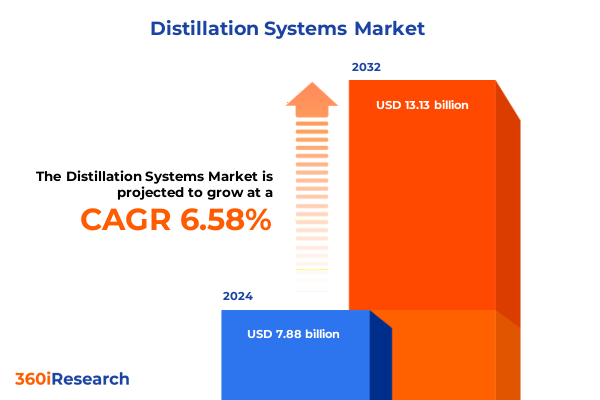

The Distillation Systems Market size was estimated at USD 8.42 billion in 2025 and expected to reach USD 8.92 billion in 2026, at a CAGR of 6.56% to reach USD 13.13 billion by 2032.

Understanding the Transformative Dynamics of Distillation Systems: Key Drivers, Technological Innovations, and Strategic Imperatives to Guide Leadership Decisions

The distillation systems market stands at the intersection of technological innovation, regulatory scrutiny, and evolving end-user demands. As industries across the globe strive to improve process efficiency, reduce environmental footprints, and maintain competitive advantage, the foundational role of distillation equipment has never been more pronounced. Continuous advancements in process intensification, digital integration, and sustainable design are reshaping how plant operators approach separation, purification, and solvent recovery tasks. In parallel, tighter emissions standards and a heightened focus on energy consumption are compelling stakeholders to reevaluate legacy systems and embrace next-generation solutions.

In this dynamic landscape, decision makers must synthesize a diverse array of factors-from raw material volatility and international trade policies to the maturation of emerging technologies and shifting application requirements. With batch operations coexisting alongside sophisticated continuous distillation units, market participants face a complex array of choices when selecting the optimal configuration. Furthermore, the proliferation of hybrid distillation techniques and the integration of advanced controls underscore the importance of strategic foresight. This introductory overview frames the critical drivers, constraints, and opportunities that shape the distillation systems ecosystem, setting the stage for a deeper exploration of transformative shifts, tariff impacts, segmentation insights, regional nuances, key player strategies, and actionable recommendations designed to inform high-impact decisions.

Navigating Revolutionary Shifts in Distillation System Technologies and Market Dynamics Reshaping Industry Competitiveness and Operational Value Chains

Over the past several years, distillation system providers and end-users have embarked on a period of rapid evolution driven by a convergence of digitalization, modularization, and sustainability imperatives. Digital twins, enabled by advanced sensor networks and predictive analytics, are now being leveraged to perform real-time performance optimization and proactive maintenance scheduling. This shift from reactive to predictive process management has reduced unplanned downtime and improved throughput consistency. Concurrently, the rise of modular, skid-mounted distillation units offers greater flexibility for retrofit projects and pilot-scale testing, allowing operators to scale capacity incrementally and rapidly adapt to product portfolio changes.

Sustainability considerations are prompting further innovation, as water- and energy-saving configurations become standard rather than optional. Heat integration networks and hybrid distillation techniques-combining fractional, steam, and extractive methods-are being implemented to minimize utility consumption while maximizing separation efficiency. At the same time, the transition toward circular economy principles has elevated the importance of solvent recovery and waste-stream purification applications. Collectively, these technological and process shifts are redefining competitive benchmarks, enabling companies to achieve lower total cost of ownership, faster time to market, and enhanced compliance with stringent environmental regulations.

Assessing the Widespread Consequences of 2025 United States Tariffs on Distillation Equipment Supply Chains, Cost Structures, and Investment Strategies

In 2025, a series of tariff measures implemented by the United States government have introduced notable cost headwinds across the distillation equipment supply chain. Components sourced from key manufacturing hubs experienced upward cost pressure, affecting not only capital expenditures but also spare parts provisioning and aftermarket service budgets. These import levies, initially imposed on select regions, have cumulatively altered the relative cost calculus of domestic versus offshore fabrication, driving a renewed emphasis on nearshoring and regional supplier development.

The ripple effects extended beyond direct equipment costs. Project timelines lengthened as procurement teams engaged in renegotiations with tier-one vendors to mitigate the impact of duty differentials. Many organizations revisited their inventory management strategies, increasing safety stock levels to buffer against future policy volatility. Simultaneously, engineering and procurement departments intensified collaboration to identify local manufacturing partners capable of meeting stringent quality and certification standards. While the adjustment period introduced short-term disruption, it has also catalyzed deeper supply-chain visibility, fostering resilience and strategic autonomy for long-term operational planning.

Unveiling Critical Segmentation Insights Across Type, Technology, Industry Verticals, and Applications Driving Tailored Solutions in Distillation Systems

Distillation system demand varies significantly when viewed through the lens of operational modality. Batch distillation units retain prominence in specialty chemical and biotech applications where formulation flexibility and small-batch precision are critical, whereas continuous systems dominate large-scale petrochemical, oil and gas, and wastewater treatment operations where steady production rates and economies of scale are paramount. By understanding the specific throughput, feed variability, and changeover requirements, stakeholders can align system design choices with process objectives and capital efficiency targets.

A deeper examination of underlying technology variants reveals that azeotropic and extractive distillation techniques are well-suited for complex separations in chemical and pharmaceutical sectors, leveraging selective solvents or entrainers to breach azeotropes and enhance purity. Fractional distillation remains a workhorse for high-volume separation of multi-component mixtures in oil refining and petrochemical processing. Steam distillation has gained traction in the extraction of heat-sensitive botanical compounds, while vacuum distillation lowers boiling points to enable energy savings and gentle handling of thermally labile materials. Vacuum-enabled units also play a pivotal role in solvent recycling loops and waste minimization initiatives.

Across industry verticals, from agrochemicals and petrochemicals to bakery goods and dairy processing, the critical performance metrics of throughput, separation efficiency, and energy utilization drive technology selection and system configuration. In environmental monitoring, air and water quality applications demand compact, skid-ready units capable of rapid sample preparation and analyte concentration. Within the oil and gas value chain, upstream operations rely on fractional towers to segregate crude feedstocks, midstream facilities deploy recovery columns for natural gas liquids, and downstream refineries integrate vacuum flash distillation to maximize product yield. Biotech and generic pharmaceutical manufacturers prioritize aseptic design and multi-purpose clean-in-place capabilities, whereas desalination and wastewater treatment systems focus on brine concentration and contaminant removal under variable feed conditions. Finally, in specialized applications such as solvent recovery and recycling, single-purpose distillation skid packages streamline process intensification efforts while delivering robust performance in continuous operation.

This segmentation framework underscores the importance of tailoring distillation solutions to the nuanced requirements of each application, ensuring that capex and opex considerations are balanced against purity demands and environmental objectives.

This comprehensive research report categorizes the Distillation Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Industry

- Application

Exploring Regional Dynamics Shaping Distillation System Adoption and Growth Patterns Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Within the Americas region, the United States leads in the adoption of advanced distillation systems, driven by strong downstream refining activity, growth in specialty chemical production, and stringent emissions regulations that incentivize energy-efficient upgrades. Canada’s environmental monitoring initiatives and burgeoning petrochemical projects likewise contribute to steady equipment demand, while Latin American markets are increasingly investing in solvent recovery and wastewater treatment solutions to address water scarcity and regulatory compliance objectives.

Europe, the Middle East, and Africa present a diverse tapestry of market conditions. In Europe, the emphasis on circular economy legislation and carbon neutrality targets is accelerating the replacement of legacy distillation assets with high-efficiency, low-emission units. The Middle East’s oil and gas sector continues to expand downstream refinery capacity, creating opportunities for large-scale fractional and vacuum distillation installations. Meanwhile, African nations are focusing on modular water treatment and desalination packages to support urbanization and agricultural irrigation, often leveraging public-private partnerships to finance infrastructure enhancements.

Asia-Pacific emerges as the fastest-growing region, propelled by rapid industrialization, expanding pharmaceutical manufacturing in India, and petrochemical megaprojects in China. Southeast Asian markets are upgrading food and beverage processing lines with steam and vacuum distillation to meet rising consumer demand for dairy, beverages, and bakery products. At the same time, stringent environmental regulations in Japan and South Korea are fostering demand for extractive and azeotropic distillation technologies used in specialty chemical segments. Across APAC, vendor partnerships with local engineering, procurement, and construction firms are instrumental in navigating regional approval processes and optimizing deployment timelines.

This comprehensive research report examines key regions that drive the evolution of the Distillation Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles and Competitive Moves Highlighting Innovation, Partnership, and Growth Strategies Among Leading Distillation System Providers

Leading distillation system providers are differentiating through strategic investments in digital solutions, sustainability-focused product lines, and expansion of service networks. Established engineering conglomerates have bolstered their offerings by introducing modular skid designs that can be rapidly deployed and easily scaled, catering to both greenfield and brownfield requirements. These players are also integrating advanced control packages and remote monitoring capabilities to deliver predictive maintenance services, reducing unplanned downtime and lowering total life-cycle costs for end-users.

Agile technology specialists have carved out niches by concentrating on high-purity applications within pharmaceuticals and specialty chemicals, where aseptic construction and multi-purpose functionality are critical. These companies often collaborate with academic and research institutions to co-develop proprietary entrainers and solvent formulations that enhance separation efficiency for azeotropic and extractive processes. Partnerships with engineering, procurement, and construction firms have further enabled them to secure turnkey project contracts in key regional markets.

Service providers are similarly evolving, shifting from traditional aftermarket support to performance-based contracts that guarantee uptime and energy efficiency improvements. By deploying dedicated analytics platforms and leveraging Internet of Things frameworks, they offer subscription-style service models, aligning incentives with customer objectives around yield maximization, compliance assurance, and continuous process improvement. This comprehensive ecosystem of technology, services, and data analytics is redefining how market leaders engage with their clients and maintain competitive edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Distillation Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Anton Paar GmbH

- BÜCHI Labortechnik AG

- C. Gerhardt GmbH & Co. KG

- Chart Industries, Inc.

- De Dietrich Process Systems

- GEA Group AG

- Hangzhou Zhengjiu Machinery Manufacturing Co., Ltd.

- HRS Heat Exchangers Ltd

- Koch-Glitsch LP

- MLS GmbH.

- Paul Mueller Company

- SPX FLOW, Inc.

- StillDragon North America

- Sulzer AG

- Velp Scientifica srl

- Vendome Copper & Brass Works, Inc.

- Wenzhou Ace Machinery Co., Ltd.

- Wenzhou Mibond Machinery Co., Ltd.

- Wenzhou Towin Machine Co., Ltd.

Actionable Recommendations for Industry Leaders to Optimize Distillation Operations, Enhance Sustainability, and Capitalize on Technological Advancements

Industry leaders should prioritize the integration of digital twins and artificial intelligence-driven process optimization tools to enhance operational visibility and drive continuous improvement. Early adoption of cloud-based monitoring solutions can enable centralized control of distributed distillation assets, facilitating rapid response to performance deviations and facilitating scenario planning for feed-stock variations. At the same time, organizations must assess modular system architectures that allow incremental expansions and simplified maintenance, reducing capital risk and accelerating project timelines.

Sustainability must remain a core tenet of technology roadmaps, with an emphasis on heat integration, vapor recompression, and solvent recycling loops to maximize resource efficiency. Leaders should collaborate with technology licensors to co-innovate new entrainer formulations or hybrid distillation configurations that target emerging feed-stock challenges, such as bio-based intermediates or complex refinery off-gases. Diversifying the supply chain through partnerships with regional fabricators and engineering firms will mitigate tariffs and geopolitical risks, while bolstering local content credentials for government-funded projects.

Finally, investing in workforce development programs that blend process engineering expertise with digital skills will ensure that organizations can fully capture the value of next-generation distillation platforms. By establishing cross-functional centers of excellence and fostering collaboration between operations, maintenance, and IT teams, companies can accelerate adoption curves and build a culture of continuous innovation and operational resilience.

Research Methodology Combining Secondary Data Analysis, Expert Interviews, and Triangulation to Ensure Rigorous Insights into Distillation Systems Market

This research employs a rigorous, multi-stage methodology designed to deliver actionable intelligence and strategic clarity. The process begins with an exhaustive review of publicly available literature, regulatory filings, technical publications, and patent databases to map existing technologies, emerging innovations, and historical market trajectories. Following this secondary research, in-depth interviews are conducted with senior executives, process engineers, and procurement specialists across equipment suppliers, end-users, and system integrators to validate trends and uncover latent adoption barriers.

Quantitative triangulation is then applied, cross-referencing qualitative insights with vendor press releases, investment announcements, and government policy updates to enhance accuracy and reliability. Proprietary data models are employed solely to facilitate contextual understanding of cyclical dynamics and to identify high-impact inflection points without forecasting specific market volumes or financial metrics. Throughout the study, stringent data verification protocols ensure consistency, while peer-reviewed validation sessions with independent industry experts provide an additional layer of methodological rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Distillation Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Distillation Systems Market, by Type

- Distillation Systems Market, by Technology

- Distillation Systems Market, by Industry

- Distillation Systems Market, by Application

- Distillation Systems Market, by Region

- Distillation Systems Market, by Group

- Distillation Systems Market, by Country

- United States Distillation Systems Market

- China Distillation Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing Key Findings and Strategic Implications of Distillation Systems Market Trends to Empower Decision Makers with Actionable Clarity and Future Outlook

The distillation systems landscape is characterized by rapid technological change, shifting regulatory demands, and evolving end-user requirements that collectively shape investment and procurement decisions. Continuous distillation and modular skid packages are redefining operational paradigms, while digital twins and advanced analytics unlock new levels of process control and efficiency. Tariff fluctuations have underscored the importance of supply chain agility, prompting a reevaluation of sourcing strategies and partnership models.

Segmentation insights reveal that success hinges on aligning system configurations with the distinct needs of each technology, industry vertical, and application scenario. Regional analysis demonstrates that mature markets focus on sustainability upgrades and digital retrofits, while high-growth economies emphasize capacity expansion and cost optimization. Leading providers are responding through diversified portfolios, collaborative R&D partnerships, and performance-aligned service offerings.

Taken together, these findings equip decision makers with a nuanced understanding of the competitive forces, operational imperatives, and strategic opportunities that define the global distillation systems market. Armed with this knowledge, organizations can make informed choices that balance efficiency, compliance, and long-term resilience in an increasingly complex environment.

Act Now to Secure Exclusive Access to the Comprehensive Distillation Systems Research Report by Consulting Ketan Rohom for Tailored Insights, Strategic Engagement

To acquire this comprehensive research report tailored to your strategic priorities, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing. Ketan brings deep expertise in distillation system market dynamics and can guide you through custom engagement options that align with your operational goals. By consulting with Ketan, you can explore bespoke data deliverables, gain early access to thought leadership insights, and secure a competitive edge by implementing industry best practices. Connect with Ketan to discuss licensing, extended support packages, or collaborative workshops designed to accelerate your decision-making and maximize the value of this in-depth analysis.

Act now to elevate your understanding of distillation systems, mitigate emerging risks, and unlock actionable strategies. Ketan’s personalized approach ensures that your organization receives the precise intelligence and recommendations needed to navigate evolving regulatory landscapes, tariff impacts, and technological breakthroughs. Whether you seek a high-level executive briefing or a ground-level technical deep dive, this report can be configured to meet your needs and accelerate time to insight.

- How big is the Distillation Systems Market?

- What is the Distillation Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?