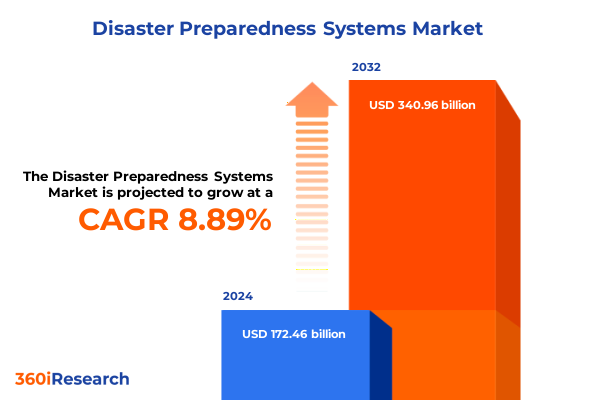

The Disaster Preparedness Systems Market size was estimated at USD 187.21 billion in 2025 and expected to reach USD 203.33 billion in 2026, at a CAGR of 8.94% to reach USD 340.96 billion by 2032.

Amid Intensifying Threats and Technological Advances, Future-Proofing Disaster Preparedness Systems Becomes a Strategic Necessity for Organizations Worldwide

Amid Intensifying Threats and Technological Advances, Future-Proofing Disaster Preparedness Systems Becomes a Strategic Necessity for Organizations Worldwide

In an era marked by escalating climate volatility, rapid urbanization, and evolving security risks, organizations face unprecedented pressure to anticipate, prepare for, and respond to a wide spectrum of emergencies. From natural hazards like hurricanes and wildfires to man-made crises such as industrial accidents and cyberattacks, the complexity and interconnectivity of these threats demand integrated, end-to-end disaster preparedness systems. Decision-makers must reconcile legacy protocols with emerging technologies-such as artificial intelligence-driven incident management and cloud-native early warning platforms-to build resilience and ensure continuity of operations across critical infrastructures.

Recent data underscore the urgency of this transformation. The U.S. endured a record-breaking 23 separate billion-dollar weather and climate disasters in 2023, shattering previous benchmarks and inflating cumulative economic losses beyond $57.6 billion. While some statistical artifacts arise from enhanced reporting since 2000, as noted by EM-DAT’s own documentation and independent analyses , the human and financial toll of these events remains undeniable. As hazards grow in frequency and severity, stakeholders must adopt a strategic, data-driven approach to disaster preparedness-leveraging advanced early warning, incident management, and communication systems-to protect lives, assets, and reputations.

Navigating Paradigm Shifts Driven by Digital Convergence and AI Innovations That Are Redefining Resilient Disaster Preparedness and Response Strategies

Navigating Paradigm Shifts Driven by Digital Convergence and AI Innovations That Are Redefining Resilient Disaster Preparedness and Response Strategies

The landscape of disaster preparedness is undergoing transformative shifts fueled by the convergence of digital platforms, artificial intelligence, and the Internet of Things. Organizations are increasingly migrating from siloed, hardware-centric models toward cloud-based ecosystems that integrate early warning sensors, GIS mapping tools, and AI-powered incident management applications. This shift enables real-time situational awareness and predictive analytics, allowing response teams to allocate resources dynamically and pre-position assets ahead of unfolding events.

Simultaneously, the rise of agentic AI systems is redefining the role of human operators. Platforms like IBM’s watsonx Orchestrate now support the rapid creation and deployment of AI agents that automate routine incident triage and communication workflows, streamlining multi-agency coordination at unprecedented scale. At the same time, next-generation 5G-enabled IoT networks are expanding the reach of surveillance systems and remote communication devices, ensuring persistent connectivity even in infrastructure-compromised environments. As these innovations gain traction, stakeholders must harmonize emerging technologies with established protocols, fostering interoperability and resilience throughout the preparedness lifecycle.

Assessing the Comprehensive Cumulative Impact of 2025 United States Tariffs on Critical Components Within Disaster Preparedness Infrastructure

Assessing the Comprehensive Cumulative Impact of 2025 United States Tariffs on Critical Components Within Disaster Preparedness Infrastructure

The U.S. government’s ongoing application and escalation of Section 301 tariffs on imports from China have substantially increased the cost of core hardware components integral to disaster preparedness systems. As of January 1, 2025, tariffs on strategic semiconductor imports surged from 25% to 50%, directly affecting the procurement cost of surveillance cameras, communication devices, and embedded control units within emergency management platforms. This tariff increase underscores a broader policy objective of fostering domestic production, yet it introduces immediate budgetary pressures for public safety agencies and infrastructure integrators reliant on global supply chains.

While certain exclusions were extended through August 31, 2025, to mitigate short-term supply disruptions for specialized equipment , the expiration of these reprieves is poised to reintroduce elevated import duties on critical components. Moreover, tariff relief measures enacted in early 2025 under the International Emergency Economic Powers Act are set to lapse, potentially resurrecting baseline 10% duties across a broad spectrum of imported goods, with elevated rates on select countries including China, the EU, and Mexico thereafter. Against this backdrop, procurement teams must develop resilient sourcing strategies-balancing domestic alternatives with multinational vendor diversification-to maintain project timelines and financial viability.

The cumulative effect of these measures has prompted leading suppliers and system integrators to reevaluate manufacturing footprints, invest in alternative supply‐chain geographies, and engage with policy stakeholders. As tariff policy continues to evolve, disaster preparedness program managers must monitor regulatory developments closely and adjust capital planning assumptions to ensure seamless deployment of essential safety and communication systems.

Uncovering Strategic Insights from the Multidimensional Segmentation Framework Shaping Disaster Preparedness System Adoption and Deployment Dynamics

Uncovering Strategic Insights from the Multidimensional Segmentation Framework Shaping Disaster Preparedness System Adoption and Deployment Dynamics

A nuanced understanding of market segmentation reveals the diverse functional, technological, and organizational drivers shaping disaster preparedness investments. Systems designed for risk management, early warning, emergency communication, and surveillance each fulfill distinct operational imperatives. The adoption curve for incident management and safety management systems, for example, is heavily influenced by end-user sector priorities-while corporate entities often prioritize integrated emergency communication platforms to safeguard personnel and assets, educational institutions emphasize incident management modules to manage campus events and drills.

Meanwhile, component-level differentiation underscores the interplay between hardware, software, and services. Communication devices and surveillance equipment form the backbone of many installations, but consulting services and technical support are often decisive in selecting a vendor, as they align system configuration with local regulatory requirements and operational protocols. Software suites encompassing disaster response, emergency management, and GIS mapping are increasingly embedded within cloud-based deployments, enabling remote access and rapid scalability. Across deployment models, the choice between on-premises infrastructure and cloud-hosted solutions reflects organizational priorities regarding data sovereignty, uptime requirements, and total cost of ownership.

Application-driven segmentation further distinguishes market needs: responses to natural disasters demand robust, wide-area alerting and predictive analytics, while man-made incident scenarios-ranging from industrial accidents to security threats-require real-time incident logging, rapid decision support, and interoperable communication channels. Public health emergencies, as witnessed during the COVID-19 pandemic, have accelerated investment in integrated communication and incident management platforms, underscoring the importance of scalable software and training services to coordinate multi-agency responses. When viewed holistically, this segmentation framework enables stakeholders to tailor their strategies to the specific functional, technical, and sectoral use cases driving growth in disaster preparedness solutions.

This comprehensive research report categorizes the Disaster Preparedness Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Application

- End User

- Deployment

Illuminating Key Regional Dynamics Influencing Disaster Preparedness System Uptake Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Illuminating Key Regional Dynamics Influencing Disaster Preparedness System Uptake Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

In the Americas, governments at federal and state levels are prioritizing modernized emergency communication networks and incident management platforms, fueled by record losses from hurricanes, wildfires, and public health crises. Private-sector adoption is driven by corporate resilience mandates and stringent regulatory requirements for critical infrastructure operators.

Across Europe, the Middle East, and Africa, investments in early warning systems and public alerting technologies are shaped by diverse hazard profiles, ranging from seismic risks in Mediterranean nations to flood threats in Western Europe and heatwaves across North Africa. Public-private partnerships and EU-backed initiatives support cross-border interoperability and data-sharing frameworks. In the Asia-Pacific region, rapid urbanization and a high incidence of tropical cyclones and earthquakes have accelerated the deployment of integrated surveillance and communication systems, with leading economies emphasizing AI-enabled predictive analytics and cloud-hosted platforms to enhance resilience.

These regional distinctions underscore the necessity of customizing solution portfolios and channel strategies to local market conditions, regulatory landscapes, and hazard patterns. Vendors that align product roadmaps with region-specific use cases-such as multi-lingual alert dissemination and flexible deployment models-are well positioned to capture growth opportunities and drive end-user adoption across continents.

This comprehensive research report examines key regions that drive the evolution of the Disaster Preparedness Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation, Partnerships, and Resilience Across the Disaster Preparedness Solutions Ecosystem in 2025

Profiling Leading Companies Driving Innovation, Partnerships, and Resilience Across the Disaster Preparedness Solutions Ecosystem in 2025

Industry leaders are accelerating innovation through strategic partnerships and targeted acquisitions to deliver end-to-end disaster preparedness capabilities. Honeywell’s launch of an AI-powered integrated building management solution harnesses machine learning to provide real-time diagnostics and predictive maintenance-enabling facility managers to preempt disruptions and optimize resource deployment. Concurrently, Honeywell’s expansion of its cybersecurity offerings for operational technology environments underscores the growing convergence of physical safety and digital resilience.

Motorola Solutions has fortified its public safety portfolio through the acquisition of RapidDeploy, integrating cloud-native NG911 mapping and analytics to enhance situational awareness and accelerate response times. The launch of the SVX integrated device, combining AI-assisted reporting, remote speaker microphones, and body-worn cameras, exemplifies the company’s commitment to streamlined workflows and multi-modal communications for first responders.

On the software front, IBM continues to invest in agentic AI platforms that automate incident triage and facilitate multi-agency collaboration. Its 2025 advancements in watsonx capabilities, including accelerated AI agent orchestration, reinforce the enterprise shift toward autonomous operations in high-pressure environments. Together, these leading companies are shaping a resilient ecosystem of integrated hardware, software, and services that address the complex demands of modern disaster preparedness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Disaster Preparedness Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 11:11 Systems Inc.

- 3M Company

- Alert Technologies Corporation

- Alertus Technologies LLC

- Amazon Web Services, Inc.

- Atos SE

- BlackBerry Limited

- Broadcom Inc.

- CHR Solutions

- Druva Inc.

- Eaton Corporation PLC

- ESRI

- Everbridge, Inc

- GeoSIG Ltd.

- Google LLC by Alphabet Inc.

- Hagerty Consulting Inc.

- Haystax Technology by Fishtech LLC

- Hewlett Packard Enterprise Company

- Hexagon AB

- Honeywell International Inc.

- ICF International, Inc.

- International Business Machines Corporation

- Japan Radio Co., Ltd. by Nisshinbo Holdings Inc.

- Johnson Controls International PLC

- Juvare, LLC

- Kenyon International Emergency Services

- Lockheed Martin Corporation

- Microsoft Corporation

- Motorola Solutions, Inc.

- NEC Corporation

- OnSolve

- Open Text Corporation

- Oracle Corporation

- Resolver Inc. by Kroll, LLC

- Rolta India Limited

- RTX Corporation

- Samsung Electronics Co., Ltd.

- SeismicAI Ltd.

- Siemens AG

- Singlewire Software, LLC

- Telegrafia, a.s.

- TRUSTIA Corporation

- Veoci Inc.

Actionable Strategic Recommendations Empowering Industry Leaders to Drive Innovation, Collaboration, and Resilience in Disaster Preparedness Initiatives

Actionable Strategic Recommendations Empowering Industry Leaders to Drive Innovation, Collaboration, and Resilience in Disaster Preparedness Initiatives

To remain at the forefront of disaster preparedness, organizations should diversify procurement strategies by integrating multiple supply-chain geographies while nurturing domestic partnerships for critical hardware manufacturing. This approach mitigates the impact of evolving tariff policies and reduces lead-time volatility for sensor networks, communication devices, and surveillance systems. Additionally, fostering strategic alliances with software vendors and system integrators can accelerate the deployment of AI-enabled incident management platforms and GIS-driven early warning tools.

Embrace hybrid deployment architectures that dynamically balance on-premises infrastructure with cloud-hosted services based on mission-critical uptime requirements and data sovereignty considerations. By leveraging containerized applications and edge computing, responders can maintain continuous operations even when connectivity is compromised. Further, embed training and consulting services within solution offerings to ensure end users achieve proficiency in incident response workflows and maximize the value of predictive analytics.

Finally, maintain a proactive regulatory engagement strategy to influence standards and secure tariff exclusions for essential components. By aligning with policy stakeholders, industry leaders can shape the evolution of interoperability frameworks and secure designation of critical equipment for preferential treatment. Collectively, these recommendations will enable organizations to optimize cost structures, accelerate innovation, and deliver robust preparedness capabilities at scale.

Detailed Research Methodology Underpinning Comprehensive Analysis of Disaster Preparedness Systems Incorporating Primary and Secondary Data Triangulation

Detailed Research Methodology Underpinning Comprehensive Analysis of Disaster Preparedness Systems Incorporating Primary and Secondary Data Triangulation

This study synthesizes primary qualitative insights and secondary quantitative data to offer a robust evaluation of the disaster preparedness landscape. Primary research comprised structured interviews and workshops with senior executives from government agencies, NGOs, and Fortune 500 corporations, focusing on use-case validation, procurement drivers, and deployment challenges. Secondary research leveraged published regulatory filings, tariff notifications, industry white papers, and reputable news sources to track policy shifts and technology trends. Publicly available databases were consulted to corroborate event frequency and economic loss patterns, while vendor disclosures and press releases provided clarity on product launches and strategic partnerships.

Analytical rigor was maintained through the triangulation of findings across multiple sources, ensuring consistency in tariff impact assessment and segmentation categorization. Data quality protocols included cross-referencing exclusion notices with official Federal Register entries and validating vendor claims against independent reviews and regulatory announcements. Geographic insights were calibrated through regional expert consultations and hazard-specific case studies. This multi-layered methodology underpins the credibility of the report’s insights and ensures stakeholders can confidently rely on the findings to inform strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Disaster Preparedness Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Disaster Preparedness Systems Market, by Type

- Disaster Preparedness Systems Market, by Component

- Disaster Preparedness Systems Market, by Application

- Disaster Preparedness Systems Market, by End User

- Disaster Preparedness Systems Market, by Deployment

- Disaster Preparedness Systems Market, by Region

- Disaster Preparedness Systems Market, by Group

- Disaster Preparedness Systems Market, by Country

- United States Disaster Preparedness Systems Market

- China Disaster Preparedness Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesis of Key Findings Emphasizing Strategic Outlook and Imperatives for Advancing Disaster Preparedness Systems Amid Complex Risks

Synthesis of Key Findings Emphasizing Strategic Outlook and Imperatives for Advancing Disaster Preparedness Systems Amid Complex Risks

The escalating complexity of disasters-driven by climate variability, urban concentration, and cyber-physical convergence-necessitates a strategic recalibration of preparedness frameworks. Advanced AI capabilities and cloud-native early warning platforms are reshaping the operational paradigm, while evolving U.S. tariff policies introduce new supply-chain considerations that underscore the need for procurement resilience. Segmentation analysis reveals that targeted systems-from incident management to surveillance-must be tailored to sectoral and hazard-specific requirements, emphasizing the importance of integrated hardware, software, and services.

Regionally differentiated adoption patterns highlight the critical role of local regulatory environments and hazard profiles in shaping investment priorities. Leading vendors are responding through strategic partnerships, technology acquisitions, and product innovations that embed AI-driven analytics and multi-modal communication into comprehensive solutions. Industry leaders are advised to diversify sourcing, adopt hybrid deployment architectures, and engage proactively with policy stakeholders to secure preferential treatment for mission-critical systems.

As organizations look ahead, the imperative is clear: build resilient, interoperable architectures that harness predictive insights, agile deployment models, and cross-sector collaboration. Only through an integrated approach-combining robust technology stacks with adaptive procurement and policy strategies-can stakeholders effectively safeguard communities, assets, and reputations in an increasingly unpredictable world.

Engage Directly with Ketan Rohom to Secure Tailored Strategic Insights and Comprehensive Disaster Preparedness System Research Reports

For tailored insights and strategic guidance crafted specifically for your organization’s unique challenges in disaster preparedness, connect with Associate Director, Sales & Marketing, Ketan Rohom. Engage directly to explore how our comprehensive research report can empower your decision-making process, unveil hidden opportunities, and fortify your resilience strategies. Reach out today to schedule a personalized consultation and secure access to the full analysis that will drive your next phase of growth and operational excellence in disaster preparedness systems.

- How big is the Disaster Preparedness Systems Market?

- What is the Disaster Preparedness Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?