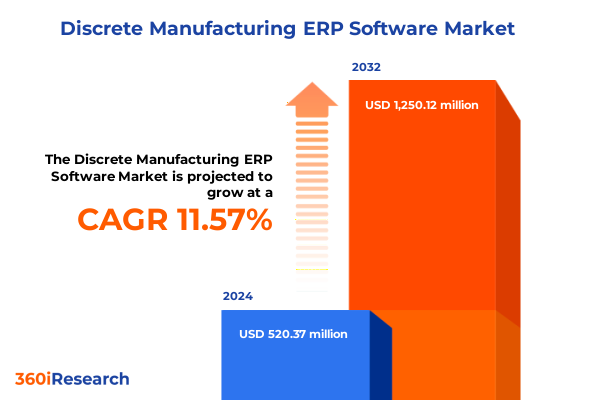

The Discrete Manufacturing ERP Software Market size was estimated at USD 570.05 million in 2025 and expected to reach USD 639.80 million in 2026, at a CAGR of 11.87% to reach USD 1,250.12 million by 2032.

Entering the Era of Agile Production: Understanding How Discrete Manufacturing ERP Platforms are Redefining Operational Excellence and Competitive Advantage

In today’s rapidly evolving industrial landscape, discrete manufacturing operations face unprecedented demands for agility, precision, and scalability. As production lines expand to accommodate increasingly sophisticated products-from aerospace components to advanced electronics-organizations require a unified system that harmonizes their processes, data flows, and strategic objectives. Discrete manufacturing ERP platforms serve as the digital backbone of modern factories, enabling seamless integration of inventory management, production scheduling, quality control, and financial reporting into a single cohesive solution.

Crafted to address the unique needs of batch-oriented, build-to-order, and engineer-to-spec environments, these ERP solutions empower manufacturers to reduce lead times, optimize resource utilization, and maintain rigorous quality standards. Through real-time visibility and automated workflows, teams gain the insights needed to rapidly adapt to changing customer requirements and mitigate the risk of supply chain disruptions. With manufacturing executives increasingly prioritizing operational excellence and data-driven decision making, the strategic importance of discrete manufacturing ERP has never been greater

Unveiling the Pivotal Technological Shifts Reshaping Discrete Manufacturing ERP Architectures Across Industry 4.0 Digital Transformation Journeys

Over the past few years, a constellation of technological innovations has coalesced to reshape the discrete manufacturing ERP environment into a highly adaptive, intelligence-driven ecosystem. Cloud computing has transcended traditional on-premise constraints, ushering in elastic infrastructure that scales effortlessly with production peaks, while edge computing brings real-time analytics directly to the shop floor. Concurrently, the proliferation of the Industrial Internet of Things (IIoT) has enabled continuous monitoring of machines and assets, transforming historical data repositories into predictive engines that anticipate maintenance needs and optimize throughput.

Moreover, breakthroughs in artificial intelligence and machine learning are driving next-generation planning and scheduling capabilities, allowing discrete operations to pivot dynamically around demand signals and material availability. At the same time, digital thread architectures are forging end-to-end connectivity-from design and engineering through production and aftermarket services-unlocking unprecedented transparency and traceability. As manufacturers contend with heightened sustainability mandates and the imperative to reduce carbon footprints, ERP solutions are embedding environmental performance metrics alongside traditional KPIs, thereby integrating corporate responsibility into core operational workflows. These transformative shifts are collectively redefining how discrete manufacturers envision, manage, and execute their production strategies.

Exploring the Broad Implications of United States Trade Tariffs on Discrete Manufacturing Supply Chains and ERP System Adoption Strategies Through 2025

The cumulative impact of United States trade tariffs in 2025 has intensified cost pressures across discrete manufacturing supply chains, compelling organizations to reexamine the robustness of their ERP implementations. Tariffs on steel and aluminum, initially imposed in preceding years, continue to elevate raw material expenses, while Section 301 duties on imported electronics and machinery components have sustained higher purchase costs. In response, manufacturing leaders are leveraging ERP modules for advanced cost tracking, scenario modeling, and supplier scorecarding to maintain visibility into the total landed cost and secure more favorable sourcing arrangements.

Simultaneously, compliance requirements introduced by updated tariff schedules have underscored the necessity of integrated trade management functionality within ERP platforms. By automating country-of-origin declarations, duty reimbursements, and export license checks, discrete manufacturers reduce manual intervention and the risk of regulatory penalties. This has accelerated adoption of ERP extensions that support tariff simulation and border compliance, enabling rapid adaptation to evolving policy landscapes. Ultimately, the persistent tariff environment has galvanized executives to deepen their reliance on ERP systems as strategic tools for cost containment and risk mitigation, transforming what was once a reactive procurement process into a proactive, data-driven discipline.

Gaining Deep Visibility into How Deployment Configurations Application Types and Industry Verticals Define Discrete Manufacturing ERP Implementations

A nuanced understanding of deployment options, application modules, and industry-specific requirements reveals how discrete manufacturing ERP adoption is tailor-fitted to organizational priorities. Deployment type analysis highlights two divergent pathways: on-premise solutions remain favored for facilities with stringent data sovereignty and security mandates, while cloud-based offerings-spanning IaaS, PaaS, and SaaS models-unlock rapid provisioning, seamless updates, and subscription-based cost structures that appeal to companies seeking operational flexibility.

When evaluating application type, manufacturers recognize that a holistic ERP suite must encompass customer relationship management to nurture order lifecycles, financial management to maintain fiscal accountability, human capital management to align workforce productivity, and inventory management to balance material availability against carrying costs. Further downstream, the manufacturing execution system module orchestrates production workflows, while supply chain management functions-demand planning, logistics management, and procurement management-serve as the connective tissue linking supplier networks to in-plant operations.

Industry vertical segmentation underscores distinct feature priorities: aerospace and defense organizations demand rigorous traceability and regulatory compliance, automotive manufacturers emphasize lean assembly line synchronization and variant configuration, consumer goods producers focus on rapid time-to-market and high-volume order management, electronics companies require precision batch control and serialized tracking, and industrial machinery firms leverage asset lifecycle management to maximize uptime and service revenue.

This comprehensive research report categorizes the Discrete Manufacturing ERP Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Type

- License Type

- Application Type

- End-User Industry

Unlocking Regional Dimensions of Discrete Manufacturing ERP Adoption Trends by Examining the Americas EMEA and Asia Pacific Markets in Depth

Regional market dynamics for discrete manufacturing ERP adoption reflect varying degrees of digital maturity, investment velocity, and regulatory complexity. In the Americas, robust capital expenditure cycles in the United States and Canada are driving widespread cloud adoption, with organizations prioritizing SaaS models to accelerate modernization initiatives. Latin American manufacturers are similarly exploring subscription-based ERP deployments to improve cost predictability and localize production capabilities closer to key consumer markets.

Across Europe, Middle East, and Africa, compliance and data privacy regulations exert a strong influence on deployment decisions; entities in the European Union emphasize on-premise or private cloud configurations to meet GDPR and industry-specific security requirements, while Middle Eastern and African governments are investing in infrastructure upgrades that support public cloud expansion and digital government frameworks.

In the Asia-Pacific region, government-led programs promoting smart factories and Made in Asia initiatives are fueling rapid ERP integration among manufacturers in China, India, Japan, and Southeast Asia. These markets value ERP systems that can accommodate high levels of customization to suit local sourcing ecosystems, labor models, and export-oriented production. Collectively, regional insights inform a geographically nuanced approach to ERP strategy, underscoring the importance of adaptable deployment, localized support networks, and compliance-ready architectures.

This comprehensive research report examines key regions that drive the evolution of the Discrete Manufacturing ERP Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Edge and Strategic Differentiators of Leading Discrete Manufacturing ERP Providers Driving Innovation Across Industries

Within the competitive landscape of discrete manufacturing ERP, several providers distinguish themselves through vertical specialization, technological innovation, and ecosystem integration. One set of leading vendors offers mature, end-to-end suites with embedded analytics and artificial intelligence capabilities that support predictive maintenance and dynamic scheduling for complex manufacturing environments. Another cohort focuses on cloud-native architectures, leveraging containerization and microservices to deliver modular ERP components that can be assembled in a composable fashion according to specific operational needs.

A third group of established players caters primarily to small and medium-sized discrete manufacturers, surfacing preconfigured industry templates, low-code customization tools, and streamlined implementation methodologies. These offerings accelerate time to value and reduce total cost of ownership, making ERP accessible to organizations with constrained IT resources. Meanwhile, emerging entrants are embedding advanced IoT connectivity, digital twin simulations, and augmented reality interfaces to enhance operator experience and optimize shop-floor decision making.

Strategic partnerships among ERP vendors, systems integrators, and cloud infrastructure providers are also reshaping the market, creating bundled solutions that combine ERP core functionality with specialized domain expertise in areas such as quality management, compliance tracking, and sustainability reporting. As a result, manufacturers benefit from end-to-end support ecosystems that accelerate continuous improvement cycles and support phased deployment strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Discrete Manufacturing ERP Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- abas Software AG

- Aptean Inc.

- Epicor Software Corporation

- IFS AB

- Infor Inc.

- Microsoft Corporation

- Oracle Corporation

- Plex Systems Inc.

- QAD Inc.

- Ramco Systems Limited

- Sage Group plc

- SAP SE

- SYSPRO (Pty) Ltd

- xTuple Inc.

Providing Actionable Blueprint Recommendations for Discrete Manufacturing Executives to Leverage ERP Investments and Drive Operational Agility

To capitalize on the value of discrete manufacturing ERP, executive teams should begin by establishing clear governance frameworks and stakeholder alignment around key performance metrics. Prioritizing a phased implementation approach enables organizations to secure early wins-such as automated inventory replenishment and real-time shop-floor monitoring-before scaling across additional facilities and functional domains. Concurrently, investing in rigorous data governance protocols ensures that process standardization efforts are supported by clean, reliable data, which in turn underpins advanced analytics and continuous improvement initiatives.

Organizations should also integrate ERP deployment with broader digitalization roadmaps, including IIoT rollout plans, quality management programs, and sustainability objectives. Embedding cross-functional teams comprising IT, operations, finance, and procurement stakeholders fosters a culture of collaboration, accelerating change management and driving user adoption. Engaging experienced systems integrators and industry consultants can mitigate implementation risks by leveraging proven best practices, while comprehensive training plans empower end users to leverage ERP capabilities fully.

Finally, remaining vigilant to software lifecycle management-regularly applying updates, leveraging vendor-provided enhancements, and conducting periodic process health checks-will safeguard ERP investments against obsolescence. By following these recommendations, manufacturing leaders can position their organizations to harness ERP as a strategic enabler of agility, resilience, and operational excellence.

Unraveling the Comprehensive Research Methodology Underpinning Insights into Discrete Manufacturing ERP Market Dynamics and Qualitative Analytical Rigor

This research report synthesizes insights derived from a blend of primary and secondary research methodologies designed to deliver both breadth and depth of understanding. At the primary level, structured interviews were conducted with senior discrete manufacturing executives, plant managers, and IT leaders across a representative cross-section of industry verticals. These interviews revealed real-world challenges, technology preferences, and implementation success factors that informed subsequent analytical frameworks.

To complement these qualitative inputs, a targeted survey of IT and operations professionals provided quantitative benchmarks on deployment preferences, module adoption rates, and perceived barriers to ERP modernization. These survey results were triangulated with secondary research sources, including trade association publications, regulatory filings, and peer-reviewed academic studies on supply chain resilience and digital transformation.

Vendor briefings and product demonstrations enabled a comparative evaluation of feature sets, architecture approaches, and ecosystem partnerships, while expert consultations with industry analysts further validated the findings. Data integrity was ensured through a rigorous validation process, including cross-referencing multiple data points, reconciling discrepancies, and engaging subject-matter experts for peer review. This comprehensive methodology delivers actionable, unbiased insights tailored to the discrete manufacturing ERP landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Discrete Manufacturing ERP Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Discrete Manufacturing ERP Software Market, by Component

- Discrete Manufacturing ERP Software Market, by Deployment Type

- Discrete Manufacturing ERP Software Market, by License Type

- Discrete Manufacturing ERP Software Market, by Application Type

- Discrete Manufacturing ERP Software Market, by End-User Industry

- Discrete Manufacturing ERP Software Market, by Region

- Discrete Manufacturing ERP Software Market, by Group

- Discrete Manufacturing ERP Software Market, by Country

- United States Discrete Manufacturing ERP Software Market

- China Discrete Manufacturing ERP Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Perspectives on the Strategic Imperatives of Discrete Manufacturing ERP Adoption for Enhancing Efficiency Resilience and Future-Proofing Operations

As discrete manufacturers navigate an increasingly complex operational environment, ERP systems emerge as foundational platforms for consolidating data, automating processes, and driving continuous improvement. The confluence of cloud adoption, Industry 4.0 innovations, and evolving regulatory requirements underscores the necessity of integrated ERP solutions that can adapt to shifting business imperatives while maintaining rigorous compliance and performance standards.

By deploying ERP platforms that encompass the full spectrum of enterprise functions-from customer relationship management to supply chain orchestration-organizations can achieve unprecedented transparency across their operations. This transparency, in turn, fuels more informed decision making, accelerates response times to market fluctuations, and strengthens resilience against supply chain disruptions and policy headwinds. As manufacturers look ahead, the integration of artificial intelligence, predictive analytics, and digital twin simulations within ERP environments will further enhance strategic planning capabilities and operational responsiveness.

In conclusion, discrete manufacturing ERP is not merely a transactional system for day-to-day operations; it is a strategic enabler that underpins innovation, competitiveness, and sustainable growth. Organizations that invest in best-in-class ERP solutions today will be best positioned to anticipate future challenges, harness emerging technologies, and secure a lasting competitive advantage.

Empowering Decision Makers to Secure Exclusive Access to an In-Depth Discrete Manufacturing ERP Market Research Report by Connecting with Ketan Rohom

As industry leaders seek to capitalize on the transformative power of ERP systems for discrete manufacturing, securing direct access to a comprehensive market research report presents a critical opportunity to inform strategic investments. By connecting with Ketan Rohom, Associate Director of Sales & Marketing, executives can arrange a personalized walkthrough of the report’s in-depth analysis, ensuring that decision makers gain clarity on the unique operational benefits and competitive advantages unlocked by advanced discrete manufacturing ERP solutions. This direct engagement offers an exclusive channel to explore tailored insights and address specific organizational questions in real time, facilitating informed budgetary commitments and roadmap prioritization.

Engaging with Ketan Rohom also provides complimentary access to supplementary materials, including detailed vendor comparison matrices and expert commentary on evolving regulatory and technological trends. Through this collaborative dialogue, stakeholders can accelerate their due-diligence process, reduce procurement cycle times, and elevate their confidence in selecting the optimal ERP partner for their discrete manufacturing environment. Act now to leverage this opportunity, unlocking strategic intelligence that will underpin resilient, data-driven decision making and propel your organization toward sustained growth and operational excellence.

- How big is the Discrete Manufacturing ERP Software Market?

- What is the Discrete Manufacturing ERP Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?