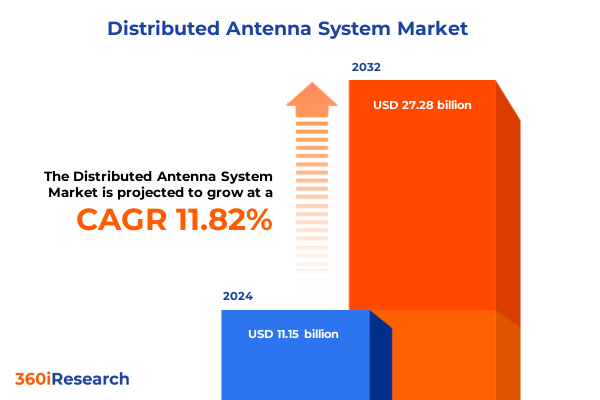

The Distributed Antenna System Market size was estimated at USD 12.40 billion in 2025 and expected to reach USD 13.81 billion in 2026, at a CAGR of 11.92% to reach USD 27.28 billion by 2032.

Introduction to the Distributed Antenna System Market’s Evolution, Key Drivers, and Strategic Imperatives for Modern Communications Infrastructure

The distributed antenna system ecosystem has emerged as a cornerstone of modern telecommunications infrastructure, driven by exponential growth in mobile data consumption and the relentless pursuit of seamless indoor coverage. In an era where user expectations for high-speed, low-latency connectivity have become non-negotiable, distributed antenna systems have moved from niche specialty deployments to mainstream network enhancement solutions. As venues ranging from shopping malls to corporate campuses and transportation hubs demand ubiquitous connectivity, the role of distributed antenna systems has evolved into a critical enabler of digital experiences on both consumer and enterprise fronts.

Amidst this backdrop, industry stakeholders are reevaluating traditional network architectures and forging partnerships that bridge the gap between wireless carriers, property owners, and technology providers. This introductory section outlines the market’s core drivers, including the densification of small cell networks, the advent of 5G and beyond, and the impact of regulatory frameworks that promote spectrum sharing and public safety communications enhancement. By framing the key imperatives-ranging from capital expenditure optimization to future-proofing network architectures-this overview sets the stage for a deeper exploration of the transformative shifts, tariff influences, segmentation insights, and regional dynamics reshaping the distributed antenna system landscape.

Emerging Technological Advancements and Market Dynamics That Are Reshaping the Distributed Antenna System Landscape for Next-Generation Connectivity

Recent years have witnessed an accelerated integration of sophisticated radio frequency management techniques, software-defined networking, and edge computing capabilities into distributed antenna system deployments. These technological advancements are converging to enhance spectral efficiency, enable dynamic traffic steering, and simplify multi-operator support within shared infrastructure. Coupled with the proliferation of Internet of Things applications and the emergence of mission-critical services such as remote healthcare monitoring and industrial automation, the DAS landscape is undergoing a profound transformation that extends well beyond traditional in-building coverage use cases.

Equally influential are evolving policy landscapes that prioritize spectrum harmonization and public safety communications modernization. Regulatory bodies are increasingly advocating for neutral-host models that allow third-party operators to deliver multi-carrier services over a common antenna infrastructure, thereby reducing duplication of assets and accelerating time to market. As a result, industry participants are recalibrating their business models to align with these collaborative frameworks, while simultaneously investing in advanced antenna architectures and AI-driven analytics to unlock new value streams from their existing networks.

Assessing the Far-Reaching Implications of 2025 United States Tariffs on Component Supply Chains and Cost Structures Within the DAS Ecosystem

In January 2025, the United States government implemented revised tariff measures on critical network components, including coaxial cables, RF connectors, and low-noise amplifiers imported from key manufacturing hubs. These tariffs have introduced additional cost burdens along the hardware supply chain, prompting original equipment manufacturers and system integrators to reassess their sourcing strategies. Consequently, the industry has witnessed a palpable shift toward nearshoring initiatives and diversification of supplier portfolios to mitigate exposure to fluctuating duty rates and geopolitical uncertainties.

Service providers and end-users have also felt the ripple effects of these tariff changes. Maintenance, support, and professional services have seen adjusted pricing structures as integrators pass through incremental expenses. Simultaneously, phased retrofit installations and greenfield deployments have been reprioritized based on total cost of ownership considerations. Despite these headwinds, the market continues to demonstrate resilience, driven by compelling business cases for network uptime, safety compliance mandates, and the imperative to support rapidly expanding 5G applications.

Deep Dive into Component, System, Deployment, Ownership, Signal Source, Installation, End-User, and Distribution Channel Segmentation Insights for DAS Applications

A nuanced understanding of market segmentation provides critical perspective on the diverse requirements shaping distributed antenna system adoption. When classified by component, offerings fall into two primary categories: the tangible hardware layer, which includes amplifiers, antennas, and cables and connectors, and the services layer, which encompasses both maintenance and support functions as well as professional services. Maintenance and support further subdivide into field services and technical support, while professional services branch into implementation and planning and consulting engagements. This bifurcation underscores the importance of integrated end-to-end solutions that marry robust physical infrastructure with expert advisory and upkeep capabilities.

Beyond component classification, system types are delineated into active, hybrid, and passive architectures, each presenting unique trade-offs in terms of power distribution, scalability, and multi-operator support. Deployment typologies distinguish between indoor and outdoor solutions, reflecting divergent environmental considerations and performance expectations. Ownership models range from carrier-owned platforms managed by wireless service providers, to enterprise-owned systems tailored for corporate campuses, and neutral-host deployments that facilitate collaborative multi-tenant access. Signal source segmentation highlights options such as off-air antennas, on-site base transceiver stations, and small cell integration, while installation approaches differentiate between new construction projects and retrofit installations within existing facilities.

End-user verticals introduce another layer of complexity, spanning commercial applications-corporate offices, hospitality venues, and retail outlets-to institutional environments like educational campuses. Government and defense installations, including civic buildings and military bases, impose stringent reliability and security requirements, mirroring the demands of healthcare settings comprised of clinics and hospitals. Public safety and transportation corridors, such as airports, subways, and tunnels, necessitate specialized coverage for mission-critical voice and data communications. Finally, the distribution channel landscape bifurcates into offline transactions through traditional system integrators and reseller networks, and online procurement models that leverage digital marketplaces for rapid quotes and configurable solutions.

This comprehensive research report categorizes the Distributed Antenna System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Deployment Type

- Ownership Model

- Signal Source

- Installation Type

- End-User

- Distribution Channel

Unveiling Regional Variations in Distributed Antenna System Demand, Regulatory Environments, and Adoption Trends Across Major Global Markets

Regional nuances play an outsized role in shaping deployment strategies and growth trajectories for distributed antenna systems. In the Americas, North American markets boast aggressive 5G rollouts, driven by substantial investments from major wireless carriers and supportive federal policies that expedite tower siting and spectrum allocation. Latin America, while at a relatively earlier stage of urban densification, is pursuing urban smart city initiatives that prioritize reliable indoor connectivity in transportation nodes and commercial hubs. The convergence of public safety funding and digital inclusion programs is likewise catalyzing momentum in community-centric deployments across the region.

In Europe, the Middle East, and Africa, diverse regulatory regimes necessitate tailored approaches to infrastructure sharing and spectrum licensing. Western European nations are advancing ambitious digital transformation agendas that integrate DAS into broader network-of-networks strategies, whereas Middle Eastern economies are leveraging high-profile infrastructure projects to showcase next-generation connectivity. Sub-Saharan Africa, by contrast, is embracing hybrid and passive solutions to address foundational coverage gaps, often in partnership with international organizations targeting emergency response and rural connectivity. Across EMEA, neutral-host frameworks are gaining traction as a pragmatic path to optimize capital expenditure and accelerate multi-operator service offerings.

Asia-Pacific remains the most dynamic theater for distributed antenna system innovation, anchored by massive urbanization in China and India, and robust industrial deployments in Japan and South Korea. Government-led smart city programs are emphasizing integrated communications platforms that seamlessly blend small cells, DAS, and public Wi-Fi, driving unprecedented levels of densification. In Southeast Asia and Oceania, the migration toward private LTE and 5G campus networks within manufacturing, logistics, and hospitality verticals is redefining the traditional boundaries of enterprise connectivity. Collectively, APAC’s blend of public sector investment and private sector ambition continues to set new benchmarks for scale and performance.

This comprehensive research report examines key regions that drive the evolution of the Distributed Antenna System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation, Strategic Alliances, and Competitive Positioning in the Global Distributed Antenna System Sector

A select cohort of technology providers and integrators is spearheading innovation in the distributed antenna system arena, leveraging strategic alliances and acquisitions to bolster end-to-end service portfolios. Hardware specialists renowned for high-performance amplifiers and advanced multi-band antennas are collaborating with software orchestration firms to deliver cohesive RF management suites. Simultaneously, global telecommunications giants are cementing their footprint by bundling DAS offerings within comprehensive connectivity packages that include small cell and macro network solutions, fostering multi-layered resilience.

On the services front, consultancies and system houses with deep expertise in network design and deployment are establishing centers of excellence focused on predictive maintenance and AI-driven optimization. These players are capitalizing on data analytics to extend the lifecycle of RF assets while minimizing downtime. At the same time, neutral-host platform providers are forging partnerships with real estate developers and enterprise IT teams to integrate distributed antenna systems into the blueprint of next-generation buildings and smart campuses. The interweaving of strategic partnerships, vertical market specialization, and technology-led differentiation continues to elevate competitive intensity within the global DAS sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Distributed Antenna System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Activo Inc.

- Advanced RF Technologies, Inc.

- Alliance Corporation

- American Tower Corporation

- Amphenol Corporation

- Anixter, Inc. by Wesco Distribution, Inc.

- AT&T Inc.

- Audiolink Limited

- Baylin Technologies Inc.

- Betacom, Inc.

- Bird Technologies Group, Inc.

- Boingo Wireless, Inc.

- Boost Pro Systems Ltd.

- BTI Wireless

- Cartel Communications

- CenRF Communications Limited

- Cobham Limited

- Comba Telecom Systems Holdings Limited

- CommScope Holdings Company Inc.

- Comtex Group Pty. Ltd.

- Connectivity Wireless

- Corning Incorporated

- Dali Wireless

- Decypher Technologies, LLC

- EMTS Telecom Services Ltd.

- Exchange Communications Group Ltd.

- Fixtel Pty Ltd.

- Grimard

- HALO Networks

- HUBER+SUHNER AG

- John Mezzalingua Associates, LLC

- Mantis Systems Limited

- McGill Microwave Systems Limited

- Newbridge Wireless

- Paragon Care Limited

- Powertec Telecommunications

- PPM Systems

- Pyott-Boone Electronics, Inc.

- Qypsys, LLC

- RF Industries, Inc.

- SOLiD Gear, Inc.

- Symphony Technology Solutions, Inc.

- Teleco Inc.

- The Siemon Company

- Waveform/RSRF

- Westcan ACS

- Whoop Wireless

- Zinwave Limited by Wilson Electronics, LLC

Strategic Roadmap for Industry Leaders to Capitalize on DAS Opportunities, Mitigate Challenges, and Accelerate Infrastructure Modernization

Industry leaders should prioritize the development of modular antenna platforms that can seamlessly align with diverse spectrum bands and operator requirements, thereby reducing deployment cycles and lowering capital barriers. Equally critical is the establishment of agile supply chain frameworks that encompass multiple geographic sourcing nodes to safeguard against tariff-induced cost fluctuations and geopolitical disruptions. By forging collaborative relationships across the value chain-from component manufacturers to facility owners-stakeholders can co-create turnkey solutions that accelerate time to revenue and enhance user satisfaction.

Moreover, forward-thinking organizations must invest in advanced analytics and remote monitoring capabilities to transition from reactive maintenance approaches to predictive asset management. Embedding machine learning algorithms within network management systems will enable real-time fault detection and performance tuning, delivering tangible improvements in reliability and operational efficiency. Finally, embracing neutral-host and shared service models in partnership with regulators and carriers can unlock new revenue streams, optimize infrastructure utilization, and future-proof network investments against evolving demands.

Comprehensive Research Methodology Employed to Ensure Rigorous Data Collection, Analysis, and Validation in Distributed Antenna System Study

This study employs a multi-faceted research methodology that integrates primary interviews with key stakeholders-including network operators, system integrators, and enterprise IT executives-with secondary data sourced from regulatory filings and industry whitepapers. Case studies of representative deployment scenarios have been analyzed to elucidate best practices in design, installation, and lifecycle management. Quantitative input was further validated through cross-referencing public project databases and technology consortium benchmarks to ensure consistency and reliability.

Analytical frameworks such as Porter’s Five Forces and PESTEL analysis were applied to assess competitive pressures and external drivers influencing market dynamics. Vendor and product profiles were developed using a combination of proprietary surveys and publicly available performance data, while regional outlooks were informed by policy documentation and infrastructure investment reports. Rigorous peer review by independent subject matter experts provided an additional layer of quality assurance, ensuring that findings accurately reflect the current state of the distributed antenna system landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Distributed Antenna System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Distributed Antenna System Market, by Component

- Distributed Antenna System Market, by System Type

- Distributed Antenna System Market, by Deployment Type

- Distributed Antenna System Market, by Ownership Model

- Distributed Antenna System Market, by Signal Source

- Distributed Antenna System Market, by Installation Type

- Distributed Antenna System Market, by End-User

- Distributed Antenna System Market, by Distribution Channel

- Distributed Antenna System Market, by Region

- Distributed Antenna System Market, by Group

- Distributed Antenna System Market, by Country

- United States Distributed Antenna System Market

- China Distributed Antenna System Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings and Strategic Implications to Illuminate the Future Trajectory of Distributed Antenna Systems in Diverse Market Contexts

The relentless evolution of network technologies, coupled with shifting regulatory landscapes and complex supply chain considerations, underscores the pivotal role that distributed antenna systems play in today’s connectivity ecosystem. From the densification of urban cores to the modernization of critical infrastructure, DAS solutions are increasingly viewed as indispensable components of holistic network strategies. By synthesizing segmentation insights, regional dynamics, and competitive intelligence, stakeholders can craft differentiated approaches that align technical capabilities with business objectives.

Looking ahead, the convergence of 5G, edge computing, and IoT stands to drive further innovation in antenna architectures and service models. Market participants who adeptly navigate tariff headwinds, embrace collaborative ownership frameworks, and leverage advanced analytics will be best positioned to capture value in this expanding market. The findings elucidated in this report provide a roadmap for decision-makers to deploy robust, scalable, and future-proof distributed antenna systems that meet the demands of an increasingly connected world.

Elevate Your Connectivity Strategy by Securing Expert DAS Market Insights Directly from Our Associate Director of Sales & Marketing to Propel Your Business

To gain unparalleled insights and a competitive edge in the rapidly evolving distributed antenna system market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expert guidance will help you customize the research findings to your specific strategic needs, ensuring that you have the actionable intelligence necessary to drive infrastructure investments, optimize supply chains, and enhance network performance. Connect directly with him to secure your copy of the comprehensive market research report and begin capitalizing on the opportunities reshaping indoor and outdoor connectivity solutions.

- How big is the Distributed Antenna System Market?

- What is the Distributed Antenna System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?