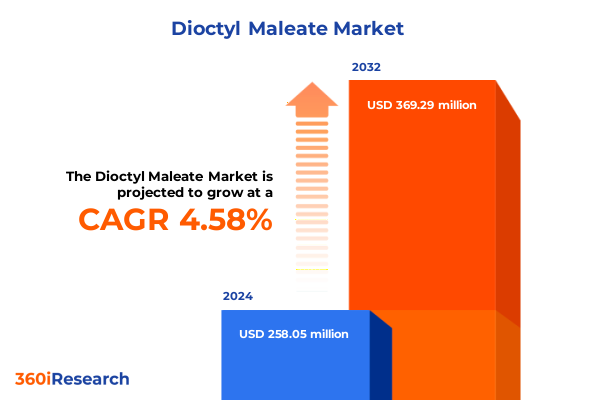

The Dioctyl Maleate Market size was estimated at USD 269.08 million in 2025 and expected to reach USD 285.41 million in 2026, at a CAGR of 4.62% to reach USD 369.29 million by 2032.

Unveiling Dioctyl Maleate’s Strategic Importance in High-Performance Plasticizers, Adhesives, Coatings, Lubricants and Emerging Specialty Chemical Platforms

Dioctyl Maleate, a high-performance ester derived from maleic acid and 2-ethylhexanol, has emerged as a critical plasticizer and co-monomer in modern industrial formulations. Valued for its ability to impart flexibility, durability, and enhanced adhesion, this versatile compound underpins advanced solutions in adhesives, coatings, and specialty chemical applications. Its compatibility with a wide range of polymer matrices and its capacity to reduce glass transition temperatures without compromising mechanical strength make it a preferred choice for formulators seeking robust performance in demanding environments.

In addition to its role as a plasticizer in polyvinyl chloride and other polymer systems, dioctyl maleate is increasingly utilized in water-based and solvent-borne coatings to achieve superior UV resistance and low-VOC emissions. As regulatory landscapes tighten around phthalate-based plasticizers, dioctyl maleate’s phthalate-free profile positions it as a sustainable alternative that aligns with global environmental and health standards. This shift has propelled innovation across end-use industries, driving the adoption of green chemistries and prompting manufacturers to reengineer formulations for both performance optimization and compliance.

Against a backdrop of rising demand for lightweight, flexible, and eco-friendly materials, the dioctyl maleate market is characterized by dynamic supply chain adjustments and strategic partnerships. Producers are investing in improved catalyst systems, advanced purification techniques, and bio-based feedstock studies to enhance product purity and reduce carbon footprints. Consequently, dioctyl maleate stands at the intersection of performance requirements and sustainability imperatives, offering a compelling value proposition for industry leaders prioritizing innovation and resilience in their material portfolios.

Navigating the Shift Toward Sustainable Practices and Digital Transformation Elevating Chemical Manufacturing and Supply Chain Resilience

The chemical industry is undergoing a transformative era marked by convergent pressures of sustainability mandates and digital innovation. Regulatory milestones, such as the European Union’s Digital Product Passport and the U.N.’s Global Framework on Chemicals, are accelerating the drive toward safer, greener chemistries and demanding rigorous transparency across product lifecycles. Awareness of the long-term accumulation of hazardous “forever chemicals” in ecosystems has intensified, compelling leading manufacturers to adopt sustainable production methods and prioritize bio-based feedstocks and low-carbon processes. This paradigm shift reflects an urgent need to balance performance imperatives with environmental stewardship.

Simultaneously, digital tools are reshaping operational and supply chain capabilities. Advances in predictive analytics, AI-driven monitoring, and blockchain-enabled traceability are empowering companies to anticipate disruptions, optimize resource utilization, and validate sustainability claims. Industry pioneers are integrating digital twins for real-time process simulation, enabling swift scenario planning and enhanced asset reliability. Furthermore, resilient supply chains built on diversified sourcing and integrated digital platforms are mitigating geopolitical and logistical uncertainties, reinforcing the sector’s ability to adapt to evolving market conditions.

This dual emphasis on environmental accountability and technological agility is redefining competitive advantage. Chemical producers that embrace circular economy principles-leveraging advanced recycling, design-for-reuse techniques, and strategic partnerships-are unlocking new value streams while reducing waste. In this context, dioctyl maleate’s role extends beyond a conventional performance additive to that of a strategic enabler, facilitating the development of next-generation formulations that meet both green chemistry criteria and the digital traceability requirements of discerning customers.

Assessing the Cumulative Effects of 2025 United States Tariffs on Dioctyl Maleate Import Costs, Sourcing Strategies, and Supply Chain Dynamics

In 2025, the United States introduced sweeping tariff measures that have reshaped the economics of dioctyl maleate imports and upstream intermediates. Under the revised tariff schedules effective April 9, the U.S. imposed a 20% duty on chemical imports from the European Union and a 24% rate for products originating in Japan, while a 10% levy targets imports from China. Although exemptions were granted for major polymers such as polyethylene and polypropylene, the broader tariff landscape has elevated input costs for specialized esters and plasticizer precursors.

These additional duties have compelled domestic formulators to seek alternative sourcing strategies. Some companies have accelerated the establishment of in-country production capabilities to insulate themselves from volatility, while others have negotiated long-term supply agreements with tariff-shielded origins. The net effect has been a strategic realignment toward supply chain resilience, where procurement teams prioritize supplier reliability and tariff avoidance over purely cost-based criteria. Distributors, in turn, are adjusting margin structures to absorb a portion of the tariff burden, ensuring continuity of supply for downstream customers.

Despite the challenges, the 2025 tariff regime has catalyzed innovation in trade management and operational planning. Domestic capacity expansions are positioning local producers to capture reshored volumes, while joint ventures in partner markets enable shared tariff advantages. As the industry navigates these trade headwinds, proactive engagement with customs authorities and dynamic scenario modeling remain critical to preserving competitive positioning in an increasingly complex global market.

Illuminating Critical Market Segmentation Insights Revealing Application, End Use Industry, Product Grade, Functional Roles, and Distribution Strategies

The dioctyl maleate market exhibits nuanced performance patterns when analyzed through the lens of its core segments. Based on application, dioctyl maleate serves as a foundational component in adhesives, where its inclusion in formulations spans epoxy, hot melt, and pressure-sensitive systems that demand reliable bond strength and flexibility. In the coatings domain, it enhances both architectural and industrial finishes with UV resistance and improved film formation. When deployed as a lubricant additive, it contributes to hydraulic fluids and metalworking fluids, optimizing viscosity and reducing friction. As a plasticizer, it finds critical use across nitrile rubber, polyvinyl chloride, and synthetic rubber applications that require enhanced elasticity and low temperature performance.

Turning to end-use industries, dioctyl maleate’s versatility drives uptake in automotive OEM and aftermarket segments that prioritize lightweight, durable components. In construction, commercial and residential projects benefit from its low-VOC profile in high-performance sealants and coatings. The electronics sector leverages its properties in both consumer and industrial devices, ensuring reliable encapsulation and moisture resistance. Packaging formats, whether flexible films or rigid containers, exploit its ability to impart toughness and clarity, while textiles utilize it in coatings and finishes for both natural and synthetic fibers.

Product grade segmentation further reveals differentiated demand for industrial, specialty, and technical grades. Industrial‐grade dioctyl maleate underpins bulk commodity applications, whereas specialty grades tailored for high-temperature or UV-resistant needs address niche performance requirements. Technical grades certified for food and pharma use enable compliance with stringent purity and safety standards. Functionally, dioctyl maleate acts as a coupling agent-employing silane and titanate chemistries-an impact modifier that enhances material toughness, or a standalone plasticizer for flexible polymer systems. Distribution channels reflect a balanced mix of traditional offline networks complemented by growing direct-to-customer online platforms that offer rapid order fulfillment and technical support.

This comprehensive research report categorizes the Dioctyl Maleate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Grade

- Function

- Distribution Channel

- Application

- End Use Industry

Distilling Pivotal Regional Market Insights Spanning Americas, Europe Middle East & Africa, and Asia-Pacific Demand Drivers and Growth Patterns

Regional dynamics in the dioctyl maleate market are shaped by distinct economic drivers and regulatory influences. In the Americas, mature infrastructure and robust manufacturing bases drive steady consumption of dioctyl maleate across building, automotive, and packaging sectors. North American producers benefit from integrated petrochemical complexes and proximity to key feedstock sources, while U.S.-Mexico-Canada supply chains leverage trade agreements to optimize cross-border flows. Amid rising environmental standards, manufacturers in the region are prioritizing low-VOC and phthalate-free formulations, reinforcing dioctyl maleate’s appeal as a compliant plasticizer alternative.

Europe, Middle East & Africa reflect a heterogeneous landscape where advanced economies in Western Europe emphasize sustainability and circularity. Stringent REACH regulations impose rigorous chemical safety and transparency requirements, prompting local formulators to adopt novel co-monomer blends that align with evolving compliance mandates. In the Middle East, expanding petrochemical investments and downstream integration are creating new demand centers for performance additives in coatings and industrial applications. Meanwhile, African markets, although emerging, present opportunities driven by infrastructure development and growing manufacturing activities.

Asia-Pacific commands a dominant position in the global dioctyl maleate ecosystem, propelled by rapid industrialization, urbanization, and consumer spending growth. China, India, Japan, and South Korea are leading adopters of advanced polymer formulations, investing heavily in water-based coatings, phthalate-free plastics, and specialty adhesives. Government incentives, lower labor costs, and abundant raw material availability further bolster regional competitiveness. As supply chains evolve, Asia-Pacific is both a key production hub and a vital consumption market, shaping global trade flows and innovation trajectories.

This comprehensive research report examines key regions that drive the evolution of the Dioctyl Maleate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Prominent Industry Leaders and Innovators Shaping the Dioctyl Maleate Market Through Strategic Initiatives and Competitive Differentiation

The competitive landscape for dioctyl maleate is marked by established chemical majors and agile specialty producers advancing product portfolios and operational capabilities. Eastman Chemical Company has implemented price adjustments across its plasticizer lines, reflecting rising production costs and sustained demand for specialized formulations. Polynt S.p.A. and Celanese Corporation continue to invest in research partnerships and capacity expansions to enhance their presence in key growth regions, while Celanese’s deployment of an AI-enabled platform streamlines grade selection and customer engagement, driving efficiency in order processing and technical service delivery.

Niche players such as Hallstar and Nayakem leverage targeted innovation in high-performance UV-resistant and bio-based maleate esters, addressing the premium segment of coatings and adhesives markets. Merck Group’s specialty chemicals unit focuses on ultra-high-purity grades for pharmaceutical and electronic applications, differentiating through stringent quality control and regulatory compliance. Meanwhile, regional producers in China and India, including Hangzhou Qianyang Technology and Prakash Chemicals International, are scaling local manufacturing to meet growing domestic demand, supported by government incentives and integrated supply chain arrangements.

Collaborative ventures, joint research efforts, and dynamic supply agreements are common strategies among leading players to mitigate tariff pressures and optimize feedstock sourcing. Through targeted capacity expansions and digital transformation initiatives, these companies aim to reinforce their competitive positioning and address the evolving requirements of downstream formulators seeking sustainable, high-performance solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dioctyl Maleate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aekyung Petrochemical Co., Ltd.

- Allan Chemical Corporation

- Anhui Xiangfeng New Material Co., Ltd.

- Banner Chemicals Ltd

- Biesterfeld AG

- Biesterfeld AG

- Biosynth

- Celanese Corporation

- ChemCeed

- ChemCeed LLC

- Eastman Chemical Company

- ESIM Chemicals GmbH

- ExxonMobil Chemical

- Hallstar Innovations Corp.

- Hangzhou Qianyang Technology Co., Ltd.

- Henan GP Chemicals Co.Ltd

- Jiangsu Yinyan Specialty Chemicals Co., Ltd.

- KLJ Group

- Merck KGaA

- Nayakem Ltd.

- Praykash Chemicals International Private Limited

- Shandong Yuanli Science and Technology Co., Ltd.

- Sinocure Chemical Group Co., Ltd.

- TCI Chemicals (India) Pvt. Ltd.

- VWR International, LLC

- YUANLI Chemical Group Co., Ltd.

- Zhejiang Weifeng New Materials Co., Ltd.

Driving Actionable Strategic Recommendations to Enhance Resilience, Sustainability, and Competitive Agility in Dioctyl Maleate Manufacturing

Industry leaders should prioritize the integration of advanced analytics and scenario planning tools to anticipate raw material disruptions and tariff fluctuations. By leveraging predictive modeling, procurement teams can dynamically adjust sourcing strategies, reducing exposure to geopolitical risks while optimizing total cost of ownership. Embedding these capabilities within risk management frameworks will drive agile decision-making and ensure uninterrupted production flow.

To capitalize on sustainability imperatives, manufacturers must accelerate the adoption of bio-based feedstocks and advanced recycling technologies. Collaborative partnerships with biotechnology firms and catalyst specialists can fast-track the development of lower-carbon dioctyl maleate variants, aligning product offerings with stringent environmental standards and customer demands. Piloting circular economy initiatives and design-for-reuse approaches will further enhance resource efficiency and foster brand differentiation in a competitive marketplace.

Digital transformation remains a pivotal lever for operational excellence. Expanding the use of digital twins, blockchain-enabled traceability, and AI-driven quality control systems will streamline workflows, reduce waste, and reinforce compliance. Cross-functional teams should champion these technologies, fostering a culture of continuous innovation and embedding sustainability metrics into core performance indicators. Through targeted training and change management, organizations can accelerate technology adoption and realize measurable efficiency gains.

Outlining a Robust Research Methodology Integrating Primary Interviews Secondary Data and Rigorous Validation Techniques for Credible Insights

This analysis is grounded in a comprehensive research methodology that synthesizes multiple data sources and validation techniques. Primary research comprised in-depth interviews with industry stakeholders, including chemical producers, formulators, and supply chain experts, to capture nuanced insights on market dynamics and strategic priorities. Secondary research involved the review of regulatory filings, company presentations, trade publications, and authoritative news sources to construct a robust contextual framework.

Quantitative data, including trade statistics and input cost indices, were triangulated through cross-referencing publicly available customs databases and industry reports. Qualitative findings were subjected to rigorous validation via expert panel reviews, ensuring that interpretations reflect current market realities. The methodological approach also incorporated scenario analysis to assess the potential impact of emerging trends, such as digitalization initiatives and tariff policy shifts, on market trajectories.

This multi-layered research design ensures both depth and credibility, delivering actionable insights that guide strategic decision-making. By blending empirical evidence with expert judgment, the report provides a reliable basis for understanding the evolving dioctyl maleate landscape and identifying opportunities for growth and differentiation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dioctyl Maleate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dioctyl Maleate Market, by Product Grade

- Dioctyl Maleate Market, by Function

- Dioctyl Maleate Market, by Distribution Channel

- Dioctyl Maleate Market, by Application

- Dioctyl Maleate Market, by End Use Industry

- Dioctyl Maleate Market, by Region

- Dioctyl Maleate Market, by Group

- Dioctyl Maleate Market, by Country

- United States Dioctyl Maleate Market

- China Dioctyl Maleate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Drawing Comprehensive Conclusions on Dioctyl Maleate Market Dynamics and Strategic Imperatives Shaping Future Industry Trajectories

In summary, dioctyl maleate stands at the confluence of performance demands and evolving regulatory requirements, offering a versatile solution for high-performance plasticizers, adhesives, coatings, and lubricants. The compound’s phthalate-free profile and compatibility with advanced polymer systems position it as a strategic enabler in sectors transitioning toward sustainability and low-VOC formulations.

The 2025 United States tariff measures have introduced complexity into supply chains, driving a strategic pivot toward localized production and long-term supplier partnerships. Meanwhile, the industry-wide embrace of digital tools and circular economy practices is reshaping competitive landscapes, rewarding organizations that integrate transparency, resilience, and innovation into their core operations.

By leveraging segmentation insights across application, end-use, grade, function, and distribution channels, stakeholders can tailor value propositions to specific market niches and optimize resource allocation. Regional dynamics underscore the importance of agility in navigating diverse regulatory regimes and geopolitical influences, while leading companies demonstrate the value of targeted investments in AI, sustainability, and strategic collaborations.

Looking ahead, actionable recommendations centered on risk-adjusted sourcing, green chemistry integration, and digital transformation will support enduring competitive advantage. This comprehensive understanding of dioctyl maleate’s market dynamics and strategic imperatives serves as a blueprint for informed decision-making and sustained growth.

Engage with Ketan Rohom to Secure Your Comprehensive Dioctyl Maleate Market Research Report and Drive Informed Strategic Decisions Today

To learn more about how this comprehensive analysis can empower your organization and to secure immediate access to an expertly crafted market research report on Dioctyl Maleate, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings extensive experience in guiding businesses through nuanced chemical market landscapes and can provide tailored insights aligned with your strategic objectives. Engage today to gain a competitive edge with actionable data and specialized recommendations designed to optimize your plasticizer sourcing, manufacturing processes, and growth initiatives. Contact Ketan to discuss licensing options, customized data packages, and next steps on your path to informed strategic decision-making.

- How big is the Dioctyl Maleate Market?

- What is the Dioctyl Maleate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?