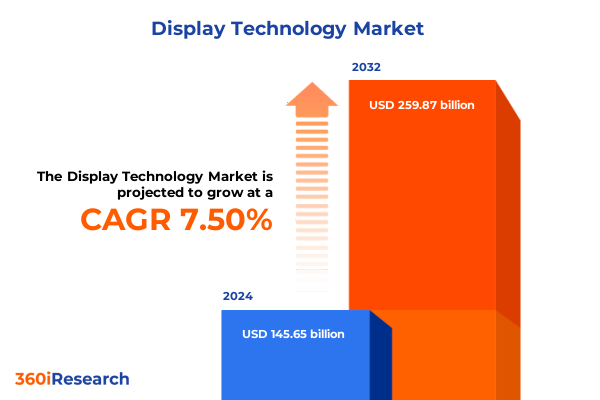

The Display Technology Market size was estimated at USD 156.00 billion in 2025 and expected to reach USD 167.08 billion in 2026, at a CAGR of 7.56% to reach USD 259.87 billion by 2032.

Embarking on a Comprehensive Exploration of Display Technology Evolution and Industry Dynamics in a Rapidly Advancing Technological Era

The display technology sector has entered an era of unprecedented transformation, characterized by continuous breakthroughs in materials science and manufacturing processes. Traditional LCD and LED displays have been complemented-and in some cases supplanted-by OLED, QLED, and the nascent MicroLED platforms, each offering unique benefits in contrast, power efficiency, and form factor flexibility. What was once constrained to rigid panel assemblies is now expanding into flexible, transparent, and foldable configurations that redefine both consumer and industrial applications. This momentum is further accelerated by advanced driver circuitry, quantum dot enhancements, and AI-driven image processing algorithms that refine color accuracy and energy management in real time. Consequently, manufacturers and end users alike are navigating a complex landscape where performance imperatives converge with cost and supply chain considerations, demanding agile strategies that balance innovation with operational resilience.

As digital experiences proliferate across smartphones, large-format video walls, automotive head-up displays, and AR/VR headsets, the importance of seamless integration and cross-device interoperability becomes paramount. Display systems are no longer isolated components but integral elements of broader ecosystems requiring rigorous compatibility testing and standards alignment. Against this backdrop, this report embarks on a comprehensive exploration of the evolving display technology ecosystem, examining its multifaceted drivers, emerging use cases, and strategic inflection points. From materials innovation to market adoption patterns, the analysis illuminates the forces shaping both current and future trajectories, equipping decision-makers with the insights necessary to harness opportunities and mitigate risks in an increasingly dynamic sector.

Charting the Profound Technological and Market Shifts Reshaping the Display Industry Landscape Amidst Emerging Innovations

The display industry’s landscape is undergoing a profound metamorphosis driven by the convergence of cutting-edge materials and system-level innovations. Mini- and MicroLED technologies are breaking long-standing cost-performance trade-offs, offering superior brightness, contrast ratios, and durability that challenge the dominance of incumbent OLED and QLED platforms. Concurrently, breakthroughs in packaging methods such as flip-chip COB and MIP architectures are enhancing yield rates and reducing assembly costs, setting the stage for broader deployment across mid- to high-end market segments. Meanwhile, quantum dot enhancements and next-generation backplane designs are pushing color gamuts closer to the Rec. 2020 standard while optimizing power efficiency.

Simultaneously, immersive display applications are reshaping user engagement, as evidenced by the integration of MicroLED walls and XR-enabled surfaces in corporate and entertainment venues. The fusion of AR/VR capabilities with high-speed, low-latency panels opens new frontiers in simulation, training, and collaborative design, transforming passive viewing into interactive experiences. Moreover, the emergence of flexible and transparent display prototypes underscores a shift toward form factors that adapt to novel product designs, from foldable smartphones to wearable heads-up displays.

Analyzing the Layered Consequences of 2025 United States Tariff Policies on the Display Technology Supply Chain and Trade Dynamics

In 2025, U.S. trade policies have introduced a layered array of duties that significantly affect the display technology supply chain. Under Section 301 of the Trade Act, the Office of the United States Trade Representative increased tariffs on critical inputs such as semiconductor wafers and polysilicon-from 25% to 50% for solar wafers and polysilicon, and 25% for tungsten products-effective January 1, 2025, directly impacting materials integral to display panel manufacturing. While this action aimed to bolster domestic resilience, it has also elevated costs and prompted manufacturers to reevaluate sourcing strategies, potentially accelerating investments in alternative feedstocks and local fabrication facilities.

To address concerns over tariff stacking, a Presidential Executive Order issued on April 29, 2025, clarified that overlapping duties on the same imported articles should not accumulate beyond policy intent, streamlining the application of Section 301, Section 232, and other statutory tariffs. This directive mitigates the risk of punitive cumulative rates, providing relief to companies navigating multiple tariff regimes. Nevertheless, the evolving trade dialogue and periodic extensions of product exclusions introduce an element of uncertainty, compelling industry stakeholders to monitor policy adjustments and engage in USTR exclusion requests proactively.

Deriving Strategic Insights from Intricate Type Screen Size Panel Technology and End User Segmentation in Display Markets

The display market’s complexity becomes apparent when examined through the lens of type-based segmentation, ranging from legacy LCD formats to the frontier of MicroLED solutions. Traditional LCD panels-encompassing In-Plane Switching, Twisted Nematic, and Vertical Alignment modalities-continue to serve cost-sensitive applications, while Edge Lit and Direct Lit LED variants expand brightness and backlighting uniformity. QLED technology bridges quantum dot enhancements with conventional backplanes, offering a performance boost in mid- to premium-tier products. At the vanguard, MicroLED and OLED categories-further delineated into Flexible, Rigid, and Transparent subsegments-are establishing new benchmarks for dynamic range, form factor versatility, and visual fidelity.

Screen size considerations further stratify the market into portable displays under 32 inches, mainstream 32–55 inch solutions, large 56–75 inch televisions, and ultra-large formats above 75 inches, each unlocking distinct use cases from compact wearable interfaces to immersive home entertainment and digital signage. In parallel, backplane materials like In-Plane Switching TFT, Indium Gallium Zinc Oxide, Low Temperature Poly Silicon, Oxide TFT, Twisted Nematic TFT, and Vertical Alignment TFT enable performance tuning across brightness, viewing angle, contrast, and ghosting metrics. Notably, LTPS variants deliver flexible or rigid OLED fabrication pathways, while vertical alignment backplanes target high-contrast and ultra-low ghosting applications.

End user segmentation spans aerospace and in-flight entertainment, automotive systems such as infotainment and advanced driver assistance, consumer electronics including smartphones and wearables, medical imaging and surgical displays, and industrial control environments like HMI and machine vision. Each sector imposes unique technical specifications and reliability standards, reinforcing the need for targeted innovation and tailored supply chain strategies.

This comprehensive research report categorizes the Display Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Screen Size

- Panel Technology

- End User

Uncovering Regional Nuances and Growth Catalysts Across Americas Europe Middle East Africa and Asia Pacific Display Markets

Geographic variations in demand and supply chain structures shape each region’s display technology landscape. In the Americas, North American OEMs and system integrators prioritize digital signage, automotive display integration, and medical imaging solutions, fueled by robust infrastructure investments and end-user emphasis on quality and regulatory compliance. Latin American markets are gradually embracing large-format LED walls for retail and broadcast applications, albeit with sensitivity to import duties and currency fluctuations.

Europe, the Middle East, and Africa exhibit diverse adoption curves. Western Europe’s premium automotive manufacturers and consumer electronics brands accelerate adoption of OLED and flexible display modules, while stringent environmental and energy efficiency regulations drive innovation in panel power consumption and recyclability. The Middle East invests heavily in high-impact visual installations-ranging from stadium video boards to experiential retail environments-leveraging its financial capacity for marquee projects. Africa’s digital transformation initiatives, though nascent, reveal opportunities in cost-effective LED-based public information systems.

Asia-Pacific remains the epicenter of both panel manufacturing and R&D innovation. Chinese giants are expanding next-generation AMOLED fabs, as evidenced by BOE’s $8.8 billion AMOLED line in Chengdu designed for high-end touchscreens. Simultaneously, concerns over national security implications of display dependency highlight strategic vulnerabilities, prompting regional governments to balance industrial growth with geopolitical considerations.

This comprehensive research report examines key regions that drive the evolution of the Display Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Technological Leadership of Key Global Display Technology Companies Driving Industry Progress

In the vanguard of display technology, Samsung Electronics leverages its pioneering work in MicroLED, targeting mainstream consumer launches with smaller, professionally installable modules that promise exceptional picture quality without OLED’s burn-in risk. LG Display continues to refine its flexible and transparent OLED offerings, integrating novel backplane materials to improve durability and form factor adaptability. Meanwhile, BOE Technology Group’s rapid expansion of Gen 8.5 and Gen 10.5 fabs underscores China’s ambition to secure leadership in both LCD and AMOLED segments.

Hisense distinguishes itself through RGB LED innovation, exemplified by its 116-inch UX Trichroma display that delivers near-Rec.2020 color coverage and ultra-high brightness, positioning the company as a strong contender in both premium and cost-sensitive markets. Other notable players-such as Japan’s JOLED and emerging MicroLED specialists like PlayNitride-extend the competitive landscape by focusing on niche applications in professional visualization and automotive interiors. Collectively, these companies emphasize vertical integration, strategic partnerships, and proprietary process improvements to differentiate their portfolios and reinforce supply chain security.

This comprehensive research report delivers an in-depth overview of the principal market players in the Display Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Applied Materials, Inc.

- AUO Corporation

- Barco NV

- BOE Technology Group Co., Ltd.

- Citizen Electronics Co., Ltd.

- Corning Incorporated

- Epson Corporation

- E Ink Holdings Inc.

- Himax Technologies, Inc.

- Innolux Corporation

- Japan Display Inc.

- Kyocera Corporation

- Leyard Optoelectronic Co., Ltd.

- LG Display Co., Ltd.

- Nanoco Group plc

- Panasonic Holdings Corporation

- Planar Systems, Inc.

- Samsung Display Co., Ltd.

- Sharp Corporation

- Sony Group Corporation

- Tianma Microelectronics Co., Ltd.

- Universal Display Corporation

- ViewSonic Corporation

Presenting Targeted Actionable Recommendations to Empower Industry Leaders in Navigating Display Technology Challenges and Opportunities

Industry leaders should prioritize investments in modular manufacturing platforms that accommodate both OLED and MicroLED processes, enabling rapid redeployment of production lines in response to shifting demand patterns. Collaborations with material science innovators will be essential for breakthroughs in perovskite quantum dot films and novel phosphor-based color conversion layers that enhance efficiency and color gamut. Equally important is the establishment of agile supply chain frameworks that incorporate dual-source strategies for critical inputs like driver ICs and wafer substrates, mitigating exposure to tariff-driven cost spikes.

Furthermore, organizations must deepen engagement with regulatory bodies to influence emerging standards on display energy consumption and material recyclability, ensuring compliance while shaping policy in favor of sustainable innovation. In parallel, tailored go-to-market strategies-segmented by end user and geography-will enable precise alignment of product roadmaps with local performance requirements and procurement cycles. Finally, continuous scenario planning for trade policy fluctuations will equip executives to pivot swiftly, leveraging USTR exclusion mechanisms and localizing key production steps to preserve margin and time-to-market.

Detailing a Robust Multimethod Research Methodology Ensuring Comprehensive and Reliable Display Technology Market Intelligence

This analysis combines extensive secondary research with primary expert insights to deliver a robust, data-driven perspective. Secondary sources encompass peer-reviewed engineering journals, government tariff publications, patent databases, and corporate financial disclosures. Tariff impacts and policy developments were triangulated using official White House Executive Orders and USTR press releases, ensuring accuracy in duty level interpretation and effective dates.

Primary research entailed in-depth interviews with display engineers, procurement directors at OEMs, and policy analysts, capturing nuanced perspectives on manufacturing bottlenecks and end-user quality criteria. Data triangulation methods cross-verify company-reported metrics with customs import records and independent industry surveys. Regional case studies were developed through collaboration with local partners, addressing market-specific dynamics in the Americas, EMEA, and Asia-Pacific.

Finally, the segmentation framework was validated via interactive workshops with technical stakeholders, ensuring that the delineation of type, screen size, panel technology, and end-user verticals reflects both current realities and emerging use cases. This multimethod approach underpins the report’s reliability and strategic relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Display Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Display Technology Market, by Type

- Display Technology Market, by Screen Size

- Display Technology Market, by Panel Technology

- Display Technology Market, by End User

- Display Technology Market, by Region

- Display Technology Market, by Group

- Display Technology Market, by Country

- United States Display Technology Market

- China Display Technology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Concluding Reflections on the Evolutionary Trajectory and Strategic Imperatives Shaping the Future of Display Technology

The journey through the evolving display technology landscape reveals a sector at the nexus of materials science, advanced manufacturing, and geopolitical forces. From incumbent LCD and LED platforms to frontier MicroLED and flexible OLED architectures, the industry’s trajectory is shaped by a drive for higher performance, novel form factors, and resilient supply chain configurations. Trade policy developments in 2025 have underscored the importance of agile sourcing and policy engagement, while segmentation insights highlight diverse opportunities across end users and geographies.

Competitive dynamics remain intense, with leading corporations and agile entrants vying for technological leadership through vertical integration, strategic collaborations, and targeted R&D investments. As immersive experiences become mainstream and sustainability considerations gain prominence, display developers must balance innovation with cost, regulatory compliance, and environmental responsibility. Ultimately, success in this dynamic environment hinges on the ability to anticipate market inflections, align product portfolios with evolving customer needs, and navigate external pressures through proactive strategic planning.

Engage Directly with Ketan Rohom to Acquire Comprehensive Display Technology Insights and Advance Your Strategic Market Decisions

Engage directly with Ketan Rohom, the Associate Director of Sales & Marketing, to secure this comprehensive display technology report and gain unparalleled insights that will drive your strategic decisions forward. By partnering with Ketan, you can tailor the report to address your organization’s specific challenges-from optimizing procurement in a tariff-driven environment to targeting high-value segmentation opportunities. His expertise ensures you receive personalized support to interpret findings, benchmark against competitors, and identify actionable pathways for innovation and growth. Whether you seek deep dives into emerging MicroLED applications or clarity on regional regulatory impacts, Ketan stands ready to facilitate access and guide you through the nuances of the report. Reach out today to unlock the strategic value within these insights and position your enterprise at the forefront of the rapidly evolving display technology landscape

- How big is the Display Technology Market?

- What is the Display Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?