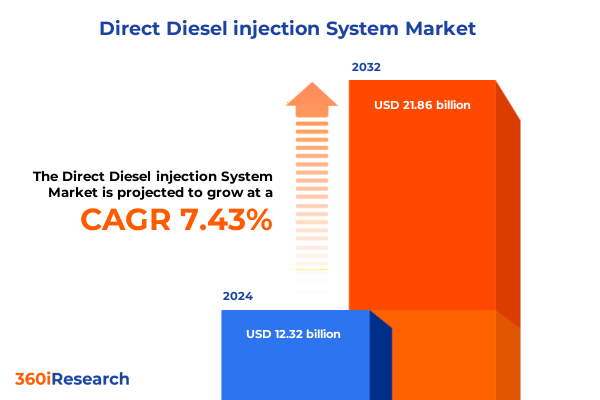

The Direct Diesel injection System Market size was estimated at USD 13.17 billion in 2025 and expected to reach USD 14.08 billion in 2026, at a CAGR of 7.50% to reach USD 21.86 billion by 2032.

Driving the Future of Fuel Efficiency Through Cutting-Edge Direct Diesel Injection Technology and Market Dynamics in 2025 Unlocking Opportunities and Challenges

The global drive toward greater operational efficiency, tighter emissions control and enhanced performance has positioned direct diesel injection technology at the forefront of powertrain innovation. In response to rigorous environmental regulations and fluctuating fuel prices, automotive and heavy machinery manufacturers have accelerated the integration of high-pressure injection systems that precisely meter fuel delivery. This introduction examines the interplay between evolving regulatory frameworks, manufacturer priorities and end-user demands, illustrating how the direct diesel injection paradigm has shifted from incremental improvement to radical transformation across industries.

As diesel engines continue to play a critical role in commercial transport and off-highway applications, stakeholders are compelled to balance cost containment with performance metrics. Advances in precision fuel metering and adaptive injection strategies have enabled significant reductions in particulate emissions and nitrogen oxide output, while simultaneously enhancing torque delivery and fuel economy. These developments create a dynamic ecosystem in which technology vendors, OEMs and aftermarket suppliers must collaborate to realize value across the supply chain.

Furthermore, the transition toward electrified powertrains and hybrid architectures introduces a new dimension of complexity. While full electrification remains a long-term objective, the intermediary adoption of mild hybrid systems and intelligent fuel injection controls underscores the continued relevance of diesel technology. This report’s introduction sets the stage for an in-depth exploration of the market’s future trajectory, focusing on disruptive innovations, regulatory pressures and strategic imperatives poised to redefine the landscape of direct diesel injection in 2025 and beyond.

Navigating the Rapid Evolution of Direct Diesel Injection Landscape Through Electrification Integration and Emissions Regulation Compliance Strategies in 2025

The direct diesel injection sector has undergone a period of accelerated transformation, driven by a confluence of technological breakthroughs and shifting market imperatives. Historically anchored on mechanical pump systems, the landscape has pivoted toward electronically controlled high-pressure pumps, piezo injectors and advanced emission after-treatment integration. These innovations have redefined engine calibration, enabling adaptive injection timing and multi-pulse strategies that simultaneously optimize combustion efficiency and reduce environmental footprint.

Regulatory mandates for lower sulfur content in diesel fuel, coupled with stringent Euro VI, EPA Tier 4 and equivalent global standards, have compelled OEMs to innovate at an unprecedented pace. Electrification of ancillary components, integration of predictive maintenance algorithms and deployment of real-time diagnostics have become essential capabilities for new injection platforms. This confluence of electrification and data-driven control systems has elevated direct injection from a purely mechanical domain into an interconnected digital architecture.

Moreover, the convergence of aftermarket and OEM channels has reshaped competitive dynamics, as suppliers strive to deliver modular, serviceable platforms that accommodate both first-fit applications and aftermarket retrofits. Emerging collaborations between traditional fuel system manufacturers and software providers underscore a broader industry shift toward holistic powertrain solutions. As the market continues to evolve, the ability to navigate these transformative shifts will determine the strategic positioning of companies operating within the direct diesel injection ecosystem.

Assessing the Far-Reaching Effects of 2025 United States Diesel Component Tariffs on Direct Injection Supply Chains and Global Cost Structures

In 2025, the imposition of tariffs on diesel engine components by the United States government has generated significant reverberations throughout the global supply chain. Originally intended to safeguard domestic manufacturing capabilities, these measures have introduced cost variances that cascade across production, distribution and end-user pricing models. Suppliers reliant on imported high-pressure tubing, rail pipes and electronic control modules have encountered margin compression, prompting a reassessment of sourcing strategies.

The ripple effects of these tariffs are particularly pronounced within first-fit channels, where OEMs must reconcile component cost escalation with long-term contract obligations and product launch schedules. Meanwhile, aftermarket participants are challenged to absorb duties without eroding competitive pricing, leading to an uptick in regional assembly and localized component fabrication. Consequently, investment in domestic manufacturing infrastructure has accelerated, with several tier-1 suppliers announcing expansion of U.S.-based machining and pump assembly facilities.

Despite initial cost pressures, the tariffs have catalyzed innovation in supply chain optimization and vertical integration. Collaborative ventures between fuel system developers and raw material suppliers aim to secure preferential terms and streamline logistics. As the direct diesel injection market adapts to new tariff regimes, stakeholders must develop agile procurement practices and enhanced supplier partnerships to mitigate ongoing trade uncertainties.

Unveiling Segmentation Insights to Decode Direct Diesel Injection System Market Dynamics Through Distribution Channels Types Vehicle Applications and Components

A comprehensive examination of market segmentation reveals nuanced performance differentials across distribution channel, type, vehicle application and component categories. When appraising the distribution channel, aftermarket demand is buoyed by retrofit cycles and service intervals, whereas OEM adoption is influenced by original equipment powertrain integration strategies. Similarly, the technology typology encompasses common rail architectures renowned for multi-pulse injection precision alongside unit injector and unit pump systems that offer modular simplicity for specific engine platforms.

Vehicle application further disaggregates market dynamics, as heavy commercial vehicles necessitate robust, redundant injection systems that operate reliably under sustained load profiles, while light commercial vehicles prioritize a balance between efficiency and total cost of ownership. Passenger car segments, extending from hatchbacks to sedans and SUVs, adopt injection configurations optimized for urban drivability and emission compliance. Component-level segmentation underscores the interplay between common rail assemblies, fuel injectors and high-pressure pumps supplemented by rail pipes and tubing. Within these assemblies, pressure accumulators and piezo injectors deliver rapid response times, while solenoid injectors and inline pumps maintain cost-effective responsiveness.

By synthesizing insights across these segmentation categories, stakeholders can identify strategic priorities such as targeting aftermarket retrofit opportunities in emerging markets or aligning first-fit OEM strategies with electrification roadmaps. The segmentation framework thus serves as a critical lens to decode where adoption curves, innovation cycles and competitive intensity intersect within the direct diesel injection system landscape.

This comprehensive research report categorizes the Direct Diesel injection System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Distribution Channel

- Type

- Vehicle Type

- Component

Spotlighting Diverse Regional Trends Shaping Direct Diesel Injection Adoption Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional market dynamics diverge based on regulatory frameworks, infrastructure maturity and fleet composition. Within the Americas, ongoing investments in freight logistics modernization and stringent EPA emission standards have fueled demand for advanced direct injection modules in both long-haul trucking and vocational applications. The United States, in particular, exhibits a trend toward localized component sourcing in response to tariff headwinds and incentives for reshoring critical manufacturing capabilities.

Across Europe, Middle East and Africa, heterogeneity in emission norms and fuel quality standards shapes market uptake. Western Europe’s aggressive carbon neutrality targets drive adoption of next-generation injection systems paired with selective catalytic reduction, while Middle Eastern markets prioritize component durability under high-temperature and low-lube conditions. In Africa, retrofit opportunities within aging commercial fleets present immediate prospects for aftermarket growth, with regional distributors emphasizing cost-effective pump and injector overhauls.

Asia-Pacific encompasses the broadest spectrum of market maturity, from highly regulated Japan and South Korea to rapidly expanding commercial vehicle sectors in China, India and Southeast Asia. Manufacturers in this region are launching scalable injection platforms that cater to diverse regulatory requirements, from Bharat Stage VI in India to China VI standards. Moreover, strategic partnerships between local equipment makers and global technology vendors facilitate knowledge transfer and localized production, reinforcing Asia-Pacific’s pivotal role in the direct diesel injection ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Direct Diesel injection System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Innovative Market Leaders and Emerging Players Driving Technological Advancement and Competitive Differentiation in Direct Diesel Injection Sector

The competitive landscape features a blend of established engine component manufacturers, emerging specialized suppliers and integrated powertrain technology firms. Leading multinational entities have leveraged decades of R&D in high-pressure pump design and injector sequencing algorithms to maintain a strong foothold in first-fit OEM programs. Concurrently, nimble innovators have carved niches in aftermarket solutions by offering modular retrofit kits enriched with sensor-enabled diagnostics and cloud-based maintenance platforms.

Strategic alliances have become commonplace as firms seek to extend product portfolios and accelerate time to market. Collaborations between pump developers and electronics specialists have produced advanced piezoelectric injection assemblies, while partnerships with materials science companies have yielded next-generation high-strength alloys for critical tubing and rail components. Moreover, mergers and acquisitions activity has intensified, with global players acquiring regional pump manufacturers to secure distribution networks and reduce tariff exposure.

Competitive differentiation increasingly hinges on value-added services, including predictive analytics, remote calibration updates and extended warranty programs. Providers that integrate digital monitoring capabilities directly into their hardware platforms offer customers real-time performance insights, thereby reducing unplanned downtime and supporting proactive maintenance regimes. As the industry continues to evolve, the most successful companies will be those that combine technological leadership with comprehensive service offerings tailored to OEM and aftermarket stakeholders alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Direct Diesel injection System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Continental AG

- Cummins Inc.

- Delphi Technologies PLC

- DENSO Corporation

- Hitachi Automotive Systems, Ltd.

- MAHLE GmbH

- Pierburg Pump Technology GmbH

- Robert Bosch GmbH

- Stanadyne LLC

- Yanmar Co., Ltd.

Empowering Industry Leaders with Strategic Roadmaps to Enhance Efficiency Maximize Performance and Sustain Growth in Direct Diesel Injection Market

Industry leaders can capitalize on current market dynamics by adopting a three-pronged strategic approach centered on innovation synergy, supply chain resilience and customer-centric service models. First, forging cross-functional partnerships between fuel system developers, software integrators and materials suppliers will accelerate the delivery of next-generation injection platforms with embedded diagnostic capabilities. Such collaborative ecosystems enable rapid prototyping, iterative validation and seamless integration with vehicle electronics.

Second, strengthening supply chain resilience is imperative in light of recent tariff-induced cost fluctuations and raw material volatility. Firms should diversify supplier portfolios, establish dual-sourcing arrangements for key components like high-pressure pumps and tubular assemblies, and explore localized manufacturing hubs to reduce logistics lead times. Investment in predictive procurement analytics will further enhance the ability to forecast demand, optimize inventory levels and mitigate exposure to trade policy shifts.

Finally, elevating customer engagement through tailored aftermarket support services represents a critical differentiator. By providing digital maintenance platforms, remote calibration updates and comprehensive training programs for field technicians, companies can foster long-term loyalty and generate recurring revenue streams. These actionable recommendations, when executed in concert, will empower industry leaders to navigate the evolving direct diesel injection landscape, optimize operational performance and secure sustainable competitive advantage.

Delivering Rigorous Research Methodology and Comprehensive Analytical Framework Underpinning the Direct Diesel Injection System Industry Study

This study employs a rigorous, multi-tiered research methodology to ensure comprehensive coverage of the direct diesel injection system landscape. Primary research involved in-depth interviews with OEM powertrain engineers, procurement specialists and aftermarket distributors, complemented by expert roundtables with technology providers and regulatory authorities. Secondary research encompassed analysis of patent filings, technical white papers and trade association publications to validate emerging innovation trajectories.

Quantitative data was synthesized through extensive supplier surveys and proprietary databases, enabling cross-comparison of component pricing trends, adoption rates and retrofit penetration. Qualitative insights were derived from case studies of real-world fleet deployments and pilot programs, providing contextual understanding of performance outcomes, maintenance intervals and total cost of ownership impacts. Geographic analysis relied on regional policy documentation, market intelligence reports and localized stakeholder consultations to capture variance in regulatory strictness and infrastructure readiness.

Triangulation of data sources ensured methodological robustness, with iterative validation cycles between primary and secondary findings to refine key themes and challenge assumptions. This comprehensive analytical framework underpins the study’s segmentation, regional breakdown and competitive profiling, delivering actionable intelligence that addresses both strategic planning and operational execution requirements across the direct diesel injection ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Direct Diesel injection System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Direct Diesel injection System Market, by Distribution Channel

- Direct Diesel injection System Market, by Type

- Direct Diesel injection System Market, by Vehicle Type

- Direct Diesel injection System Market, by Component

- Direct Diesel injection System Market, by Region

- Direct Diesel injection System Market, by Group

- Direct Diesel injection System Market, by Country

- United States Direct Diesel injection System Market

- China Direct Diesel injection System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding Critical Insights and Forward-Looking Perspectives to Guide Stakeholders Through Emerging Challenges and Opportunities in Direct Diesel Injection

The direct diesel injection market stands at an inflection point, shaped by intertwined forces of regulatory rigor, technological advancement and global trade dynamics. Critical insights underscore that precise fuel metering, high-pressure pump innovation and integrated digital diagnostics are no longer optional enhancements but strategic imperatives for achieving performance benchmarks and emissions compliance. Stakeholders must reconcile the demands of OEM first-fit programs with aftermarket renewal cycles, all while navigating cost pressures stemming from evolving tariff regimes.

Looking ahead, the convergence of electrified powertrain architectures and advanced combustion strategies will create hybridized injection solutions that bridge current diesel applications with emerging low-carbon mobility paradigms. The ability to anticipate regulatory shifts, secure resilient supply chains and deliver enhanced service offerings will delineate market winners. Furthermore, regional heterogeneity in emission standards and fleet composition will drive differentiated go-to-market strategies, necessitating a finely tuned understanding of local market drivers.

By synthesizing segmentation intelligence, regional trends and competitive positioning, stakeholders can chart a strategic course that harmonizes innovation investments with market realities. This conclusion crystallizes the study’s forward-looking perspectives, equipping decision-makers with the clarity needed to capitalize on emerging opportunities and navigate the challenges inherent in the direct diesel injection ecosystem.

Take Immediate Action to Secure Direct Diesel Injection Market Intelligence Report with Ketan Rohom Associate Director Sales and Marketing

Engaging directly with Ketan Rohom, Associate Director of Sales and Marketing, offers a strategic pathway to transform organizational insights into actionable outcomes for stakeholders seeking authoritative market intelligence. His expertise in articulating complex technological and commercial analyses ensures that clients receive a tailored approach aligned with corporate objectives. By initiating a dialogue with Ketan Rohom, prospective purchasers gain immediate access to premium data on supply chain dynamics, competitive positioning and tariff impact implications. Leveraging his guidance accelerates decision-making, enabling procurement of the comprehensive Direct Diesel Injection System market report in a manner that addresses budgetary priorities and long-term growth strategies.

The consultation process under Ketan Rohom’s stewardship involves an in-depth needs assessment, ensuring that each element of the report-from segmentation deep dives to regional trend analysis-complements the client’s strategic planning cycle. Engagement with his team secures prompt delivery timelines, customized executive summaries and ongoing support for interpretation of findings. Prospective clients can thus capitalize on the report’s insights to refine product development roadmaps, optimize supply chain resilience and anticipate regulatory shifts with confidence. Reach out to Ketan Rohom today to acquire the definitive resource for navigating the next wave of innovation in Direct Diesel Injection Systems.

- How big is the Direct Diesel injection System Market?

- What is the Direct Diesel injection System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?