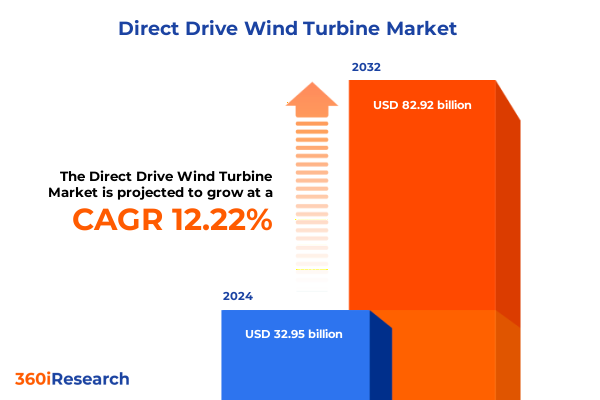

The Direct Drive Wind Turbine Market size was estimated at USD 36.80 billion in 2025 and expected to reach USD 41.11 billion in 2026, at a CAGR of 12.30% to reach USD 82.92 billion by 2032.

Introducing the Critical Role of Direct Drive Wind Turbines in Modern Energy Portfolios Highlighting Key Drivers and Strategic Benefits

Direct drive wind turbines have emerged as a cornerstone of modern energy transition strategies, offering a streamlined architecture that eliminates the gearbox and its associated maintenance complexities. This architectural innovation not only enhances system reliability but also significantly reduces downtime and total life-cycle costs. As utilities and independent power producers increasingly prioritize operational efficiency and grid stability, direct drive systems have captured attention for their capacity to deliver higher energy yields and seamless integration with emerging grid-balancing technologies.

The role of direct drive wind turbines extends beyond mere performance gains. They reflect a broader technological evolution, driven by advances in materials science, magnetic technology, and digital control systems. Industry stakeholders are witnessing a paradigm shift in generator design, where electrically excited and permanent magnet configurations offer disparate trade-offs between weight, cost, and power output. At the same time, original equipment manufacturers are leveraging modular designs and digital twins to accelerate deployment timelines and enhance predictive maintenance capabilities.

In this context, decision-makers require an authoritative perspective on the dynamic forces shaping the direct drive landscape. This report provides an executive-level summary of the critical drivers, challenges, and emerging opportunities in the market, serving as both a strategic primer for newcomers and a comprehensive update for seasoned participants. By grounding the analysis in rigorous segmentation, regional dynamics, and regulatory impacts, the introduction sets the stage for a nuanced understanding of how direct drive wind turbines will contribute to the next generation of renewable energy systems.

Examining the Transformative Shifts Disrupting the Direct Drive Wind Turbine Arena from Supply Chains to Technological Breakthroughs

The direct drive wind turbine market is undergoing a series of disruptive shifts that are redefining competitive dynamics and supply-chain configurations. In recent years, raw material constraints and global semiconductor shortages have compelled turbine manufacturers to diversify their sourcing strategies and invest in localized component production. Concurrently, governments around the world are accelerating decarbonization targets, spurring innovation in marine-grade corrosion resistance for offshore fixed-bottom and floating platforms alike.

Technology breakthroughs have also transformed design philosophies. Electrically excited generators, once prized for their lower upfront material costs, are now rivaled by high-efficiency permanent magnet systems incorporating advanced neodymium alloys. These magnet innovations, paired with real-time digital control algorithms, unlock greater torque density and enable larger rotors without proportionate increases in nacelle mass. Offshore, tension leg platforms and semi-submersible floating foundations are unlocking deep-water sites that were previously inaccessible to fixed-bottom structures.

Strategic partnerships are emerging as a critical enabler of scale. Turbine OEMs are aligning with logistics providers to navigate the complexities of transporting 100-meter-class blades and multi-megawatt nacelles across ports with varying infrastructure capabilities. Meanwhile, cross-sector collaborations between energy companies and digital firms are embedding advanced analytics at every stage-from resource assessment to predictive maintenance. These transformative shifts collectively signal a maturation of the direct drive segment, one in which technological prowess and supply-chain resilience will determine long-term market leadership.

Analyzing the Cumulative Impact of United States 2025 Wind Turbine Tariffs on Supply Chains Manufacturing and Competitive Dynamics

In 2025, the United States implemented a new set of tariffs targeting imported wind turbine components, with particularly steep duties on assemblies originating from select East Asian markets. These measures were introduced to bolster domestic manufacturing but have produced a range of unintended consequences across the supply chain. Turbine developers have encountered price inflation for permanent magnet assemblies, prompting a resurgence of interest in electrically excited alternatives as a hedge against tariff-induced cost volatility.

The impact on offshore and onshore projects has been uneven. Onshore facility planners, striving to meet aggressive Corporate Renewable Energy Buyers’ Principles deadlines, have absorbed the tariff shock by renegotiating power purchase agreements and extending procurement windows. Conversely, offshore developers face tighter timelines due to stringent permitting and vessel availability; the higher duties on floating platform components have exacerbated capital expenditure pressure, leading to select project deferrals in deep-water regions.

National utilities with vertically integrated generation portfolios have leveraged their scale to negotiate tariff exemptions and negotiate domestic content waivers. Regional utilities and smaller independent power producers, however, have experienced tighter credit conditions as lenders scrutinize project cost overruns. As a result, many in the sector are exploring strategic alliances with domestic equipment manufacturers to secure tariff-protected supply chains. This cumulative tariff impact is reshaping procurement strategies and prompting a reevaluation of long-term technology roadmaps across the United States wind energy industry.

Uncovering Distinct Segment Dynamics Across End Users Generator Technologies Application Types and Turbine Capacities Driving Market Differentiation

A nuanced understanding of market segmentation reveals how diverging end-user profiles influence direct drive procurement strategies. Independent power producers prioritize competitive levelized costs of energy and often gravitate toward permanent magnet systems for their superior efficiency in high-wind regimes. Residential and commercial applications demand compact turbine footprints and minimal maintenance intervals, making electrically excited machines preferable where weight and cost sensitivity are paramount. Among utilities, national entities leverage scale to optimize fixed-bottom offshore deployments, whereas regional utilities focus on distributed generation and onshore utility-scale farms that align with local grid requirements.

Generator technology choices further underscore the intersection of performance and fiscal discipline. Electrically excited generators appeal to stakeholders seeking lower magnet material exposure, while permanent magnet alternatives command a premium based on higher energy capture and simplified rotor design. Site developers evaluating application categories must balance the robust structural demands of floating platforms-both semi-submersible and tension leg platform architectures-with the established reliability of fixed-bottom foundations. Inland projects, whether utility-scale or community-focused distributed generation, must also consider blade sweep constraints and turbine capacity classes ranging from sub-2 MW units suitable for small-scale installations to high-capacity models exceeding 5 MW for utility projects.

These segmentation insights illuminate the trade-offs that shape turbine selection, project design, and financing structures. They highlight why a one-size-fits-all approach fails in a market defined by end-user diversity, generator technology evolution, varied application contexts, and a spectrum of turbine capacities driving customized solutions.

This comprehensive research report categorizes the Direct Drive Wind Turbine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Generator Technology

- Turbine Capacity

- Application

- End User

Illuminating Regional Trends and Growth Patterns in Direct Drive Wind Turbines Across Americas Europe Middle East Africa and Asia Pacific

Regional market dynamics illustrate the varied pace and nature of direct drive wind turbine adoption around the world. In the Americas, the interplay between federal incentives and state-level renewable portfolio standards has fueled rapid onshore deployments in the Midwest and Texas, where utility-scale turbines dominate the landscape. Meanwhile, offshore projects along the Atlantic seaboard are progressing through permitting milestones, albeit at a slower clip due to coastal regulatory complexity.

Europe, the Middle East and Africa exhibit a mosaic of investment patterns. Northern European nations, incentivized by carbon pricing and ambitious 2030 targets, are leading fixed-bottom offshore roll-outs in the North Sea. Southern European markets show growing interest in floating wind technology to leverage deep-water Mediterranean sites, with semi-submersible designs attracting pilot projects. In sub-Saharan Africa, nascent onshore installations are emerging to electrify remote communities, often coupling sub-2 MW turbines with microgrid configurations to ensure energy access and resilience.

Asia-Pacific remains the global growth frontier, thanks to offshore capacity auctions in China, Japan, and South Korea. Fixed-bottom farms are scaling up in shallow coastal zones, while floating tension leg and semi-submersible prototypes are entering the demonstration phase in deeper waters off Japan’s coast. Onshore, utility-scale arrays in Australia and India continue to capitalize on high-wattage turbines exceeding 5 MW, supported by robust transmission upgrades. These regional insights underscore why market entrants must tailor their value propositions to distinct regulatory environments, infrastructure realities, and resource profiles.

This comprehensive research report examines key regions that drive the evolution of the Direct Drive Wind Turbine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Market Players Innovations Partnerships and Strategic Moves Shaping the Direct Drive Wind Turbine Competitive Landscape

Leading engineering and technology firms are actively consolidating their positions in the direct drive market through strategic alliances, targeted R&D investments, and localized manufacturing partnerships. Several key players are advancing permanent magnet generator architectures with next-generation rare earth magnet compositions that deliver lower weight and higher torque density. Others are optimizing electrically excited designs through integrated power electronics to extend mean time between overhauls and reduce operational expenditure.

Collaborative ventures between turbine OEMs and digital analytics providers have generated predictive maintenance platforms that aggregate condition monitoring data-from vibration signatures to bearing temperature profiles-and apply machine learning to forecast component failures with greater accuracy. These platforms are now being licensed to utilities and independent power producers as part of service-based agreements that align vendor incentives with availability targets.

Meanwhile, an emerging cohort of regional enterprises in Asia-Pacific and the Americas is capitalizing on tariff arbitrage and domestic content incentives to establish high-volume manufacturing facilities. This shift is forcing legacy incumbents to recalibrate their global supply-chain strategies and evaluate joint ventures in key markets, particularly for offshore foundation fabrication and high-voltage converter systems. Overall, these company-level developments highlight a competitive landscape defined by technological differentiation, digital enablement, and strategic geographic expansion.

This comprehensive research report delivers an in-depth overview of the principal market players in the Direct Drive Wind Turbine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acciona Energía SA

- AVANTIS Energy Group GmbH

- Chongqing Haizhuang Wind Power Equipment Co., Ltd.

- Doosan Enerbility Co., Ltd.

- Enercon GmbH

- Envision Energy (Group) Co., Ltd.

- GE Renewable Energy

- Hitachi Energy Ltd.

- Hyundai Electric & Energy Systems Co., Ltd.

- Ingeteam SA

- Inox Wind Ltd.

- Lagerwey Wind BV

- Leitwind AG

- MHI Vestas Offshore Wind A/S

- Sany Heavy Industry Co., Ltd.

- Shanghai Electric Wind Power Group Co., Ltd.

- Shanghai Electric Wind Power Group Co., Ltd.

- Siemens Gamesa Renewable Energy, S.A.

- Toshiba Energy Systems & Solutions Corporation

- United Power Technology Co., Ltd.

- XEMC Wind Power Co., Ltd.

- Xinjiang Goldwind Science & Technology Co., Ltd.

- Yangzhou Mingyang Wind Power Group Co., Ltd.

Providing Actionable Recommendations for Industry Leaders Navigating Technological Integration Regulatory Changes and Market Volatility in Wind Turbine Sector

Industry leaders must accelerate integration of advanced analytics and digital twin capabilities to optimize life-cycle performance and minimize unplanned maintenance costs. By embedding real-time condition monitoring sensors within generator assemblies and blade roots, companies can shift from reactive repairs to predictive interventions, thus preserving uptime and enhancing return on investment.

Stakeholders should also explore hybrid generator configurations that combine electrically excited and permanent magnet elements. Such hybrid designs offer the flexibility to balance material costs against efficiency gains, enabling turbine fleet standardization across diverse wind regimes. This approach can also mitigate exposure to rare earth price volatility and supply disruptions.

Finally, forging cross-sector alliances remains paramount. Collaborative frameworks with port authorities and logistics specialists will resolve the logistical challenges of oversized component transport, while partnerships with financial institutions can deliver innovative funding mechanisms that de-risk project financing in the wake of tariff uncertainty. By adopting a multi-dimensional strategy that weaves together digitalization, hybrid technology selection, and strategic collaborations, industry players can navigate shifting market conditions and secure a leadership position in the direct drive segment.

Outlining Rigorous Research Methodology Ensuring Data Accuracy Market Coverage and Analytical Transparency for Direct Drive Wind Turbine Study

This study employs a rigorous research methodology combining comprehensive secondary data collection, in-depth expert interviews, and robust data triangulation processes. Secondary sources include industry white papers, government policy documents, patent filings, and technical journals, ensuring thorough coverage of generator technologies, application modalities, and global regulatory frameworks. We cross-reference proprietary datasets with publicly available information to validate key trends and eliminate data gaps.

Primary research comprises structured interviews with turbine OEM executives, project developers, end-user representatives, and logistics specialists. These dialogues illuminate real-world challenges and strategic responses to tariffs, supply-chain disruptions, and emerging marine platform designs. Our qualitative insights are systematically coded and integrated into the analysis to contextualize quantitative findings from secondary sources.

Data triangulation occurs through iterative cross-checking of segment definitions, regional adoption rates, and technology performance metrics. Quality assurance protocols include peer review by internal subject-matter experts and alignment with recognized industry benchmarks. This multi-pronged methodology guarantees analytical transparency, data accuracy, and a holistic perspective on the direct drive wind turbine market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Direct Drive Wind Turbine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Direct Drive Wind Turbine Market, by Generator Technology

- Direct Drive Wind Turbine Market, by Turbine Capacity

- Direct Drive Wind Turbine Market, by Application

- Direct Drive Wind Turbine Market, by End User

- Direct Drive Wind Turbine Market, by Region

- Direct Drive Wind Turbine Market, by Group

- Direct Drive Wind Turbine Market, by Country

- United States Direct Drive Wind Turbine Market

- China Direct Drive Wind Turbine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Drawing Conclusive Insights on the Future Trajectory of Direct Drive Wind Turbines in Light of Technological Trends and Market Dynamics

Direct drive wind turbines stand at the confluence of technological innovation, supply-chain realignment, and evolving regulatory landscapes. The elimination of gearboxes has simplified mechanical complexity, yet the choice between electrically excited and permanent magnet generators underscores a broader tension between upfront capital outlays and long-term operational efficiency. Tariff policies enacted in 2025 have accentuated the need for domestic manufacturing resilience, prompting end users to reevaluate procurement strategies and localize critical component production.

Market segmentation analyses reveal that independent power producers favor high-torque permanent magnet systems, while utilities and commercial operators balance cost and reliability by integrating electrically excited machines in specific applications. Offshore and onshore contexts present distinct logistical and engineering challenges, from deep-water floating platforms requiring semi-submersible or tension leg solutions to distributed generation schemes leveraging small-capacity turbines.

Regional trajectories diverge markedly: the Americas emphasize large-scale onshore wind farms underpinned by state incentives; EMEA focuses on offshore innovation in the North Sea and pilot floating projects in Mediterranean waters; Asia-Pacific leads in both fixed-bottom installations and deep-water floating demonstrations. In parallel, leading market players are forging strategic alliances and investing in digital maintenance platforms to differentiate and scale. These converging forces herald a future in which agile technology selection, data-driven operations, and collaborative ecosystems will determine market leadership in direct drive wind energy.

Encouraging Decision Makers to Secure Comprehensive Direct Drive Wind Turbine Market Intelligence by Connecting with Sales and Marketing Leadership Today

To explore the full depth of insights and equip your organization with a competitive advantage in the evolving direct drive wind turbine sector, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to discuss how this market research report can be tailored to your strategic needs and investment priorities. Engage with our team to schedule a customized briefing, secure priority access to the comprehensive data sets, and leverage expert guidance that will inform your next major initiatives. Act now to ensure your leadership in the direct drive wind turbine industry by connecting directly with our sales and marketing leadership.

- How big is the Direct Drive Wind Turbine Market?

- What is the Direct Drive Wind Turbine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?