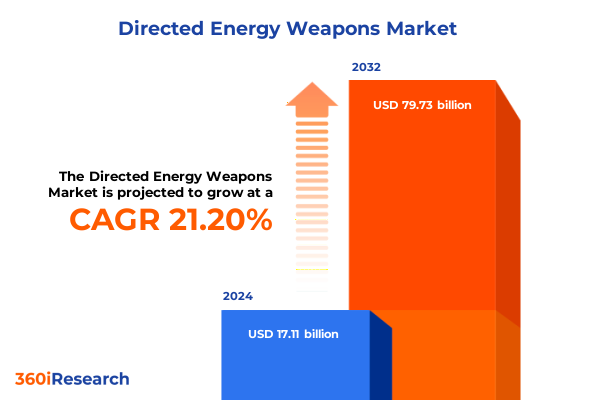

The Directed Energy Weapons Market size was estimated at USD 20.62 billion in 2025 and expected to reach USD 24.86 billion in 2026, at a CAGR of 21.30% to reach USD 79.73 billion by 2032.

Harnessing the Speed of Light: How Directed Energy Weapons Are Transforming Strategic Defense and Shaping the Future of Modern Warfare

Directed energy weapons leverage focused electromagnetic or particle beams to neutralize threats at the speed of light, marking a profound shift from traditional kinetic systems. These technologies encompass high-energy lasers, high-power microwaves, and emerging particle beam platforms that can incapacitate, disable, or destroy targets with unparalleled precision. As defense agencies worldwide confront an accelerating drone proliferation and advanced missile threats, directed energy weapons are now viewed as essential force multipliers that address capability gaps in cost and scalability compared to conventional munitions.

In recent years, the Department of Defense has invested over one billion dollars annually in directed energy initiatives, highlighting a strategic commitment to transition these systems from experimental prototypes to deployed assets. Collaborative ventures between leading primes like Lockheed Martin and Northrop Grumman on demonstrator programs have yielded continuous-beam outputs exceeding 150 kilowatts, a 300% increase over legacy systems. These advancements are underpinned by joint research frameworks that now include 43 active projects between manufacturers and research institutions, accelerating maturation and interoperability across multiple platforms.

From Concept to Combat-Ready Systems Revolutionizing Defense Capabilities with Scalable Directed Energy Weapon Deployments Worldwide

The directed energy weapons landscape is undergoing transformative shifts as innovations move beyond laboratory demonstrations into operationally relevant systems. Industry alliances, such as the International Directed Energy Alliance established in 2024, now coordinate 12 focused research projects spanning power management, thermal control, and target acquisition. These collaborations have driven a surge in patent filings-187 new patents in 2025 alone-signifying a robust ecosystem where shared expertise expedites the development of scalable, field-deployable systems.

Moreover, defense departments have reoriented acquisition strategies to embrace flexible, modular architectures that support rapid integration with existing platforms. The U.S. Navy’s deployment of a 60-kilowatt laser in active service and the U.K.’s successful engagement tests with its DragonFire prototype illustrate a shift from singular technology demonstrations to networked, multi-domain applications. These milestones reflect a broader industry pivot toward cost-effective, adaptive solutions capable of countering swarms of evolving threats under diverse environmental conditions.

Assessing the Ripple Effects of Recent U.S. Tariffs on Critical Components Influencing the Directed Energy Weapons Supply Chain in 2025

The introduction of new U.S. tariffs effective January 1, 2025, on key components such as solar wafers, polysilicon, semiconductors, and tungsten-based materials has introduced complexity into directed energy supply chains. Solar wafers and polysilicon now face a 50% Section 301 duty, while semiconductor and permanent magnet imports encounter increases to 50% and 25% respectively. These measures aim to fortify domestic production but have led to immediate cost escalations for raw materials critical to laser and microwave weapon development.

Consequently, defense primes and subsystem suppliers are recalibrating procurement strategies by diversifying sourcing into allied markets and deepening investments in U.S.-based fabrication capacity. This recalibration not only mitigates risk associated with elevated tariffs but also incentivizes strategic partnerships that localize manufacturing of photonic components and high-power electronics. Although initial pricing pressures have strained project budgets, the long-term effect is expected to strengthen resilience across the directed energy value chain, supporting sustained innovation and production scalability.

Illuminating Market Segments with In-Depth Analysis of Directed Energy Weapons by Type, Application, Platform, and Power Output

Directed energy weapons are rigorously segmented by type, with market offerings spanning high-energy lasers, high-power microwaves, and emerging particle beam platforms. Laser technologies now include chemical variants prized for peak power output, fiber lasers valued for compactness and robustness, and solid-state systems optimized for integration on mobile platforms. Microwave systems bifurcate into active denial configurations engineered for nonlethal crowd control and high-power microwave weapons designed to disrupt or damage electronic circuits. Particle beam applications focus on electron beam systems for precise material disruption and proton beams for long-range, high-penetration effects.

Complementing type-based segmentation, directed energy demand is shaped by application domains-from homeland security operations countering unmanned aerial threats to industrial use cases in material processing, military mission profiles across tactical air, land, naval, and space platforms, and research-driven experimentation. Power output tiers further refine this segmentation into low-power demonstrator systems suited for electronic warfare, medium-power solutions for counter-drone engagements, and high-power installations capable of neutralizing hardened targets. This layered classification enables stakeholders to align technology selection with mission requirements and performance parameters.

This comprehensive research report categorizes the Directed Energy Weapons market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Platform

- Power Output

- Application

Mapping Global Footprints Highlighting Regional Leadership Trends in Directed Energy Weapon Development and Deployment across Americas, EMEA, and APAC

North America continues to lead in directed energy weapon development, propelled by robust federal funding and a mature defense industrial base. The United States alone represented 40% of global DEW activity in 2024, with prime contractors collaborating closely with national laboratories to advance lethality and reliability under the Army’s Next-Generation Command and Control initiative. Cross-industry alliances and venture capital inflows-surpassing $1.8 billion in startup funding-have further cemented the region’s technological edge and supply chain depth.

In Europe, strategic defense agencies in the United Kingdom, France, and Germany have channeled resources into demonstrator programs like DragonFire and Peresvet upgrades, achieving milestone tests in laser output and engagement range. Collaborative frameworks under the European Defense Agency’s directed energy program have amplified patent activity, with European players securing 28% of global DEW patents by 2025. Meanwhile, Asia-Pacific nations, led by China’s high-power microwave research and India’s nascent laser development initiatives, are rapidly scaling capability through government-backed R&D and international partnerships. This regional diversification underscores a global pivot toward distributed innovation and strategic autonomy in DEW capabilities.

This comprehensive research report examines key regions that drive the evolution of the Directed Energy Weapons market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Industry Leaders and Emerging Innovators Driving Directed Energy Weapon Advancements in 2025

Industry leaders continue to shape the directed energy landscape through substantial R&D and strategic acquisitions. Lockheed Martin’s acquisition of a leading photonics innovator strengthened its high-power laser portfolio, while Raytheon Technologies’ focus on microwave weapon development has bolstered its electronic warfare offerings. Northrop Grumman and Boeing Defense maintain parallel programs that integrate energy-based weapons into multi-domain platforms, and BAE Systems has expanded its footprint via proprietary solid-state laser modules. Collectively, these primes drive over 70% of market activity, leveraging deep technological expertise and established production capacities to deliver increasingly capable systems.

Concurrent with prime-driven innovation, an emerging ecosystem of startups and university spin-offs accelerates niche breakthroughs in areas such as quantum-enhanced target acquisition and thermal management. Venture-backed enterprises have increased patent filings by 25% year-over-year, focusing on modular beam directors and compact power supplies. These agile innovators often collaborate with major contractors and government labs, enabling rapid technology transitions from lab demonstrations to field trials. This dynamic interplay between incumbents and startups is critical for sustaining technological momentum and overcoming long-standing challenges in thermal dissipation, system miniaturization, and battlefield integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Directed Energy Weapons market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- AND

- Applied Research Associates, Inc.

- BAE Systems plc

- Bharat El

- Dynetics Inc.

- General Atomics

- Honeywell International Inc.

- Kord Technologies Inc.

- Kratos Defense & Axes

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MBDA UK Limited

- Moog, Inc.

- Northrop Grumman Corporation

- Qine

- Rafael Advanced Defense Systems Ltd.

- Raytheon Technologies Corporation

- Rheinmetall AG

- SAIC

- Teledyne Technologies Incorporated

- Textron Inc.

- Thales S.A.

- The Boeing Company

Practical Strategic Imperatives Guiding Defense Contractors and Policymakers to Accelerate Directed Energy Weapon Integration and Supply Chain Resilience

Defense contractors and policymakers must adopt a multi-pronged approach to accelerate directed energy weapon deployment. First, investing in modular, open-architecture designs will facilitate integration with diverse platforms and ensure upgrade paths for emerging beam directors and power systems. Strengthening domestic manufacturing for critical components-such as photonic chips and specialized optics-can mitigate tariff-induced supply risks and reduce dependency on single-source imports. Additionally, fostering cross-sector partnerships with academia and adjacent industries will catalyze breakthroughs in materials science and thermal management, enhancing weapon system reliability under operational stress conditions.

Equally important is establishing clear operational concepts of employment, informed by rigorous transition planning to move prototypes swiftly from test ranges into live environments. Implementing multi-year contracts with performance-based milestones will align stakeholder incentives and stabilize production pipelines. Finally, engaging with regulatory bodies to refine export controls and standardize international interoperability protocols will unlock new markets and fortify allied support networks. By embracing these strategic imperatives, industry leaders can overcome technical and logistical hurdles, ensuring directed energy systems achieve full battlefield impact.

Comprehensive Research Framework Outlining Rigorous Data Collection and Analysis Techniques Underpinning the Directed Energy Weapons Study

This research employs a mixed-methods framework integrating secondary data analysis with primary qualitative insights. We conducted a comprehensive review of government publications, including GAO reports and Congressional primers, to establish baseline definitions, technology taxonomies, and policy contexts. Patent databases and industry alliance disclosures informed our segmentation of technology subtypes and collaboration trends. Additionally, expert interviews with leading defense contractors, systems integrators, and academic researchers provided first-hand perspectives on programmatic challenges and innovation trajectories.

Quantitative data were triangulated across multiple proprietary and public sources, while scenario-based modeling assessed supply chain resilience under tariff regimes and procurement shifts. An expert advisory panel, comprising former defense officials and technical specialists, validated analytical assumptions and ensured methodological rigor. This dual-pronged approach delivers robust, actionable intelligence that aligns with stakeholder decision-making frameworks and supports strategic planning in the directed energy domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Directed Energy Weapons market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Directed Energy Weapons Market, by Type

- Directed Energy Weapons Market, by Platform

- Directed Energy Weapons Market, by Power Output

- Directed Energy Weapons Market, by Application

- Directed Energy Weapons Market, by Region

- Directed Energy Weapons Market, by Group

- Directed Energy Weapons Market, by Country

- United States Directed Energy Weapons Market

- China Directed Energy Weapons Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Converging Insights Underscore the Transformative Potential and Strategic Imperatives of Directed Energy Weapons in Shaping Future Defense Landscapes

Directed energy weapons represent a transformative nexus of physics and defense engineering, offering precision effects that conventional munitions cannot match. Across the examined segments-type, application, platform, and power output-clear patterns emerge: laser systems excel in point defense roles, microwave and particle beams address electronic warfare and hard-target engagement, and power scaling dictates operational tempo and mission viability. These insights underscore the critical need for tailored acquisition strategies and continued technology maturation efforts to fully exploit DEW advantages.

As regional dynamics shift and the supply chain adjusts to new tariff environments, stakeholders must remain agile, leveraging collaborative R&D and domestic production investments to sustain innovation. The confluence of prime-driven development, startup-led breakthroughs, and multilateral partnerships forms the cornerstone of a resilient directed energy ecosystem. By translating these findings into targeted action plans, defense organizations can harness DEW systems to secure strategic superiority in an increasingly contested global security landscape.

Unlock Critical Strategic Advantages by Procuring the In-Depth Directed Energy Weapons Market Report Through Direct Engagement with Our Associate Director Ketan Rohom

Engaging with this comprehensive market research report offers your organization unparalleled insights into the directed energy weapons sector’s evolving dynamics and strategic trajectories. By partnering with Ketan Rohom, Associate Director of Sales & Marketing, you will receive personalized support to align the report’s findings with your specific operational objectives and investment priorities. This tailored engagement ensures that your team can swiftly translate data-driven intelligence into actionable strategies that fortify competitive advantages and inform critical procurement decisions.

Reach out to Ketan Rohom today to secure access to the full directed energy weapons market research report. Empower your organization with the foresight needed to navigate complex regulatory shifts, optimize supply chains, and leverage breakthrough technologies. Take this decisive step toward shaping your future defense capability roadmap and establishing your leadership in the transformative domain of directed energy weapons.

- How big is the Directed Energy Weapons Market?

- What is the Directed Energy Weapons Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?