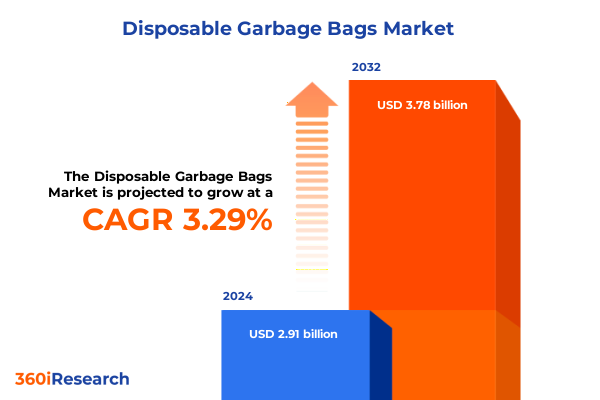

The Disposable Garbage Bags Market size was estimated at USD 3.00 billion in 2025 and expected to reach USD 3.09 billion in 2026, at a CAGR of 3.33% to reach USD 3.78 billion by 2032.

Setting the Stage with an Overview of Key Drivers and Market Forces Shaping the Disposable Waste Containment Bag Industry Landscape

In recent years, the disposable garbage bag industry has undergone significant evolution in response to shifting consumer expectations, material innovations, and regulatory pressures. Households, commercial establishments, and industrial users alike have elevated their requirements, demanding products that not only offer robust performance but also address sustainability concerns. As awareness of plastic waste impacts intensifies, manufacturers are compelled to balance cost efficiency with environmental responsibility, shaping an arena marked by both opportunity and complexity.

This executive summary distills the critical insights emerging from a comprehensive study of the disposable waste bag market. It outlines the major forces driving transformation, examines how tariffs and trade policies are reshaping supply chains, and highlights the nuanced segmentation frameworks that illuminate diverse end-user needs. By synthesizing regional variations and profiling leading players, this report delivers strategic clarity for stakeholders seeking to navigate competitive challenges and capitalize on growth avenues. Ultimately, the insights contained herein serve as a strategic compass, guiding decision-makers toward more informed, resilient, and sustainable outcomes.

Identifying the Pivotal Transitions in Consumer Preferences, Regulatory Frameworks, and Polymer Technology Reshaping the Trash Containment Bag Sector

The disposable garbage bag landscape is experiencing a wave of transformative change driven by converging trends in consumer behavior, regulatory frameworks, and technological breakthroughs. Rising environmental consciousness has prompted retailers and end users to scrutinize product life cycles more rigorously, prompting material suppliers to innovate with bio-based polymers and enhanced recyclability. Consequently, brands are investing heavily in research and development to introduce advanced formulations that reduce ecological footprints without compromising tensile strength or puncture resistance.

Simultaneously, evolving regulations at local, national, and supranational levels are redefining manufacturing and labeling standards. Extended producer responsibility schemes and single-use plastic restrictions have intensified the need for transparent supply chains and compliant product lines. In parallel, digital commerce platforms have become pivotal distribution channels, reshaping purchasing patterns and enabling direct interactions with end users. As a result, companies must adopt agile production capabilities and omnichannel strategies to align with dynamic market demands.

Finally, innovations in polymer processing and smart packaging technologies are enabling differentiated offerings, such as odor-control formulations and indicator-based containers. These advances not only enhance functionality but also provide branding opportunities in a crowded market. By embracing these transformative shifts, stakeholders can better anticipate future challenges and position themselves for sustained leadership in waste containment solutions.

Analyzing the Aggregate Consequences of 2025 U.S. Import Tariffs on Polyethylene-Based Waste Bags and Downstream Supply Chain Dynamics

In early 2025, the United States implemented sweeping import duties aimed at addressing national security and domestic manufacturing objectives. Tariffs of 25 percent were imposed on polyethylene imports from Canada and Mexico under the International Emergency Economic Powers Act, while a 10 percent levy targeted goods originating in China. In March, the administration increased the additional duty on Chinese exports to 20 percent and eliminated de minimis exemptions, raising the effective tariff rate on polyolefins to approximately 26.5 percent. Downstream plastic products, including waste containment bags, faced combined rates reaching up to 45 percent when factoring in existing Section 301 measures.

These duties have prompted supply chain realignment and cost pressures across the polyethylene value chain. Many domestic producers have ramped up ethane-based feedstock utilization to mitigate heightened naphtha costs abroad, while operating rates risk declining below 80 percent amid constrained export routes. Concurrently, potential retaliatory measures from key trade partners, such as a proposed 25 percent tariff on U.S. polyethylene by the European Union, threaten to further complicate cross-border flows and elevate raw material expenses. The cumulative impact necessitates strategic sourcing, price renegotiations, and close monitoring of policy developments to preserve margins and maintain supply reliability.

Unveiling In-Depth Segmentation Perspectives on Material Types, Application Scenarios, Sales Channels, Dimensions, and Closure Mechanisms in the Bag Market

A granular understanding of market segmentation is essential for identifying strategic niches and aligning product portfolios with varied customer demands. When analyzing material composition, the landscape is dominated by high density polyethylene, linear low density polyethylene, and low density polyethylene, with high density variants further categorized into bio-based and petroleum-based options. This bifurcation underscores the rising importance of renewable feedstocks in response to tightening environmental standards.

End-use applications reveal another layer of diversity, encompassing commercial venues focused on custodial efficiency, industrial settings requiring heavy-duty durability, and residential users seeking convenience and odor control. Distribution channel dynamics also play a pivotal role, spanning both offline networks-such as convenience outlets, specialty retailers, supermarkets, and wholesale distributors-and rapidly growing online marketplaces that facilitate bulk purchases and subscription models.

Physical specifications further differentiate offerings, as thickness categories range from extra heavy solutions designed for industrial waste to standard and light profiles suited for everyday residential use. Size variations extend from small liners for bathroom bins to extra large bags for bulk refuse collection. Finally, closure mechanisms, including drawstring, flap tie, and spiral tie configurations, enhance user experience and product sealing performance. Together, these segmentation dimensions offer a comprehensive framework for tailoring innovations and go-to-market strategies with high precision.

This comprehensive research report categorizes the Disposable Garbage Bags market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Thickness

- Size

- Closure Type

- End Use

- Distribution Channel

Examining the Regional Variations and Growth Drivers Shaping Demand and Distribution Trends Across Key Global Territories for Waste Bag Solutions

Regional analysis reveals distinct demand drivers and growth trajectories across major global territories. In the Americas, heightened sensitivity to waste management regulations and strong retail infrastructure have accelerated adoption of advanced polyethylene blends, particularly those incorporating bio-based components. Consumer awareness campaigns and municipal recycling incentives further underpin expansion of premium and eco-friendly product lines.

Over in Europe, the Middle East, and Africa, stringent single-use plastic directives and sustainability targets are reshaping supply chains. Manufacturers in this region are increasingly partnering with chemical recyclers and leveraging post-consumer resin streams to maintain compliance and reduce carbon footprints. At the same time, rapid urbanization in parts of the Middle East and North Africa is driving demand for industrial-grade waste bags capable of handling diverse waste streams under challenging environmental conditions.

The Asia-Pacific region exhibits a dual profile characterized by mature markets demanding premium performance products alongside emerging economies prioritizing cost efficiency. In countries with well-established environmental regulations, brand owners focus on high-strength formulations that balance durability with recyclability. Conversely, in developing markets, price-sensitive consumers and expanding e-commerce access have fueled uptake of lightweight standard bags, creating opportunities for volume plays and local manufacturing partnerships.

This comprehensive research report examines key regions that drive the evolution of the Disposable Garbage Bags market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Market Players’ Strategic Positioning, Innovation Initiatives, and Competitive Advantages in the Disposable Garbage Bag Industry

A host of established and emerging players are vying for leadership in the disposable bag arena, each leveraging unique competencies to differentiate offerings and fortify market positions. Large integrated packaging firms have capitalized on vertical integration, controlling resin supply and converting capabilities to optimize cost structures. This approach has allowed them to introduce value-added products, such as enhanced puncture-resistant bags and those utilizing renewable feedstocks, while maintaining competitive pricing.

Niche specialists have pursued partnerships with chemical recyclers and biopolymer innovators to co-develop sustainable resin formulations. By securing early-stage access to advanced materials, these companies have launched eco-branded lines that resonate with environmentally conscious consumers and corporate buyers operating under strict ESG mandates. Concurrently, agile regional manufacturers have focused on shorter lead times and localized production footprints, enabling rapid responsiveness to sudden shifts in raw material availability or regulatory changes.

Meanwhile, online-native brands are exploiting digital platforms and subscription models to build direct relationships with end users, capturing data on usage patterns to refine product design and packaging sizes. These players have demonstrated the ability to scale quickly, tapping into growing demand for doorstep delivery of household essentials. Through strategic investments in sustainability, supply chain agility, and digital engagement, leading firms are shaping the competitive contours of the market and raising the bar for innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Disposable Garbage Bags market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Al‑Shoaibi Plastic Factory

- Berry Global, Inc.

- Cosmoplast Industrial Company LLC

- Dagoplast Corporation

- Emil Deiss KG

- Inteplast Group Ltd.

- Luban Packing Corporation

- Novolex Holdings, LLC

- Pack‑It B.V.

- Poly‑America, L.P.

- Primax Corporation

- RDE Corporation

- Reynolds Consumer Products Inc.

- S.C. Johnson & Son, Inc.

- Teruijie Corporation

- The Clorox Company

- The Glad Products Company

- ZhanHong Corporation

- Zubairi Plastic Bags Industry LLC

Formulating Strategic, Data-Driven Recommendations to Empower Industry Leaders and Stakeholders in Maximizing Opportunities Within the Trash Bag Market

Industry leaders should prioritize investments in next-generation materials that offer improved environmental profiles without sacrificing performance. By collaborating with biopolymer producers and chemical recycling partners, firms can develop differentiated products aligned with evolving regulatory mandates and consumer preferences. Simultaneously, strengthening relationships with resin suppliers and diversifying feedstock sources will help mitigate the impact of trade policy fluctuations and raw material cost volatility.

Embracing digital commerce and omnichannel distribution is equally critical. Companies must enhance their e-commerce capabilities, leveraging data analytics to personalize offerings and optimize inventory management. Integrating subscription services and just-in-time delivery models can further deepen customer engagement and foster recurring revenue streams.

Finally, operational agility should be embedded across R&D, manufacturing, and supply chain functions. Implementing advanced analytics and predictive planning tools will enable proactive responses to market disruptions. Establishing scenario-based planning frameworks and cross-functional “war rooms” can ensure rapid decision-making during periods of regulatory change or supply chain stress. By focusing on material innovation, digital transformation, and operational resilience, industry leaders can capitalize on growth opportunities and maintain competitive advantage.

Detailing the Comprehensive Research Methodology and Analytical Framework Underpinning the Market Intelligence and Insights Compilation Process

This research was conducted using a multi-layered methodology combining primary and secondary data sources. Initial secondary research involved analysis of industry publications, regulatory filings, and trade association reports to establish a foundational understanding of market dynamics and policy developments. Proprietary databases were leveraged to extract historical import–export volumes, price movements, and production statistics.

Primary insights were obtained through interviews with senior executives across resin producers, bag converters, and major end users, providing qualitative perspectives on demand drivers, innovation pipelines, and supply chain challenges. These dialogues were supplemented by discussions with regulatory specialists to interpret emerging compliance frameworks and extended producer responsibility initiatives.

Data triangulation techniques ensured quantitative reliability, aligning disparate sources to validate supply-demand balances and cost analyses. A scenario modeling approach was applied to assess the impact of tariff changes, raw material price shifts, and technology adoption rates. Expert reviewers with deep sector experience audited the findings and provided validation, fostering a high degree of confidence in the report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Disposable Garbage Bags market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Disposable Garbage Bags Market, by Material

- Disposable Garbage Bags Market, by Thickness

- Disposable Garbage Bags Market, by Size

- Disposable Garbage Bags Market, by Closure Type

- Disposable Garbage Bags Market, by End Use

- Disposable Garbage Bags Market, by Distribution Channel

- Disposable Garbage Bags Market, by Region

- Disposable Garbage Bags Market, by Group

- Disposable Garbage Bags Market, by Country

- United States Disposable Garbage Bags Market

- China Disposable Garbage Bags Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Drawing Holistic Conclusions on Market Trajectories, Core Insights, and Imperatives for Sustainable Growth in the Disposable Waste Bag Landscape

The disposable garbage bag market is characterized by dynamic interplay between evolving consumer expectations, regulatory pressures, and technological innovation. Sustainability considerations have emerged as a defining force, compelling stakeholders to embrace bio-based materials and circular economy principles. At the same time, shifting trade policies have underscored the importance of supply chain resilience and diversified sourcing strategies.

Segmentation analysis reveals a nuanced landscape where material types, end-use applications, distribution channels, physical attributes, and closure mechanisms each unlock unique value propositions. Regional insights further illustrate how localized regulations and market maturity levels shape product preferences and channel strategies. Leading companies demonstrate that competitive advantage increasingly hinges on the ability to integrate sustainability, digital engagement, and operational agility.

As the industry evolves, stakeholders that proactively adapt to regulatory changes, invest in next-generation materials, and harness data-driven decision-making will be best positioned to capture emerging opportunities. This balanced synthesis of market dynamics, segmentation nuances, and strategic imperatives provides a roadmap for achieving sustainable growth and long-term leadership in the disposable waste containment bag arena.

Encouraging Direct Engagement with Senior Sales Leadership to Acquire Essential Market Research Intelligence on Disposable Garbage Bags

To access a comprehensive, in-depth analysis of the disposable garbage bag market, connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure the full market research report and unlock strategic insights tailored for your business objectives. Our dedicated sales team will guide you through the report’s exclusive findings and customization options, ensuring you have the data and recommendations needed to stay ahead in a rapidly evolving industry. Reach out today to obtain the definitive resource that empowers informed decision-making and competitive differentiation in the waste containment solutions sector

- How big is the Disposable Garbage Bags Market?

- What is the Disposable Garbage Bags Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?