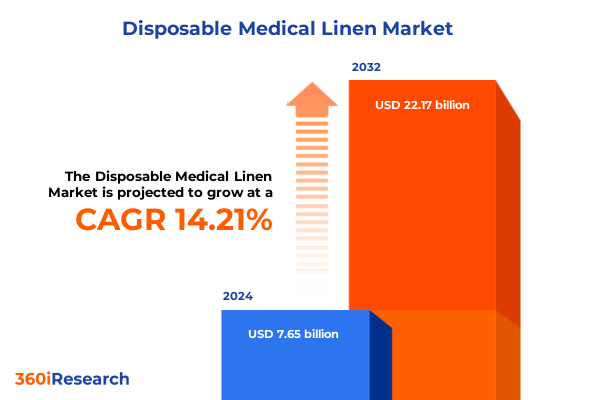

The Disposable Medical Linen Market size was estimated at USD 8.22 billion in 2025 and expected to reach USD 8.83 billion in 2026, at a CAGR of 15.22% to reach USD 22.17 billion by 2032.

Exploring the Critical Role, Emerging Dynamics, and Strategic Imperatives of Disposable Medical Linen in Modern Healthcare Environments

The landscape of healthcare supply chains has experienced unprecedented pressure in recent years, thrusting disposable medical linen into the spotlight as a critical enabler of operational efficiency and patient safety. As infection control protocols have tightened, and healthcare providers strive to reduce costs while maintaining high standards of care, the demand for single-use surgical drapes, gowns, caps, and related disposables has surged. New concerns over cross-contamination, coupled with the drive to limit environmental footprint, are prompting rapid innovation in material science and manufacturing processes. Consequently, disposable medical linen has transcended its traditional role as a secondary expense and become central to strategic procurement and quality assurance initiatives.

Amid these dynamics, disruptive events such as global pandemics and shifting regulatory frameworks have underscored the necessity for resilient supply networks and agile production capacity. Hospitals, outpatient surgical centers, and specialty clinics are reevaluating their linen strategies, balancing the imperatives of patient protection, workforce safety, and environmental stewardship. This report introduces key trends shaping this market, highlights the evolving interplay between product innovation and end-user requirements, and sets the stage for a detailed exploration of the transformative forces redefining the disposable medical linen industry today.

Unveiling the Disruptive Technological, Regulatory, and Sustainability Shifts Reshaping the Disposable Medical Linen Landscape Today

The disposable medical linen sector is undergoing a profound metamorphosis driven by converging technological, regulatory, and environmental imperatives. Innovations in fabric engineering have yielded composite materials with enhanced barrier properties while optimizing breathability, thereby addressing the dual challenges of comfort and infection prevention. At the same time, advanced SMS nonwoven fibers are being reengineered to enable greater durability, while spunbond substrates are increasingly integrated with biodegradable coatings. These material breakthroughs are complemented by digital traceability systems that utilize RFID tagging and blockchain-ledger authentication to guarantee sterility compliance and minimize product diversion.

Regulatory bodies around the world have also intensified scrutiny of disposables, incentivizing manufacturers to adopt eco-friendly processes and attain third-party certifications for reduced microplastic emissions and carbon footprints. In tandem, major healthcare networks are prioritizing supplier diversity and onshoring strategies to mitigate risks exposed by past supply chain disruptions. Such shifts are fostering greater collaboration between equipment providers, distributors, and end users, with shared goals of accelerating time-to-market for next-generation surgical gowns and drapes. Through these collective transformations, the disposable medical linen landscape is being reshaped by more resilient, transparent, and environmentally responsible practices.

Analyzing the Concurrent Effects of 2025 US Tariff Measures on Cost Structures, Supply Chains, and Competitive Strategies in Disposable Medical Linen

In 2025, the cumulative impact of United States tariffs on imported nonwoven fabrics and finished disposable medical linen products has reverberated across the supply chain, altering cost structures, sourcing strategies, and market competitiveness. Manufacturers reliant on overseas raw materials have faced escalated input costs, prompting many to reevaluate supplier relationships and pursue dual-sourcing models. For hospitals and ambulatory surgical centers, the tariff-related price increases have translated into tighter capital allocation, compelling procurement teams to negotiate longer-term agreements and explore bulk purchasing or consortium-based contracts to stabilize expenses.

Concurrently, the tariff environment has catalyzed a gradual shift toward domestic manufacturing, with some contract fabricators expanding capacity to capitalize on reshoring incentives and avoid import duties. While these investments enhance supply security, they often carry higher labor and regulatory compliance costs, creating a delicate balance between cost containment and operational reliability. From a competitive standpoint, established multinational players with diversified production footprints have been better positioned to absorb tariff shocks, while smaller regional suppliers have faced more acute margin pressures. As the dust settles on the most recent tariff adjustments, industry stakeholders continue to refine their procurement frameworks, blending spot-market agility with long-term capacity planning to navigate this more complex trade landscape.

Deriving Actionable Intelligence from Product, Material, End User, Sales Channel, and Sterility Segmentation in the Disposable Medical Linen Market

Dissecting market performance through a multi-dimensional segmentation lens reveals nuanced growth trajectories and strategic inflection points. Within product offerings, surgical drapes and gowns dominate attention, yet their internal composition spans cardiovascular, general surgery, gynecology, and orthopedic subclasses, each demanding tailored barrier ratings and ergonomic designs. Meanwhile, ancillary items such as caps, bonnets, patient gowns, and shoe covers continue to evolve with an emphasis on user comfort, fast donning procedures, and environmental end-of-life considerations.

Material selection further delineates market behavior, as composite fabrics-available in PE coated and SMS laminate variants-compete against pure SMS and spunbond substrates. Composite options often command a premium where high fluid repellency is paramount, whereas SMS materials deliver a balance of performance and value for lower-acuity procedures. End-user segmentation underscores the diversity of demand patterns: high-volume settings like hospitals and ambulatory surgical centers prioritize standardized bulk consumables, diagnostic centers seek specialized low-lint draping systems, and specialty clinics opt for customizable gown sets aligned with procedural volumes and regulatory mandates.

Sales channels introduce another strategic dimension; traditional distributor networks and direct hospital sales remain fundamental, while online platforms have emerged as flexible channels for smaller practices. Retail pharmacies, though a modest slice of total volume, play a crucial role in outpatient and home-care segments. Finally, sterility status bifurcates demand streams: sterile disposables are indispensable in operating environments, whereas non-sterile assortments serve general ward, rehabilitation, and outpatient care. Together, these segmentation insights inform differentiated product roadmaps and channel strategies that align with specific end-market needs.

This comprehensive research report categorizes the Disposable Medical Linen market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sterility

- End User

- Sales Channel

Mapping Regional Dynamics and Growth Drivers across Americas, Europe Middle East Africa, and Asia Pacific in the Disposable Medical Linen Sector

Regional dynamics exert a profound influence on disposable medical linen adoption, as healthcare infrastructure maturity, regulatory frameworks, and sustainability agendas vary across geographies. In the Americas, the United States leads demand with its expansive hospital networks, consolidated purchasing groups, and rigorous infection control mandates, while Canada and Latin American markets are gradually aligning their standards with North American benchmarks, driving incremental growth in higher-performance drapes and gowns.

Meanwhile, the Europe, Middle East, and Africa cluster presents a tapestry of regulatory regimes and healthcare financing models. Western European nations emphasize circular economy principles and strict environmental certifications, fostering innovation in biodegradable substrates. Gulf Cooperation Council states are investing in world-class medical facilities and local production incentives, whereas sub-Saharan Africa continues to expand basic disposable linen penetration in public health initiatives and NGO-supported clinics.

Across Asia-Pacific, rapid hospital expansions, a surge in outpatient surgical centers, and government-driven healthcare reforms are fueling demand for both high-specification surgical textiles and cost-effective non-sterile variants. Markets like China and India feature a dynamic local manufacturing ecosystem, compressing lead times and reducing dependency on imports, while Australia and Japan maintain stringent quality standards that sustain a preference for internationally certified disposable linen solutions.

This comprehensive research report examines key regions that drive the evolution of the Disposable Medical Linen market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Innovation, Partnerships, and Growth Tactics in the Disposable Medical Linen Market

Major industry participants are leveraging diverse strategies to solidify their positions in the disposable medical linen arena. Leading global healthcare suppliers have channeled investments into R&D initiatives aimed at integrating advanced antimicrobial treatments and anomaly-detection technologies within surgical drapes and gowns. Parallel ventures into sustainable manufacturing processes have enabled them to pursue eco-label certifications, reinforcing their appeal to environmentally conscious health systems.

Simultaneously, mid-size regional fabricators are forging strategic partnerships with nonwoven material innovators to co-develop next-generation SMS and composite products tailored for specialty applications, such as minimally invasive procedures and extended-duration surgeries. These collaborations often include joint piloting programs with hospital procurement teams to validate product performance under real-world conditions and accelerate time-to-market.

Beyond product innovation, established distributors and logistics providers are differentiating through integrated warehousing solutions and predictive inventory models. By deploying data analytics to forecast consumption trends and align replenishment cycles, these channel partners are helping healthcare facilities minimize stockouts and reduce emergency purchasing premiums. Collectively, these company-level initiatives underscore a competitive environment where technological leadership, sustainability credentials, and supply chain agility serve as critical differentiators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Disposable Medical Linen market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Ansell Limited

- Cardinal Health, Inc.

- Essity AB

- Freudenberg Medical SE & Co. KG

- Kimberly-Clark Corporation

- Medline Industries, L.P.

- Mölnlycke Health Care AB

- Owens & Minor, Inc.

- Paul Hartmann AG

Strategic Roadmap for Healthcare Suppliers to Capitalize on Emerging Trends and Mitigate Risks in Disposable Medical Linen Operations

To thrive amidst intensifying competition and evolving stakeholder expectations, industry leaders should prioritize a multi-pronged strategic agenda. Advancing next-generation materials that balance barrier efficacy with environmental responsibility will meet escalating regulatory and buyer demands. At the same time, cultivating strong alliances with technical textiles firms and academic research centers can expedite the commercialization of novel antimicrobial and low-carbon substrates.

Enhancing supply chain resilience is equally essential; executives must evaluate the merits of regional production hubs complemented by dual-sourcing arrangements to buffer against geopolitical shocks and tariff fluctuations. Integrating digital traceability tools will not only ensure compliance with tightening sterility regulations but also provide real-time visibility into inventory levels, facilitating proactive replenishment and minimizing excess stock holdings.

Finally, aligning sales channel strategies with end-user preferences-whether through tailored direct-to-hospital programs, e-commerce portals for outpatient clinics, or pharmacy partnerships for home care-enables portfolio optimization and revenue diversification. By combining product innovation, supply chain robustness, and channel agility, organizations can capture new market opportunities while safeguarding against the disruptive forces at play.

Outlining a Rigorous Mixed Methodology Blending Primary, Secondary, Qualitative, and Quantitative Approaches for Accurate Market Insights

This report is underpinned by a rigorous research methodology that blends primary and secondary data sources, qualitative insights, and quantitative analysis. Primary research included in-depth interviews with key opinion leaders spanning senior procurement officers, supply chain directors, and clinical specialists within hospitals, ambulatory surgical centers, and specialty clinics. These discussions provided first-hand perspectives on purchasing criteria, emerging product requirements, and the operational challenges faced in maintaining sterile environments.

Secondary research encompassed a comprehensive review of industry publications, regulatory filings, and technical whitepapers to map material innovations, tariff developments, and regional market nuances. Company websites, investor presentations, and press releases were examined to track strategic initiatives and competitive positioning. Additionally, proprietary databases and trade association reports were analyzed to identify historical consumption patterns, price trend fluctuations, and technological adoption rates.

Data triangulation techniques were employed to validate findings, ensuring consistency across diverse information streams. Quantitative modeling supported the segmentation deep dives, and qualitative thematic analysis illuminated the underlying drivers of change. This mixed-methods approach ensures that conclusions and recommendations are grounded in robust evidence and reflect the current realities of the disposable medical linen market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Disposable Medical Linen market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Disposable Medical Linen Market, by Product Type

- Disposable Medical Linen Market, by Sterility

- Disposable Medical Linen Market, by End User

- Disposable Medical Linen Market, by Sales Channel

- Disposable Medical Linen Market, by Region

- Disposable Medical Linen Market, by Group

- Disposable Medical Linen Market, by Country

- United States Disposable Medical Linen Market

- China Disposable Medical Linen Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Critical Takeaways and Forward Looking Considerations for Stakeholders in the Evolving Disposable Medical Linen Ecosystem

As the disposable medical linen market continues to adapt to technological breakthroughs, regulatory evolution, and shifting end-user expectations, stakeholders must maintain a forward-looking perspective. The interplay of advanced materials research, digital supply chain enhancements, and sustainability mandates will shape product innovation roadmaps and channel dynamics in the years ahead. Organizations that anticipate these converging trends and embed agility into their operational frameworks will be better positioned to deliver high-value solutions and create lasting competitive advantage.

Moreover, the recalibration of sourcing strategies in response to global trade measures underscores the importance of balanced risk management and cost optimization. By aligning investments in domestic capacity expansion with targeted partnerships in key regions, industry players can secure supply continuity while managing expenditure pressures. Ultimately, success in this evolving ecosystem will hinge on the ability to integrate performance excellence, environmental stewardship, and seamless customer engagement into every stage of the disposable medical linen value chain.

Secure Your Competitive Edge Today by Partnering with Ketan Rohom to Gain Exclusive Access to the Comprehensive Disposable Medical Linen Market Report

For decision-makers seeking unparalleled insights into the transformative opportunities and evolving dynamics of disposable medical linen, securing the full market research report will provide strategic clarity and a competitive edge. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to access a comprehensive analysis encompassing market drivers, segment-specific deep dives, regional growth projections, and actionable strategies tailored to optimize supply chains, product portfolios, and partnership models. Whether you aim to fortify resilience against regulatory shifts, calibrate investment in sustainable materials, or unlock untapped growth in emerging end markets, our exhaustive report equips you with the rigorous data and expert interpretation required to inform confident, forward-looking decisions. Reach out today to arrange a personalized briefing and transform your strategic planning with the authoritative market intelligence you need to lead in the disposable medical linen sector in 2025 and beyond

- How big is the Disposable Medical Linen Market?

- What is the Disposable Medical Linen Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?