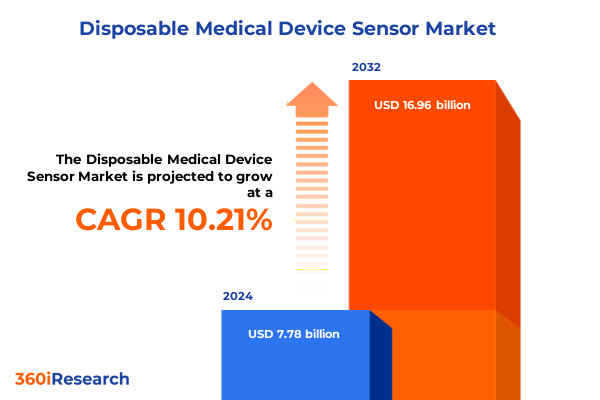

The Disposable Medical Device Sensor Market size was estimated at USD 8.52 billion in 2025 and expected to reach USD 9.34 billion in 2026, at a CAGR of 10.32% to reach USD 16.96 billion by 2032.

Setting the Stage for Innovation and Sustainable Growth in Disposable Medical Device Sensor Applications Across Healthcare Environments

The disposable medical device sensor industry has emerged as a critical pillar in modern healthcare, supporting real-time monitoring and diagnostics across a variety of clinical settings. As healthcare systems increasingly emphasize value-based care, the integration of single-use sensors that deliver accurate, timely patient data has become indispensable. These innovative devices are transforming traditional workflows, enabling clinicians to monitor vital signs, biochemical markers, and therapeutic delivery parameters with minimal risk of cross-contamination.

This convergence of clinical need and technological advancement has accelerated the adoption of sensors designed for one-time use. From ambulatory care units to home healthcare environments, these devices ensure patient safety and streamline diagnostic processes. Moreover, they empower healthcare providers with actionable insights that drive personalized treatment decisions. Amidst rising cost pressures and stringent hygiene protocols, the disposable sensor segment stands out by offering both economic and clinical advantages, setting the stage for a new era of connected, patient-centric care.

Uncovering the Fundamental Transformative Technological and Market Shifts Reshaping the Future of Disposable Medical Device Sensors

The disposable sensor domain is undergoing fundamental transformation fueled by breakthroughs in materials science, microfabrication, and device integration. Advanced biosensor platforms now incorporate enzymatic and electronic components to detect glucose and lactate with unprecedented sensitivity. At the same time, next-generation flow, pH, pressure, and temperature sensors harness miniaturized piezoelectric and thermal technologies to deliver continuous, real-time monitoring in critical care and drug delivery applications.

Emerging optical and electrochemical detection methods are redefining how single-use devices capture and transmit patient data. Conductometric and potentiometric approaches have expanded the diagnostic capabilities of disposable sensors, enabling precise measurement of biochemical parameters at the point of care. Coupled with wireless connectivity and cloud-based analytics, these technological shifts are dismantling traditional barriers to adoption, fostering deeper integration with electronic health record systems, and catalyzing data-driven clinical workflows. As a result, the industry is on a trajectory toward fully integrated, smart sensor solutions that empower proactive patient management and accelerate therapeutic interventions.

Analyzing the Cumulative Effects of 2025 United States Tariffs on Innovation, Supply Chains, and Pricing Dynamics for Medical Device Sensors

The introduction of new United States tariff measures in 2025 has had a profound ripple effect across the disposable sensor supply chain, influencing everything from raw material procurement to final pricing. Manufacturers have faced increased costs for imported electronic components and specialty polymers, prompting a reassessment of global sourcing strategies. Many have responded by diversifying supplier networks, relocating assembly operations, or forging strategic partnerships with domestic fabricators to mitigate the impact of higher duties.

These tariff-driven adjustments have accelerated innovation in cost-effective manufacturing techniques, such as roll-to-roll printing and injection molding, to offset elevated input expenses. In turn, the reshaped supply chain has fostered more resilient distribution networks, reducing lead times and fostering just-in-time inventory practices. While end users may experience modest pricing adjustments, the heightened focus on localized production and streamlined logistics ultimately enhances product availability and supports continuous patient care without compromise.

Extracting Actionable Insights from Key Segmentation Parameters Shaping the Disposable Medical Device Sensor Market Trajectories

An in-depth examination of market segmentation reveals diverse value drivers across sensor type, technology, application, end user, and distribution channel. Within sensor types, biosensors-particularly glucose and lactate sensors-continue to dominate clinical adoption due to their direct relevance in diabetes management and critical care monitoring. Alongside flow and pressure sensors, temperature and pH devices are expanding their footprint in drug delivery systems, offering real-time feedback during infusion therapies.

From a technology standpoint, electrochemical sensors remain at the forefront, with amperometric, conductometric, and potentiometric variants enabling precise biochemical analysis. Optical detection methods are gaining traction in applications requiring non-invasive monitoring, while piezoelectric and thermal sensors support fluid flow and tactile measurement in disposable formats. Application segmentation underscores the pivotal role of diagnostics-especially glucose and pH measurement-alongside patient monitoring and targeted drug delivery systems.

End users span hospitals, clinics, ambulatory care centers, and home healthcare providers, each prioritizing single-use sensors that blend reliability with ease of use. Pharmaceutical and research laboratories harness disposable sensors for assay development and quality control, driving collaborative development efforts between industry and academia. Finally, distribution through direct sales, specialized distributors, and online retail channels ensures broad market reach, enabling rapid adoption across diverse healthcare infrastructures.

This comprehensive research report categorizes the Disposable Medical Device Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Application

- End User

- Channel

Identifying Regional Drivers and Emerging Opportunities across the Americas, Europe, Middle East & Africa and Asia-Pacific for Medical Device Sensors

Regionally, the Americas continue to lead in disposable sensor innovation, driven by a robust healthcare infrastructure, regulatory support for single-use devices, and significant investment in diabetes management solutions. In North America, rising prevalence of chronic diseases has spurred adoption of next-generation biosensors in both hospital settings and home monitoring programs. Latin American markets, while more price sensitive, are witnessing gradual uptake as public health initiatives prioritize accessible diagnostic tools.

Over in Europe, the Middle East, and Africa, regulatory alignment with stringent European Medical Device Regulations is catalyzing improvements in product standards and quality assurance. European healthcare providers are embracing digital health strategies, integrating sensors into telemedicine platforms to enhance remote patient monitoring. Meanwhile, investment in healthcare infrastructure across the Middle East and Africa is surging, opening avenues for disposable sensors in outbreak management and routine diagnostics.

Asia-Pacific represents a rapidly evolving landscape, characterized by strong manufacturing capabilities, competitive production costs, and expanding middle-class demand for advanced healthcare solutions. Countries like China, Japan, and South Korea are at the vanguard of sensor technology development, while Southeast Asian markets prioritize cost-effective, locally produced single-use devices. India’s growing home healthcare segment and Australia’s emphasis on patient safety further underscore the region’s dynamic growth potential.

This comprehensive research report examines key regions that drive the evolution of the Disposable Medical Device Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovative Challengers Driving Competitive Dynamics in the Disposable Medical Device Sensor Arena

Prominent industry leaders are driving the disposable sensor market through sustained investment in research and development, strategic collaborations, and targeted acquisitions. These companies leverage advanced microfabrication techniques to introduce innovative sensor platforms that combine high sensitivity with streamlined manufacturing processes. Partnerships with academic institutions and technology incubators have accelerated breakthroughs in novel materials, such as biocompatible polymers and nanoscale coatings, enhancing device performance and shelf stability.

At the same time, agile challengers are carving out niche positions by focusing on cost-efficient production models, modular sensor designs, and open platform connectivity. These smaller innovators often collaborate with clinical research organizations to validate application-specific use cases, from point-of-care diagnostics to continuous patient monitoring. Across the competitive landscape, mergers and joint ventures are reshaping market dynamics, enabling companies to integrate complementary competencies-from electrochemical detection modules to wireless data transmission infrastructure-into comprehensive, single-use sensor ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Disposable Medical Device Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Becton, Dickinson and Company

- F. Hoffmann-La Roche Ltd.

- ICU Medical, Inc.

- Masimo Corporation

- Medtronic plc

- Nipro Corporation

- Nissha Co., Ltd.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Presenting Pragmatic Recommendations for Industry Leaders to Capitalize on Emerging Trends in Disposable Medical Device Sensor Innovation

To capitalize on emerging trends, industry leaders should prioritize cross-functional collaboration between R&D, regulatory affairs, and commercial teams to accelerate product introductions. Embracing adaptive manufacturing techniques, such as roll-to-roll fabrication and additive printing, will reduce unit costs and enhance scalability. In parallel, companies should invest in robust validation protocols and real-world evidence studies to demonstrate clinical efficacy and safety, thereby streamlining market approvals.

Strategic alliances with digital health platform providers can unlock new revenue streams by embedding disposable sensors into telehealth and remote monitoring solutions. Moreover, expanding distribution partnerships-especially in high-growth Asia-Pacific and emerging Latin American markets-will ensure broader access and market penetration. Finally, maintaining flexibility in supply chain configurations, through near-shoring or dual-sourcing strategies, will safeguard against tariff volatility and geopolitical disruptions, ensuring reliable product availability to end users.

Detailing Rigorous Research Methodology and Data Triangulation Approach Ensuring High Confidence in Medical Sensor Market Insights

This analysis is grounded in a rigorous research methodology that blends comprehensive secondary research with primary stakeholder engagements. The secondary research phase encompassed a systematic review of public filings, peer-reviewed journals, regulatory publications, and patent databases. Concurrently, primary insights were obtained through in-depth interviews with industry executives, clinical specialists, procurement leaders, and technology experts, ensuring diverse perspectives across the value chain.

Data triangulation techniques were applied to reconcile disparate data sources, validate key assumptions, and enhance confidence in derived insights. Quantitative datasets were cross-verified against industry benchmarks and adjusted to reflect the impact of recent policy shifts, such as the 2025 U.S. tariffs. Qualitative findings were corroborated with on-the-ground observations and real-world case studies, offering nuanced understanding of adoption barriers and growth enablers. Throughout the process, strict quality controls and peer reviews were implemented to maintain objectivity and accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Disposable Medical Device Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Disposable Medical Device Sensor Market, by Type

- Disposable Medical Device Sensor Market, by Technology

- Disposable Medical Device Sensor Market, by Application

- Disposable Medical Device Sensor Market, by End User

- Disposable Medical Device Sensor Market, by Channel

- Disposable Medical Device Sensor Market, by Region

- Disposable Medical Device Sensor Market, by Group

- Disposable Medical Device Sensor Market, by Country

- United States Disposable Medical Device Sensor Market

- China Disposable Medical Device Sensor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Core Findings and Strategic Imperatives for Stakeholders Engaged in the Disposable Medical Device Sensor Sector

The disposable medical device sensor sector stands at a pivotal juncture, characterized by rapid technological progress and evolving regulatory landscapes. Core findings highlight the critical role of biosensors in chronic disease management, the growing influence of electrochemical and optical technologies, and the strategic importance of diversified supply chains in response to tariff pressures. Regional insights underscore distinct growth drivers-from established markets in North America to the manufacturing prowess of Asia-Pacific and the regulatory harmonization in Europe, Middle East, and Africa.

Strategic imperatives for stakeholders include investing in adaptive manufacturing, fostering cross-sector collaborations, and leveraging digital health ecosystems to broaden application footprints. As market complexity intensifies, companies that integrate robust validation frameworks and agile distribution models will secure competitive advantage. Ultimately, the intersection of advanced sensor technologies, targeted clinical use cases, and resilient supply networks will define the next phase of growth in this dynamic market.

Engage with Associate Director Ketan Rohom Today to Secure Comprehensive Disposable Medical Device Sensor Market Intelligence

To gain a comprehensive understanding of the evolving disposable medical device sensor landscape and stay ahead of competitive, regulatory, and technological shifts, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His team stands ready to provide tailored insights, detailed data, and strategic guidance designed to empower informed decision-making. By securing this report, you will benefit from deep segmentation analysis, regional perspectives, and practical recommendations that align with your organization’s growth objectives. Connect today to explore how this market intelligence can drive innovation strategies, optimize supply chains, and unlock new opportunities in healthcare delivery.

- How big is the Disposable Medical Device Sensor Market?

- What is the Disposable Medical Device Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?