions for grid-tie inverters across hydroelectric, photovoltaic, and wind farms. Telecommunications infrastructure prioritizes redundancy and network-grade reliability to support data centers and network switches, while transportation electrification leverages power supplies designed for vibration resistance and space constraints in rail and commercial vehicle applications.

Efficiency level constitutes another axis of differentiation. High efficiency units strike a balance between performance and cost, standard efficiency options cater to legacy systems where budget constraints dominate, and ultra-high efficiency modules meet the most demanding green building and sustainability mandates. Certification regimes further refine the landscape; CE marking ensures compliance with European safety and EMC directives, CSA certification underpins acceptance in North American jurisdictions, TUV endorses adherence to rigorous German and international standards, and UL listing is often non-negotiable for critical infrastructure deployments.

These intersecting segmentation dimensions not only inform product design roadmaps but also guide go-to-market strategies, channel alignment, and value propositions tailored to diverse end customers.

This comprehensive research report categorizes the DIN Rail Power Supply market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Output Type

- Efficiency Level

- Certification

- Application

Strategic Regional Perspectives Highlighting Growth Drivers and Challenges Across Americas EMEA and Asia Pacific in the DIN Rail Power Supply Domain

Regional dynamics exert a profound influence on the development and adoption of DIN rail power supplies, with each geography presenting unique drivers and constraints. In the Americas, substantial investments in advanced manufacturing corridors and renewable energy infrastructure have heightened demand for rugged, high-efficiency power modules. The U.S. government’s incentives for clean energy expansion further propel procurement of equipment designed to integrate seamlessly with solar and wind installations, while initiatives to reshore critical component manufacturing foster local supply ecosystems.

Within Europe, Middle East, and Africa, the imposition of progressively stringent environmental regulations in the European Union has elevated the importance of both energy efficiency labels and product circularity. System integrators must navigate a complex certification landscape to comply with directives such as Ecodesign and REACH, driving suppliers to offer modular, upgradeable designs. In the Middle East, large-scale infrastructure projects in oil-and-gas and water treatment sectors demand high‐reliability power supplies capable of enduring corrosive environments. African markets, while still maturing, present growth prospects tied to telecommunication network expansion and off-grid renewable microgrids.

Asia-Pacific showcases a dual narrative of cost competitiveness and rapid technological adoption. Manufacturing hubs in China and Southeast Asia continue to supply high-volume, standard efficiency modules, although premium segments in Japan, South Korea, and Australia demand ultra-high efficiency products with advanced diagnostics. The region’s aggressive build-out of smart grid and 5G telecommunications infrastructure intensifies the need for DIN rail power units that integrate communication protocols and adhere to international safety standards.

Collectively, these regional insights underscore the imperative for suppliers to adopt flexible manufacturing footprints, region-specific certification strategies, and tailored channel partnerships to capture the diverse opportunities across global markets.

This comprehensive research report examines key regions that drive the evolution of the DIN Rail Power Supply market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insightful Analysis of Leading Industry Players Innovations Partnerships and Strategic Movements Shaping the Competitive Landscape of Din Rail Power Supply Sector

The competitive terrain of DIN rail power supplies is shaped by a set of leading players whose product portfolios, strategic alliances, and innovation roadmaps set the pace for the broader industry. One prominent manufacturer has distinguished itself through investments in embedded monitoring software and integrated energy management solutions, enabling real-time analytics and predictive maintenance for critical installations. Another global conglomerate leverages its established automation ecosystem to bundle power supplies with controllers and drives, reinforcing customer lock-in through seamless interoperability and unified support services.

Strategic partnerships also play a decisive role. Alliances between power module vendors and semiconductor suppliers have accelerated the adoption of wide bandgap materials, resulting in higher switching frequencies, reduced thermal losses, and more compact form factors. Additionally, collaborations with cloud platform providers facilitate remote firmware updates and cybersecurity monitoring, addressing growing concerns over industrial network vulnerabilities.

Acquisitions and joint ventures further redefine market boundaries. Several companies have acquired specialized niche players to broaden their product breadth, while cross-sector joint ventures expand service offerings into areas such as custom rack systems and turnkey power management. These strategic moves not only diversify revenue streams but also position the companies to meet increasingly integrated customer requirements that span hardware, software, and lifecycle support.

In this dynamic environment, agility and technological differentiation remain paramount. Companies that can swiftly incorporate customer feedback, adapt certification profiles for emerging regions, and deliver scalable digital features will continue to shape the trajectory of the DIN rail power supply market.

This comprehensive research report delivers an in-depth overview of the principal market players in the DIN Rail Power Supply market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advantech Co., Ltd.

- Astrodyne TDI

- Bel Fuse Inc.

- CAREL INDUSTRIES S.p.A.

- CP Power & Automation

- Delta Electronics, Inc.

- Eaton Corporation PLC

- Emerson Electric Co.

- Hengfu Enterprises Co., Ltd.

- Honeywell International Inc.

- IDEC Corporation

- K-array Surl

- MEAN WELL Enterprises Co., Ltd.

- Mornsun Guangzhou Science & Technology Co. Ltd.

- Moxa Inc.

- Murrelektronik GmbH

Actionable Strategies and Recommendations for Industry Leaders to Navigate Market Complexity Harness Growth Trends and Mitigate Supply Chain and Regulatory Risks

Industry leaders seeking to excel in the evolving DIN rail power supply market should adopt a multifaceted strategy that combines technological investment with strategic supply chain and regulatory alignment. Securing multiple component sourcing channels and establishing contingency partnerships with regional manufacturers will mitigate the risk of further tariff escalations or unforeseen logistic disruptions. By maintaining flexible production agreements and volume commitments, organizations can respond nimbly to sudden shifts in trade policy or demand fluctuations.

On the product innovation front, priority should be placed on accelerating development of ultra-high efficiency modules that meet or exceed emerging regulatory thresholds. Incorporating advanced digital diagnostics and connectivity features into mainstream offerings will create a compelling value proposition for customers pursuing Industry 4.0 and IIoT deployments. Simultaneously, fostering cross-functional collaboration between engineering, regulatory, and marketing teams will ensure that certifications and compliance requirements are integrated into the design process early, reducing time to market and avoiding costly retrofits.

From a market engagement perspective, tailoring channel strategies to regional demand profiles is crucial. Leveraging established industrial automation distributors in mature markets while forging alliances with local system integrators in emerging geographies will optimize coverage and customer responsiveness. Lastly, building robust after-sales service frameworks-encompassing training, predictive maintenance contracts, and retrofit programs-will not only generate recurring revenue but also reinforce brand loyalty in a competitive landscape.

Transparent Overview of Research Methodology Detailing Data Sources Analytical Frameworks Primary and Secondary Research Processes Ensuring Robust Report Integrity

This research adopts a comprehensive methodology, integrating both primary and secondary data gathering to ensure rigorous validation of insights. Primary research encompassed structured interviews with senior executives from power supply manufacturers, system integrators, and end-user organizations across key industries. These interactions yielded firsthand perspectives on technology adoption rates, procurement decision criteria, and the operational impact of regulatory changes.

Secondary research involved an extensive review of technical papers, industry white papers, and regulatory filings, including tariff schedules, efficiency standards, and safety certifications. Trade association databases provided detailed statistics on import-export flows and production capacities, while patent analytics tools offered visibility into emerging innovations and intellectual property trends.

Quantitative analysis was conducted by triangulating shipment data, trade volumes, and revenue figures, enabling the identification of growth patterns and regional shifts. Complementing this, qualitative case studies illustrated successful deployment scenarios and highlighted best practices for product customization, supply chain resilience, and digital integration.

To further enhance credibility, all findings were vetted by an independent advisory panel comprising subject matter experts in electrical engineering, regulatory compliance, and industrial automation. This multi-layered approach ensures that the report’s conclusions are both robust and actionable for stakeholders across the DIN rail power supply ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our DIN Rail Power Supply market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- DIN Rail Power Supply Market, by Output Type

- DIN Rail Power Supply Market, by Efficiency Level

- DIN Rail Power Supply Market, by Certification

- DIN Rail Power Supply Market, by Application

- DIN Rail Power Supply Market, by Region

- DIN Rail Power Supply Market, by Group

- DIN Rail Power Supply Market, by Country

- United States DIN Rail Power Supply Market

- China DIN Rail Power Supply Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concise Conclusion Synthesizing Key Findings Emphasizing Market Imperatives and Outlining Strategic Pathways for Stakeholders in the Din Rail Power Supply Domain

The analysis underscores that the DIN rail power supply market is at a strategic inflection point, propelled by regulatory pressures, technological breakthroughs, and evolving end-user expectations. Key trends such as the shift toward ultra-high efficiency, the integration of digital monitoring capabilities, and the drive for regionalized manufacturing footprints define the current competitive landscape.

Segmentation insights reveal that multiple output modules and niche application segments, including advanced robotics and diagnostic imaging, represent high-value arenas requiring targeted product roadmaps. Similarly, efficiency tiers and certification profiles offer a framework for aligning new product introductions with specific compliance regimes and sustainability mandates.

Regional perspectives highlight the necessity of customized market approaches: the Americas emphasize reshoring and clean energy incentives, EMEA prioritizes compliance with stringent environmental directives, and Asia-Pacific balances cost competitiveness with rapid technology adoption. Meanwhile, the cumulative impact of 2025 tariff adjustments accentuates the strategic importance of diversified supplier networks and inventory planning agility.

For industry stakeholders, the confluence of these dynamics presents both challenges and avenues for growth. Organizations that proactively embed digital functionalities, secure robust supply chain architectures, and align product portfolios with regional and segment-specific requirements will be best positioned to capture emerging opportunities and enhance resilience over the next planning horizon.

Compelling Invitation for Decision Makers to Connect with Associate Director of Sales and Marketing Ketan Rohom to Secure the Comprehensive Research Report

To secure the in-depth market intelligence and comprehensive data analysis on the DIN rail power supply industry, decision makers are invited to connect directly with Associate Director of Sales and Marketing Ketan Rohom. With extensive experience guiding clients through complex market landscapes, Ketan Rohom can tailor the research deliverables to suit specific organizational needs and strategic objectives.

Engaging with Ketan Rohom not only grants you immediate access to the full suite of insights but also unlocks personalized support for implementation planning, ensuring that your team can translate the report’s findings into actionable initiatives. Reach out to establish the right licensing arrangement and gain the competitive advantage offered by exclusive, meticulously validated information.

Investing in this report will equip your organization with the clarity, foresight, and practical roadmaps necessary to outperform peers, optimize supply chain resilience, and capitalize on emerging opportunities within the DIN rail power supply market. Don’t miss this opportunity to collaborate with Ketan Rohom and drive informed decision making across your enterprise.

- How big is the DIN Rail Power Supply Market?

- What is the DIN Rail Power Supply Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?