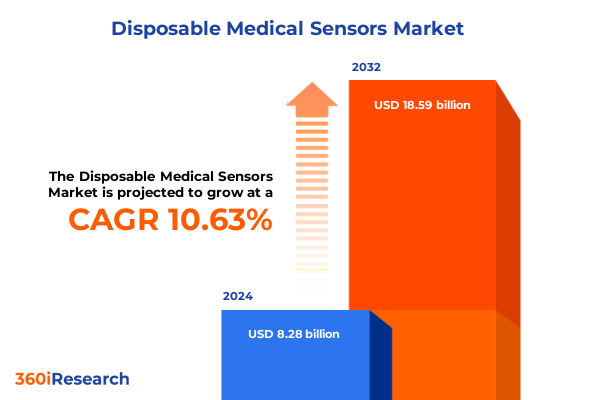

The Disposable Medical Sensors Market size was estimated at USD 9.14 billion in 2025 and expected to reach USD 10.10 billion in 2026, at a CAGR of 10.66% to reach USD 18.59 billion by 2032.

Exploring the Critical Role of Disposable Medical Sensors in Enhancing Patient Safety, Infection Control, and Remote Monitoring Across Healthcare Settings

Disposable medical sensors have emerged as pivotal components in modern healthcare delivery by prioritizing sterility and convenience. By minimizing the need for complex sterilization processes and ensuring sterility with each use, these single-use sensor technologies reduce cross-contamination risks and streamline clinical workflows, particularly in high-volume settings such as intensive care units and surgical suites.

In addition to enhancing patient safety, disposable sensors facilitate the transition from episodic assessments to continuous monitoring. Integration with mobile connectivity and cloud platforms has allowed real-time data transmission to clinicians, supporting proactive interventions and reducing hospital readmissions in chronic disease management. As healthcare systems increasingly adopt telehealth and remote patient monitoring initiatives, the demand for disposable sensors capable of delivering accurate, actionable insights outside the clinical environment continues to grow.

Furthermore, the reliance on global supply chains and the imperatives of infection prevention have magnified the appeal of disposables. The strain on hospital budgets and logistical complexities heightened by recent health crises underscores the essential role of sterile, single-use sensor devices in maintaining resilience and safeguarding patient outcomes. Transitioning to disposable sensor formats not only addresses immediate clinical needs but also aligns with broader healthcare strategies aimed at improving operational efficiency and patient satisfaction.

Revolution in Healthcare Delivery Enabled by IoT Integration, AI-Driven Analytics, Flexible Electronics, and Human-Centered Design in Disposable Sensor Technologies

The landscape of disposable medical sensors is undergoing a profound transformation marked by technological breakthroughs and evolving care paradigms. The emergence of Internet of Medical Things (IoMT) architectures has enabled seamless connectivity between single-use sensors and cloud-based analytics platforms, facilitating continuous data collection and remote monitoring in real time. This integration accelerates the shift from episodic clinical assessments to proactive, data-driven care models, empowering healthcare providers to anticipate patient needs and intervene earlier.

Concurrently, advancements in materials science, including biocompatible polymers and microfabrication techniques, have given rise to flexible and conformable sensors that adapt to the body’s contours. These devices minimize motion artifacts and enhance patient comfort, thereby supporting extended wear durations and improving compliance. The push toward multifunctional, miniaturized sensor designs allows for simultaneous monitoring of multiple physiological parameters-such as temperature, pressure, and biochemical markers-in a single, discreet format, further expanding clinical applications and use cases.

Artificial intelligence and machine learning algorithms are also redefining sensor capabilities by refining signal processing and anomaly detection. AI-driven analytics can sift through vast datasets generated by disposable sensors to identify subtle patterns, predict clinical deterioration, and personalize treatment regimens. This trend aligns with regulatory frameworks that are evolving to support digital health innovations through accelerated approval pathways and adaptive evidence requirements, ultimately shortening time-to-market for transformative sensor solutions.

Finally, human-centered design principles are driving the development of sensor interfaces that prioritize ease of use, data transparency, and seamless integration into daily routines. By incorporating patient and clinician feedback into product development cycles, manufacturers are creating solutions that not only deliver high-fidelity data but also resonate with end users, ensuring broader acceptance and adoption across diverse healthcare environments.

Assessing the Cumulative Impact of United States Tariffs on Medical Sensor Supply Chains, Component Costs, and Innovation Trajectories Through 2025

United States tariffs on imported medical supplies and sensor components have cumulatively reshaped cost structures and supply chain strategies for disposable sensor manufacturers. In 2024 and 2025, the U.S. Trade Representative expanded Section 301 duties on key inputs-such as semiconductors and medical-grade polymers-resulting in tariff rates rising from 25% to 50% for high-volume consumables like gloves and syringes. This has necessitated revision of sourcing strategies and prompted manufacturers to evaluate near-shoring and regional diversification to mitigate escalating duties.

Moreover, targeted increases on specific goods-such as a 100% duty on syringes and needles implemented in September 2024-exacerbated component cost pressures for sensor designs incorporating microfluidic or electrochemical elements. Industry associations have reported that these measures created temporary disruptions and led to increased lead times as suppliers adjusted production plans to accommodate shifting tariff regimes. As a result, several OEMs have begun qualifying alternative suppliers in tariff-exempt jurisdictions to sustain uninterrupted sensor output and preserve affordability for healthcare providers.

Further complicating the landscape, proposed reciprocal tariffs on medical goods imported from traditional allies introduced uncertainty for manufacturers reliant on precision components sourced from Europe and Southeast Asia. The specter of tariffs reaching up to 145% on certain categories has underscored the importance of comprehensive supply chain risk management and has driven renewed emphasis on domestic production capabilities. Moving forward, collaboration with policymakers to secure targeted exemptions for critical medical components, coupled with strategic investments in localized manufacturing, will prove critical to balancing cost containment with innovation continuity.

Unearthing Vital Market Segmentation Insights Across Product Types, Technologies, Applications, and End Users to Drive Strategic Positioning

The disposable medical sensors market is defined by distinct product categories, each with unique subsegment characteristics. ECG sensors, available in single-channel and multi-channel formats, deliver high-resolution cardiac monitoring capabilities while meeting stringent sterility requirements for each single use. Glucose sensors leverage both electrochemical and optical detection techniques, enabling precise glycemic management for diabetes patients while streamlining sensor replacements in home and clinical settings. Pressure sensors encompass piezoelectric and strain gauge modalities, facilitating real-time hemodynamic monitoring across postoperative and intensive care applications. Complementing these, temperature sensors deploy digital and infrared technologies to provide accurate thermometric readings critical to neonatal care and infection control scenarios.

On the technology front, wired configurations such as direct cable and USB-connected sensors ensure consistent data integrity for in-facility monitoring, whereas Bluetooth-based devices-spanning Classic and Low Energy variants-and wireless solutions using cellular and Wi-Fi networks support remote patient monitoring and seamless data transmission to cloud platforms. This technological diversity enables a spectrum of deployment models, from bedside consoles to wearable form factors.

Application segmentation reveals a tripartite landscape encompassing home healthcare, hospital monitoring, and remote patient monitoring. Within home healthcare, disposable sensors facilitate chronic disease tracking and postoperative surveillance, empowering patients and caregivers. Hospital environments employ sensors in both ICU and ward contexts to support continuous vital sign assessment. In the realm of remote patient monitoring, specialized cardiac and respiratory sensor packages allow clinicians to oversee patient status beyond facility walls.

Finally, end-user segmentation highlights the varying procurement and utilization patterns across ambulatory care clinics, professional and self-care contexts within home healthcare, and both private and public hospital settings. Each end-user group presents distinct requirements for sensor durability, connectivity, and cost structures, underscoring the necessity for tailored market approaches.

This comprehensive research report categorizes the Disposable Medical Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Analyzing Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia-Pacific for Disposable Medical Sensors

The Americas region represents a mature market for disposable medical sensors, underpinned by advanced healthcare infrastructure, robust reimbursement frameworks, and a growing emphasis on remote and home-based care models. North America, in particular, benefits from established regulatory pathways and a high level of interoperability between digital health platforms and sensor technologies. This has fostered an environment conducive to rapid adoption of IoT-enabled disposable devices within both chronic disease management and acute care settings. Meanwhile, Latin American markets are gradually accelerating investments in telemedicine and home monitoring solutions, seeking to bridge accessibility gaps and control costs in emerging healthcare systems.

Across Europe, Middle East & Africa (EMEA), heterogeneous healthcare delivery landscapes have driven diverse demand dynamics. Western European nations continue to drive sensor innovation through publicly funded research initiatives and reimbursement policies favoring preventative care. In contrast, Middle Eastern and African markets are witnessing incremental uptake of disposable sensors, motivated by efforts to modernize clinical practices and address workforce shortages. Collaborative partnerships between global sensor manufacturers and local health authorities are instrumental in tailoring products for these varied environments, with a focus on affordability and streamlined supply chains.

The Asia-Pacific region is characterized by rapid healthcare expansion, driven by rising chronic disease prevalence, government-led digital health roadmaps, and growing middle-class demand for advanced diagnostics. Countries such as China, India, and Australia have launched national initiatives to bolster domestic manufacturing of medical devices, including disposable sensors, to enhance self-sufficiency and reduce import dependencies. Concurrently, the proliferation of telehealth services and remote monitoring adoption in APAC markets continues to accelerate, presenting significant opportunities for disposable sensor deployment across both urban and rural healthcare ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Disposable Medical Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves and Innovation Leadership Among Key Industry Players Shaping the Disposable Medical Sensor Market Landscape

The competitive landscape of disposable medical sensors is shaped by both specialized biosensing pioneers and diversified medical technology conglomerates. Dexcom leads the continuous glucose monitoring segment with its recently FDA-cleared G7 15 Day system featuring the longest wear time of 15.5 days and industry-leading accuracy, reinforcing its position as a market innovator and driving increased clinician and patient adoption across the United States.

Abbott holds a significant presence in the glucose monitoring arena through its FreeStyle Libre portfolio, which has expanded regulatory approvals to include imaging test compatibility and integration with automated insulin delivery systems. These advancements underscore Abbott’s strategy of enhancing user convenience and connectivity within its iCGM offerings, supporting end-to-end diabetes management solutions.

Beyond CGM, prominent players such as Medtronic and Philips are investing in disposable pressure, temperature, and ECG sensor technologies, leveraging their broad device portfolios and deep clinical expertise. Notably, Sensirion and STMicroelectronics continue to advance sensor miniaturization and performance through MEMS and nanotechnology innovations. These companies, alongside other established manufacturers, are forging partnerships with digital health platforms and cloud analytics providers to deliver comprehensive sensor-to-insight solutions, thereby reinforcing the shift toward data-driven care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Disposable Medical Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abbott Laboratories

- Baxter International Inc.

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health, Inc.

- CONMED Corporation

- Edward Lifesciences Corporation

- F. Hoffmann-La Roche Ltd

- Fresenius SE & Co. KGaA

- GE HealthCare Technologies Inc.

- Getinge AB

- Koninklijke Philips N.V.

- Masimo Corporation

- Medline Industries, LP

- Medtronic plc

- Mindray Bio-Medical Electronics Co., Ltd.

- Nipro Corporation

- Nonin Medical, Inc.

- Siemens Healthineers AG

- Smith & Nephew plc

- Stryker Corporation

- Terumo Corporation

- Zimmer Biomet Holdings, Inc.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Technological Advances, Regulatory Shifts, and Evolving Care Models

Industry leaders must invest in agile supply chain models that incorporate near-sourcing and multi-regional manufacturing hubs to mitigate tariff-related cost pressures and ensure uninterrupted sensor availability. Collaborating with policymakers to secure targeted tariff exemptions for critical sensor components can further safeguard margins and sustain innovation initiatives.

Embracing open standards for connectivity and data exchange will facilitate seamless IoMT integration, enabling disposables to interface with diverse clinical information systems and patient management platforms. Strategic alliances with cloud and AI analytics providers can unlock enhanced diagnostic capabilities and predictive insights, reinforcing value propositions for end-users.

Companies should prioritize human-centered design frameworks that incorporate patient and clinician feedback early in the development cycle, thereby optimizing sensor ergonomics, ease of use, and data transparency. Tailoring product portfolios to address the distinct needs of ambulatory care, home healthcare, and remote monitoring applications will strengthen market positioning and drive adoption across heterogeneous clinical settings.

Finally, investing in sustainability initiatives-such as biodegradable sensor substrates and recycling programs-will resonate with healthcare institutions focused on environmental stewardship. Demonstrating commitment to corporate social responsibility and aligning with emerging regulatory requirements for medical device waste management can enhance brand reputation and foster stakeholder trust.

Detailing a Robust Mixed-Methods Research Methodology Integrating Primary Interviews, Secondary Data, and Triangulated Analysis for Reliability

This report employs a mixed-methods research methodology combining primary and secondary data sources to ensure robust, triangulated insights. Primary research comprised structured interviews and surveys with a cross section of stakeholders, including clinicians, procurement specialists, regulatory experts, and manufacturing executives. These engagements provided qualitative perspectives on current adoption challenges, feature priorities, and future requirements for disposable sensor technologies.

Secondary research involved a comprehensive review of industry publications, regulatory filings, patent filings, and academic literature to map technological developments and market trends. We analyzed U.S. Trade Representative notices, FDA clearances, and tariff schedules to quantify the impact of trade policies on component sourcing and cost structures.

Quantitative analysis was underpinned by data aggregation from proprietary databases, peer-reviewed studies, and government-published import/export statistics. We applied data triangulation techniques to validate findings across disparate data sets, ensuring consistency and reliability of insights. Finally, expert panel workshops facilitated iterative validation of draft conclusions and strategic recommendations, aligning the report’s outcomes with real-world stakeholder experiences.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Disposable Medical Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Disposable Medical Sensors Market, by Product Type

- Disposable Medical Sensors Market, by Technology

- Disposable Medical Sensors Market, by Application

- Disposable Medical Sensors Market, by End User

- Disposable Medical Sensors Market, by Region

- Disposable Medical Sensors Market, by Group

- Disposable Medical Sensors Market, by Country

- United States Disposable Medical Sensors Market

- China Disposable Medical Sensors Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Concluding Insights on the Future Pathways and Strategic Imperatives Driving the Widespread Adoption of Disposable Medical Sensors in Healthcare

Disposable medical sensors have transitioned from niche innovations to foundational elements of modern healthcare delivery. The convergence of advanced materials, connectivity, and analytics is establishing new standards for patient monitoring, empowering clinicians with timely, accurate insights while enhancing patient experiences through minimally invasive, single-use formats.

As regulatory frameworks adapt to digital health solutions, and as healthcare delivery paradigms shift toward decentralized and preventative care, the role of disposable sensors will continue to expand. Strategic investments in supply chain resilience, interoperability, and human-centered design will be critical to capturing emerging growth opportunities.

Moving forward, market participants that proactively align innovation roadmaps with evolving clinical workflows and policy environments will be best positioned to lead the disposable sensor market, delivering superior value propositions and advancing global healthcare outcomes.

Contact Associate Director of Sales & Marketing to Secure Your Comprehensive Disposable Medical Sensors Market Research Report

For further information on how this comprehensive market research report can support your strategic decisions and drive your organization’s success, please reach out to Ketan Rohom, Associate Director, Sales & Marketing at our firm. By engaging directly, you can secure tailored insights, receive an executive briefing, and explore flexible licensing options designed to meet your business needs. Contact Ketan to arrange a personalized discussion and gain immediate access to the in-depth analysis and data essential for staying ahead in the competitive field of disposable medical sensors

- How big is the Disposable Medical Sensors Market?

- What is the Disposable Medical Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?