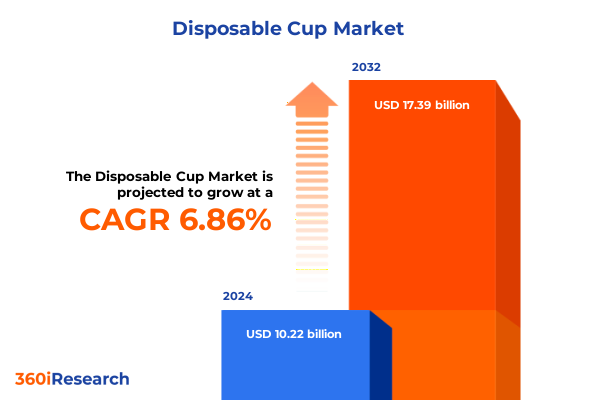

The Disposable Cup Market size was estimated at USD 10.84 billion in 2025 and expected to reach USD 11.49 billion in 2026, at a CAGR of 6.99% to reach USD 17.39 billion by 2032.

Unveiling the Transformative Evolution and Sustainability Imperatives Driving the Future Landscape of the Global Disposable Cup Industry

The disposable cup industry has evolved into a complex, multifaceted sector driven by shifting consumer behaviors, heightened environmental scrutiny, and rapid technological advances. In the wake of intensifying sustainability mandates and growing demand for convenience, manufacturers and stakeholders are reimagining product design, material sourcing, and manufacturing processes. As single-use vessels continue to play a pivotal role in fast-casual dining, mobile beverage services, and on-the-go consumption, industry participants must balance performance, cost, and ecological impact.

Against this backdrop, the executive summary delivers a concise yet comprehensive view of key trends and strategic imperatives. Emerging regulatory pressures at local and national levels are catalyzing a shift towards compostable and recyclable substrates, while innovations in material science are giving rise to new bio-based and hybrid formulations. Meanwhile, digital ordering platforms and branding opportunities have transformed packaging from a passive container into an interactive marketing asset. By synthesizing transformative shifts, tariff influences, segmentation dynamics, regional variations, and competitive moves, this summary equips decision-makers with the clarity required to navigate current market conditions and anticipate future developments.

Navigating the Convergence of Technological Innovations Sustainability Drivers and Consumer Preferences Reshaping the Disposable Cup Market

Disruption in the disposable cup market stems from the convergence of sustainability philosophies, manufacturing innovations, and evolving consumer expectations. First, environmental stewardship has accelerated investment into renewable feedstocks and end-of-life recovery systems; this momentum has prompted brand owners to establish closed-loop programs and seek certifications that enhance their corporate responsibility credentials. Concurrently, digital printing technologies and custom decoration solutions are enabling small batch personalization, allowing beverage retailers to differentiate their offerings and deepen customer engagement.

Beyond aesthetics, production processes have been streamlined through automation and real-time quality monitoring, reducing material waste and energy consumption. At the same time, supply chains are recalibrating to favor regionalized sourcing of pulp, plastics, and compostable polymers-limiting exposure to global logistics disruptions. Lastly, the proliferation of on-demand delivery services and digitally enabled on-premise experiences has shifted packaging design requirements, demanding leak-proof, stackable vessels that integrate seamlessly with smart lids, tap-and-go transactions, and thermal insulation. Together, these forces are reshaping the market’s structural underpinnings and defining new benchmarks for performance, sustainability, and user convenience.

Assessing the Multidimensional Impact of 2025 United States Tariffs on Raw Material Costs Supply Chain Realignment and Industry Competitiveness

The introduction of new United States tariffs in 2025 has had a pronounced effect on raw material costs, compelling industry players to reevaluate supplier relationships and manufacturing footprints. Imported polymers, paper substrates, and compostable biopolymers now carry elevated duties, stretching input budgets and shifting the competitive landscape. In response, many manufacturers have accelerated nearshoring initiatives, forging partnerships with domestic resin producers and investing in localized paper mills to insulate operations from cross-border levy fluctuations.

These tariff-induced cost pressures have also spurred renegotiation of long-term contracts and incentivized the exploration of alternative feedstocks such as agricultural residues and post-consumer recycled content. Given the dynamic regulatory environment, companies that demonstrate agility in their procurement strategies are better positioned to mitigate margin erosion. Moreover, the realignment of supply chains has yielded ancillary benefits, including reduced transit times, lower carbon footprints, and enhanced traceability. As the industry continues to adapt, sustained collaboration between manufacturers, material suppliers, and logistics providers will be paramount to maintaining price stability and ensuring seamless market responsiveness.

Unraveling Core Market Segmentation Patterns Across Capacity Types Product Variations Material Compositions End Users Channels and Applications

Segmentation analysis reveals a nuanced tapestry of product variants and end-user demands. Within capacity dimensions, stakeholders examine under-eight-ounce vessels alongside mid-range options-distinguished as twelve-ounce and sixteen-ounce cups-and larger formats exceeding sixteen ounces, including twenty-ounce and twenty-four-ounce sizes. This spectrum accommodates everything from espresso shots to oversized fountain beverages. When evaluating product types, the dichotomy between cold-cup and hot-cup applications underscores divergent performance requirements, with thermal insulation prioritized for hotter contents and structural rigidity emphasized for chilled presentations.

Material composition segmentation highlights a pronounced shift toward biodegradable alternatives, yet paper, plastic, and polystyrene formats continue to serve critical market niches. Within the plastic cohort, polyethylene terephthalate, polylactic acid, polypropylene, and polystyrene each convey distinct recyclability profiles and cost attributes. From the vantage point of end users, food service outlets-ranging from cafés and catering services to fast-food chains and seated restaurants-remain the primary consumers, while households, industrial operations, and retail environments represent growing adjacent markets. Distribution channels encompass offline retail and digital commerce, the latter bifurcated into proprietary websites and third-party e-commerce platforms. Finally, application contexts span commercial engagements-covering events, healthcare settings, and hospitality venues-as well as residential usage, each demanding tailored functionality and aesthetic considerations.

This comprehensive research report categorizes the Disposable Cup market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Capacity

- Product Type

- Material Type

- End User

- Distribution Channel

- Application

Exploring Distinct Regional Market Dynamics Regulatory Landscapes and Consumption Behaviors Across the Americas EMEA and Asia-Pacific Territories

Regional market dynamics are defined by divergent regulatory regimes, consumer preferences, and logistical infrastructures. In the Americas, sustainability mandates at municipal and state levels have accelerated the phase-out of non-recyclable materials, driving industry transformation and fostering collaboration between packagers and recycling entities. Meanwhile, market participants in Europe, the Middle East, and Africa operate under stringent single-use plastic directives, rigorous compostability standards, and diverse consumption behaviors influenced by cultural norms and climatic conditions.

In the Asia-Pacific realm, rapid urbanization and the proliferation of on-demand beverage services have amplified demand for both economy-priced and premium disposable cups. Local raw material availability in pulp, coupled with burgeoning bioplastic fabrication capacity, has positioned Asia-Pacific as a production hub for export and regional consumption alike. Additionally, the interplay of emerging middle-class lifestyles, government sustainability targets, and infrastructure modernization programs is catalyzing investments in recycling streams and biodegradable alternatives. Collectively, these regional nuances underscore the importance of tailoring product portfolios, regulatory compliance frameworks, and supply chain architectures to specific geographic markets.

This comprehensive research report examines key regions that drive the evolution of the Disposable Cup market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Innovations Strategic Partnerships and Competitive Differentiators Shaping the Disposable Cup Ecosystem

Leading industry participants are distinguished by their strategic emphasis on material innovation, operational resilience, and brand partnerships. Several established manufacturers have expanded their portfolios to include compostable and plant-based polymer blends, while specialized startups focus exclusively on next-generation substrates and circular economy models. Strategic alliances between cup producers, beverage chains, and packaging technology firms have yielded co-development programs for branded eco-friendly vessels that enhance customer loyalty and streamline supply logistics.

Beyond core production, companies are investing in automated finishing lines, digital quality assurance platforms, and traceability solutions that authenticate sustainable claims. To differentiate in a crowded market, some operators are deploying smart cup technologies-such as embedded NFC chips and QR-enabled lids-to offer loyalty rewards, anti-counterfeiting verification, and real-time inventory tracking. Mergers and acquisitions continue to reshape the competitive environment, enabling agile players to access new geographic territories and broaden their material science capabilities. Collectively, these strategic moves illustrate how innovation, partnership, and scale converge to define success in today’s disposable cup ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Disposable Cup market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Brendos Ltd.

- Cascades Inc.

- CEE Schisler Packaging Solutions

- Century Pulp and Paper

- Clearwater Paper Corporation

- ConverPack Inc.

- Dart Container Corporation

- Eco-Products Inc. by Novolex Holdings, LLC

- EcoSoul Home Inc.

- Essity AB

- F Bender Limited

- Gaia Eco

- Genpak LLC

- Georgia-Pacific LLC

- Go-Pak Group by SCG Packaging Public Company Limited

- Grupo Phoenix by Tekni-Plex, Inc.

- Huhtamäki Oyj

- International Paper Company

- Ishwara Paper Cups

- JK Paper Ltd.

- Konie Cups International, Inc.

- Leetha Industries

- Nippon Paper Industries Co., Ltd.

- Oji Paper Co., Ltd.

- Pactiv Evergreen Inc.

- Scyphus Paper Cups

- Sri Lakshmi Polypack

- Stora Enso Oyj

Developing Strategic Action Plans for Industry Leaders to Capitalize on Sustainability Trends Technological Advancements and Regulatory Challenges

Industry leaders should prioritize several strategic imperatives to capitalize on evolving market conditions. First, integrating sustainable material pipelines-including post-consumer recycled content and bio-based feedstocks-will substantiate environmental commitments and mitigate exposure to tariff or raw-material volatility. Second, forging collaborative alliances with logistics partners and recyclers can unlock closed-loop systems that reduce waste, lower costs, and enhance brand credentials.

Simultaneously, investing in digital customization capabilities and smart packaging technologies will differentiate offerings and deepen consumer engagement. Companies are advised to deploy agile manufacturing cells that can accommodate rapid SKU changes and short-run personalization demands. Furthermore, rigorous compliance management and proactive regulatory monitoring will ensure readiness for emerging sustainability policies across key markets. Finally, developing scenario-based supply chain models and robust risk-management frameworks will equip decision-makers to respond swiftly to trade fluctuations, material shortages, and shifting demand patterns. By executing on these action plans, organizations can strengthen their competitive positioning and pave the way for sustained growth.

Detailing the Robust Research Methodology Employed for Data Collection Validation and Comprehensive Analysis Ensuring Actionable Market Insights

The research methodology underpinning this executive summary combines primary and secondary approaches to deliver a rigorous, transparent analysis. Primary data sources include structured interviews with supply chain executives, cup manufacturers, raw material suppliers, and industry associations, supplemented by on-site observations of manufacturing facilities and recycling operations. Secondary research encompasses review of industry publications, regulatory filings, trade journals, technical white papers, and sustainability frameworks to contextualize current trends and historical developments.

Quantitative data were triangulated through cross-referencing import/export logs, tariff schedules, and public financial disclosures to validate cost-impact assessments and supply chain reconfigurations. Qualitative insights were synthesized via thematic coding of expert interviews and stakeholder surveys, ensuring that emerging innovations and consumer sentiment are accurately represented. All data underwent rigorous quality checks, including consistency validation, source credibility evaluation, and peer review by sector specialists. This methodological rigor ensures that the insights presented herein are robust, actionable, and reflective of the evolving dynamics within the disposable cup industry.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Disposable Cup market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Disposable Cup Market, by Capacity

- Disposable Cup Market, by Product Type

- Disposable Cup Market, by Material Type

- Disposable Cup Market, by End User

- Disposable Cup Market, by Distribution Channel

- Disposable Cup Market, by Application

- Disposable Cup Market, by Region

- Disposable Cup Market, by Group

- Disposable Cup Market, by Country

- United States Disposable Cup Market

- China Disposable Cup Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Key Takeaways Reinforcing the Strategic Imperatives and Future Opportunities within the Evolving Disposable Cup Industry Ecosystem

Throughout this summary, compelling opportunities and strategic imperatives have emerged for participants across the disposable cup value chain. Manufacturers that embrace material science breakthroughs and invest in circular economy models will lead the transition toward more sustainable packaging solutions. Supply chain realignment-motivated by new tariff structures and logistical considerations-underscores the need for diversified sourcing strategies and agile production footprints.

Furthermore, segmentation and regional analyses reveal nuanced demand drivers, from capacity and material preferences to distribution and application contexts. Competitive landscapes are characterized by collaborative partnerships, technological differentiation, and M&A activity aimed at broadening capabilities. By synthesizing these insights, organizations can craft data-driven roadmaps that enhance resilience, strengthen market positioning, and support long-term profitability. As the disposable cup industry continues to evolve under environmental, economic, and consumer pressures, the ability to anticipate change and execute strategic initiatives will define leadership and success in this vital packaging segment.

Reach Out to Ketan Rohom to Secure Your Comprehensive Market Research Report on the Disposable Cup Industry and Drive Strategic Growth Initiatives

Thank you for exploring this comprehensive executive summary on the disposable cup industry. To gain full access to the in-depth analysis, strategic insights, and actionable recommendations contained within the complete market research report, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with this resource will empower your organization to navigate evolving regulations, harness sustainability opportunities, and optimize supply chains. Ketan Rohom will guide you through tailored licensing options, answer detailed inquiries, and facilitate seamless report delivery. Contact him to secure your copy and equip your leadership team with the intelligence needed to drive strategic growth initiatives and maintain a competitive edge in the dynamic disposable cup ecosystem.

- How big is the Disposable Cup Market?

- What is the Disposable Cup Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?