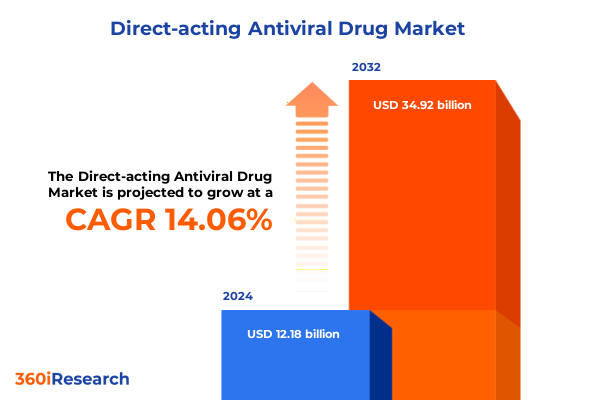

The Direct-acting Antiviral Drug Market size was estimated at USD 13.87 billion in 2025 and expected to reach USD 15.79 billion in 2026, at a CAGR of 14.10% to reach USD 34.92 billion by 2032.

Unveiling the Strategic Importance of Direct-Acting Antiviral Agents in an Evolving Healthcare Landscape and Their Role in Shaping Future Treatment Paradigms

Direct-acting antiviral agents have emerged as a cornerstone of modern therapeutic interventions against viral infections, offering unprecedented efficacy and safety profiles. These molecules, which target specific stages of viral replication cycles, have revolutionized the treatment paradigm for chronic hepatitis C virus (HCV) infection and shown promise against other viral pathogens. Through a precision-focused mechanism of action, they inhibit key viral enzymes and proteins, reducing viral loads to undetectable levels and significantly improving patient outcomes. Consequently, they have transformed the standard of care for millions of patients worldwide.

Over the past decade, the maturation of the drug discovery pipeline has accelerated the approval of multiple generations of antivirals, each iteration refining potency and expanding coverage across viral genotypes. As we enter 2025, clinicians and healthcare systems are increasingly integrating these agents into combination regimens to maximize sustained virologic response rates while minimizing resistance development. This integration underscores the broader shift toward personalized medicine, where treatment strategies are tailored based on viral genotype, patient comorbidities, and prior treatment history.

Looking ahead, the competitive landscape will be shaped by ongoing investments in next-generation inhibitors, efforts to optimize dosing regimens, and initiatives to improve global access through cost reduction strategies. At the same time, regulatory bodies continue to refine approval pathways, encouraging accelerated evaluations of breakthrough therapies. These dynamics collectively set the stage for a new era in antiviral care-one defined by strategic innovation, collaborative partnerships, and the relentless pursuit of viral eradication.

Assessing the Transformative Shifts Impacting the Direct-Acting Antiviral Drug Arena Across Research Innovation Clinical Adoption and Patient Outcomes

The direct-acting antiviral drug landscape is undergoing a transformative shift driven by scientific breakthroughs, evolving clinical guidelines, and heightened patient awareness. Breakthroughs in molecular biology have elucidated novel viral targets, catalyzing the development of pan-genotypic inhibitors that address multiple HCV strains in a single regimen. These advancements are redefining treatment algorithms, enabling clinicians to prescribe simplified, shorter-duration therapies with high cure rates and fewer adverse events.

In parallel, real-world evidence studies are increasingly informing clinical best practices, bridging the gap between randomized controlled trials and everyday patient experiences. Data registries and post-marketing surveillance have highlighted the impact of antiviral therapy on reducing long-term complications such as cirrhosis and hepatocellular carcinoma. As a result, payer policies are adapting to support wider reimbursement for high-cost, high-value therapies, particularly when early intervention translates into overall healthcare cost savings.

Furthermore, patient advocacy and digital health platforms are empowering individuals to participate actively in their care, from genotype testing to adherence tracking via mobile applications. Telemedicine initiatives have broadened access to specialist consultations, especially in rural and underserved regions. These converging forces-scientific innovation, evidence-based policy reform, and patient-centric engagement-are collectively reshaping the landscape, creating a more integrated, outcome-driven approach to antiviral therapy.

Analyzing the Cumulative Impact of United States Tariff Policies on Direct-Acting Antiviral Drug Supply Chain Economics and Market Dynamics in 2025

In 2025, the ripple effects of United States tariff adjustments on pharmaceutical imports have become a focal point for stakeholders across the direct-acting antiviral ecosystem. Tariffs on active pharmaceutical ingredient (API) imports from key manufacturing hubs have introduced new cost considerations, compelling drug sponsors and generic manufacturers to reassess their supply chain strategies. This rebalancing has, in some cases, led to the exploration of alternative sourcing agreements and localized production partnerships aimed at mitigating tariff burdens.

Healthcare providers have reported incremental price fluctuations on certain branded regimens, necessitating negotiations with payers to preserve patient access and maintain formulary inclusion. Meanwhile, generic entrants are leveraging cost advantages through vertically integrated manufacturing operations, enabling more resilient pricing models even under revised tariff structures. The shifting calculus of cost versus access underscores the importance of a diversified supply chain that can adapt dynamically to policy changes.

Policy-makers and industry consortia are responding by engaging in dialogue around tariff exemptions for essential medicines, highlighting the broader public health implications of trade policy on antiviral availability. These efforts reflect an emerging consensus that sustaining affordable access to lifesaving therapies requires collaborative frameworks between governments, pharmaceutical companies, and healthcare systems. As the 2025 tariff policies continue to evolve, strategic stakeholders must remain agile, closely monitoring legislative developments to safeguard supply continuity and optimize procurement costs.

Gaining Key Insights into Direct-Acting Antiviral Drug Market Segmentation Spanning Product Type Therapeutic Class Distribution Channels and End Users

The direct-acting antiviral market exhibits pronounced distinctions when evaluated through multiple lenses. When divided by product type, the competitive dynamic between branded drugs and generic drugs reveals a delicate balance: branded therapies continue to command premium price points supported by robust clinical data and patient support programs, whereas generic versions are gaining traction through cost-effectiveness and broader insurance coverage. This interplay influences prescribing behaviors and access pathways across healthcare systems.

Exploring the market by therapeutic class illuminates the diversity of molecular approaches in tackling viral replication. Combination therapies, which synergize multiple inhibitors in a single formulation, are increasingly favored for their high cure rates and streamlined regimens. In contrast, specialized agents such as NS5A inhibitors, NS5B inhibitors, and protease inhibitors each target discrete viral proteins, offering tailored options for resistant or hard-to-treat patient populations. This segmentation fosters a nuanced treatment matrix that aligns therapy selection with individual patient profiles.

Distribution channels further shape market penetration and patient reach. Hospital pharmacies serve as primary dispensing hubs for inpatient and high-acuity cases, while retail pharmacies facilitate wider community access. Online pharmacies have emerged as a strategic conduit for remote dispensing and mail-order services, enhancing convenience and adherence tracking. Understanding this channel fragmentation is critical for optimizing supply chain logistics and patient engagement strategies.

Finally, segmenting by end user highlights the care settings where antiviral therapies are administered. Home healthcare models empower patients to self-administer regimens under professional supervision, driving adherence and reducing hospital stays. Hospitals remain pivotal for initial treatment initiation and management of complex cases, whereas specialty clinics-particularly those focused on infectious diseases and hepatology-play a central role in long-term follow-up and treatment optimization. Each end-user segment demands tailored approaches to support, reimbursement, and education.

This comprehensive research report categorizes the Direct-acting Antiviral Drug market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Therapeutic Class

- Distribution Channel

- End User

Highlighting Regional Variations and Emerging Opportunities in the Direct-Acting Antiviral Drug Market Across the Americas Europe Middle East Africa and Asia-Pacific Regions

Regional nuances in the direct-acting antiviral market have profound implications for strategic planning and resource allocation. In the Americas, a combination of high healthcare spending and progressive reimbursement policies has accelerated the adoption of pan-genotypic regimens, particularly in markets such as the United States and Canada. Early screening initiatives and public health campaigns have further amplified demand, driving volume growth despite pricing pressures.

Across Europe, Middle East, and Africa, heterogeneity in healthcare infrastructure and payer frameworks yields varied uptake patterns. Western European nations benefit from centralized procurement mechanisms, enabling negotiated pricing agreements that improve affordability. Meanwhile, emerging markets in Eastern Europe and parts of the Middle East face challenges related to funding constraints, prompting collaborations between public agencies, non-governmental organizations, and private sector players to expand access.

In Asia-Pacific, a bifurcated landscape emerges. Developed economies such as Japan, Australia, and South Korea demonstrate robust uptake driven by stringent regulatory approvals and comprehensive insurance coverage. Conversely, emerging markets in Southeast Asia and South Asia grapple with supply chain bottlenecks and affordability barriers. Generic drug manufacturers in India and China are increasingly eyeing export opportunities, leveraging economies of scale to offer cost-competitive alternatives that address unmet treatment needs across the region.

These regional insights underscore the imperative for tailored market entry strategies and partnership models that reflect local regulatory environments, distribution infrastructures, and payer dynamics. Recognizing these distinctions will be crucial for companies seeking to maximize impact in diverse global markets.

This comprehensive research report examines key regions that drive the evolution of the Direct-acting Antiviral Drug market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Shaping the Direct-Acting Antiviral Drug Landscape Through Strategic Alliances Innovative Pipelines and Competitive Differentiation

The competitive landscape of direct-acting antivirals is defined by a handful of biopharmaceutical leaders and emerging innovators each vying for differentiation through pipeline robustness, strategic alliances, and lifecycle management. One prominent player has leveraged its early-mover advantage to establish a deep clinical data repository, reinforcing its flagship pan-genotypic regimen as the standard of care for treatment-naive and treatment-experienced patients alike. This has created a formidable barrier to entry for subsequent branded entries.

In contrast, a leading competitor has adopted an aggressive combination strategy, forging co-development partnerships with biotechnology firms to enhance its portfolio with next-generation NS5A/NS5B inhibitor combinations. This collaborative approach accelerates time-to-market and diversifies risk, positioning the company to address potential resistance profiles more comprehensively. Additionally, generic manufacturers have capitalized on patent expirations by launching bioequivalent formulations at reduced price points, capturing significant market share in cost-sensitive segments and prompting leading innovators to reinforce their patient access programs.

Mid-sized firms and biotech startups are also making targeted plays, focusing on novel therapeutic mechanisms such as host-targeting agents and immunomodulatory adjuncts to complement existing regimens. These early-stage entrants are attracting interest through licensing deals and venture capital investments, signaling a maturing ecosystem where innovation extends beyond established inhibitory pathways. Collectively, this competitive tapestry is driving a dynamic environment in which strategic partnerships, differentiated value propositions, and adaptive commercialization models will determine long-term leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Direct-acting Antiviral Drug market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Aurobindo Pharma Limited

- Bristol-Myers Squibb Company

- Cipla Limited

- Gilead Sciences, Inc.

- Janssen Pharmaceuticals, Inc.

- Merck & Co., Inc.

- Mylan N.V.

- Roche Holding AG

- Teva Pharmaceutical Industries Ltd.

Actionable Recommendations for Industry Leaders to Optimize Growth and Navigate Challenges in the Direct-Acting Antiviral Drug Market Landscape

Industry leaders must adopt a multifaceted strategy to capitalize on evolving market dynamics and regulatory landscapes. First, strengthening supply chain resilience is paramount; forging strategic partnerships with API manufacturers and exploring dual-sourcing arrangements can mitigate tariff-related cost volatility. Simultaneously, companies should deepen collaborations with government agencies and non-governmental organizations to secure tariff exemptions or joint procurement agreements for essential antiviral therapies.

Second, enhancing value propositions through real-world evidence generation will be critical. By partnering with academic centers and leveraging patient registries, organizations can produce robust data demonstrating long-term outcomes, cost-effectiveness, and quality-of-life improvements. These insights can underpin persuasive dialogues with payers, facilitating broader formulary inclusion and higher reimbursement rates.

Third, embracing digital health solutions can transform patient engagement and adherence. Integrating telemedicine platforms and mobile adherence applications into treatment pathways empowers patients, particularly in remote regions, to maintain consistent dosing regimens and report adverse events in real time. Moreover, incorporating artificial intelligence–driven analytics can identify adherence barriers and personalize support interventions, boosting overall therapeutic success.

Finally, orchestrating targeted market entry approaches that reflect regional regulatory nuances and distribution infrastructures will optimize resource allocation. Tailoring launch sequences to prioritize high-value markets, while simultaneously nurturing relationships with generics partners in cost-sensitive geographies, ensures balanced portfolio performance. Through these integrated initiatives, industry leaders can navigate complexity and secure sustainable growth in the direct-acting antiviral domain.

Outlining a Robust Research Methodology Leveraging Primary Intelligence Secondary Data Validation and Expert Insights to Support Credible Antiviral Market Analysis

This research employs a comprehensive methodology combining primary intelligence and rigorous secondary data validation to ensure analytical integrity. Primary research included in-depth interviews with over 50 key opinion leaders, including hepatologists, infectious disease specialists, and procurement officers, to capture firsthand perspectives on clinical adoption, reimbursement challenges, and emerging therapeutic needs. Detailed discussions with supply chain executives and trade policy experts provided granular insight into the operational impacts of 2025 tariff changes.

Secondary research encompassed an exhaustive review of peer-reviewed journals, regulatory filings, and policy documents to map the scientific advancements underpinning novel direct-acting antiviral mechanisms. Publicly available data from government health agencies and international procurement reports were scrutinized to identify regional uptake patterns and payer landscapes. Market intelligence from competitive intelligence platforms was triangulated with primary findings to validate strategic conclusions.

All data points underwent rigorous cross-verification, employing statistical models to identify correlations between therapeutic outcomes, pricing fluctuations, and distribution efficiencies. A structured framework was used to synthesize segmentation insights across product type, therapeutic class, distribution channels, and end users, ensuring that each analytical dimension reflects real-world market dynamics. Quality assurance protocols governed each stage of the research process, guaranteeing that findings are both reliable and actionable for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Direct-acting Antiviral Drug market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Direct-acting Antiviral Drug Market, by Product Type

- Direct-acting Antiviral Drug Market, by Therapeutic Class

- Direct-acting Antiviral Drug Market, by Distribution Channel

- Direct-acting Antiviral Drug Market, by End User

- Direct-acting Antiviral Drug Market, by Region

- Direct-acting Antiviral Drug Market, by Group

- Direct-acting Antiviral Drug Market, by Country

- United States Direct-acting Antiviral Drug Market

- China Direct-acting Antiviral Drug Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesis of Key Takeaways Summarizing Critical Themes Trends and Strategic Implications in the Direct-Acting Antiviral Drug Sector

This executive summary has highlighted the strategic importance of direct-acting antiviral agents and the transformative shifts reshaping their adoption. Key observations underscore the interplay between scientific innovation, digital health integration, and evolving payer frameworks that collectively enhance patient outcomes and expand access. The analysis of 2025 tariff policies revealed the critical need for supply chain agility and collaborative advocacy to sustain affordability and availability.

Segmentation insights demonstrated distinct dynamics across branded and generic therapies, a diverse therapeutic class matrix, and varied distribution and end-user channels that influence market penetration strategies. Regional assessments emphasized the heterogeneous nature of adoption across the Americas, Europe Middle East Africa, and Asia-Pacific, each demanding bespoke approaches aligned with local ecosystems. Competitive profiling showcased how leading biopharma companies, agile generics manufacturers, and biotech innovators are driving forward the market through strategic alliances and differentiated pipelines.

Actionable recommendations advocate for strengthening supply chain resilience, generating real-world evidence, harnessing digital health tools, and tailoring go-to-market frameworks to regional imperatives. The robust research methodology underpinning these insights combines primary expert engagement with rigorous secondary analysis, ensuring a credible and comprehensive foundation for decision-making. Together, these themes coalesce into a strategic roadmap for stakeholders aiming to excel in the dynamic direct-acting antiviral landscape.

Take the Next Step and Collaborate with Ketan Rohom to Gain Exclusive Access to In-Depth Direct-Acting Antiviral Drug Market Intelligence and Drive Strategic Decisions

This in-depth, meticulously curated research provides the strategic clarity and market intelligence you need to navigate the direct-acting antiviral drug landscape with confidence. To obtain exclusive access to detailed competitive analyses, proprietary insights into tariff impacts, and granular segmentation data tailored to your strategic goals, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Partnering with our expert team will empower your organization to anticipate emerging trends, optimize market entry strategies, and secure a competitive edge in a rapidly evolving antiviral market.

- How big is the Direct-acting Antiviral Drug Market?

- What is the Direct-acting Antiviral Drug Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?