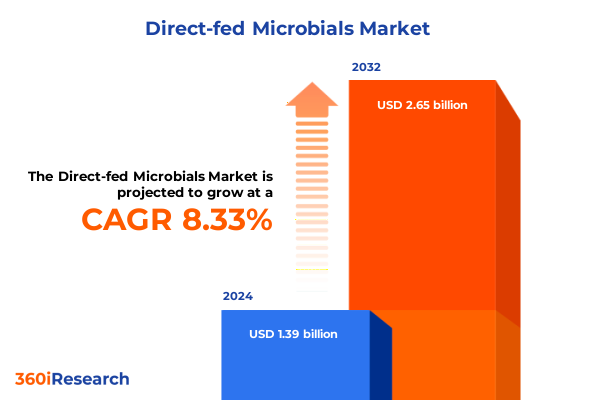

The Direct-fed Microbials Market size was estimated at USD 1.51 billion in 2025 and expected to reach USD 1.63 billion in 2026, at a CAGR of 8.35% to reach USD 2.65 billion by 2032.

Driving New Horizons in Animal Health with Direct-Fed Microbials: Unlocking the Potential of Natural Solutions in Modern Nutrition

The landscape of animal health and nutrition has undergone a profound evolution, with direct-fed microbials emerging as a pivotal natural solution for enhancing gut health and performance across diverse livestock species. By introducing live beneficial microorganisms directly into the animal’s diet, producers can achieve better feed conversion, bolster immune defenses, and support overall well-being. As antibiotic alternatives gain traction under stringent regulatory frameworks and shifting consumer preferences, the role of direct-fed microbials has become ever more critical for delivering both productivity gains and sustainability credentials.

This executive summary offers a strategic overview of the direct-fed microbial sector, outlining key market drivers, transformative trends, and the implications of recent United States tariff measures. It presents in-depth segmentation insights across animal types, product categories, formulation forms, functional applications, and distribution channels, while also highlighting regional nuances across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In addition, we examine competitive dynamics among leading industry participants, propose actionable recommendations for stakeholders, and detail the research methodology underpinning these insights. Ultimately, this summary equips decision-makers with a clear understanding of the opportunities and challenges shaping the future of direct-fed microbials.

Navigating Transformative Shifts Driving Growth and Innovation in Direct-Fed Microbials Amid Evolving Regulations, Sustainability and Advanced Biotechnologies

The direct-fed microbial domain is experiencing a series of transformative shifts driven by evolving regulatory frameworks, heightened consumer expectations, and rapid advances in microbial strain development. In many regions, regulatory agencies have implemented stricter guidelines on antibiotic use in animal agriculture, prompting producers to explore probiotic and enzyme-based alternatives for maintaining herd health. Moreover, investors and feed manufacturers are increasingly drawn to solutions that can demonstrate measurable sustainability benefits, such as reductions in greenhouse gas emissions and improved nutrient utilization, aligning with global environmental targets.

Furthermore, breakthroughs in biotechnology and genomic screening have enabled the identification of novel microbial strains tailored to specific animal species and production goals. These scientific advances, combined with digital monitoring platforms that track gut health metrics in real time, are fostering a more data-driven approach to additive deployment. Consequently, companies that can integrate advanced analytics, targeted strain selection, and proven performance outcomes are well-positioned to lead the next wave of innovation in direct-fed microbials.

Assessing the Cumulative Impact of 2025 United States Tariffs on Direct-Fed Microbial Supply Chains Costs and Strategic Sourcing Decisions

In early 2025, the United States introduced a tiered tariff structure affecting key inputs used in the manufacture of direct-fed microbials, including specialized enzymes and probiotic cultures sourced from major exporting countries. These levies have incrementally increased the landed cost of imported raw materials, prompting manufacturers to reevaluate supply chain configurations and cost-management strategies. As a result, many global producers are accelerating efforts to establish local fermentation and formulation facilities in North America to mitigate tariff exposure and ensure consistent access to critical inputs.

The cumulative impact of these tariff measures extends beyond direct cost inflation; it has also catalyzed strategic sourcing diversification. Feed additive companies are forging partnerships with regional suppliers in Latin America and Southeast Asia, where production costs remain competitive and trade terms less restrictive. At the same time, domestic R&D investments are accelerating the development of patented microbial strains that can be produced entirely within the United States. This shift toward localized manufacturing and innovation ecosystems is reshaping traditional procurement models and reinforcing the importance of supply chain resilience.

Unearthing Key Segmentation Insights Revealing How Animal Type Product Variations Form Factors Functions and Channels Drive Market Dynamics

An examination of market segmentation reveals nuanced adoption patterns across animal types, with aquaculture operations differentiating between freshwater and marine environments to leverage targeted probiotic blends that optimize water quality and fish immune responses. Companion animal applications are segmented into cat and dog formulations, where pet owners increasingly seek natural gut health supplements to address dietary sensitivities and boost vitality. Poultry producers drive significant volume demand for spore-forming Bacillus species that enhance feed conversion in intensive production. In contrast, ruminant nutrition strategies vary between beef and dairy systems, with dairy producers emphasizing yeast cultures to stabilize rumen pH and improve milk yield, while beef operations prioritize direct-fed microbials that enhance weight gain and muscle deposition.

Product type insights underscore the critical role of enzyme additives, including carbohydrases, lipases, phytases, and proteases, which facilitate the breakdown of complex feed components and unlock nutrient availability. Probiotic solutions span Bacillus species, bifidobacteria, and lactic acid bacteria, each offering distinct advantages for bacterial balance and intestinal integrity. Spore-forming strains like Bacillus licheniformis and Bacillus subtilis provide robust stability during feed processing and storage, whereas yeast derivatives support microbial ecology in the gut. Formulation preferences vary among dry granules, dry powder, gel, and liquid presentations, reflecting trade-off considerations between ease of mixing, shelf life, and targeted delivery.

Functional classification highlights the multifaceted benefits of direct-fed microbials: gut health applications focus on maintaining bacterial balance and intestinal integrity to reduce pathogen colonization. Immune support formulations aim to enhance disease resistance and boost vaccine responses, particularly in high-stress production phases. Nutrient utilization additives concentrate on phosphorus and protein efficiency, enabling feed cost savings and environmental compliance, while performance enhancement products are designed to optimize feed conversion ratio and accelerate weight gain. Distribution channels continue to evolve, with traditional offline feed supply networks coexisting alongside emerging online retail platforms that cater directly to smaller producers and specialty segments.

This comprehensive research report categorizes the Direct-fed Microbials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Product Type

- Form

- Function

- Distribution Channel

Illuminating Regional Perspectives to Understand How Americas Europe Middle East Africa and Asia-Pacific Are Shaping Global Direct-Fed Microbial Adoption

Regional dynamics in the Americas reflect a mature direct-fed microbial landscape, with advanced feed mill infrastructure and a highly organized livestock sector driving innovation adoption. The United States remains a focal point for large-scale commercial trials and collaborative research initiatives between academia and industry. In Latin America, growing poultry and aquaculture sectors are increasingly integrating probiotic and enzyme blends, supported by favorable regulatory environments and government incentives for sustainable farming practices.

The Europe, Middle East & Africa territory presents a complex mosaic of regulatory regimes and market maturity. Western European nations lead in antimicrobial stewardship, resulting in widespread acceptance of alternative feed additives and a thriving startup ecosystem focused on novel microbial strain development. In contrast, many regions in the Middle East and Africa are in the early stages of direct-fed microbial adoption, driven by pilot projects in intensive livestock operations and government efforts to reduce antibiotic dependency.

Asia-Pacific exhibits the fastest growth trajectory, propelled by expanding aquaculture in Southeast Asia and rising poultry demand in India. Regulatory modernization in China has opened new market opportunities for enzyme-based feed solutions, while Japan and Australia maintain stringent quality standards that encourage the use of high-performance probiotic products. These regional insights underscore the importance of location-specific strategies and tailored product portfolios to meet diverse regulatory, environmental, and production requirements.

This comprehensive research report examines key regions that drive the evolution of the Direct-fed Microbials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Analysis Highlighting How Leading Enterprises Are Innovating Product Portfolios Alliances and Market Penetration in Direct-Fed Microbials

Leading corporations in the direct-fed microbial arena are emphasizing proprietary strain libraries, advanced formulation techniques, and integrated service models to secure competitive advantage. One major global supplier has invested heavily in genomics-driven strain optimization, resulting in next-generation probiotic blends backed by peer-reviewed efficacy studies. Another key player has forged strategic alliances with precision nutrition platforms, offering digital tools that measure gut health indicators and inform real-time feed additive adjustments.

Mid-sized firms and specialized biotech companies are also making notable strides by establishing regional centers of excellence and entering co-development partnerships with feed integrators and animal health companies. These collaborations often focus on customizing microbial consortia for specific production systems, such as high-yield dairy herds or recirculating aquaculture setups. In addition, recent mergers and acquisitions have expanded product portfolios to include complementary feed enzymes and immune modulators, creating holistic solutions that address multiple performance and health parameters simultaneously.

This comprehensive research report delivers an in-depth overview of the principal market players in the Direct-fed Microbials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adisseo France SAS

- Archer Daniels Midland Company

- BASF SE

- Bayer AG

- Bio-Vet, Inc.

- Biomin Holding GmbH

- Cargill, Incorporated

- Chr. Hansen Holding A/S

- E. I. du Pont de Nemours and Company

- Evonik Industries AG

- Kemin Industries, Inc.

- Koninklijke DSM N.V.

- Lallemand, Inc.

- Lesaffre Feed Additives & Solutions

- Maxum Foods

- Novozymes A/S

- Novus International, Inc.

- Nutreco N.V.

Empowering Stakeholders with Actionable Recommendations to Accelerate Innovation Efficiency and Sustainable Growth in Direct-Fed Microbial Solutions

Industry stakeholders can strengthen their market position by investing in localized manufacturing capabilities to offset tariff impacts and ensure uninterrupted supply of critical microbial inputs. By establishing regional fermentation and formulation facilities, companies can reduce lead times, tailor products to local feed compositions, and demonstrate commitment to domestic value creation. Moreover, a focus on multi-strain consortia that combine gut health, immune support, and nutrient utilization functions will meet the growing demand for comprehensive feed solutions and differentiate offerings in a crowded marketplace.

Collaboration with feed millers, integrators, and end-users is essential to validate product performance under real-world conditions and build credibility. Companies should also leverage digital monitoring platforms to capture animal health data, enabling continuous improvement and personalized dosing protocols. Finally, engaging proactively with regulatory authorities and industry associations will facilitate smoother approvals and provide early insights into emerging legislative trends. These strategic actions will position industry leaders to capitalize on growth opportunities while navigating an increasingly dynamic global environment.

Comprehensive Research Methodology Integrating Primary Interviews Secondary Data and Quantitative Analysis Ensuring Robust and Credible Industry Insights

The research underpinning this executive summary combines robust secondary analysis with targeted primary engagements. Secondary data sources include regulatory filings, peer-reviewed scientific literature, industry white papers, and trade association publications, providing a comprehensive view of technical developments and policy landscapes. These insights were supplemented by quantitative surveys of feed manufacturers, livestock producers, and distributors to capture real-time usage patterns and adoption drivers.

To enrich the findings, in-depth interviews were conducted with subject-matter experts encompassing R&D directors, regulatory affairs professionals, and commercial leaders from leading biotechnology and animal nutrition firms. All qualitative inputs were systematically validated through cross-reference with market data points and statistical checks. The final synthesis was reviewed by a panel of industry advisors to ensure accuracy, relevance, and actionable value, resulting in a credible and detailed portrayal of the direct-fed microbial sector’s current state and near-term imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Direct-fed Microbials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Direct-fed Microbials Market, by Animal Type

- Direct-fed Microbials Market, by Product Type

- Direct-fed Microbials Market, by Form

- Direct-fed Microbials Market, by Function

- Direct-fed Microbials Market, by Distribution Channel

- Direct-fed Microbials Market, by Region

- Direct-fed Microbials Market, by Group

- Direct-fed Microbials Market, by Country

- United States Direct-fed Microbials Market

- China Direct-fed Microbials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Concluding Insights Emphasizing the Strategic Importance of Direct-Fed Microbials in Enhancing Animal Health and Nutrient Efficiency

In summary, direct-fed microbials stand at the forefront of animal nutrition strategies, offering proven benefits in gut health, immune resilience, nutrient efficiency, and performance enhancement. The convergence of regulatory pressures, consumer demand for antibiotic-free production, and technological breakthroughs in microbial science has accelerated market momentum. Stakeholders must navigate evolving tariff landscapes, leverage segmentation insights to tailor product offerings, and deploy regionally attuned approaches to maximize impact.

As competition intensifies, companies that integrate cutting-edge R&D, strategic partnerships, and data-driven service models will capture disproportionate value. By implementing the actionable recommendations outlined herein and maintaining vigilant monitoring of regulatory and market developments, industry leaders can secure sustainable growth trajectories and contribute to more efficient, responsible animal agriculture practices worldwide.

Unlock Deeper Insights and Drive Growth by Partnering with Ketan Rohom to Access the Comprehensive Market Research Report on Direct-Fed Microbials

To explore how customized insights can empower your business goals and to secure full access to the comprehensive market research report on direct-fed microbials, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through tailored subscription options and discuss how the findings can address your organization’s specific challenges and growth aspirations. Schedule a personalized consultation today to obtain immediate insights and actionable data that will inform your strategic planning and investment decisions.

- How big is the Direct-fed Microbials Market?

- What is the Direct-fed Microbials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?