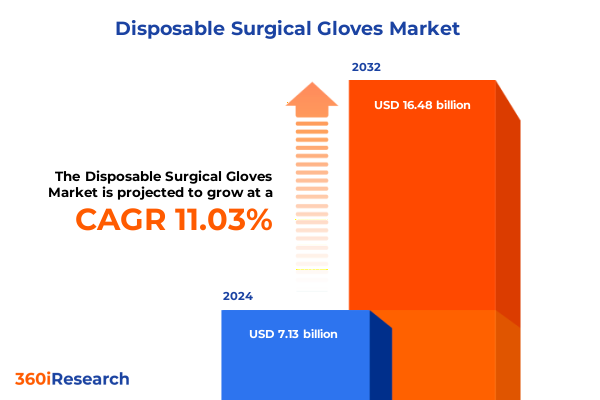

The Disposable Surgical Gloves Market size was estimated at USD 7.84 billion in 2025 and expected to reach USD 8.63 billion in 2026, at a CAGR of 11.18% to reach USD 16.48 billion by 2032.

Exploring the Critical Role and Evolving Dynamics of Disposable Surgical Gloves in Safeguarding Patient Health in Modern Healthcare Settings

Disposable surgical gloves stand at the forefront of infection control, forming the first line of defense against cross-contamination and safeguarding both patient and clinician. From traditional latex formulations to advanced synthetic alternatives, these gloves have evolved in composition, performance, and ergonomic design to meet the stringent demands of modern healthcare. Increasing awareness of hospital-acquired infections, combined with global public health emergencies, has elevated the role of disposable barriers from a routine safety measure to a critical component of patient care protocols.

In recent years, the medical community has witnessed a dramatic expansion in the variety of glove materials, each engineered to balance tactile sensitivity, chemical resistance, and allergenicity. Natural rubber latex, valued for its elasticity and fit, coexists with neoprene for enhanced chemical protection, nitrile for puncture resistance, polyisoprene for latex-like comfort without protein risks, and vinyl for cost-effective procedures with lower exposure demands. These technological advancements have been complemented by rigorous regulatory oversight, ensuring that each glove variant adheres to standards that prioritize both performance and wearer safety.

As healthcare facilities navigate evolving procedural requirements and heightened scrutiny around sterilization practices, understanding the multifaceted nature of disposable surgical gloves becomes essential for stakeholders. This introduction lays the groundwork for a deeper exploration of market shifts, policy impacts, segmentation insights, regional nuances, and strategic imperatives that shape the trajectory of this indispensable medical device.

Uncovering Paradigm Shifts Reshaping the Disposable Surgical Gloves Market Landscape Through Innovation, Sustainability, and Regulatory Evolution

The disposable surgical gloves market has been reshaped by a confluence of technological breakthroughs, environmental imperatives, and regulatory reforms. Innovations in polymer science have yielded thinner, stronger glove substrates, unlocking heightened tactile precision while maintaining robust barrier protection. This development, spurred by clinician feedback and ergonomic research, has facilitated delicate surgical manipulations and minimally invasive procedures without compromising on safety.

Parallel to material upgrades, sustainability considerations have gained traction across the value chain. Manufacturers have begun integrating post-industrial recycling streams and biodegradable polymer blends, thereby mitigating the environmental footprint of single-use products. At the same time, regulatory bodies have introduced more stringent testing protocols for glove integrity and biocompatibility, driving producers to invest in advanced quality-assurance systems and transparent supply-chain traceability.

Moreover, the legacy of global health crises has illuminated vulnerabilities in procurement models, prompting the adoption of strategic reserves, diversified sourcing, and localized production hubs. Digital transformation, incorporating AI-powered defect detection and blockchain-based lot tracking, has further enhanced responsiveness to demand surges and recall management. Taken together, these transformative shifts underscore a market that is both resilient and adaptive, poised to meet the evolving requirements of clinicians, patients, and policymakers alike.

Assessing the Ripple Effects of 2025 US Tariffs on Disposable Surgical Gloves Supply Chains, Pricing Strategies, and Market Accessibility Nationwide

The imposition of new tariffs on imported raw materials and finished products in 2025 has generated ripple effects throughout the disposable surgical gloves ecosystem. Increased duties on key inputs such as nitrile precursors and natural rubber have elevated production costs for downstream manufacturers, prompting a reassessment of procurement strategies and pricing structures. Several producers have responded by seeking domestic feedstock alternatives or exploring long-term sourcing agreements in tariff-exempt regions, aiming to stabilize cost volatility and maintain competitive pricing.

Hospitals and clinics have faced the dual challenge of absorbing incremental price increases while adhering to budget constraints. In some cases, procurement teams have opted for centralized tendering processes and framework agreements to leverage volume discounts and secure uninterrupted supply. At the same time, smaller ambulatory surgical centers and research institutes have encountered tighter margins, leading them to negotiate flexible payment terms or reevaluate the portfolio mix of sterile versus non-sterile glove usage.

Beyond cost implications, the 2025 tariffs have catalyzed discussions on reshoring components of the supply chain. Strategic investors have accelerated capacity expansions in North America, aligning with broader policy incentives to reduce dependency on overseas suppliers. This shift towards localized manufacturing has the potential to shorten lead times, enhance quality oversight, and cushion against future trade disruptions. Overall, the tariff landscape has underscored the importance of supply-chain diversification and proactive cost management in sustaining market stability.

Illuminating Core Insights from Diverse Material, End User, Type, and Distribution Channel Segmentation That Define Industry Growth Drivers

Insights derived from a deep segmentation analysis reveal differentiated growth drivers and strategic considerations spanning material composition, end-user application, glove type, and distribution pathways. In terms of composition, natural rubber latex remains valued for surgical precision and elasticity, while neoprene offers robust chemical protection in high-hazard settings. Nitrile’s puncture resistance and hypoallergenic profile have positioned it as the fastest-adopted synthetic alternative, even as polyisoprene emerges as a premium option for professionals seeking latex-like comfort without protein exposure. Vinyl continues to serve lower-risk procedures where cost-effectiveness outweighs barrier performance.

End-user segmentation further refines market dynamics by highlighting discrete needs across ambulatory surgical centers, diagnostic laboratories, hospitals, and research institutes. Ambulatory centers prioritize cost-efficient, non-sterile solutions for outpatient interventions, whereas diagnostic labs demand high chemical resistance and dexterity. Within hospital settings, private institutions often emphasize premium sterile gloves backed by service agreements, while public hospitals balance performance requirements with tighter budget parameters. Research institutes, in turn, require specialized formulations to accommodate sensitive assays and contamination-free environments.

The distinction between non-sterile and sterile glove offerings underscores procedural relevance, with sterile variants dominating surgical suites and non-sterile models more prevalent in general examination and support functions. Distribution channels bridge supply and demand through traditional drug stores, diversified hospital pharmacy systems-encompassing both in-house and third-party operations-industrial distributors, and the burgeoning online retail space. E-commerce marketplaces and dedicated manufacturer websites have unlocked direct-to-end-user procurement, complementing brick-and-mortar channels and accelerating product accessibility. Collectively, these segmentation insights inform targeted product development, pricing strategies, and distribution optimization for industry participants.

This comprehensive research report categorizes the Disposable Surgical Gloves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Type

- End User

- Distribution Channel

Analyzing Regional Variations in Demand, Adoption, and Market Trends Across the Americas, Europe Middle East & Africa, and Asia-Pacific Zones

Regional dynamics in the disposable surgical gloves market reflect a tapestry of regulatory regimes, healthcare infrastructure maturity, and procurement paradigms. In the Americas, elevated standards for clinical safety and widespread adoption of nitrile formulations have driven demand, particularly in the United States and Canada. Collaborative initiatives between federal agencies and manufacturers have streamlined approval pathways and facilitated rapid scale-up during public health emergencies, reinforcing an innovation-friendly ecosystem.

Europe, the Middle East, and Africa present a heterogeneous landscape shaped by the European Union’s Medical Devices Regulation, Gulf Cooperation Council standards, and diverse procurement frameworks across sub-Saharan and North African markets. Stringent compliance requirements in the EU have spurred investments in quality-management systems and traceability, while cost-sensitive regions in Africa gravitate towards vinyl and non-sterile variants for routine clinical use. Meanwhile, Gulf states leverage strategic public-private partnerships to ensure supply security and support emerging local production capacities.

In the Asia-Pacific, manufacturing prowess in key markets such as China, Malaysia, and Thailand has created a global export hub for surgical gloves. However, rising labor costs and environmental regulations are prompting industry consolidation and technological upgrades. Emerging markets including India and Southeast Asian nations continue to expand healthcare spending, with procurement prioritizing price competitiveness. At the same time, regional trade agreements and tariff policies influence cross-border flows, underscoring the importance of geopolitical considerations in procurement planning.

This comprehensive research report examines key regions that drive the evolution of the Disposable Surgical Gloves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players Driving Innovation, Strategic Collaborations, and Competitive Differentiation in the Global Disposable Surgical Gloves Arena

A cadre of leading manufacturers and distributors has emerged as pivotal architects of innovation and competitive differentiation in the surgical gloves domain. Industry incumbents are investing strategically in capacity expansion, proprietary polymer formulations, and end-to-end supply-chain integration to meet surging demand and evolving safety standards. Collaborative ventures between established producers and specialized technology firms are accelerating the development of ultra-thin, high-strength materials that cater to both surgical precision and extended wear times.

Beyond product innovation, major players are forging cross-sector partnerships to enhance sustainability credentials. Initiatives range from converting manufacturing waste streams into energy-efficient feedstocks to deploying water-conservation measures in rubber processing facilities. Such endeavors not only address regulatory pressures but also resonate with procurement teams seeking eco-friendly alternatives. Simultaneously, a dynamic M&A landscape is reshaping market concentration, as companies pursue strategic acquisitions to augment geographic reach and broaden service offerings.

Digital transformation remains a core focus among leading companies, with investments in automated inspection systems, data-driven procurement platforms, and blockchain-enabled lot verification. These platforms empower clinicians and supply-chain managers with real-time visibility into product authenticity, manufacturing provenance, and compliance documentation. Collectively, the actions of these key organizations are setting new benchmarks for performance, sustainability, and transparency across the disposable surgical gloves market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Disposable Surgical Gloves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abbott Laboratories

- Anhui Tianyuan Latex Technology Co.,Ltd.

- Ansell Limited

- Asma Rubber Products Pvt. Ltd.

- B. Braun SE

- Becton Dickinson and Company

- Berner International GmbH

- Boston Scientific Corporation

- Cardinal Health Inc.

- Crown Healthcare Ltd.

- Cypress Medical Products LLC

- Dynarex Corporation

- Harps Holdings Sdn. Bhd

- Honeywell International Inc.

- Kimberly-Clark Corporation

- Kossan Rubber Industries Bhd.

- Medisafe Technologies

- Medline Industries, Inc.

- Medtronic PLC

- Motex Healthcare Corporation

- Mölnlycke Health Care AB

- Sara Healthcare Pvt. Ltd.

- SHOWA Group

- Smart Glove Corporation Sdn Bhd.

- Supermax Corporation Berhad

Recommending Targeted Actions and Strategic Priorities for Industry Leaders to Enhance Operational Resilience and Market Penetration Strategies

Industry leaders must embrace a proactive stance to navigate ongoing market fluctuations and capitalize on emerging opportunities. Prioritizing the integration of sustainable materials and circular-economy practices within the manufacturing footprint will not only align with tightening environmental regulations but also resonate with ESG-focused procurement mandates. In parallel, diversifying supply chains through strategic partnerships and regional manufacturing alliances can attenuate tariff-driven cost pressures and ensure uninterrupted availability during demand surges.

Allocating resources to digital quality-assurance systems, including AI-powered inspection and blockchain-based track-and-trace, will enhance product integrity and bolster stakeholder confidence. Procurement teams should also consider tiered product portfolios that balance premium sterile offerings with cost-effective non-sterile alternatives, thereby maximizing clinical applicability across diverse end-use settings. Furthermore, strengthening relationships with hospital group purchasing organizations and clinical end users through value-added support services will foster long-term contracts and service agreements.

Finally, continuous engagement with regulatory bodies and participation in standards committees will enable companies to anticipate policy shifts and influence framework development. By adopting these targeted actions, industry participants can fortify operational resilience, sustain competitive advantage, and drive meaningful growth in the rapidly evolving disposable surgical gloves market.

Detailing the Comprehensive Research Methodology, Data Sources, and Analytical Frameworks Underpinning the Market Study with Rigor and Transparency

The findings presented in this report are grounded in a rigorous research methodology combining primary and secondary data sources, expert interviews, and proprietary analytical frameworks. Secondary research encompassed a thorough review of regulatory filings, published standards, peer-reviewed journals, and trade association publications to establish a foundational understanding of product specifications, compliance requirements, and market drivers.

Primary research leveraged structured interviews with procurement managers, clinical practitioners, and manufacturing executives to gain nuanced perspectives on purchasing criteria, supply-chain challenges, and innovation priorities. These qualitative insights were triangulated with quantitative data extracted from customs records, distribution channel performance metrics, and industry financial disclosures. A multi-layered approach to data validation, including cross-site consistency checks and trend analysis, ensured the reliability and relevance of insights.

Analytical models were built upon a bespoke framework that integrates material science advancements, regulatory impact assessment, and segmentation analysis to uncover critical growth enablers. Geospatial mapping tools were utilized to visualize regional supply-chain flows and tariff exposure, while scenario planning exercises tested the resilience of procurement strategies under varying market conditions. This methodology underscores the depth and transparency of the research process, providing stakeholders with actionable intelligence validated by robust evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Disposable Surgical Gloves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Disposable Surgical Gloves Market, by Material

- Disposable Surgical Gloves Market, by Type

- Disposable Surgical Gloves Market, by End User

- Disposable Surgical Gloves Market, by Distribution Channel

- Disposable Surgical Gloves Market, by Region

- Disposable Surgical Gloves Market, by Group

- Disposable Surgical Gloves Market, by Country

- United States Disposable Surgical Gloves Market

- China Disposable Surgical Gloves Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Synthesis of Critical Findings Highlighting Market Dynamics, Strategic Imperatives, and the Path Forward for Stakeholders

In synthesizing the multifaceted dynamics of the disposable surgical gloves market, several key themes emerge. Technological progress in material engineering has elevated product performance and comfort, meeting heightened clinical expectations. Simultaneously, environmental and regulatory pressures are driving manufacturers toward sustainable practices and transparent supply-chain operations. The 2025 US tariffs have spotlighted the fragility of single-source dependencies, reinforcing the strategic imperative of supply-chain diversification and domestic capacity expansion.

Segmentation insights have illuminated distinct requirements across material types, end-user settings, glove types, and distribution channels, enabling tailored product development and go-to-market strategies. Regional analyses reveal the interplay of regulatory frameworks, healthcare infrastructure maturity, and trade policies in shaping procurement priorities and market accessibility. Leading companies are differentiating through innovation partnerships, sustainability initiatives, and digital transformation, setting elevated performance benchmarks.

Looking ahead, market participants must navigate a complex landscape characterized by evolving clinical standards, geopolitical dynamics, and rising sustainability expectations. By aligning strategic initiatives with actionable recommendations-spanning material innovation, supply-chain resilience, and regulatory engagement-stakeholders can position themselves for sustained success. This conclusion encapsulates the strategic imperatives that will drive robust growth and resilience in the disposable surgical gloves sector.

Engage with Ketan Rohom to Secure the In-Depth Market Intelligence Report and Empower Your Strategic Decision-Making in Disposable Surgical Gloves

To access the comprehensive market research report and gain exclusive insights tailored to your strategic priorities, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise in market dynamics will ensure you receive the most relevant data, bespoke analyses, and guidance necessary to drive growth in the disposable surgical gloves sector. Engage now to secure your competitive advantage, customize the research to your organizational needs, and leverage actionable intelligence that empowers informed decision-making across procurement, product development, and regulatory planning. Connect with Ketan today to discuss pricing tiers, sample deliverables, and value-added services designed to elevate your market strategy and operational resilience.

- How big is the Disposable Surgical Gloves Market?

- What is the Disposable Surgical Gloves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?