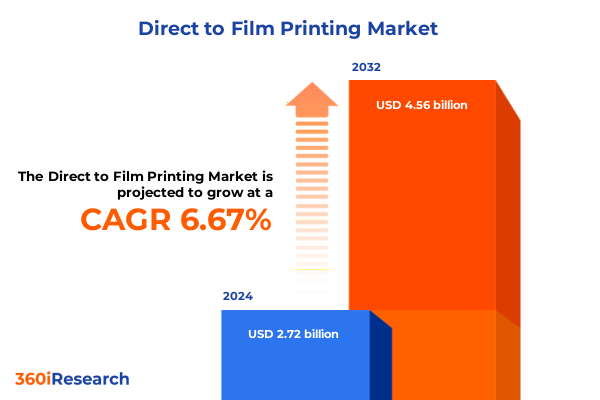

The Direct to Film Printing Market size was estimated at USD 2.89 billion in 2025 and expected to reach USD 3.08 billion in 2026, at a CAGR of 6.72% to reach USD 4.56 billion by 2032.

Unveiling the Evolution of Direct-to-Film Printing as a Disruptive Force in Textile Decoration and Custom Merchandise Landscape and its Role in Redefining Print-on-Demand Strategies for Modern Apparel Businesses

Direct-to-film printing has emerged as a revolutionary technology, reshaping the landscape of textile decoration and personalized merchandise. Powered by advanced digital workflows and optimized ink transfer systems, this method enables businesses to produce vibrant, high-definition prints on a diverse range of fabrics without the constraints of traditional screen-print setups. As brands and decorators increasingly seek agile, cost-effective solutions that support small batch runs and rapid turnarounds, direct-to-film has moved from niche applications into mainstream production lines.

The evolution of this technology is marked by an expanding spectrum of printer types, from dedicated single-function systems to versatile hybrid and UV-capable devices. These developments facilitate seamless integration with design software and e-commerce platforms, allowing on-demand customization across online marketplaces and brick-and-mortar stores alike. In turn, companies can offer end customers truly personalized apparel, home décor, and promotional items with minimal lead times and reduced material waste.

Moreover, direct-to-film printing empowers businesses to streamline their operations by minimizing setup complexities and eliminating the need for costly stencil inventories. This agility not only enhances operational efficiency but also fosters innovation in product offerings, enabling market players to experiment with new textures, color effects, and substrate types. Consequently, direct-to-film printing is redefining industry expectations around quality, flexibility, and responsiveness in the dynamic world of digital textile decoration.

Exploring the Key Technological, Operational, and Consumer-Driven Shifts Reshaping the Direct-to-Film Printing Industry and Paving the Way for Next-Generation Customization Solutions

Recent years have witnessed a proliferation of technological breakthroughs within direct-to-film printing, each unlocking new realms of performance and application. Industry leaders have introduced UV-curable direct-to-film systems that expand customization into rigid substrates and specialty items, enabling brands to offer high-value interior graphics and decorative products. These systems boast faster cure times and enhanced durability, setting a new benchmark for decorative printing applications.

At the operational level, manufacturers are refining hybrid printers that seamlessly switch between screen-print reproduction and direct-to-film transfers, delivering both scalability and versatility within a single platform. Roll-to-roll configurations are gaining traction for high-volume production, allowing continuous feed of transfer media and further reducing manual interventions. Such scalability enhancements are critical for companies that must adapt quickly to fluctuating demand and seasonal peaks, ensuring consistent throughput without sacrificing quality.

Parallel to these technological strides, evolving consumer expectations have placed personalization and immediacy at the forefront of purchasing decisions. E-commerce growth has accelerated the shift toward on-demand apparel, with customers demanding unique designs and rapid fulfillment. As brands strive to differentiate themselves in crowded marketplaces, direct-to-film printing has become a strategic enabler, marrying digital agility with cost efficiency to meet the demands of today’s fast-paced fashion and merchandise sectors.

Analyzing the Comprehensive Impact of 2025 United States Tariff Measures on the Direct-to-Film Printing Supply Chain, Raw Material Costs, and Operational Strategies

The implementation of U.S. tariff measures in 2025 has introduced significant cost pressures across the direct-to-film printing supply chain. With baseline duties on printing equipment and consumables rising to 10% on many imports and surcharges reaching 25% for select product categories, vendors are experiencing margin compression that is reverberating from manufacturers to end users. These adjustments stem from broad trade policy shifts aimed at bolstering domestic production but have also elevated capital and operational expenditures for print service providers.

Raw material procurement has become particularly challenging, as components like flexible PVC transfer films and specialized pigment inks are heavily reliant on overseas suppliers. Industry data indicate that up to 15% of PVC film used in printing is imported from regions subject to tariff levies, while roughly 10–15% of key ink consumables originate from Asia and Europe. The tariff burden has prompted some buyers to absorb additional costs, while others are passing increases onto their customers, heightening competitive pressures across the market.

In response to these headwinds, many direct-to-film stakeholders are exploring reshoring strategies and establishing regional distribution hubs to circumvent future trade disruptions. By localizing portions of their supply chains and forging partnerships with alternative suppliers in Latin America and Southeast Asia, companies aim to mitigate tariff exposure and secure material continuity. This adaptive approach underscores a broader industry trend of supply chain resilience, with digital printing businesses seeking to balance cost management against operational stability.

Delving into Critical Segmentation Insights Across Printer Types, Transfer Film Variants, Distribution Channels, and Application Categories to Illuminate Market Dynamics and Growth Opportunities

The direct-to-film printing market is structured around a diverse array of printer types, each designed to address specific production scales and quality benchmarks. Dedicated DTF printers offer streamlined workflows for small to midsized print shops seeking simplicity and reliability, while hybrid systems combine traditional screen-printing capabilities with digital film transfers to maximize versatility. Roll-to-roll machines cater to high-volume operations by enabling continuous media feeding, and UV printers extend customization potential into rigid and unconventional substrates, broadening application possibilities.

Within the transfer film domain, two primary variants have secured market prominence: cold peel films, prized for their superior adhesion and detailed design transfer, and hot peel films, valued for expedited application cycles and simplified handling. These differentiated film types allow providers to tailor their offerings to customer priorities, whether optimizing for fidelity or speed of production.

Distribution pathways in this market span offline and online channels, with many manufacturers leveraging digital storefronts to reach end-users directly, while established dealers and equipment resellers continue to play a vital role in onboarding customers and providing on-site technical support. This dual-channel approach ensures that businesses of all sizes can access equipment and consumables with the level of service that aligns to their operational needs.

The spectrum of end-use applications is equally diverse, encompassing core apparel and garments-ranging from hoodies and sportswear to t-shirts and professional workwear-to home décor segments such as bedding, curtains, cushions, table linens, towels, and wall art. Additionally, promotional products and custom merchandise rely on DTF printing to deliver vibrant, durable branding across trinkets, accessories, and point-of-sale displays. Together, these segments illustrate the broad relevance of direct-to-film printing across multiple market verticals.

This comprehensive research report categorizes the Direct to Film Printing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Film

- Distribution Channel

- Application

Uncovering Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia-Pacific Markets Shaping the Trajectory of Direct-to-Film Printing Adoption Worldwide

The Americas region remains a cornerstone of direct-to-film printing adoption, driven by a mature U.S. market with robust infrastructure and a growing cohort of specialized print service providers. Nearshoring trends have further reinforced North American capabilities, as businesses seek to reduce lead times and capitalize on regional manufacturing incentives. Investments in advanced DTF technologies have bolstered the appeal of print-on-demand services for both domestic brands and international clients targeting the American consumer base.

Europe, the Middle East, and Africa (EMEA) continue to benefit from established fashion capitals and a strong tradition of textile craftsmanship. European designers and merchandising firms are embracing direct-to-film printing to streamline small-batch production and support seasonal collections with intricate, high-resolution graphics. In parallel, regional garment hubs in Turkey and North Africa are leveraging DTF-based workflows to serve both local and export-oriented apparel markets, reinforcing the strategic value of this technology in EMEA supply chains.

The Asia-Pacific market is experiencing rapid growth, propelled by expanding domestic textile manufacturing and a surge in e-commerce platforms that demand quick-turn customization. Nations such as India and Vietnam are emerging as key investment destinations for DTF equipment vendors, offering competitive labor costs and strong government support for industrial modernization. As regional operators seek to enhance productivity and diversify product portfolios, direct-to-film printing is increasingly recognized as a critical enabler of competitive differentiation across the Asia-Pacific landscape.

This comprehensive research report examines key regions that drive the evolution of the Direct to Film Printing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Imperatives and Innovation Trajectories of Leading Manufacturers and Service Providers Driving Innovation and Competition in the Direct-to-Film Printing Arena

Leading original equipment manufacturers (OEMs) and service providers are driving continuous innovation in direct-to-film printing technologies. Seiko Epson Corporation has expanded its presence with the SureColor G-Series, offering wide-format DTF solutions that balance high-quality output with low maintenance requirements. Meanwhile, Roland DG Corporation’s TY-300 model has demonstrated significant improvements in print speed and graphic consistency, reinforcing the company’s competitive edge in high-volume applications.

Mimaki Engineering has entered the UV-DTF segment with its UJV300DTF-75, catering to customers seeking value-added decoration on non-textile substrates. This strategic move underscores a growing emphasis on product diversification and cross-market appeal. At the same time, Kornit Digital, Brother International, Ricoh, ColDesi, Aeoon Technologies, Adelco Screen Process, and Axiom America continue to refine their portfolios through targeted R&D investments and collaborative partnerships, focusing on ink chemistry advancements, workflow automation, and integration with digital printing ecosystems.

Service-oriented companies are also playing a pivotal role, offering turnkey solutions that encompass equipment leasing, technical training, and consumable supply management. These value-added services are essential for smaller operators seeking to adopt direct-to-film printing without extensive capital outlay, enabling broader market penetration and accelerated technology diffusion.

This comprehensive research report delivers an in-depth overview of the principal market players in the Direct to Film Printing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adelco Screen Process Ltd.

- aeoon Technologies GmbH

- Arcus Printer by Axiom America, LLC

- Brother Industries, Ltd.

- CADlink Technology Corporation by Fiery, LLC

- Cobra Flex Printers

- ColDesi, Inc.

- DTF Station

- DTF2U by DigiFab Systems, Inc.

- DTG PRO

- DuPont de Nemours, Inc.

- FOREVER GmbH

- Gallery DTF

- Hanrun Paper Industrial Co., Ltd.

- InkTec Co.,Ltd.

- Kornit Digital Ltd.

- Mimaki Engineering Co., Ltd.

- MTEX NS, S.A. by AstroNova, Inc.

- Mutoh Holdings Co., Ltd.

- Polyprint S.A.

- Ricoh Company, Ltd.

- Roland DG Corporation

- Sawgrass Technologies, Inc.

- Seiko Epson Corporation

- STS Refill Technology, LLC

- Sublistar

- UniNet, Inc.

- Xenons Group

Strategic Imperatives and Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the Direct-to-Film Printing Ecosystem

To thrive in the evolving direct-to-film printing ecosystem, industry leaders should prioritize supply chain diversification by cultivating relationships with multiple film and ink suppliers across different geographies. This strategy will mitigate tariff risks and safeguard production continuity amidst geopolitical uncertainties.

Investment in next-generation print platforms-such as UV-curable DTF and hybrid conversion systems-will enable companies to expand their service offerings and address emerging market segments beyond apparel. By integrating advanced digital workflows and cloud-based color management tools, printers can enhance operational efficiency and accelerate time-to-market for customized products.

Sustainability initiatives must become a core focus, with stakeholders exploring recycled PET films, water-based ink formulations, and closed-loop recycling programs to minimize environmental impact. Demonstrating eco-conscious practices will not only satisfy regulatory requirements but also resonate with increasingly environmentally aware consumers.

Finally, cultivating technical expertise through targeted training programs and strategic partnerships with industry associations will ensure a skilled workforce capable of maximizing the performance of sophisticated DTF equipment and delivering premium service to customers.

Detailing the Rigorous Multi-Stage Research Methodology Employed to Analyze Direct-to-Film Printing Market Trends, Segmentation, and Competitive Dynamics with Precision and Reliability

The research underpinning this executive summary was conducted through a structured, multi-stage methodology designed to ensure accuracy and relevance. It commenced with an extensive secondary data review, sourcing insights from corporate reports, industry publications, and proprietary databases to map out market contours and competitive landscapes.

Subsequently, primary research was undertaken via in-depth interviews with key stakeholders, including printer manufacturers, film suppliers, industry consultants, and print service providers. These interviews provided nuanced understanding of technological adoption patterns, supply chain challenges, and customer preferences.

Data triangulation techniques were employed to cross-verify findings from multiple sources, ensuring the elimination of inconsistencies. Expert validation sessions with independent analysts and subject matter specialists further refined the insights, reinforcing the credibility of the segmentation, regional, tariff, and company analyses presented herein.

Finally, rigorous quality checks and iterative reviews within the research team were conducted to uphold methodological integrity and deliver a definitive perspective on the direct-to-film printing market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Direct to Film Printing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Direct to Film Printing Market, by Type

- Direct to Film Printing Market, by Film

- Direct to Film Printing Market, by Distribution Channel

- Direct to Film Printing Market, by Application

- Direct to Film Printing Market, by Region

- Direct to Film Printing Market, by Group

- Direct to Film Printing Market, by Country

- United States Direct to Film Printing Market

- China Direct to Film Printing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Critical Findings and Future Outlook for Direct-to-Film Printing to Inform Strategic Decision-Making and Drive Sustainable Growth in Textile Decoration and Custom Merchandise

This executive summary highlights the transformative potential of direct-to-film printing, underscoring its role as a versatile, efficient solution for modern textile decoration and personalized merchandise. Technological advancements-from UV-curable transfers to hybrid printer platforms-are expanding application horizons and enhancing the value proposition for both equipment vendors and end users.

The cumulative impact of 2025 U.S. tariffs has introduced new cost considerations, prompting industry stakeholders to pursue supply chain resilience through reshoring initiatives and diversified sourcing strategies. At the same time, segmentation insights reveal a dynamic market shaped by printer type, film variant, distribution channel, and a broad range of applications spanning apparel, home décor, and promotional products.

Regional analysis underscores the continued leadership of the Americas, the strategic importance of EMEA fashion hubs, and the rapid adoption momentum in Asia-Pacific. Leading companies are responding with targeted product innovations, service expansions, and collaborative partnerships, reinforcing a competitive landscape characterized by continuous evolution.

By adopting the actionable recommendations outlined and leveraging the comprehensive insights provided, industry participants are well positioned to navigate emerging challenges, capitalize on growth opportunities, and drive sustainable success in the direct-to-film printing domain.

Engage with Ketan Rohom Associate Director of Sales and Marketing to Unlock Comprehensive Direct-to-Film Printing Market Insights and Strategic Intelligence

To gain unparalleled access to in-depth analysis, strategic insights, and practical guidance tailored for the direct-to-film printing market, please contact Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise bridges the gap between cutting-edge research and actionable strategies, ensuring your organization can capitalize on emerging opportunities while navigating complex market dynamics.

By engaging with Ketan, you will receive a comprehensive market research report that delves into technological innovations, segmentation insights, regional dynamics, and the cumulative effects of U.S. tariffs on the supply chain. This definitive resource empowers stakeholders to make informed investments, optimize operations, and enhance competitive positioning. Reach out today to secure your copy and embark on a data-driven journey toward sustainable growth and market leadership in direct-to-film printing.

- How big is the Direct to Film Printing Market?

- What is the Direct to Film Printing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?