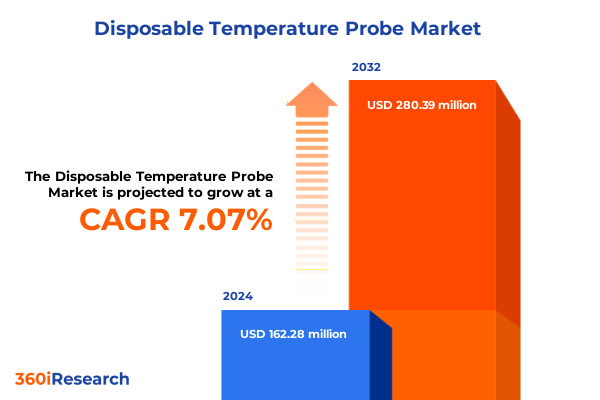

The Disposable Temperature Probe Market size was estimated at USD 171.18 million in 2025 and expected to reach USD 183.96 million in 2026, at a CAGR of 7.30% to reach USD 280.39 million by 2032.

Exploring the Evolution, Market Drivers, and Strategic Imperatives for Disposable Temperature Probes in Today’s Dynamic Healthcare and Research Environments

Healthcare and research settings have experienced a paradigm shift in recent years, emphasizing both patient safety and data precision. At the heart of these shifts lie disposable temperature probes, single-use devices designed to deliver accurate core and peripheral body temperature measurements while mitigating risks of cross-contamination. Innovations in materials science, sensor miniaturization, and wireless integration have bolstered their adoption, enabling clinicians and researchers to monitor vital signs more reliably across diverse environments. This evolution reflects a broader industry trend toward disposable, point-of-care diagnostics that prioritize both performance and infection control.

Moreover, regulatory frameworks have evolved to incentivize single-use technologies, driving manufacturers to invest in sustainable materials and enhanced sensor accuracy. Healthcare providers are increasingly mandated to adopt protocols that reduce healthcare-associated infections, making disposable probes an operational imperative for hospitals, ambulatory care centers, and home health services. Concurrently, research institutions and veterinary practices have embraced these probes for their convenience and consistent performance, illustrating the cross-sector applicability of these technologies.

Today’s market participants must navigate a landscape characterized by rapid technological advancements, tightening regulations, and shifting end-user expectations. This executive summary offers a concise yet comprehensive overview of the disposable temperature probe market’s current state, transformative trends, tariff implications, segmentation nuances, regional dynamics, competitive positioning, and strategic recommendations. By framing these insights within a unified narrative, stakeholders will be equipped to make informed decisions and capitalize on emerging opportunities.

Uncovering the Major Technological, Regulatory, and Supply Chain Transformations Shaping the Future of Disposable Temperature Probe Solutions Across Diverse Care Settings

Technological breakthroughs have fundamentally altered the disposable temperature probe landscape, introducing advanced sensor modalities, integrated connectivity, and smart analytics capabilities. Contact sensor designs now leverage infrared arrays that deliver faster, noninvasive readings with minimal patient discomfort. Furthermore, the incorporation of Bluetooth and near-field communication modules has enabled seamless data transmission to electronic health record systems, enhancing real-time patient monitoring and telemedicine applications. These innovations are not only improving clinical workflow efficiency, but also shaping new use cases in remote care and post-operative recovery monitoring.

Regulatory pressures have further catalyzed this evolution by imposing stringent sterilization standards and incentivizing single-use device adoption to curb hospital-acquired infections. Healthcare providers are consequently shifting procurement priorities toward disposable solutions that align with these durability and safety mandates. In parallel, cost-efficiency programs are driving procurement teams to seek probes that balance per-unit affordability with high accuracy and reliability, fostering a fertile ground for disruptive entrants and established players alike.

Meanwhile, global supply chains have been recalibrating in response to trade adjustments, environmental considerations, and supplier diversification strategies. Manufacturers are increasingly exploring local production partnerships and modular assembly frameworks to reduce lead times and ensure continuity of supply. Collectively, these transformative shifts underscore an industry in transition, where technological prowess, regulatory adherence, and operational resilience converge to define competitive advantage.

Analyzing How the 2025 United States Tariffs on Imported Components Are Reshaping Supply Chains, Cost Structures, and Sourcing Strategies for Disposable Temperature Probes

In 2025, the United States government enacted a series of tariffs targeting imported medical device components, significantly affecting temperature sensor modules, plastic casings, and electronic subassemblies commonly sourced from Asia. These measures have introduced more pronounced cost pressures for manufacturers reliant on offshore production, leading to higher landed costs and narrowed profit margins. Consequently, many suppliers have reevaluated their sourcing strategies, opting for nearshore manufacturing and diversified vendor networks to mitigate tariff-induced risks and maintain competitive pricing.

Furthermore, the tariff landscape has compelled device makers to accelerate vertical integration efforts, bringing critical sensor fabrication and overmolding processes in-house. This strategic pivot not only offsets some of the heightened import duties, but also enhances quality control, reduces lead times, and strengthens intellectual property protection. Simultaneously, procurement teams have renegotiated long-term contracts with domestic suppliers to secure tariff-free raw materials and components, fostering closer collaboration and shared risk frameworks.

However, these adjustments have introduced transitional challenges, including capital investment in local machinery, workforce training, and compliance with domestic manufacturing regulations. Nevertheless, companies that have proactively embraced reshoring and supplier diversification are now experiencing improved supply chain resilience and predictable cost structures. As a result, stakeholders across the value chain are better positioned to navigate future trade policy shifts and fortify their market standing.

Leveraging Insights from Product Type, End User, Application, Technology, and Sales Channel Segmentation to Illuminate Strategic Opportunities in the Disposable Temperature Probe Market

Product type segmentation reveals that axillary probes remain the preferred choice in outpatient and home care due to their noninvasive design and patient comfort, while esophageal and rectal probes are predominantly utilized in critical care and surgical environments, where rapid core temperature assessment is paramount. Oral probes serve as a versatile option in general clinical settings, striking a balance between accuracy and ease of use. Meanwhile, tympanic probes, leveraging infrared sensing technology, have gained traction for their swift readings and minimal patient disruption, particularly in pediatric and emergency department scenarios.

Examining end-user segmentation, hospitals continue to dominate consumption, driven by stringent monitoring protocols and high patient turnover, whereas ambulatory care centers leverage portable probe solutions for quick diagnostics. Home care services are increasingly adopting disposable temperature probes to enable remote patient monitoring and telehealth initiatives, improving chronic disease management and post-discharge follow-ups. Research laboratories demand probes with enhanced precision and data logging capabilities for experimental reproducibility, and veterinary clinics require specialized probes calibrated for various animal anatomies in livestock and companion animal healthcare.

When viewed through the lens of application, food safety inspections incorporate disposable probes to ensure regulatory compliance and streamline sanitation workflows in processing plants. Patient monitoring applications prioritize single-use probes to reduce infection risk, while research deployments value their consistency and minimal cross-experiment contamination. Veterinary applications, spanning livestock surveillance to clinical diagnostics, emphasize probes designed for rugged use and species-specific calibration.

Technology segmentation underscores a bifurcation between chemical strip probes, valued for low cost and simplicity, and electronic probes, which integrate contact sensors for direct tissue interface or infrared sensors for noncontact readings. Electronic contact sensors yield high-fidelity data ideal for critical care, and infrared variants cater to rapid screening scenarios. Sales channel segmentation highlights distributors as key intermediaries for large institutional orders, hospital channels that bundle probes with comprehensive device portfolios, online retailers that enable direct-to-consumer access, and pharmacies and drug stores serving home care and ambulatory segments.

This comprehensive research report categorizes the Disposable Temperature Probe market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Sales Channel

- Application

- End User

Deciphering the Regional Dynamics and Growth Drivers Shaping Disposable Temperature Probe Adoption Across the Americas, EMEA, and Asia-Pacific Markets

In the Americas region, advanced healthcare infrastructure and proactive regulatory frameworks are driving robust adoption of disposable temperature probes across acute care and home health networks. The United States, in particular, has seen an uptick in telehealth utilization, prompting end users to integrate probes with remote patient monitoring platforms. Meanwhile, Latin American markets are showing gradual uptake as hospitals and clinics seek high-value yet cost-effective single-use measurement devices to manage infection control.

Europe, the Middle East, and Africa present a heterogeneous landscape, where Western European nations enforce rigorous medical device regulations that favor disposable probes with validated performance and sustainability credentials. The Middle East has accelerated procurement to support large-scale hospital expansions and specialty clinics, often leveraging government tenders for standardized single-use instruments. In Africa, adoption remains nascent but is growing as public health initiatives and international aid programs introduce disposable probes into primary care and maternal health initiatives.

Asia-Pacific exhibits dynamic growth trajectories fueled by rising healthcare expenditure, expanding clinical infrastructure, and an increasing focus on patient safety. Advanced markets like Japan and Australia are early adopters of connected probe technologies, while emerging economies in Southeast Asia are balancing cost considerations with the imperative to reduce cross-contamination in high-volume hospital settings. Across all regions, tailored sales and distribution strategies are critical, as local reimbursement policies, import regulations, and clinical practices shape procurement decisions.

This comprehensive research report examines key regions that drive the evolution of the Disposable Temperature Probe market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Innovators, Strategic Collaborations, and Competitive Differentiation Strategies Driving Market Leadership in Disposable Temperature Probe Manufacturing

Prominent manufacturers have distinguished themselves through targeted investments in sensor R&D, strategic partnerships, and operational scale. Leading companies have introduced next-generation probes that combine miniaturized infrared arrays with embedded analytics, enabling predictive alerting and integration with advanced patient monitoring systems. These market leaders have also pursued certifications across global regulatory bodies, reinforcing their credibility and broadening their addressable markets.

Collaborations between established medical device firms and technology startups have further accelerated product innovation, with joint ventures yielding hybrid solutions that merge disposable sensor accuracy with cloud-based data management platforms. Concurrently, competitive strategies such as value-added bundling-integrating probes with comprehensive patient monitoring kits-have emerged to differentiate offerings in price-sensitive institutional procurement environments.

Meanwhile, tier-two suppliers are capitalizing on niche applications, developing probes tailored for veterinary or food safety contexts. These specialized providers often maintain agile manufacturing footprints, enabling rapid customization and small-batch production to meet bespoke client requirements. Collectively, the competitive landscape highlights an ecosystem of innovation, strategic alliances, and operational excellence, where companies vie to deliver both technological differentiation and cost efficiency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Disposable Temperature Probe market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpha Technics Co.

- Amphenol Advanced Sensors

- Amphenol Corporation

- Analog Devices Inc.

- BSK Technologies

- Cardio Beats LLP

- Delta-T Devices Ltd.

- Emerson Electric Co.

- Explore Medical Accessories LLP

- General Electric Company

- Henan Joinsjoy Industrial Co. Ltd.

- Honeywell International Inc.

- Koninklijke Philips N.V.

- Med-Linket

- Medtronic plc

- Pacific Medical Inc.

- R. M. Medical

- SCW Medicath Ltd.

- Shanghai Woodlands International Trading Co. Ltd.

- Siemens AG

- TE Connectivity Ltd.

- TED-MED Equipments Private Limited

- VVM Biotech Infra Private Limited

- Zensorate

Implementing Strategic Supplier Partnerships, AI-Driven Sensor Innovation, and Regulatory Engagement to Strengthen Market Position and Maximize Growth Potential

Industry leaders should prioritize forging strategic alliances with component suppliers and contract manufacturers to lock in preferential pricing and ensure uninterrupted access to critical sensor and casing materials. By establishing long-term supply agreements and embracing demand-driven production models, companies can enhance supply chain agility and reduce exposure to tariff volatility. In parallel, investing in advanced sensor R&D with a focus on AI-enabled accuracy improvements will unlock new clinical use cases and position organizations as the go-to provider for precision-centric temperature monitoring solutions.

Moreover, companies must engage proactively with regulatory bodies to align device specifications with emerging safety and sustainability guidelines. Early participation in standards development can facilitate smoother product approvals and strengthen market credibility. Alongside regulatory engagement, innovative go-to-market strategies-such as bundled service offerings that combine probes with digital analytics platforms-can create value differentiation and deepen customer relationships in both institutional and home care settings.

Finally, executives should champion cross-functional teams that integrate commercial, engineering, and clinical expertise to accelerate time-to-market for new probe technologies. By fostering a culture of rapid prototyping and iterative feedback, organizations will be better equipped to respond to shifting end-user expectations and maintain a competitive edge in a rapidly evolving healthcare landscape.

Detailing a Comprehensive Mixed-Method Research Framework Integrating Primary Interviews, Secondary Data Analysis, and Strategic Analytical Models for Insight Accuracy

This research adopts a rigorous mixed-methods approach, blending primary and secondary data collection to ensure robust insight generation. Primary research involved in-depth interviews with senior procurement executives, clinical leaders, and R&D heads across hospitals, ambulatory care centers, research labs, and veterinary clinics. These discussions provided firsthand perspectives on device requirements, procurement drivers, and emerging use cases, informing the qualitative narrative on market dynamics.

Secondary research encompassed an exhaustive review of regulatory filings, technical whitepapers, patent databases, and scientific publications to validate sensor performance characteristics and manufacturing trends. Additionally, industry association reports and public health guidelines were analyzed to contextualize infection control imperatives and sustainability frameworks. Data triangulation was achieved by cross-referencing primary insights with published evidence, ensuring that the findings accurately represent current technological, regulatory, and operational realities.

Analytical frameworks, including Porter’s Five Forces and SWOT analysis, were applied to assess competitive intensity, barriers to entry, and strategic opportunities. Segmentation matrices were developed to map product types, end users, applications, technologies, and sales channels, yielding granular insights on market behavior. Finally, regional models were constructed by synthesizing macroeconomic indicators, healthcare expenditure trends, and procurement policy landscapes across the Americas, EMEA, and Asia-Pacific to illuminate geographic variation in adoption patterns.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Disposable Temperature Probe market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Disposable Temperature Probe Market, by Product Type

- Disposable Temperature Probe Market, by Technology

- Disposable Temperature Probe Market, by Sales Channel

- Disposable Temperature Probe Market, by Application

- Disposable Temperature Probe Market, by End User

- Disposable Temperature Probe Market, by Region

- Disposable Temperature Probe Market, by Group

- Disposable Temperature Probe Market, by Country

- United States Disposable Temperature Probe Market

- China Disposable Temperature Probe Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Strategic Imperatives and Insight-Driven Imperatives to Navigate Opportunity and Risk in the Evolving Disposable Temperature Probe Ecosystem

The disposable temperature probe market stands at a critical juncture, defined by rapid technological innovation, evolving regulatory mandates, and strategic supply chain realignments. Through examining transformative shifts, tariff impacts, segmentation nuances, regional dynamics, and competitive strategies, this report uncovers a complex ecosystem where agility and innovation are paramount. Stakeholders who proactively invest in AI-enhanced sensor development, sustainable manufacturing practices, and resilient sourcing models will be best positioned to capture emerging opportunities and mitigate operational risks.

Moreover, the cross-sector applicability of disposable probes-from acute care to telehealth, research, food safety, and veterinary applications-underscores the expansive market potential that extends beyond traditional hospital settings. Companies that align product development with end-user insights and regional procurement policies can unlock new revenue streams and solidify their leadership credentials. Concurrently, industry participants that engage early with regulatory bodies and standards organizations will streamline approvals and bolster their market credibility.

Ultimately, strategic foresight and collaborative innovation will define competitive differentiation in the coming years. By leveraging the comprehensive insights presented in this summary, decision-makers can craft evidence-based strategies that drive technological advancement, enhance patient and consumer safety, and secure sustainable growth within the dynamic disposable temperature probe landscape.

Engage with Ketan Rohom to Secure Insider Access to the Definitive Disposable Temperature Probe Market Research Report and Drive Strategic Growth

Take decisive ownership of your strategic posture by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to unlock unparalleled insights into the disposable temperature probe market and accelerate your organization’s competitive growth trajectory. Ketan’s deep domain expertise will guide you through a tailored review of the comprehensive market research report, ensuring that you derive maximum value, address your specific business challenges, and uncover actionable opportunities in product innovation, supply chain optimization, and regulatory alignment. By scheduling a personalized consultation, you will gain early access to proprietary data, competitive intelligence, and executive-level recommendations that are essential for cementing market leadership.

Whether you seek to refine your go-to-market strategy, enhance profit margins, or evaluate strategic partnerships, Ketan’s consultative approach will equip you with the precise insights and customized frameworks required to navigate complexities and advance your commercial objectives. Reach out now to convert strategic foresight into tactical execution and secure your copy of the definitive market research report today.

- How big is the Disposable Temperature Probe Market?

- What is the Disposable Temperature Probe Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?