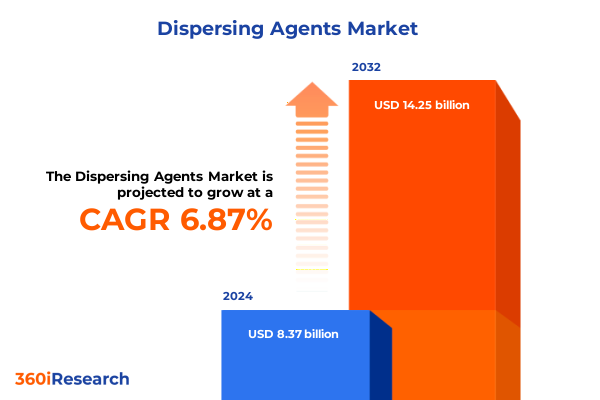

The Dispersing Agents Market size was estimated at USD 8.94 billion in 2025 and expected to reach USD 9.54 billion in 2026, at a CAGR of 6.88% to reach USD 14.25 billion by 2032.

Discover the fundamental importance of dispersing agents in industrial processes highlighting innovations end use demands shaping global market dynamics

Dispersing agents serve as indispensable chemical additives that drive efficiency and performance across a diverse array of industrial applications. By preventing agglomeration and ensuring uniform distribution of particulate matter, these additives enhance the structural integrity and functional properties of products ranging from paints and coatings to concrete and agricultural formulations. The critical importance of these agents is underscored by the rising demand for high-performance materials capable of meeting ever-stringent quality standards in construction, energy, and consumer goods.

In recent years, the convergence of technological innovation and evolving regulatory frameworks has elevated dispersing agents from simple auxiliary substances to strategic enablers of product differentiation. Industry participants are increasingly focused on leveraging advanced chemistries, such as polycarboxylate ethers and bio-based solutions, to deliver enhanced rheological control, improved environmental profiles, and cost efficiencies. As a result, the dispersing agent segment now occupies a pivotal role in the broader chemical industry value chain, directly impacting downstream manufacturing processes and end user satisfaction.

This executive summary distills key market dynamics, transformative trends, and actionable recommendations to inform decision-making among manufacturers, distributors, and end users. Through a structured analysis of tariff influences, segmentation insights, regional disparities, and competitive landscapes, this document provides a strategic roadmap for stakeholders seeking to optimize their positioning in the dispersing agent market.

Explore the key shifts reshaping the dispersing agent sector including sustainability mandates supply chain reconfiguration and advanced technological solutions

The dispersing agent market has undergone significant transformation driven by a confluence of sustainability imperatives, supply chain realignment, and technological breakthroughs. Heightened regulatory scrutiny on volatile organic compounds and a growing emphasis on life-cycle environmental impact have accelerated the adoption of greener dispersant chemistries. Manufacturers are investing in bio-derived and low-emission formulations that not only comply with global environmental mandates but also deliver competitive performance advantages in applications ranging from paint stabilization to polymer compounding.

Concurrently, the maturation of digital manufacturing and advanced analytics has redefined operational efficiencies within production facilities. Real-time monitoring of reaction parameters and predictive maintenance algorithms are enabling chemical producers to optimize throughput while reducing waste. These digital interventions, combined with strategic partnerships between specialty chemical houses and technology providers, are reshaping supply chain architectures and fostering more resilient sourcing strategies.

Moreover, the entry of novel raw material suppliers and the expansion of capacity in emerging markets have intensified competitive pressures. Established participants must now contend with agile niche players offering tailored solutions to address specific end use challenges. As a result, differentiation through formulation innovation, application support, and value-added services has emerged as a critical success factor for sustaining growth and market share.

Analyze the cumulative impact of 2025 United States tariffs on dispersing agent raw materials production costs supply networks and competitive positioning

In early 2025, the United States implemented a series of targeted tariffs on chemical imports including lignosulfonate, melamine sulfonate, and select naphthalene formaldehyde derivatives, aiming to support domestic manufacturing and address trade imbalances. These measures introduced a new cost layer for manufacturers reliant on imported raw materials, catalyzing a ripple effect throughout the dispersing agent supply chain. Producers responded by recalibrating sourcing strategies, exploring alternative feedstocks, and reallocating production volumes across domestic and international sites.

The immediate outcome was an uptick in landed costs for key dispersant intermediates, which, in turn, pressured end product pricing. Some manufacturers pursued backward integration to secure feedstock availability, while others engaged in strategic stockpiling to mitigate exposure to tariff volatility. Simultaneously, distributors sought to renegotiate contracts, diversify supplier portfolios, and implement flexible pricing mechanisms to absorb short-term shocks.

Over the medium term, these tariffs have prompted a broader realignment of global value chains. Regionalized production hubs are emerging as companies strive for near-shoring to minimize tariff burdens and logistical complexities. While this decentralization fosters supply continuity, it also requires significant investment in local infrastructure and quality assurance protocols. As a result, stakeholders must balance the trade-offs between cost, reliability, and regulatory compliance to maintain competitive positioning in a tariff-impacted environment.

Uncover segmentation insights detailing distribution channels formulation types dispersant chemistries end use industries and comprehensive application scenarios

An in-depth examination of market segmentation reveals distinct performance patterns across distribution channels. Manufacturers are increasingly leveraging direct sales to foster closer customer collaboration, optimize technical support, and capture higher margins, while distributors continue to play a critical role in accessing regional end users. Online sales platforms have gained traction for small-batch requisitions and rapid sample delivery, enabling faster innovation cycles and agile market entry for niche chemistries.

When analyzing formulation types, dry powders remain the preferred medium for concrete admixtures and agricultural feed applications due to their stability and ease of handling. Emulsions are particularly prevalent in paints and coatings, offering superior film formation and pigment dispersion. Liquid concentrates serve as high-efficiency platforms in drilling fluids and ink formulations, while suspensions are indispensable for textile dyeing and pulp paper coating processes that demand precise viscosity control.

Dispersant chemistries exhibit a spectrum of functional attributes. Lignosulfonates offer cost-effective performance in general industrial contexts, whereas melamine sulfonates deliver enhanced charge control and reduced foaming. Polycarboxylate ethers have become the standard for high-performance concrete admixtures, and sulfonated naphthalene formaldehyde maintains relevance in specialty ink and coating applications. Each chemistry segment aligns uniquely with end use industries such as agriculture feed, construction, oil and gas, paints and coatings, plastics packaging, pulp paper, and textile processing, reflecting a complex interplay of performance requirements and regulatory constraints.

Application diversity further underscores market complexity. In agrochemical formulations, fungicides, herbicides, and insecticides each demand customized dispersing profiles to ensure active ingredient stability and field efficacy. Concrete admixtures bifurcate into prepacked dry mixes and ready mix systems, each requiring tailored rheology modifiers. Drilling fluids span oil-based, synthetic-based, and water-based variants that must perform under extreme temperature and pressure. Inks differentiate between packaging and printing grades, while paints and coatings range from architectural to automotive and industrial specifications. Plastics compounding encompasses engineering resins, polyolefins, and PVC, and pulp paper applications extend to coating and size press operations. Textile treatments involve both coating and dyeing processes, each dependent on precise particle distribution for fabric quality.

This comprehensive research report categorizes the Dispersing Agents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Dispersant Type

- Formulation

- Application

- Distribution Channel

Illuminate distinctive regional dynamics influencing dispersing agent demand across Americas Europe Middle East Africa and Asia Pacific industrial landscapes

In the Americas, robust infrastructure development and sustained investment in advanced manufacturing have fueled demand for high-performance dispersing agents. North America’s proximity to key chemical feedstock sources, coupled with established technical service networks, has positioned it as a production and innovation hub. Latin American markets, while more price sensitive, are experiencing gradual shifts toward value-added formulations in agricultural and construction segments as regulatory environments evolve.

Europe, the Middle East, and Africa present a mosaic of regulatory frameworks and end use drivers. The European Union’s rigorous environmental directives have accelerated adoption of low-VOC and bio-based dispersants, fostering a landscape where sustainability credentials are paramount. In the Middle East, energy sector investments drive demand for drilling fluid additives, while infrastructure expansion in select African economies is creating nascent opportunities for concrete admixtures.

Asia-Pacific remains the fastest growing region, driven by urbanization and large-scale infrastructure projects in China, India, and Southeast Asia. Domestic chemical producers are rapidly scaling capacity and enhancing technical capabilities to meet local demand for specialty dispersants. Moreover, government incentives for green chemistry and self-sufficiency in strategic industries have spurred innovation, making the region a critical focus for global market participants seeking to establish or expand their footprint.

This comprehensive research report examines key regions that drive the evolution of the Dispersing Agents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine key players shaping the dispersing agent market through strategic innovation partnerships operational excellence and sustainable product portfolios

Tier-one chemical producers have consolidated leadership positions through strategic investments in R&D and production capacity. Multinational companies have reinforced their product portfolios with next-generation dispersants that combine high performance with environmental compliance. Collaborative ventures between established firms and specialty technology providers have accelerated time-to-market for innovative chemistries while also enhancing service capabilities.

Mid-tier players are differentiating through niche expertise, offering tailored solutions for specific end use challenges such as complex pigment dispersion in premium coatings or specialized rheology control in high-performance composites. Their agility in responding to customer feedback and customizing formulations has enabled them to win business in segments where technical precision outweighs scale economies.

Smaller, regionally focused enterprises are leveraging local market knowledge and flexible manufacturing footprints to serve emerging demand centers. By aligning product attributes with local regulatory frameworks and cost expectations, these companies are forging resilient partnerships with regional distributors and end users. Yet, across all tiers, a shared emphasis on sustainability, quality assurance, and supply chain transparency underscores the ongoing competitive imperative.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dispersing Agents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALTANA AG

- Arkema S.A.

- BASF SE

- BYK-Chemie GmbH

- Clariant AG

- Croda International Plc

- Dow Inc.

- Elementis plc

- Evonik Industries AG

- LANXESS AG

- Lubrizol Corporation

- Nouryon Chemicals Holding B.V.

- SNF Group

- Solvay S.A.

Discover recommendations for industry leaders to optimize supply chains innovate formulations and capitalize on emerging opportunities

Industry leaders should prioritize the development and commercialization of bio-based dispersants to align with tightening environmental regulations and shifting customer preferences. By integrating renewable feedstocks and green chemistry processes into production pipelines, companies can enhance their sustainability narratives while preserving or improving performance metrics.

Strategic diversification of supply chains is critical to mitigating risks associated with tariffs, logistics disruptions, and raw material volatility. Establishing dual sourcing agreements, near-shoring production, and investing in regional warehousing can bolster operational resilience and reduce lead times for key markets.

Digital transformation initiatives, such as implementing advanced process controls and predictive analytics, can drive significant improvements in yield, energy efficiency, and quality consistency. Coupled with enhanced customer portals and technical collaboration platforms, these efforts foster stronger customer engagement and accelerate product adoption cycles.

Collaborative partnerships with end users, research institutions, and upstream suppliers can expedite innovation while sharing the costs and risks of new product development. By co-creating customized solutions for specific application challenges, manufacturers can secure long-term supply agreements and deepen customer loyalty.

Detail the comprehensive research methodology integrating primary interviews secondary sources and rigorous data validation protocols supporting the analysis

This research integrates a multi-tiered methodology combining primary interaction with industry stakeholders and comprehensive secondary data analysis. Structured interviews with senior executives, technical experts, and key distributors provided qualitative insights into market drivers, technology adoption, and strategic priorities.

Secondary research encompassed review of peer-reviewed journals, patent landscapes, regulatory filings, and publicly disclosed financial records. Data triangulation techniques ensured consistency between primary observations and secondary intelligence, while scenario analysis tools were employed to understand potential market trajectories under varying regulatory and economic conditions.

Quantitative inputs were validated through cross-verification with trade association statistics, customs data, and proprietary shipment records. Rigorous quality control protocols, including stakeholder review sessions and methodological audits, underpin the credibility of findings and recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dispersing Agents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dispersing Agents Market, by Dispersant Type

- Dispersing Agents Market, by Formulation

- Dispersing Agents Market, by Application

- Dispersing Agents Market, by Distribution Channel

- Dispersing Agents Market, by Region

- Dispersing Agents Market, by Group

- Dispersing Agents Market, by Country

- United States Dispersing Agents Market

- China Dispersing Agents Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesize key takeaways from shifts regulatory impacts segmentation insights and regional dynamics to underscore strategic imperatives for market stakeholders

The dispersing agent market stands at a juncture defined by accelerating sustainability mandates, evolving tariff environments, and shifting end use requirements. Transformative trends such as the rise of bio-based chemistries, digital manufacturing, and regional supply chain realignment underscore the dynamic nature of this sector. Cumulative tariff impacts in 2025 have prompted manufacturers to reevaluate sourcing strategies and invest in production resilience, setting the stage for a more distributed global value chain.

Segmentation analysis reveals that distribution channels, formulation types, dispersant chemistries, end use industries, and application sub-segments each present distinct performance patterns and growth drivers. Regional dynamics further add complexity, with Americas, EMEA, and Asia-Pacific exhibiting unique regulatory frameworks and demand profiles. Within this landscape, leading players are differentiating through product innovation, strategic partnerships, and sustainability credentials, while mid-tier and regional firms capitalize on niche opportunities and local market expertise.

Collectively, these insights highlight the imperative for stakeholders to embrace proactive strategies focused on green chemistry, digital integration, supply chain diversification, and collaborative innovation. By aligning capabilities with emerging market requirements, organizations can unlock new revenue streams, strengthen competitive positioning, and contribute to the ongoing evolution of high-performance material solutions.

Engage with Associate Director Sales Marketing Ketan Rohom to unlock comprehensive insights and secure the full dispersing agent market research report

To explore the full breadth of strategic insights, proprietary data, and in-depth analysis covering the dispersing agent landscape, programmatic recommendations, and actionable market opportunities, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. By securing the comprehensive research dossier, stakeholders will gain exclusive access to bespoke intelligence on industry trends, competitive positioning, and nuanced regional developments. Engage today to arm your organization with the knowledge foundation necessary to enhance product innovation, streamline operations, and foster high-impact partnerships across end use sectors.

- How big is the Dispersing Agents Market?

- What is the Dispersing Agents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?