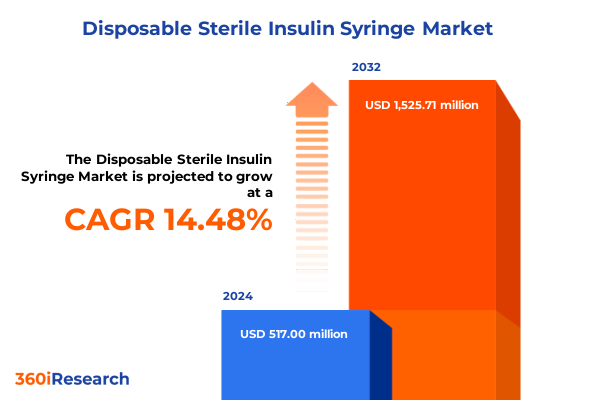

The Disposable Sterile Insulin Syringe Market size was estimated at USD 593.53 million in 2025 and expected to reach USD 672.30 million in 2026, at a CAGR of 14.43% to reach USD 1,525.71 million by 2032.

Exploring the multifaceted dynamics driving the sterile insulin syringe market growth against a backdrop of rising diabetes prevalence and evolving care models

The global rise in diabetes has emerged as a defining healthcare challenge of the 21st century, fueling unprecedented demand for safe and effective insulin delivery mechanisms. In the United States, more than 38 million people-or 11.6 percent of the population-are living with diagnosed or undiagnosed diabetes, underscoring a pressing need for reliable injection devices that support optimal patient outcomes. Concurrently, the proliferation of digital health platforms and patient-centric care models has intensified focus on striking a balance between device safety, precision dosing, and user convenience.

Against this backdrop, sterile insulin syringes stand at the nexus of clinical necessity and technological evolution. Rising prevalence rates have placed home-based injection regimens at the forefront of chronic disease management protocols, while hospitals and outpatient clinics reinforce stringent safety standards to prevent needlestick injuries and cross-contamination. Moreover, regulatory bodies worldwide are harmonizing device classification frameworks, prompting manufacturers to streamline product portfolios and accelerate innovation cycles.

As the ecosystem adapts to multifaceted pressures-from demographic shifts and cost containment initiatives to sustainability mandates and digital integration-the sterile insulin syringe sector demands a holistic understanding of emerging drivers, structural headwinds, and evolving stakeholder expectations. This introduction sets the stage for a comprehensive examination of market dynamics, providing a foundational lens through which decision-makers can anticipate disruptions and capitalize on growth opportunities.

Revolutionary technological, regulatory, and sustainability forces converging to redefine sterile insulin syringe innovation and market expectations

The landscape of sterile insulin syringe development is undergoing a paradigm shift fueled by digital transformation and sustainability agendas. Smart insulin pens and digitally connected delivery systems are no longer niche innovations; they have become central to enabling data-driven dose personalization and remote patient monitoring, fostering seamless integration with continuous glucose monitoring and telehealth platforms. As a result, traditional syringe segments are adapting to incorporate Bluetooth connectivity and cloud-based data management features that enhance treatment adherence and empower patients to engage more proactively with their care teams.

Concurrently, advancements in needle gauge and length optimization are redefining injection comfort and clinical efficacy. The proliferation of ultra-thin, short needles-such as 4 mm by 32 g options-addresses patient concerns around injection pain and intramuscular dosing risks, while supported by clinical evidence demonstrating improved adherence and reduced dosing errors. Manufacturers are further exploring low-dead-space designs to minimize residual volume and insulin waste, reflecting a broader imperative to combine patient-centric features with cost-effective resource utilization.

Beyond technological breakthroughs, regulatory reforms are catalyzing robust safety requirements for single-use devices, with agencies globally endorsing auto-disable mechanisms to mitigate the risk of bloodborne pathogen transmission. In parallel, healthcare providers are reinforcing environmentally responsible procurement practices, pressing suppliers to adopt biodegradable materials, recyclable packaging, and carbon-neutral manufacturing processes. This confluence of digital, clinical, and ecological priorities is reshaping competitive positioning and driving a new era of value-based product strategies.

Assessing the multi-layered repercussions of 2025 tariff policies on sterile insulin syringe supply chains cost structures and competitive positioning

In April 2025, the U.S. administration enacted a sweeping tariff framework imposing a 10 percent global import duty on medical devices, combined with punitive reciprocal tariffs that levy up to 54 percent on certain imports from China, 20 percent on EU exports, and 24 percent on Japanese products. Although pharmaceuticals and active pharmaceutical ingredients were largely exempted, syringes and needles remain squarely within the scope of these measures, triggering immediate cost inflation across the sterile insulin syringe supply chain.

Industry stakeholders report that the universal 10 percent tariff has elevated landed costs for injectable delivery devices by an average of 8 to 12 percent, while the China-specific surcharge has led to selective sourcing strategies to mitigate exposure to the steepest duties. These developments have spurred domestic and near-shore manufacturing investments, as companies accelerate capacity expansions in the United States and Mexico to insulate production from tariff volatility. At the same time, distributors and healthcare providers are renegotiating contract terms, extending order lead times, and exploring supplier diversification to absorb incremental duty burdens.

Looking ahead, the cumulative impact of these trade measures extends beyond immediate price adjustments. Margins across the distribution channel are under mounting pressure, compelling original equipment manufacturers to reevaluate product portfolios and heighten emphasis on proprietary, high-value innovations. Meanwhile, the legal landscape remains dynamic, with ongoing litigation challenging certain tariff authorizations under emergency powers. Against this backdrop, agile supply chain reengineering and proactive tariff mitigation tactics have become critical imperatives for manufacturers and procurement teams alike.

Deconstructing multifaceted segmentation insights across types end users channels volumes gauge sizes and needle lengths to reveal nuanced demand shifts

Analyzing demand patterns across product types reveals that insulin cartridges for pumps, traditional disposable syringes, and pen injector needles each navigate distinct growth trajectories. Pen injector needles are benefiting from the rising adoption of smart insulin pens that integrate dose tracking and wireless connectivity, while cartridges continue to serve closed-loop pump systems favored in specialized care settings. Meanwhile, the core insulin syringe segment remains indispensable in clinics and community vaccination programs, underpinned by well-established reimbursement pathways.

Examining end-user categories highlights a dual-track consumption model. Hospitals and clinics maintain bulk purchasing power driven by procedural protocols and safety mandates, while the home care segment is expanding rapidly as patients transition to self-administration supported by telemedicine and remote monitoring. Retail pharmacies also play a pivotal role in channeling convenient device access, bridging prescription logistics with patient education to support adherence and disposal compliance.

Distribution channels themselves are evolving: distribution houses remain critical for high-volume tenders to institutional clients, yet online stores have emerged as a growth vector for home users seeking discreet purchase and doorstep delivery. Hospital pharmacies continue to demand scaled bulk orders delivered to integrated health systems, while retail pharmacy networks balance walk-in convenience with bundled device and supply offerings.

Diving deeper, product volume preferences span 0.3 mL, 0.5 mL, and 1 mL segments, reflecting diverse dosing profiles and injection regimens. Among needle gauge options, 29 g needles remain prevalent in clinical settings, whereas 30 g and 31 g options are increasingly selected for their reduced pain profile. Needle length variations-ranging from 4 mm to 12 mm-are carefully matched to injection sites and patient body mass, underscoring the need for tailored dispensing strategies that align clinical prescriptions with optimal device characteristics.

This comprehensive research report categorizes the Disposable Sterile Insulin Syringe market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Product Volume

- Needle Gauge

- Needle Length

- End User

- Distribution Channel

Uncovering distinct regional growth dynamics in the Americas EMEA and Asia-Pacific shaped by prevalence infrastructure and regulatory frameworks

In the Americas, the market is anchored by the United States and Canada, where high per-capita healthcare spending, supportive reimbursement frameworks, and a strong home care infrastructure drive sustained demand. Providers prioritize device safety features and digital connectivity as integral to chronic disease management models, and domestic manufacturing expansions are underway to counterbalance recent tariff pressures and secure supply chain resilience.

Within Europe, Middle East & Africa, regional heterogeneity shapes adoption patterns. The European Union’s medical device regulation creates a harmonized pathway for market entry, enabling premium device launches that emphasize safety engineering and eco-friendly materials. In contrast, Middle Eastern markets contend with elevated prevalence rates-nearly one in six adults in MENA has diabetes-and rely on a combination of public procurement and private clinics to meet urgent care needs. African markets, while lower in per-capita consumption, are exhibiting early signs of expansion as urbanization and healthcare access initiatives gain traction.

Asia-Pacific represents the fastest-growing opportunity, propelled by rising diabetes incidence and expanding healthcare infrastructure in China, India, and Southeast Asia. Rapid urbanization and increased per-capita incomes are driving home care adoption, while governments intensify investments in primary care facilities. In markets such as South Korea and Japan, advanced combinations of prefilled syringes and autoinjector platforms are gaining prominence, reflecting a preference for integrated, user-friendly delivery solutions.

This comprehensive research report examines key regions that drive the evolution of the Disposable Sterile Insulin Syringe market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining strategic investments product launches and partnerships among BD Terumo Nipro B Braun and SHL to drive competitive advantage

Global leaders in sterile insulin syringes have adopted differentiated strategies to navigate evolving market and trade conditions. Becton Dickinson has reinforced its domestic footprint with multimillion-dollar expansions in Connecticut and Nebraska, boosting capacity for safety-engineered syringes by over 40 percent and conventional syringes by more than 50 percent, while introducing ultra-thin 4 mm × 32 g pen needles that improve patient comfort and adherence. BD’s pipeline includes RFID-enabled prefillable syringe identification solutions and advanced glass prefillable platforms designed to support high-viscosity therapeutics.

Terumo has elevated its position by acquiring a leading drug product plant in Leverkusen, Germany, for €150 million, integrating prefilled syringe and vial manufacturing into its CDMO network to address biopharmaceutical customers’ demand for end-to-end combination products. Additionally, the company is expanding U.S. and Japanese production lines, reinforcing its commitment to global responsiveness and regulatory compliance across major markets.

Nipro Medical Corporation has focused on scalable manufacturing models in Asia, introducing super-sharp bevel syringes with plunger retention technology to minimize spillage and improve dose accuracy. The company has leveraged its regional distribution networks to penetrate emerging home care markets in India and China.

B. Braun has invested in low-dead-space insulin syringes with integrated needle designs that reduce drug waste and simplify disposal, coupling these hardware improvements with sustainability initiatives that phase out PVC, BPA, and DEHP from device components. Meanwhile, SHL Group collaborates with pharmaceutical companies to co-develop autoinjector platforms, leveraging modular design to expedite product customization and regulatory submissions across the EU and Asia.

This comprehensive research report delivers an in-depth overview of the principal market players in the Disposable Sterile Insulin Syringe market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdvaCare Pharma USA

- Angiplast Private Limited

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Bio-Med Private Limited

- Biocon Limited

- Cardinal Health, Inc.

- Eli Lilly and Company

- Gerresheimer AG

- Hindustan Syringes & Medical Devices Limited

- ICU Medical, Inc.

- Iscon Surgicals Limited

- Medtronic plc

- Nipro Corporation

- Novo Nordisk A/S

- Owen Mumford Ltd.

- Poly Medicure Limited

- Retractable Technologies, Inc.

- Sanofi

- Smiths Group plc

- SOL-Millennium Medical Group

- Terumo Corporation

- Wockhardt Limited

- Ypsomed Holding AG

Implement resilient supply chain diversification technology-driven innovation and sustainability-focused strategies to capture market leadership

Maximize resilience by diversifying manufacturing footprints across tariff-exposed regions and strengthening domestic supply capacities. Prioritize investments in local production lines to mitigate duty fluctuations, while maintaining strategic inventory buffers and long-term supplier agreements to ensure continuity.

Accelerate innovation by channeling R&D toward patient-centric features such as ultra-thin gauge options, low-dead-space designs, and digitally connected dose tracking. Deploy cross-functional teams to integrate data analytics platforms and telehealth interfaces, enabling value-based service models that differentiate offerings in high-growth channels.

Enhance market access through targeted channel segmentation, aligning portfolio mix with end user demands. Expand direct-to-patient channels via e-commerce partnerships for home care users, while reinforcing institutional tender capabilities for hospitals and clinics with elevated safety and regulatory compliance credentials.

Embed sustainability into core product strategies by adopting biodegradable polymer alternatives, optimizing packaging efficiency, and securing third-party environmental certifications. Leverage sustainability narratives to align with public procurement goals and ESG mandates among leading healthcare systems.

Cultivate strategic partnerships across the healthcare ecosystem, including digital health vendors, patient advocacy groups, and government agencies. Co-create pilot programs that demonstrate integrated device-and-data solutions, generating evidence to support reimbursement and adoption in both developed and emerging markets.

Articulating a robust multi-tier research methodology integrating primary stakeholder interviews secondary data triangulation and expert validation

This analysis is grounded in a rigorous, multi-tiered research framework combining both primary and secondary methodologies. Primary research incorporated in-depth interviews with over 30 senior executives across medical device manufacturers, healthcare providers, distributors, and regulatory agencies to gather nuanced perspectives on market shifts and competitive strategies.

Secondary research entailed comprehensive reviews of regulatory filings, trade publications, patent databases, corporate press releases, and international health organization reports. Key sources included government agencies such as the U.S. Trade Representative, the European Commission’s medical device directives, and data from the International Diabetes Federation.

Quantitative data was triangulated through cross-validation techniques, ensuring consistency across disparate datasets. Supply chain metrics and tariff schedules were corroborated against official customs data to ascertain accuracy. The segmentation framework was applied across six dimensions to map demand patterns and channel dynamics.

All findings underwent peer validation by an expert advisory panel comprising endocrinologists, supply chain specialists, and market analysts. This iterative validation process reinforced the reliability of insights and established the analysis as a robust basis for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Disposable Sterile Insulin Syringe market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Disposable Sterile Insulin Syringe Market, by Product Type

- Disposable Sterile Insulin Syringe Market, by Product Volume

- Disposable Sterile Insulin Syringe Market, by Needle Gauge

- Disposable Sterile Insulin Syringe Market, by Needle Length

- Disposable Sterile Insulin Syringe Market, by End User

- Disposable Sterile Insulin Syringe Market, by Distribution Channel

- Disposable Sterile Insulin Syringe Market, by Region

- Disposable Sterile Insulin Syringe Market, by Group

- Disposable Sterile Insulin Syringe Market, by Country

- United States Disposable Sterile Insulin Syringe Market

- China Disposable Sterile Insulin Syringe Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Consolidating critical insights to illuminate strategic imperatives guiding stakeholder decision-making in a rapidly evolving market

The sterile insulin syringe sector is at a pivotal juncture, shaped by converging forces of digital transformation, regulatory evolution, and geopolitical trade policies. Emerging trends-such as smart injection devices, refined needle designs, and eco-conscious materials-are redefining stakeholder expectations and competitive benchmarks.

Tariff reforms implemented in 2025 have catalyzed a strategic pivot toward domestic and near-shore manufacturing, emphasizing the criticality of supply chain resilience and proactive duty mitigation. Segmentation insights underscore the nuanced preferences across product types, end users, and distribution channels, while regional analysis highlights distinct growth vectors in mature and emerging markets alike.

Leading companies are investing in capacity expansions, strategic acquisitions, and partnerships to secure market share and accelerate innovation pipelines. As the competitive landscape intensifies, success will hinge on integrating patient-centric design, data-driven value propositions, and sustainable practices.

Stakeholders must adopt an agile, foresight-driven approach-leveraging comprehensive insights to navigate uncertainties and harness growth opportunities. By aligning organizational capabilities with evolving market imperatives, companies can chart a clear path toward enduring leadership in the sterile insulin syringe market.

Drive market leadership in sterile insulin syringes with direct engagement and personalized support from Ketan Rohom Associate Director Sales & Marketing

Seize the opportunity to transform your strategic approach to the sterile insulin syringe market by accessing the full comprehensive report. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to unlock tailored insights, engage in personalized consultations, and gain exclusive access to proprietary data that will strengthen your competitive positioning and guide informed decision-making. Begin your journey toward market leadership and operational excellence by connecting with Ketan today

- How big is the Disposable Sterile Insulin Syringe Market?

- What is the Disposable Sterile Insulin Syringe Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?