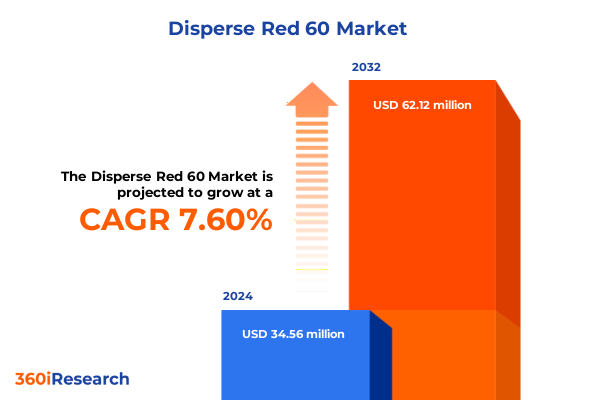

The Disperse Red 60 Market size was estimated at USD 36.74 million in 2025 and expected to reach USD 39.70 million in 2026, at a CAGR of 7.79% to reach USD 62.12 million by 2032.

Unveiling the Core Dynamics of Disperse Red 60 Market Landscape and Its Strategic Significance for Stakeholders and Decision Makers

Disperse Red 60 represents a cornerstone in the realm of synthetic dyes, renowned for its vibrant red spectrum and exceptional affinity toward hydrophobic substrates. This azo-based molecule exhibits high substantivity and dispersibility, making it indispensable in applications that demand brilliant, long-lasting coloration. Its molecular structure is optimized to ensure uniform particle distribution within various carrier systems, which enhances fastness properties and minimizes bleeding under challenging processing conditions. Consequently, manufacturers across textile, plastics, leather, and paper segments have adopted Disperse Red 60 as a critical component in their color portfolio.

Furthermore, the dye’s compatibility with diverse dyeing processes, including high-temperature and carrier-assisted techniques, has solidified its role in advanced coloration workflows. As industries pursue higher performance standards and broader color gamuts, Disperse Red 60 remains at the forefront of innovation, offering reproducibility and consistency even at large scales. In light of increasing sustainability mandates and consumer demand for eco-friendly products, the industry is undergoing a strategic shift toward dyes that align with circular economy principles. Accordingly, a nuanced understanding of Disperse Red 60’s chemical behavior, processing requirements, and end use performance is essential for executives charting future growth in this vibrant market.

Exploring the Pivotal Technological Advancements and Regulatory Transformations Reshaping the Disperse Red 60 Industry Infrastructure

In recent years, the Disperse Red 60 landscape has been reshaped by a series of technological breakthroughs and regulatory paradigms that collectively define the industry’s next phase of evolution. Advances in digital dyeing platforms have introduced precise color matching algorithms and closed-loop process controls, enabling manufacturers to optimize resource utilization and reduce effluent. Simultaneously, microencapsulation and nanotechnology-based dispersion techniques have enhanced color clarity while lowering the overall dye dosage requirement, thereby improving cost efficiencies and environmental footprints.

Moreover, policy frameworks such as REACH in Europe, TSCA in the United States, and emerging chemical restrictions in Asia-Pacific markets have imposed stringent guidelines on azo dye constituents. These measures have spurred innovation in dye formulation, compelling suppliers to invest in non-toxic carrier systems and develop substitute intermediates that comply with global safety standards. As a result, leading producers are actively collaborating with research institutes and downstream converters to pioneer next-generation dispersed dyes, positioning themselves to meet both compliance demands and shifting end use expectations.

Assessing the Cumulative Effects of United States Trade Tariffs Implemented in 2025 on the Operational and Financial Dimensions of Disperse Red 60

The introduction of targeted tariffs on imported Disperse Red 60 and precursor intermediates in early 2025 has had a profound effect on the cost structure for U.S. end users. Tariff increments ranging across key raw material categories have elevated landed costs, compelling businesses to reassess sourcing strategies and renegotiate supplier agreements. In response, some converters have accelerated domestic procurement or sought alternative chemistries to mitigate margin compression. This rebalancing of supply chains underscores the necessity for agile procurement frameworks that can absorb fiscal shocks while preserving access to critical colorants.

Consequently, import-dependent segments, particularly in textile and printing ink applications, have experienced transitional volatility as purchasers adapt to new duty schedules. The longer-term implications include potential insulation of local producers who can offer tariff-exempt products, yet these dynamics also risk pricing inconsistencies and downstream cost pass-through. Forward-thinking organizations are therefore calibrating inventory methodologies and exploring bonded warehouses to smooth out duty-related fluctuations. This strategic pivot highlights the importance of robust trade compliance and supply chain visibility in a landscape marked by evolving tariff regimes.

Decoding Critical Market Segment Insights Spanning Application Forms End Use Industries Purity Grades Color Shades and Solubility Characteristics

Market segmentation provides a granular lens through which the Disperse Red 60 domain can be deconstructed according to performance requirements, formulation characteristics, and end use dynamics. When examining application diversity, the dye’s adoption spans leather dyeing with its demand for high wet rub fastness, paper printing where sharp contrast and minimal bleed are paramount, plastics coloring that prioritizes thermal stability within polymer matrices, and textile dyeing processes requiring robust light fastness under repeated wash cycles. Each application segment presents distinct challenges, from optimizing dispersion in carrier oils for leather to maintaining particle size distribution in aqueous polymer systems for printing inks.

Turning to form factors, the industry differentiates liquid dispersions that facilitate low-shear mixing, paste concentrates favored for precision dosing, and dry powder variants used where storage stability is critical. Navigating end use industries further underscores this complexity: leather manufacturers focus on tactile surface properties, plastics processors emphasize color uniformity in extrusion and injection molding, printing ink producers target high-definition reproduction, and textile mills balance throughput demands with color yield optimization. Purity grade distinctions-ranging from stringent food grade for applications in packaging and printing to standard grade utilized in industrial textile applications-shape formulation tolerances and compliance pathways. Color shade preferences within red gamut specialties, such as crimson hue sought for deep tonal richness, ruby hue chosen for premium textiles, and scarlet hue leveraged in mass market plastics, illuminate brand-driven user preferences. Finally, solubility requirements bifurcate products into solvent soluble chemistries designed for non-aqueous carrier systems and water soluble variations tailored to aqueous processes. This multidimensional segmentation framework is instrumental for suppliers and converters to align portfolios with end user performance criteria and regulatory mandates.

This comprehensive research report categorizes the Disperse Red 60 market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Purity Grade

- Color Shade

- Solubility

- Application

- End Use Industry

Illuminating Regional Performance Patterns of Disperse Red 60 Across Americas Europe Middle East Africa and Asia Pacific Territories

Regional performance trends in Disperse Red 60 vividly illustrate the interplay between supply chain maturity, regulatory environment, and end use demand across the Americas, Europe Middle East & Africa, and Asia-Pacific territories. In the Americas, established textile markets and advanced chemical infrastructure have fostered a stable base of technical expertise and downstream capacity. This environment has consistently supported innovations in carrier technology and eco-friendly dye systems. Yet, shifting trade policies and a resurgence in reshoring efforts introduce both cost optimization opportunities and nearshoring complexities as companies balance domestic stability with global sourcing synergies.

Transitioning to the EMEA region, stringent environmental regulations and a commitment to circular economy principles have catalyzed the adoption of bio-based dispersants and closed water-loop dyeing systems. Suppliers in this geography are investing in local research centers to ensure compliance with REACH and related directives, providing clients with specialized solutions that preempt regulatory disruptions. Meanwhile, the Asia-Pacific corridor remains the largest-volume consumer, underpinned by expansive textile and leather manufacturing hubs. Here, rapid industrialization, competitive raw material pricing, and a growing middle class drive demand for vibrant colorants. However, the need for localized supply resilience has emerged as a key theme, prompting multinational players to establish joint ventures and regional production sites to better service fluctuating local requirements.

This comprehensive research report examines key regions that drive the evolution of the Disperse Red 60 market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Disperse Red 60 Manufacturers and Suppliers to Understand Competitive Strategies Innovations and Market Positioning Dynamics

At the forefront of the Disperse Red 60 ecosystem are manufacturers and suppliers who leverage deep technical expertise, global distribution networks, and intensive R&D pipelines to maintain competitive advantage. One cohort of industry pioneers has concentrated on developing proprietary dispersion technologies that optimize particle encapsulation, thereby enhancing color fastness and reducing environmental impact. Another group has focused on strategic alliances with downstream converters to co-develop tailored color solutions, integrating digital color matching capabilities and on-site service support.

Across the competitive landscape, established specialty chemical companies and mid-sized dye houses alike are pursuing differentiated innovation pathways. Some players have diversified portfolios to include ancillary functional additives that improve process yield and effluent treatment, while others prioritize vertical integration to secure feedstock continuity. Collaborative research ventures between suppliers and academic institutions have further accelerated the emergence of next-generation dye intermediates, positioning the most proactive organizations to lead on sustainability metrics, regulatory compliance, and performance differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Disperse Red 60 market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amogh Chemicals Pvt Ltd

- Anand International

- Anhuyan (Hainan) Biotechnology Co., LTD

- Archroma Management LLC

- BASF SE

- Colourtex Industries Pvt. Ltd.

- GLR Innovations

- Henan Tianfu Chemical Co.,Ltd.

- Huafeng Group Co., Ltd.

- Huntsman International LLC

- INDO COLCHEM

- Jaffs Dyechem Private Limited

- Kiri Industries Ltd

- MARUTI DYECHEM

- Merck Life Science Private Limited

- S D International

- SBL Colortech Pvt Ltd

- Shandong Jufar Biochemical Co., Ltd.

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Disruptions Enhance Value Chains and Secure Competitive Advantages

Industry leaders seeking to navigate the dynamic Disperse Red 60 landscape should prioritize strategic investments in sustainable dye technologies and circular economy integration. By directing R&D resources toward non-toxic carrier systems and water reduction initiatives, organizations can simultaneously enhance environmental performance and address tightening regulatory requirements. Moreover, establishing collaborative innovation platforms with academic institutions and technology start-ups can accelerate time-to-market for advanced dispersion solutions and create defensible intellectual property portfolios.

In parallel, executives must cultivate supply chain resilience through diversification of raw material sources and adoption of real-time procurement analytics. Digital trade compliance tools and predictive demand forecasting can mitigate the impact of tariff fluctuations and logistical disruptions, ensuring continuity of supply. Finally, fostering closer alignment between marketing and technical teams will enable more targeted customer engagement, leveraging data-driven insights on shade preferences and application performance to differentiate offerings and capture higher-value contracts.

Detailing Rigorous Research Methodology Framework Encompassing Data Collection Analysis Validation and Triangulation Procedures for Credibility Assurance

This analysis synthesizes insights derived from a robust mixed-methods research framework. Primary data was gathered through structured interviews with key stakeholders across the supply chain, including dye producers, converters, and regulatory experts. Secondary research sources encompassed peer-reviewed journals, industry association publications, and public regulatory filings, which were meticulously cross-referenced to ensure consistency and accuracy. Throughout the process, data integrity checks were performed to validate both quantitative inputs and qualitative findings.

The methodological approach also integrated triangulation techniques, comparing statistical data from trade organizations with firsthand commentary from sector specialists. This combination of empirical evidence and experiential insights facilitated a comprehensive understanding of market drivers, challenges, and emerging trends. Quality assurance protocols, such as blind peer reviews and iterative data verification rounds, were employed to preserve objectivity and reinforce the credibility of the conclusions presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Disperse Red 60 market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Disperse Red 60 Market, by Form

- Disperse Red 60 Market, by Purity Grade

- Disperse Red 60 Market, by Color Shade

- Disperse Red 60 Market, by Solubility

- Disperse Red 60 Market, by Application

- Disperse Red 60 Market, by End Use Industry

- Disperse Red 60 Market, by Region

- Disperse Red 60 Market, by Group

- Disperse Red 60 Market, by Country

- United States Disperse Red 60 Market

- China Disperse Red 60 Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Comprehensive Conclusions on Key Drivers Challenges Opportunities and Strategic Imperatives Shaping the Future Trajectory of Disperse Red 60

In conclusion, the Disperse Red 60 market is defined by a confluence of technological innovation, regulatory evolution, and global trade realignments. Key drivers include the pursuit of sustainable formulations, the integration of digital dyeing platforms, and strategic tariff-induced sourcing adjustments. These forces collectively shape an environment where agility, technical differentiation, and supply chain visibility are paramount for market success.

Looking ahead, stakeholders must remain vigilant to shifting compliance requirements, evolving end use demands, and emerging competitive dynamics. Organizations that proactively engage in collaborative R&D, embrace circular economy principles, and deploy advanced procurement analytics will be best positioned to capitalize on growth opportunities and bolster their resilience against future disruptions. By synthesizing these strategic imperatives, executives can develop informed roadmaps that safeguard profitability and foster long-term sector leadership.

Seizing Your Opportunity to Access the Full Disperse Red 60 Market Study by Engaging with Ketan Rohom Associate Director of Sales Marketing

To delve deeper into the comprehensive Disperse Red 60 market analysis and secure a strategic advantage for your organization, reader engagement is key. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to gain immediate access to the full study, which delivers actionable insights, competitive intelligence, and tailored recommendations.

By connecting with Ketan Rohom, you will receive a bespoke walkthrough of the report’s highlights, helping you identify the specific sections most relevant to your business objectives. This personalized approach ensures that your investment is aligned with your strategic priorities and that you can leverage the data to optimize your supply chain, refine product innovation, and navigate regulatory complexities with confidence.

Act now to transform data into decisions, empower your teams, and stay ahead in a competitive landscape. Secure your copy of the Disperse Red 60 market research report today by contacting Ketan Rohom to schedule a consultation and unlock the full potential of the insights at your disposal

- How big is the Disperse Red 60 Market?

- What is the Disperse Red 60 Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?