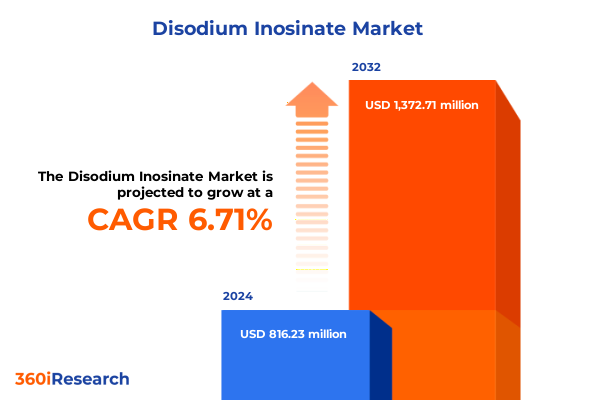

The Disodium Inosinate Market size was estimated at USD 870.10 million in 2025 and expected to reach USD 923.79 million in 2026, at a CAGR of 6.73% to reach USD 1,372.71 million by 2032.

Disodium inosinate stands at the forefront of natural umami enhancement, reshaping flavor profiles across food, beverage, cosmetic, and animal feed applications

Disodium inosinate, known chemically as the disodium salt of inosinic acid, offers a robust flavor-enhancement profile that elevates umami taste without contributing excessive sodium chloride. Approved by the U.S. Food and Drug Administration as a Generally Recognized as Safe (GRAS) flavoring adjuvant under 21 CFR 172.535, the additive must meet stringent purity criteria, including limits on soluble barium, and is widely adopted across diverse food segments due to its safety and efficacy.

Rapid technological advances and shifting consumer preferences are redefining production, sourcing, and regulatory paradigms in the flavor enhancer landscape

The flavor enhancer landscape is undergoing seismic transformation driven by intensified consumer demand for transparency, natural sourcing, and functional innovation. In recent years, clean-label initiatives have propelled formulators to explore alternative production methods, fostering investment in microbial fermentation technologies that yield disodium inosinate without animal-derived inputs. This shift is further reinforced by the rising popularity of plant-based and vegan product portfolios, which leverage fermentation-based nucleotides to deliver authentic savory notes without compromising ethical positioning. Simultaneously, regulatory scrutiny has sharpened on additive labeling and permissible use levels, compelling manufacturers to enhance traceability and document adherence to global standards.

Mounting tariff burdens and trade policy shifts are exerting significant pressure on supply chain costs and sourcing strategies for disodium inosinate imports in 2025

Cumulative tariff adjustments in 2025 have reshaped the economic calculus for disodium inosinate imports into the United States. Under Harmonized Tariff Schedule heading 2835.22.00.00, mono- and disodium phosphate compounds attract a baseline general duty of 1.4 percent, while imports originating from China incur an additional 25 percent ad valorem surcharge. This dual-layer duty structure elevates landed cost for Chinese-sourced material to approximately 26.4 percent, intensifying the incentive to realign procurement toward free-trade partners such as Korea, Mexico, and Singapore, where the special rate of duty is zero. As a result, ingredient buyers are reevaluating origin strategies, leveraging preferential trade agreements, and optimally balancing supply security against duty exposure.

Comprehensive segmentation analysis unlocks nuanced insights into application, form, source, and distribution channel dynamics shaping disodium inosinate utilization

A granular look at segment dynamics reveals that disodium inosinate’s performance varies markedly across end-use applications, product forms, raw material origins, and delivery channels. When deployed in meat products, sauces and dressings, seasonings and condiments, snacks, and soups and broths, formulators capitalize on its synergistic effect with glutamate to amplify savory notes, tailoring dosage and blend methods for each culinary category. Across granule, liquid, and powder formats, functionality shifts in key attributes such as solubility, dispersibility, and shelf stability, compelling manufacturers to select the optimal form factor for their processing environment. The source matrix bifurcates between traditional meat extract and yeast extract pathways, each offering distinct organoleptic and labeling considerations. Meanwhile, distribution arcs encompass direct sales to industrial end users, regional distributors serving niche markets, and e-commerce channels-both business-to-business platforms targeting food processors and business-to-consumer portals catering to boutique and artisanal producers.

This comprehensive research report categorizes the Disodium Inosinate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Source

- Function

- Application

- End Use

- Distribution Channel

Regional market dynamics reveal divergent growth drivers and regulatory landscapes across the Americas, EMEA, and Asia-Pacific for disodium inosinate

Regional market nuances are defined by divergent consumer preferences, regulatory climates, and supply-chain infrastructures. In the Americas, robust demand for convenience foods and savory snacks underpins ongoing uptake of flavor enhancers, with manufacturers navigating regulatory alignment and label transparency to meet North American clean-label expectations. In Europe, Middle East, and Africa, stringent additive approvals and evolving consumer skepticism toward synthetic names are driving localization of supply and investment in all-natural sourcing, while EMEA producers leverage established distribution networks to advance clean-label formulations. Across Asia-Pacific, where umami traditions originate, legacy usage in instant noodles, broths, and seasoning mixes persists alongside rapid adoption in emerging markets, prompting capacity expansions and collaborative ventures between multinational ingredient suppliers and regional producers.

This comprehensive research report examines key regions that drive the evolution of the Disodium Inosinate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading industry players uncovers strategic initiatives, competitive positioning, and innovation trajectories in the disodium inosinate market

Leading players in the disodium inosinate ecosystem are deploying differentiated strategies to consolidate market share, expand capacities, and advance technical capabilities. Ajinomoto Co., Inc. pioneered large-scale nucleotide seasoning production, inaugurating a global plant in Thailand to secure tapioca-sourced raw materials and bolster cost competitiveness. Fufeng Group has accelerated its footprint in Asia through vertically integrated production complexes, emphasizing supply security and quality control. Kyowa Hakko Bio Co., Ltd. leverages proprietary fermentation strains to optimize yield and pursue niche applications in nutritional and cosmetic formulations. Foodchem International Corporation exemplifies a distribution-focused model, channeling extensive international trade experience to supply high-purity disodium inosinate powders to diverse end users, while emphasizing certified quality systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Disodium Inosinate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Co., Inc.

- Cheil Jedang Corporation

- Foodchem International Corporation

- Fufeng Group Company Limited

- Huanghua Ouhai Biology Co., Ltd.

- Lian Company Limited

- Meihua Holdings Group Co., Ltd.

- Ningbo Pangs Chem Int'l Co., Ltd.

- Roquette Frères

- Shandong Shenghua Biotechnology Co., Ltd.

- Vedan International (Holdings) Limited

- Wuhan Vanz Pharm Inc.

- Zhejiang Wansheng Co., Ltd.

Strategic imperatives for industry leaders to capitalize on emerging trends, optimize supply chains, and innovate responsibly in the disodium inosinate sector

To navigate the evolving flavor enhancer landscape successfully, industry leaders should prioritize diversification of raw material sourcing by qualifying suppliers in countries benefiting from zero-duty trade agreements, thus mitigating tariff volatility. Investing in advanced fermentation and downstream purification technologies will enhance cost efficiency, reduce reliance on animal-derived inputs, and support clean-label credentials. Collaborative R&D partnerships between academic institutions and specialized biotech firms can accelerate novel umami formulations, unlocking opportunities in reduced-sodium and plant-based applications. Strengthening end-use channel integration through digital platforms and targeted technical support programs will deepen customer engagement, drive formulation innovation, and elevate brand trust.

Rigorous, multi-stage research methodology underpins the comprehensive analysis of market dynamics, regulatory trends, and stakeholder perspectives

This study employed a rigorous, multi-phase methodology combining primary qualitative interviews with C-suite executives, R&D leaders, and procurement specialists across major ingredient suppliers and end-use manufacturers. Secondary research encompassed exhaustive review of regulatory frameworks, including the U.S. CFR and Harmonized Tariff Schedule databases, complemented by technical literature from peer-reviewed journals and industry consortium reports. Competitive analysis integrated company disclosures, capital expenditure filings, and site visits to production facilities. Segmentation assessments were informed by product registries, trade data analytics, and end-use channel feedback, while regional insights derived from import-export statistics, consumer preference surveys, and local market committee publications. All findings underwent triangulation to validate consistency and accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Disodium Inosinate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Disodium Inosinate Market, by Form

- Disodium Inosinate Market, by Source

- Disodium Inosinate Market, by Function

- Disodium Inosinate Market, by Application

- Disodium Inosinate Market, by End Use

- Disodium Inosinate Market, by Distribution Channel

- Disodium Inosinate Market, by Region

- Disodium Inosinate Market, by Group

- Disodium Inosinate Market, by Country

- United States Disodium Inosinate Market

- China Disodium Inosinate Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Integrative summary underscores key takeaways, strategic priorities, and future pathways for leveraging disodium inosinate in a competitive marketplace

In summary, disodium inosinate remains a cornerstone in flavor enhancement, harnessing its unique synergy with glutamate to meet evolving consumer demands for umami intensity, clean-label integrity, and formulation versatility. The additive’s future trajectory will be shaped by overcoming tariff challenges, embracing biotechnology-driven production, and aligning with stringent regulatory and consumer expectations in major markets. By capitalizing on supply chain optimization, fostering innovation in product form and application, and strengthening strategic partnerships, stakeholders can secure competitive advantage and contribute to the sustained expansion of the flavor enhancer sector.

Engage with our Associate Director of Sales & Marketing to secure strategic market insights and comprehensive analysis in the disodium inosinate report

Seize the opportunity to unlock in-depth strategic insights and comprehensive market intelligence tailored to your organization’s needs. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to learn how this authoritative report on disodium inosinate can inform critical decision-making, fuel innovation, and sharpen your competitive edge. Engage today to secure access to exclusive analysis, detailed regulatory overviews, supply chain benchmarking, and actionable recommendations that empower leaders to navigate the evolving flavor enhancer landscape with confidence and clarity.

- How big is the Disodium Inosinate Market?

- What is the Disodium Inosinate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?